Western Asset’s Municipal Portfolio Management Team is actively coordinating with the Firm’s coronavirus/COVID-19 task force to assess the spread and magnitude of the virus within the US. At this time, we do not expect a pandemic across all 50,000 obligors in the municipal bond market, but we do expect vulnerabilities and opportunities to emerge as a result of the crisis.

While municipal bonds will likely benefit from their safe haven status, we do not expect munis to be immune to coronavirus-related concerns, let alone a pandemic. We will seek out opportunities to take advantage of potential imbalances in the market by separating fundamentals from technically driven valuations, particularly in those sectors that we believe could be most adversely impacted.

We believe issuers in the sectors listed below could be exposed to economic stresses that may surface due to virus-related issues. In our view, investors should consider working with an active manager with a deep credit team that can both monitor for such vulnerabilities and seek to capitalize on opportunities if there is indiscriminate selling across sound names within these sectors:

- General obligation: Risks may be present in select general obligation securities related to economies linked to the oil sector, such as those in Texas, Louisiana, New Mexico and Colorado—particularly those in rural areas that might already have challenged operating profiles due to outmigration trends or elevated pension obligations. Highly levered, international tourism-based economies may also struggle under prolonged international travel bans. A severe equity downturn could also negatively impact pension funded ratios, which remain challenged in many areas. Even one the largest state issuers noted in a bond disclosure, “There can be no assurances that the spread of a novel strain of coronavirus called COVID-19 will not materially impact the state and national economies and, accordingly, materially adversely impact the general fund.”

- Healthcare: Hospitals could come under pressure if we have a prolonged outbreak that would drive capacity and operational concerns. While the federal government wants to provide funding for uninsured patients, there could be staff shortages, especially if health care workers become infected, as well as a shortage of medical supplies, as many are manufactured in China.

- CCRCs: The continuing care and retirement community (CCRC) sector has been a challenging municipal asset class due to oversupply concerns amid a backdrop of seniors not moving from their homes. The first coronavirus death in the US occurred at a retirement center and the event risk associated with an outbreak at one of these centers would be highly concerning.

- Tourism and hotel occupancy tax: We have observed heightened tourism and hotel occupancy tax bonds issued in recent years to fund infrastructure projects and convention centers, and these structures could be vulnerable not only to a prolonged impasse in travel but also if this accelerates the general acceptance of virtual meetings as a new normal.

- Airlines and mass transportation: Several major air carriers have issued municipal obligations. If domestic travel is curtailed substantially to prevent the spread of the virus, the risk of impairment by these major issuers increases. Mass transportation backed by fare revenues would be adversely impacted by lower ridership, and we would particularly be concerned about projects in construction phases that need to meet ridership targets to fund debt service.

- Ports: US ports are expected to see a decline in shipments as the coronavirus impacts supply chains across the world, particularly those that have high concentration to Asia. We will continue to favor geographically diverse ports with favorable contract structures and sound coverage levels.

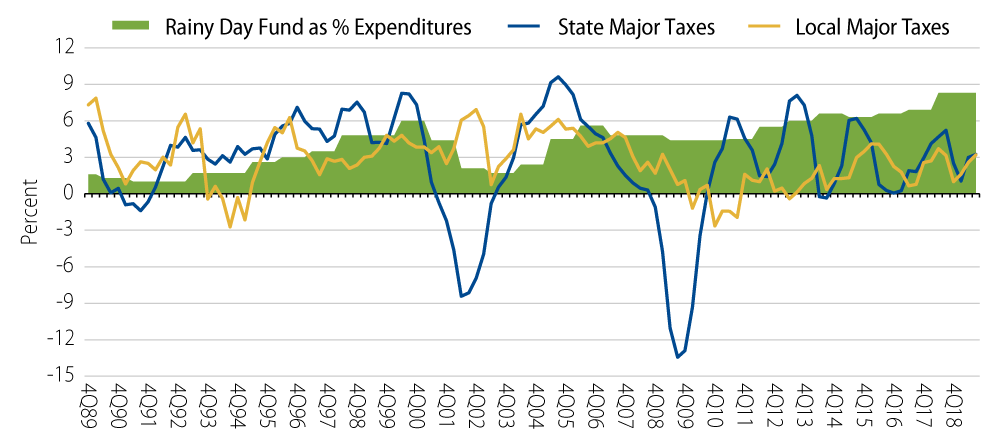

On the whole, municipal credit quality has benefited from a long economic recovery. Improving labor force and wage trends have strengthened most tax bases, a steady housing market has bolstered assessed values, and a healthy consumer has supported sales tax collections. Most states have built up significant reserve funds.

Municipalities have not all benefited from the recovery equally. Since the great recession, there has been a migration of population and wealth to metropolitan areas from rural communities. In some cases, an underfunding of pensions has contributed to high fixed cost profiles and lack of investment to attract people and jobs in communities while funding budgets. These challenges have left many municipalities vulnerable to a recessionary environment.

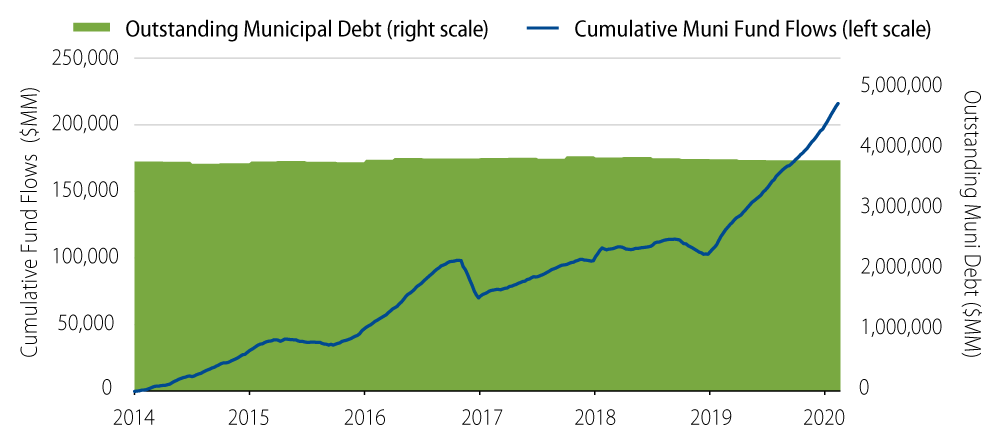

Meanwhile, the technical environment for municipals has been robust. Despite improving revenues and socioeconomic growth, municipalities have remained focused on balancing their budgets and addressing pensions instead of issuing new debt to fund long-term capital projects. Net municipal supply continues to decline as redemptions and maturing bonds outpace new money issuance. Demand for tax-exempt income has proven unrelenting, partially driven by higher effective tax rates following the passage of the 2017 Tax Cuts and Jobs Act. Before the coronavirus hit US shores, municipal mutual funds recorded over $100 billion of inflows in the 13 months that include all of 2019 and January 2020, with additional demand derived from separately managed accounts flows. This demand accelerated into February 2020 as uncertainty associated with the coronavirus drove a flight-to-quality sentiment throughout global markets.

As a result, we observed aggressive structuring of dedicated revenue and project-related transactions, with limited bondholder protections and reliance on capitalized interest to fund debt service until the project can begin producing revenues to support the security. Western Asset believes a prolonged economic contraction associated with the coronavirus, or even a modest recession driven by prevention measures, can drive these structures into impairment.

We continue to see the opportunity presented by current market conditions as two-fold: (1) use the strong bid in the market to rotate out of structures where valuations no longer align with fundamentals and (2) employ deep credit analysis on vulnerable sectors to capture any material spread widening if market fears in a sector present sound opportunity.