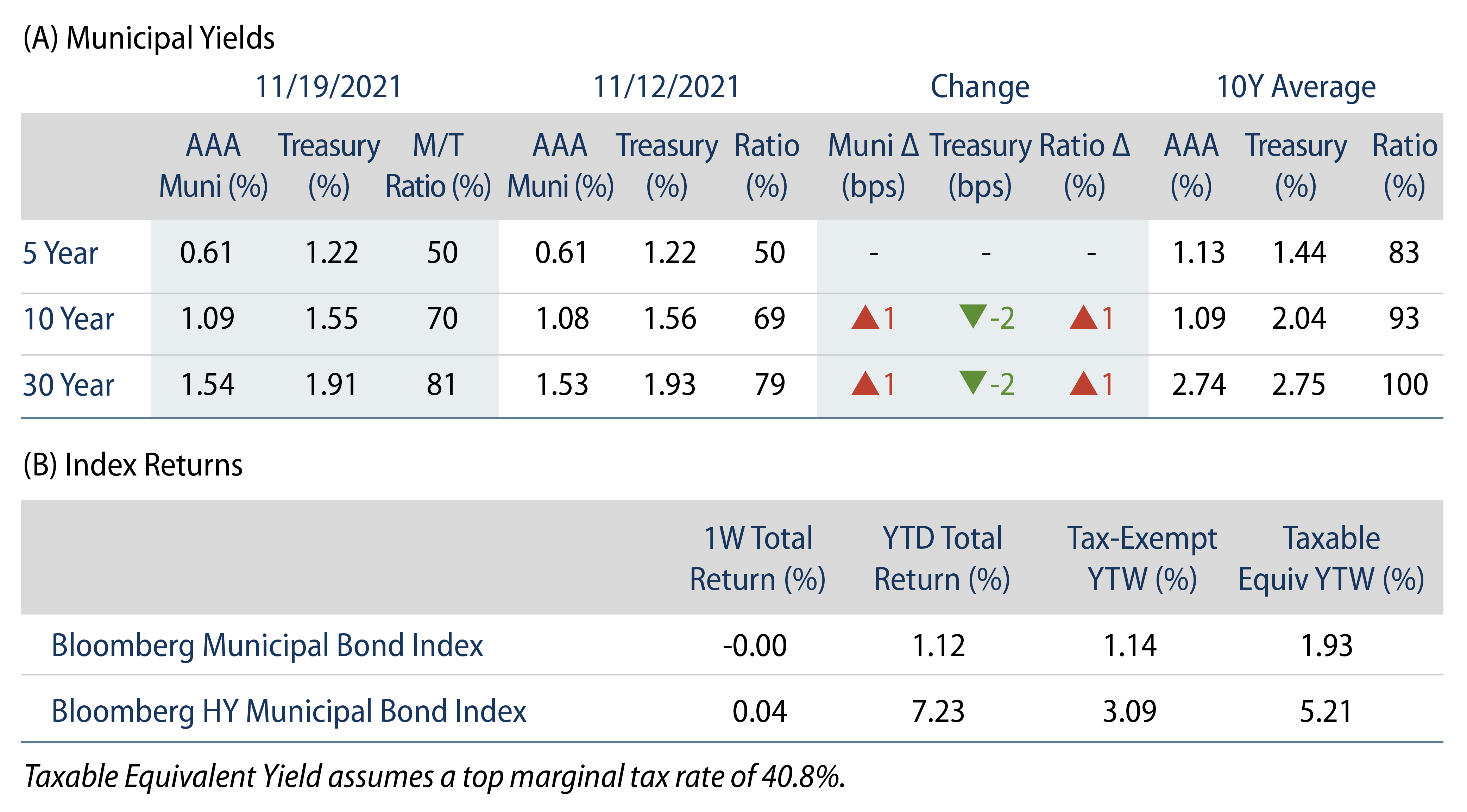

High-Grade Municipals Yields Moved Higher During the Week

High-grade muni yields moved higher during the week, as the AAA muni yield curve moved 1 bp higher across intermediate and long maturities. Municipals underperformed US Treasuries (USTs), resulting in modestly higher ratios. Technicals strengthened as fund flows accelerated. The Bloomberg Municipal Index returned 0.00%, while the HY Muni Index returned 0.04%. This week we look at the municipal market’s limited reaction to the recent uptick in inflation.

Fund Flows Extend a Record Pace

Fund Flows: During the week ending November 17, municipal mutual funds recorded $1.4 billion of net inflows. Long-term funds recorded $1.0 billion of inflows, high-yield funds recorded $549 million of inflows and intermediate funds recorded $367 million of inflows. Municipal mutual funds have now recorded inflows 78 of the last 79 weeks, extending the record inflow cycle to $158 billion, with year-to-date (YTD) net inflows surpassing a record calendar year pace at $96 billion.

Supply: The muni market recorded $17.5 billion of new-issue volume during the week, up 61% from the prior week. Total YTD issuance of $423 billion is 1% higher from last year’s levels, with tax-exempt issuance trending 10% higher year-over-year (YoY) and taxable issuance trending 20% lower YoY. This week’s new-issue calendar is expected to decline to less than $1 billion due to the Thanksgiving holiday, with the only deal of note being a $292 million Desert Community College District transaction.

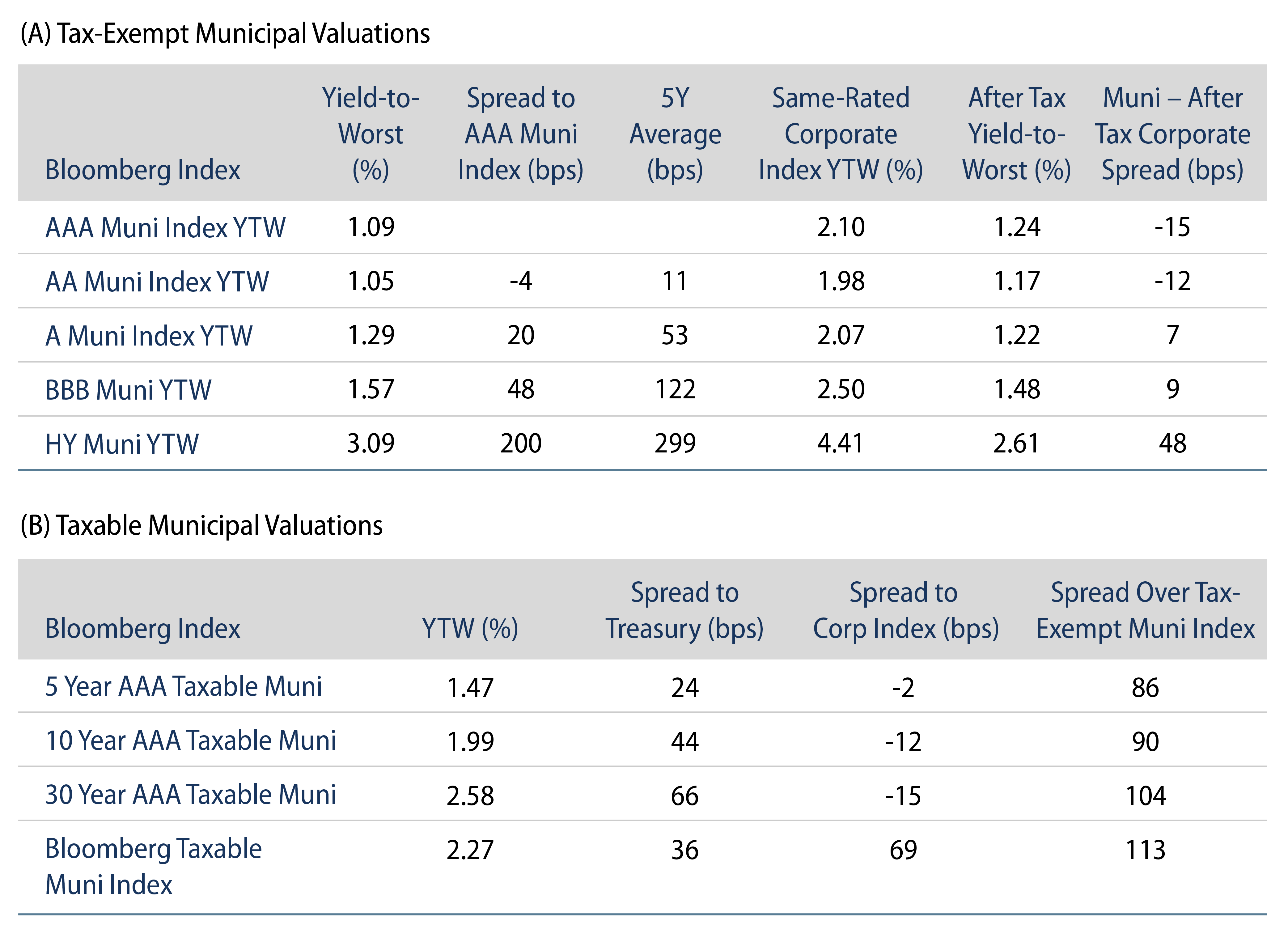

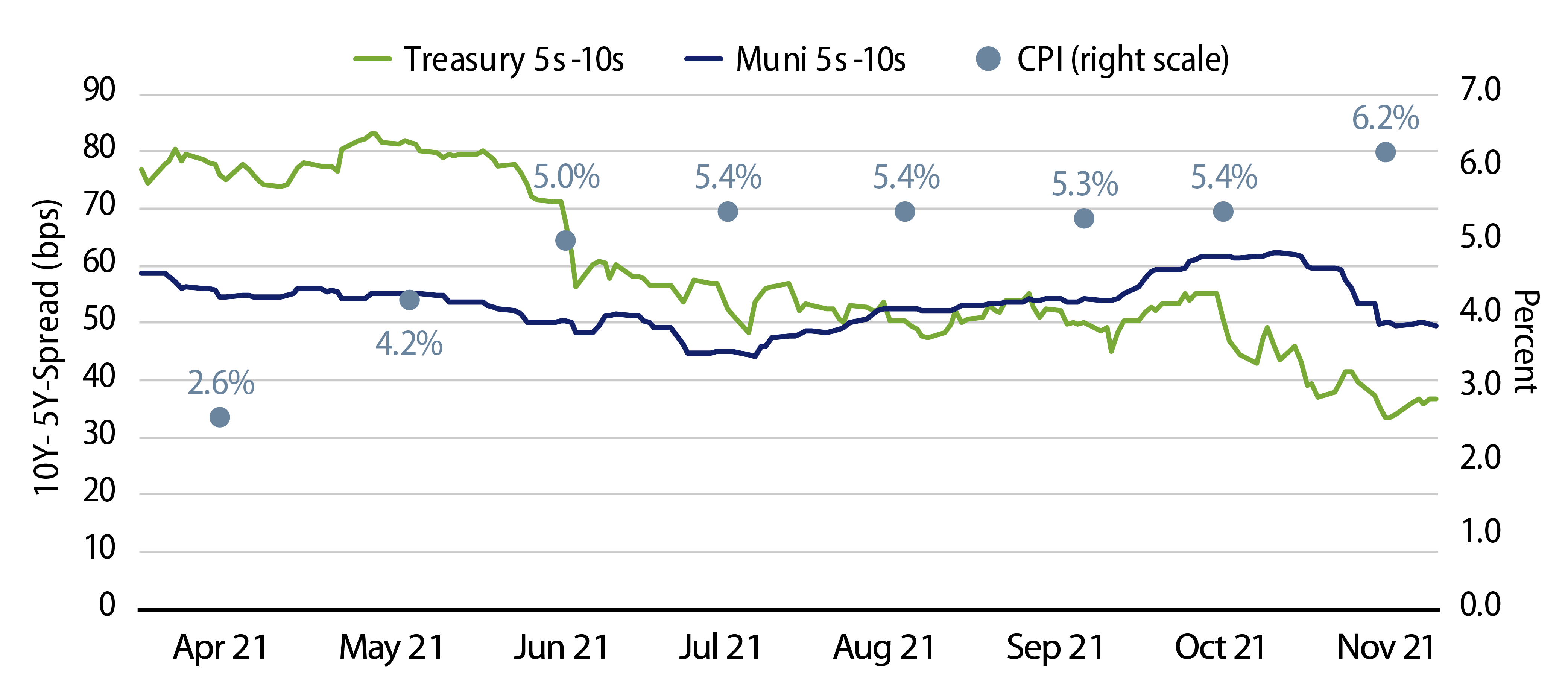

This Week in Munis—Municipals Shrug off Inflation Fears

The US Consumer Price Index (CPI) posted a 30-year high this month at 6.2%. While UST rates expressed sensitivity to the above-consensus inflation print by increasing approximately 20 bps across the curve from November 5 through November 16, the AAA Municipal Curve (MMD) moved 2-3 bps higher. Over the past five months since the CPI crossed 4.2% and started becoming a headline concern, the spread between the yields of UST 10- and 5-years moved as high as 82 bps before declining to 33 bps, whereas the spread between the 10- and 5-years of the municipal market was range-bound between 44 bps and 62 bps, highlighting a limited reaction to the market’s forward-looking inflation expectations.

Robust demand for tax-exempt income associated with the prospect of higher tax rates, along with relatively limited tax-exempt supply, has supported a strong technical backdrop that certainly contributed to relative performance versus USTs. However, the resilience of the asset class in a rising-rate environment can also be attributable to key structural benefits that support municipals as a core allocation for high net worth individuals’ portfolios in this environment.

- Tax-exempt structure provides insulation to rate increases. All else being equal, it is likely that an increase in UST yields should result in a lower increase in municipal yields to maintain economic equilibrium for taxpayers. In the majority of prior Fed hiking cycles, municipals outperformed USTs and other like-quality fixed-income asset classes.

- Market premiums reduce duration sensitivity. The municipal market remains overwhelmingly a 4%-5% coupon market with a large proportion of callable structures. In the current lower-rate environment, the relative sensitivity to rate fluctuations is lower today as most callable municipal debt is “in the money,” that is, priced to their call at a lower duration.

- Limited correlation with other high-quality fixed-income and negative correlation to equities support the asset class as part of a well-diversified portfolio. We believe this supports a long-term value proposition for most municipal bondholders, resulting in relatively low turnover.

Western Asset’s macro view continues to reflect the expectation that long-term forces of aging demographics and elevated debt loads should constrain growth, which coupled with ongoing technology forces, will continue to anchor long-term inflation. This informed an above-benchmark duration positioning in our municipal portfolios. While the UST market may not have started to reflect our long-term thesis, the municipal market’s muted reaction to recent inflation data is more closely aligned with our long-term inflation outlook.