Payroll jobs rose by 1.763 million in July, with private-sector jobs up 1.462 million. The “core” jobs measure we usually track, private sector less construction and retailing, gained 1.184 million jobs. June job counts were revised up for total jobs and down for private sector, but these changes were slight relative to the monthly changes.

Before making editorial comment, we’ll stipulate that the July gains are far lower than 4-to-5 million gains of June (how could they not be?) and July employment levels remain well below the pre-shutdown levels of February. Still, the announced July gains are far stronger than one would have expected given media accounts of a faltering/reversing economic recovery, and the data clearly show workers gradually getting back on the job.

It is hard work putting data together from all sectors of the economy. When private-sector and media analysts attempt to front-run the official news, they can easily be swayed by anecdotes and, occasionally, by political and epidemiological biases. Hence, we were skeptical of various claims that the economic recovery was relapsing in July in the face of a rebound in COVID cases. Those caseloads have since started to head down again, and, meanwhile, today’s data failed to show any meaningful setbacks in the pace of economic recovery.

There were a few pockets of especially strong gains, namely restaurants up 502,000, retail trade up 258,000, public schools up 215,000, temporary help services up 144,000, health care up 126,000, apparel stores up 121,000, personal services (barbers, etc.) up 119,000, recreation up 87,000, and childcare up 45,000. The public school gains are a false flag, as teachers who normally would have been “furloughed” in July this year went off the payrolls in May. The other large gains here are more substantial. Elsewhere, gains were more modest, with a few sectors showing slight declines, as there almost always are.

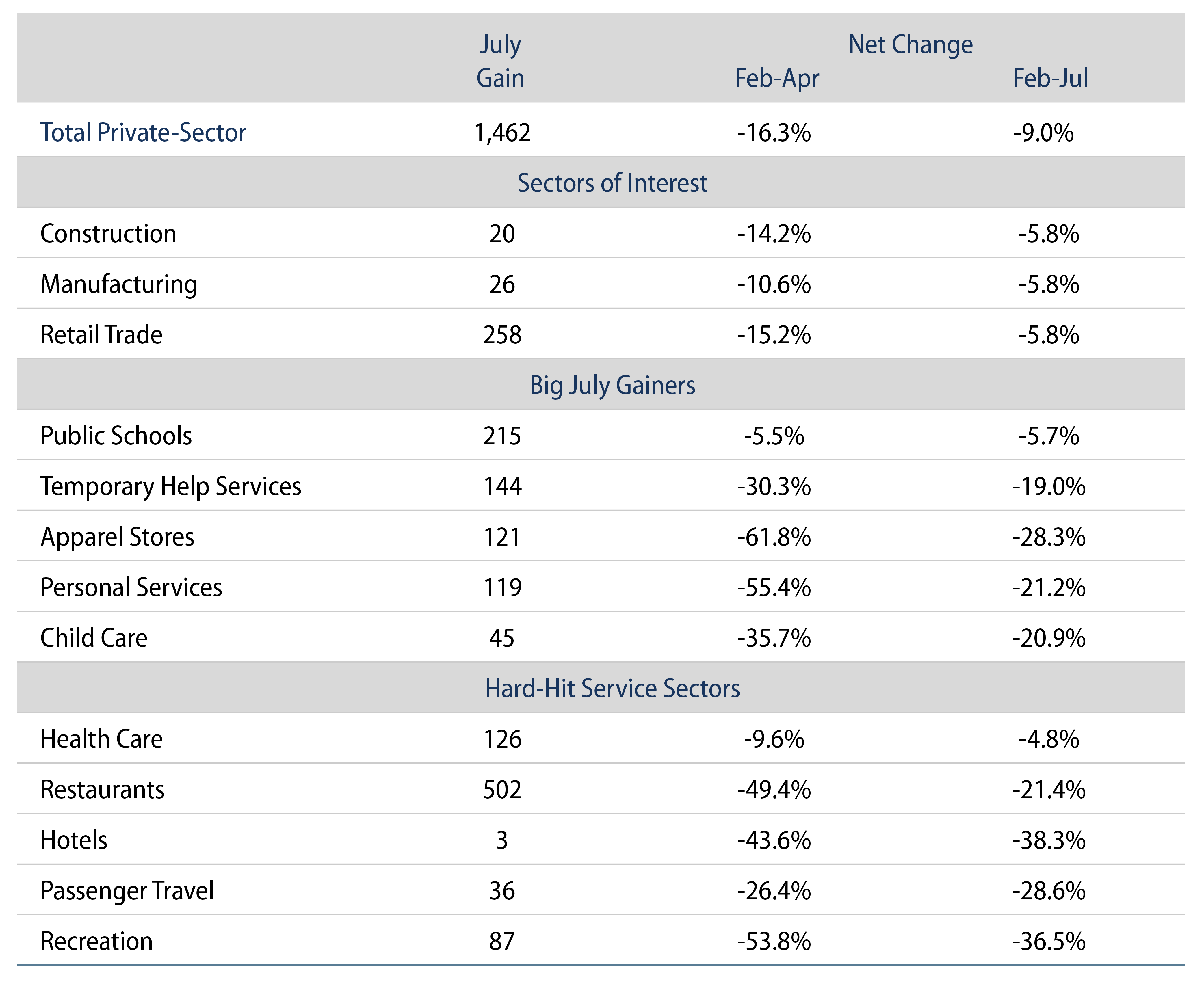

To put things in perspective, the accompanying table shows how various sectors have performed: those we normally focus on (construction, manufacturing, etc.), those showing especially sharp July gains and those sectors we have been describing in recent months as having been especially hard hit by the shutdown.

As you can see from the table, no sector is fully recovered from the shutdown. Construction and manufacturing have seen substantial rebounds, and, interestingly enough, so has retail trade. (The Paycheck Protection Program—PPP—is likely helping there.) Other sectors showing large job gains in July generally saw extremely sharp declines through April and, even with the July gains, remain substantially depressed. Still, they are recovering.

Among the hard-hit service sectors, health care and restaurants have shown nice rebounds, with health care nearly back to full strength and restaurants back more than one might have expected (PPP again?). However, not surprisingly, hotels, travel and recreation have barely bounced over the last three months. For these sectors, continued shutdown and fears of infection among potential customers are powerful forces holding them back.

These last few industries are unlikely to see a more substantial recovery until an effective vaccine emerges or else popular fears somehow dissipate. In the meantime, though, it is important to distinguish the rest of the economy from these “special case” sectors.

The economy on balance will still be depressed, thanks to continuing woes in the shutdown “epicenter” sectors. However, total employment and GDP can still achieve something resembling a V-shaped recovery just on the strength of those sectors where recovery is occurring. In other words, after GDP growth rates of -5.0% and -32.9% in 1Q and 2Q, a second-half performance of +25% and +5% in 3Q and 4Q would look strong, but would leave the economy in 4Q at 4% below year-ago levels. Those suggested second-half growth numbers look about right to us, and the 4% net decline in 4Q20 over 4Q19 looks to be consistent with the ongoing softness in the aforementioned service sectors.