With the year’s end nigh and a snow flurry of economic releases in the last few days, it is a good time to step back and take stock of the US economy. Rather than bury the lede, we’ll state up front that things are mostly okay. Stock market valuations notwithstanding, no sector of the economy is growing rapidly; but at the same time, no sector is especially weak. Service sectors are growing steadily, while the most cyclically sensitive sectors, manufacturing and construction, are, at best, treading water. And we just got some cheery news on inflation to end the year.

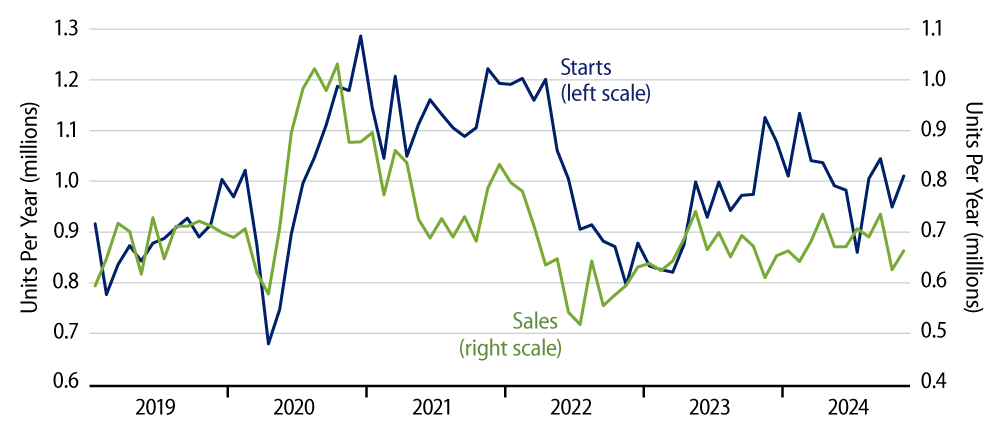

New-home sales bounced a bit in November, but still remained well below their mid-year levels—and even those mid-year levels, in turn, were too low to sustain the current level of single-family housing starts, as indicated in Exhibit 1.

Given the disparity between single-family starts and new-home sales along with the accompanying increase in inventories of unsold new homes, we have been projecting a sharp drop in home construction. That hasn’t happened yet, but neither is single-family construction rising. Meanwhile, multi-family construction is declining steadily, and nonresidential construction is flat at best.

The latest manufacturing data show both employment and output declining, despite the federal government having poured hundreds of billions of dollars into construction of new plants over the last two years. Still, factory output is not dropping sharply.

Again, the current star of the economy is the service sector, led mostly by health care. Services account for the bulk of recent job growth, and health care comprises the lion’s share of service-sector job growth. Still, other service sectors are generally showing at least some growth. The driver of good service-sector growth has been the steady growth in consumer spending, and that continued in the November data announced this month.

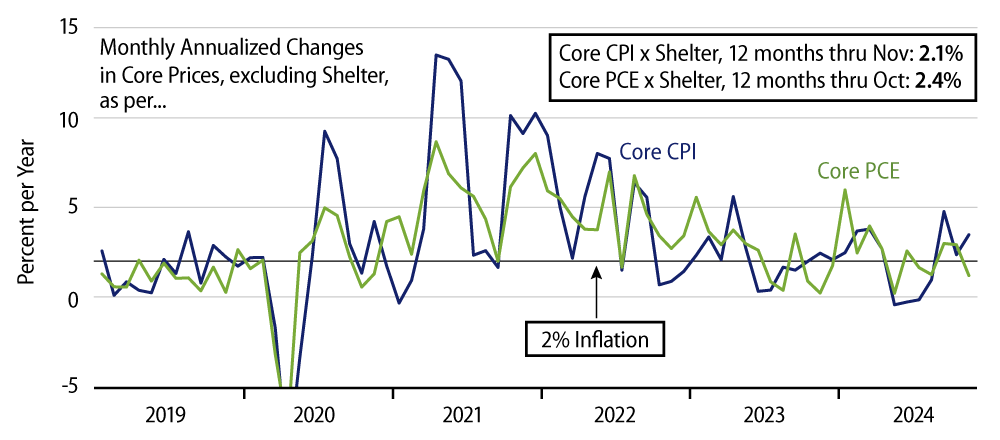

One bright spot worth recounting is the news on inflation as per the Federal Reserve’s (Fed) favored gauge, the Personal Consumption Expenditures (PCE) price index. While the November Consumer Price Index (CPI) news was slightly elevated, the PCE came in very favorably. Headline PCE showed a -0.9% annualized decline, while core PCE increased only 1.4% annualized, and core PCE ex-housing rose only 1.2% annualized (Exhibit 2).

For the last 12 months together, of course, inflation rates were higher, but that mostly reflects a bulge last January and February. Exhibit 2 shows that outside of that early-2024 bulge, core inflation ex-shelter has been generally stable at acceptable rates since mid-2023. Meanwhile, as detailed earlier this month, shelter inflation has finally started to head lower. Parlaying these two trends, we expect core inflation to fall within the Fed’s targets this year, even while the Federal Open Market Committee (FOMC) seems to have pushed its hopes for within-target inflation out to 2026.

In conclusion, while there are concerns, economic growth has held up better in the face of higher interest rates than we would have expected, and we still have hopes and expectations of further improvement on the inflation front.

Thanks for reading these posts this year. Merry Christmas, Happy Holidays and Happy New Year! We hope to see you on these pages in 2025.