Since our last update in June, recent trade talks between the UK and EU have followed several plot twists and moments of suspense worthy of a festive blockbuster movie. While recognizing that negotiations were always likely to be fraught and possibly go down to the wire, our base case remained that both sides would reach an accord on some form of free trade agreement. We believe the deal that was agreed on December 24 delivered on the key issue for Brexit supporters of restoring UK sovereignty, yet despite now knowing the details, estimating the potential impact on the UK economy remains opaque given the ongoing challenges arising from the Covid pandemic.

What We Know

After more than four years of uncertainty since the Brexit referendum, the UK and EU finally agreed on an expansive free trade agreement. The deal itself was ratified by UK parliament and signed into law on December 30, having already been given unanimous provisional approval by EU officials. The trade agreement is comprehensive compared to typical trade agreements and covers trade in goods and some services, investment, energy, aviation, transport, fisheries, regulatory cooperation, level playing field provisions, dispute settlement and more. That said, the deal clearly doesn’t replicate previous arrangements, particularly with regard to services, and over time, divergence risks may emerge. With respect to some of the key political issues there will be no role for the European Court of Justice and freedom of movement will end. However, while the deal broadly ‘delivers’ from a UK perspective, it falls short in the key area of financial services where the EU is yet to grant the UK equivalence, thereby resulting in UK financial servicing firms losing automatic passporting rights from January 1, 2021.

What We Don’t Know

Despite removing uncertainty and mitigating the negative impact of a no-deal scenario, it is unclear how impactful the non-tariff frictions reintroduced by the UK leaving the EU single market and customs union will be over the long term. In the short term, some disruption to trade is inevitable as businesses adapt to the new arrangements, a view shared by the Bank of England (BoE), which forecasts this to shave around 1% off GDP growth in 1Q21. It is also still too early to estimate the positive impact of future new trade deals between the UK and other large trading partners and in addition the various domestic measures already announced aimed at boosting UK growth.

What We Expect

The short-term disruptions to trade, together with current tighter restrictions resulting from a sharp increase in new Covid cases, reinforce our view that the BoE will keep rates on hold for the foreseeable future. The announcement of a deal also lowers the risk of imported inflation (from either tariffs or currency weakness). The likelihood of the base rate being cut into negative territory is reduced in our opinion but we would not be surprised to see additional asset purchases and a strengthening of forward guidance should the growth and inflation outlook come in below the BoE’s forecasts.

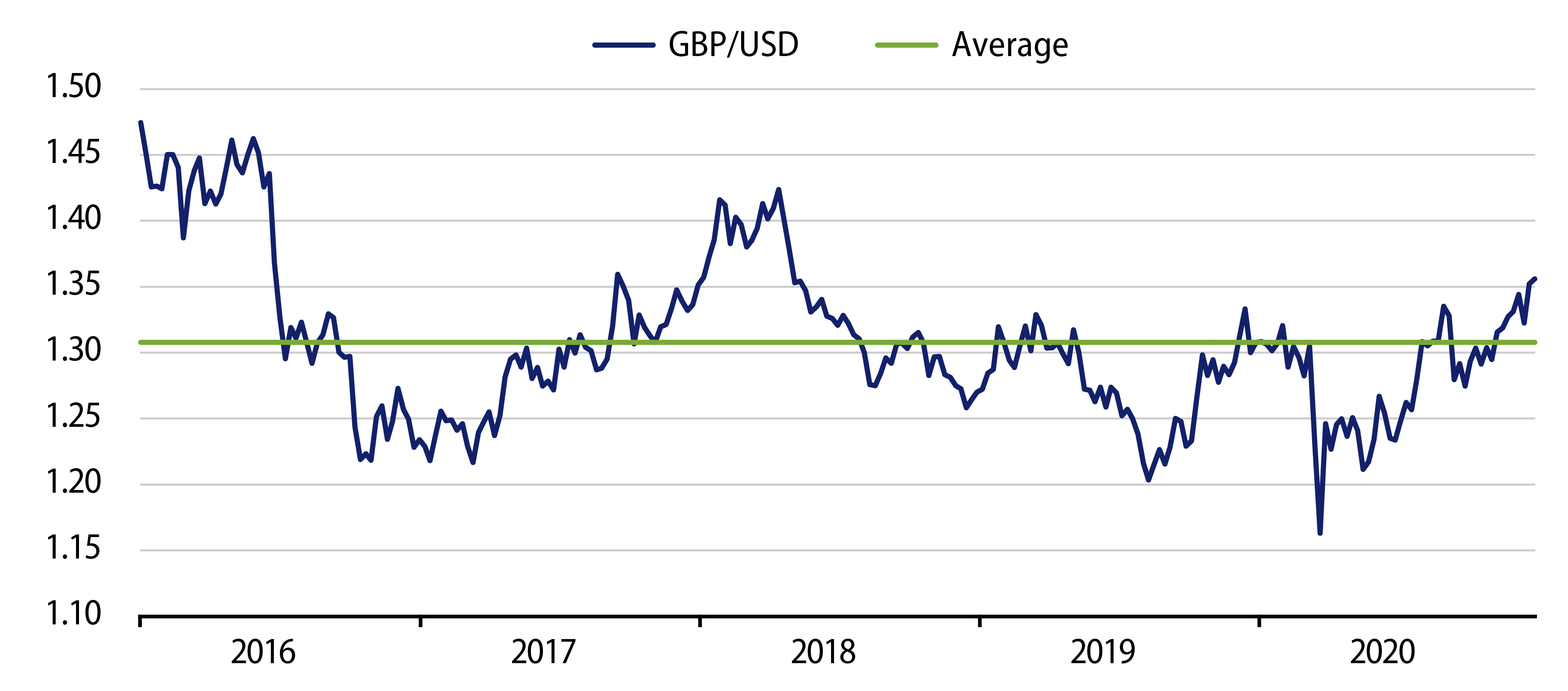

From a market perspective, the level of sterling had risen sharply in recent weeks in anticipation of a deal being agreed upon and appreciated further post the deal being signed. While we believe that sterling can remain supported in the short term, we expect further strength to be limited given the aforementioned growth and inflation challenges and the prospect of further BoE easing.

We expect UK gilt yields to remain within recent ranges with significant additional issuance next year likely to be largely offset by BoE purchases. A meaningful breakout in either direction would most likely come from a significant growth and/or inflation surprise. In that respect, the prospect of a faster than expected roll out of the Covid vaccine could provide a boost to growth but this is unlikely to meaningfully impact the inflation trajectory.

In summary Prime Minister Johnson fulfilled his pledge of ‘getting Brexit done’ but it remains far from clear what the impact of Boris’ Brexit will be for the British economy over the longer term.