ESG Integration in Fixed-Income

Fixed-income investors play a key role as creditors in assessing material environmental, social and governance (ESG) risks and opportunities that may impede creditworthiness of bond issuers. While ESG integration has often been associated with equity investing, integration of these facets should be a central tenet for bond investors too. ESG considerations are very contextual in nature and differ across sectors. Material concerns such as climate risk and environmental management, diversity and development of talent, human rights and supply chain management, product safety and security, transparency in reporting as well as governance and corporate management, to name a few, are key considerations that should form part of a fixed-income investor’s assessment. Academic research and practitioner experience have indicated that issuers with superior ESG practices have a lower cost of debt, favourable future bond spreads and tend to experience lower drawdowns during periods of market stress. Conversely, issuers that are deemed to be lower in ESG quality tend to have a higher level of risk associated with their future ability to meet debt obligations and must compensate investors with a higher premium. Poor-quality ESG issuers are also more likely to be adversely affected by developments such as legal sanctions, the introduction of new regulations or shifts in consumer sentiment. It is therefore imperative that issuers and fixed-income asset managers understand, measure and allocate strategically to mitigate these risks while seeking to benefit from opportunities that ESG megatrends may usher in.

Climate Change and the Role of Trustees

Increasingly, financial regulators recognize climate change as a systemic risk that has the potential to disrupt financial markets, affect returns and negatively impact the broader economy. A study conducted by Munich Re1, found that damage related to natural disasters exceeded $200 billion in 2020. However, the risks from climate change are not restricted to the physical risks alone. Failure to recognize and adapt to transition risks stemming from a move to low or net-zero carbon agreements could cause similar dislocations in markets and impair an issuer’s ability to meet debt obligations. It is therefore imperative for asset owners and trustees to not just understand the implications of climate change risk, but also to seek to ensure that asset managers incorporate climate risk assessments as part of their risk management process. If ignored, there is a danger that these risks escalate over time and encumber creditworthiness, affecting valuations and resulting in crippling financial losses.

In the UK, the Pensions Climate Risk Industry Group in consultation with the UK government has recommended that trustees should define their climate-related investment beliefs, incorporate climate change into their frameworks and consider engagement as a tool to manage climate risk. Trustees are obliged to consider whether climate risk is adequately “priced in” as part of their fiduciary duty to beneficiaries. It is therefore incumbent on trustees to assess climate exposure, evaluate whether certain sectors are likely to benefit from low carbon transition and evaluate the need to increase allocations to less-sensitive sectors or change a scheme’s strategic allocation. Trustees acting as stewards for scheme beneficiaries must be able to understand the impact of various potential future climate change scenarios and how best to mitigate against that risk while taking advantage of climate-related opportunities.

Stress Testing Portfolios for Climate Risk

One way to achieve this goal is through scenario analysis and modelling to assess climate risks in an underlying scheme’s investment strategy. This can be enhanced by applying an implied carbon price that assigns costs to emitters based on various climate scenarios to lower global greenhouse gas (GHG) emissions through a market-based mechanism. Western Asset has developed climate risk assessment capabilities which enable it to stress test a portfolio and its benchmark to help trustees understand and measure the impact of climate-related risks in a variety of scenarios.

Western Asset’s carbon stress-testing framework for assessing the likelihood of default of a company is based on options pricing. This framework is based on a credit default model (CDM) and is run through the Firm’s proprietary risk system, WISER. The model estimates the likelihood that a borrower’s liabilities increase above its assets, and uses that information to infer the predicted default likelihood for that company. By incorporating the impact of carbon prices under different scenarios for rises in global temperature, the Firm estimates the impact on the valuation of companies and the increase in their probabilities of default. Some of the factors that drive carbon pricing include scale of emission, carbon taxes, emission trading schemes, location of operations, issuers’ ability to absorb additional shocks and nuances of individual sectors and regions.

The model developed by Western Asset uses five different pathways that link potential future carbon prices to the likelihood of containing the rise of global temperature by different amounts published by the Intergovernmental Panel on Climate Change (IPCC). Pathways describe the evolutions of all emission to the end of the 21st century from all energy sources, regions and sectors. This helps Western Asset report portfolio allocation with emissions reduction targets that are aligned with the 1.5C Degrees scenario, the Below 2 Degrees scenario, the 2 Degrees scenario, International Pledges and Paris Pledges, using data from the Transition Pathway Initiative (TPI) and the Science Based Targets Initiative (SBTi).

Exhibit 1 illustrates the “future carbon price”—both in 2030 and discounted for 2021—based on the five published pathways under IPCC. (Please note that all three Exhibits show Western Asset’s estimates, which are based on numerous assumptions and economic factors, and inherently cannot be guaranteed.)

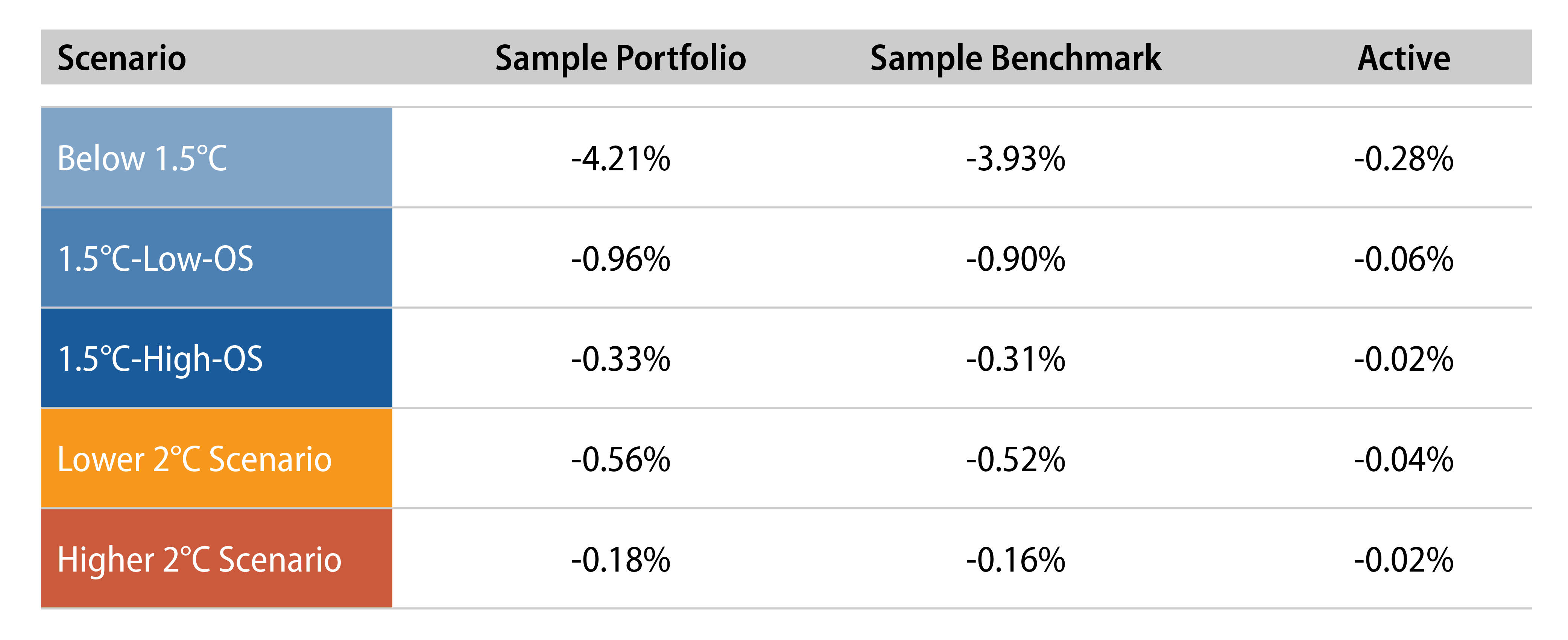

Exhibit 2 illustrates the estimated impact on returns for a sample global credit portfolio and benchmark across various climate pathways.

Estimated impacts on individual companies are aggregated at portfolio and benchmark levels, so that a comparison between portfolio impacts and benchmark impacts can be made. Exhibit 3 illustrates the estimated probability of default for the various climate pathways.

Stress testing portfolios for various climate scenarios allows analysts to assess the impact of future carbon pricing on the creditworthiness of issuers. The climate stress test models complement the proprietary ESG frameworks developed by credit analysts to assess material risks and opportunities across each sector. Furthermore, the Firm has developed an optimizer developed in conjunction with its Risk Management Team which assigns a charge to securities based on their emissions and yield profile (e.g., higher-emitting and lower-yielding issuers receive a higher charge) and enables portfolio managers to improve not only the carbon footprint of the portfolio but also other risk attributes. Taken in conjunction, the climate stress test and frameworks allow Western Asset to develop a more nuanced view on credit spreads, default probabilities, valuations and risk, which enable us to seek better risk-adjusted returns for clients.

ENDNOTES

1. https://www.munichre.com/en/company/media-relations/media-information-and-corporate-news/media-information/2021/2020-natural-disasters-balance.html