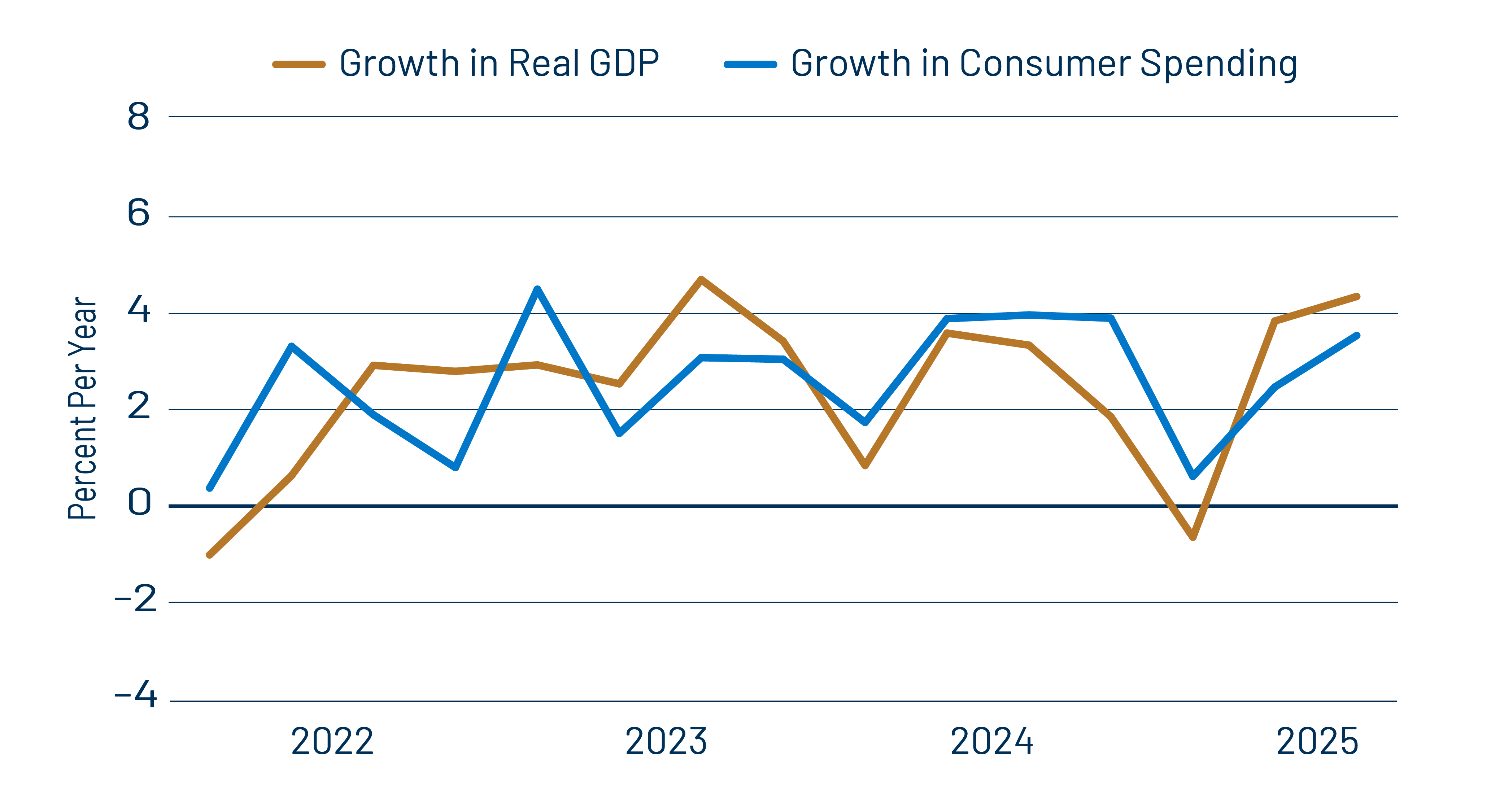

Real gross domestic product (GDP) grew at a 4.3% annualized rate in 3Q2025, according to estimates released today by the Commerce Department (Bureau of Economic Analysis, or BEA). Growth was paced by a 3.5% rate of growth in consumer spending, a 7.9% rate of growth in business equipment investment, and an improvement in the foreign trade balance.

In our view, it is not quite accurate to describe the economy as booming. That is, the robust growth rates in both 3Q and 2Q (3.8%) come off a -0.6% rate of decline in 1Q. As we remarked at the time (see our 5/2/25 post), that 1Q decline was likely wrong, reflecting inaccurate accounting of the effects of the Trump tariffs. Those effects that (inaccurately?) reduced reported growth in 1Q were then reversed in 2Q and 3Q, boosting growth in those quarters. More on this below.

Looking at growth for the first three quarters of 2025 combined provides a more meaningful take. For 2025 to date (1Q through 3Q), GDP growth has averaged 2.5%. This is slightly better than the 2.4% growth shown for all of 2024, but a much smaller improvement than the boom-like growth rates of 2Q and 3Q by themselves would suggest.

Within the components of GDP, consumer spending has grown at a 2.2% rate for 2025 to date, down from a 3.9% rate for all of 2024. However, business equipment investment has growth at a much faster rate, 11.6% for 2025 to date, compared to 3.2% for all of 2024. Furthermore, there has been a net improvement in the foreign trade balance this year, compared to a deterioration in 2024. The improvements in equipment investment and foreign trade more than offset the slower growth in consumer spending, thus providing slightly faster growth in GDP.

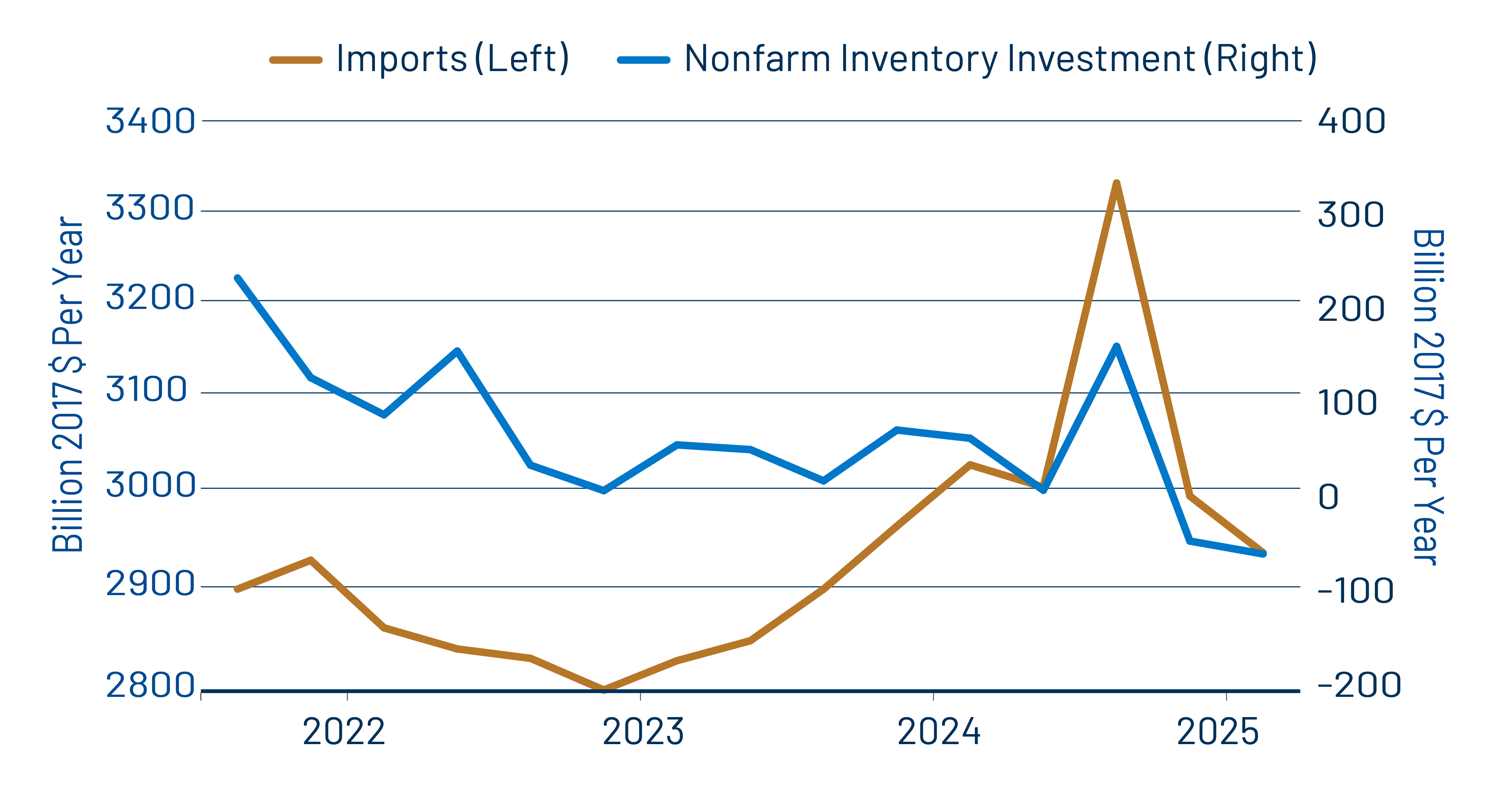

Earlier, we mentioned the effects of the Trump tariffs. In 1Q, in anticipation of the tariffs, US merchants ratcheted up imports from foreign producers, and, by itself, this does subtract from GDP. However, in reality, those goods had to go somewhere. They were either consumed or, more likely, allocated to inventories, and those boosts to GDP offset the drag from imports proper. Indeed, in 1Q, inventories surged alongside imports.

However, the magnitude of the reported 1Q inventory jump was only about half as large as that of imports, as you can see in Exhibit 2. (The scales in Exhibit 2 are both calibrated to cover a range of US$600billion, so that the visual sizes of the swings in the two lines accurately reflect the relative magnitudes of these effects on GDP.) Thus, the big reported drag seen on 1Q GDP growth.

If that drag were for real, we should have seen accompanying declines in measures of domestic goods production, such as industrial production data from the Federal Reserve (Fed). Instead, Fed data showed a nice increase in domestic goods production in 1Q.

This is what led us to believe that the reported 1Q GDP decline was inaccurate, and, indeed, imports and inventory investment have come back ''to ground'' in more recent quarters, that 1Q drag from these components morphed into significant boosts to growth in 2Q and 3Q. This is what we projected in our 5/2/25 post, and it has indeed come to fruition. This is not a boast, but merely a substantiation of our point that both the weak 1Q and strong 2Q/3Q growth rates are parts of the same story.

Again, net of the statistical noise, economic growth has improved very slightly so far this year, as strong gains in business investment and improvements in the trade balance have offset a slight slowing in consumer spending. Meanwhile, the decent 3Q growth rate for consumer spending along with upbeat retailer reports on holiday shopping suggest that the earlier, slight slowing in consumer spending might be ephemeral. It is also noteworthy that despite the net decline in imports in response to the tariffs, US exports continue to growth steadily. So, at least to date, worries about a trade war in response to the tariffs have yet to materialize.

Thanks for reading our posts this year. We wish you a joyous holiday season, and we look forward to providing more of these posts to you in 2026.