Private-sector payrolls rose by 344,000 jobs in November, with a slight +9,000 revision to the October estimate. This gain was above the 307,000 gain suggested by ADP Wednesday. However, the headlines we’ve seen this morning emphasize that job growth is slowing.

As can be seen in last week’s October personal income data, of course growth is slowing. There is no way the economy could continue to add millions of jobs per month or continue to match the 30% plus growth rate of 3Q20. As some parts of the economy achieved full or nearly full recovery from the Covid recession, and as other sectors bumped up against constraints imposed by government fiat and customer fears, it was inevitable that growth numbers would recede a bit. As noted last week, even Shaquille O’Neill eventually stopped growing inches per year.

The issue is whether the 340,000 gains of November and 900,000-something gains of September and October are truly signs of weakening or merely of maturation. Our answer is a little of both, but mostly the latter.

We’ll start by acknowledging that total nonfarm payrolls rose only 245,000 jobs, as a loss of 99,000 government jobs restrained that metric. As was the case with the October data, where private-sector payrolls were up 877,000, but total payrolls “only” 610,000, the declines in government jobs reflect unwinding of temporarily hired 2020 Census workers as well as a failure of public schools to reopen for the fall semester. So, the government job declines are more technical glitch and imposed softness than an actual weakening.

In the private-sector, job growth in November declined by over 400,000 in two specific industry groups, business/professional services and restaurants. For business/professional services, monthly gains there had been roughly 200,000 per month since May. Maybe the 60,000 jobs gained in November is a sign of topping out, or maybe it is a statistical blip, with the sector catching its breath after six months of rapid recovery. Time will tell.

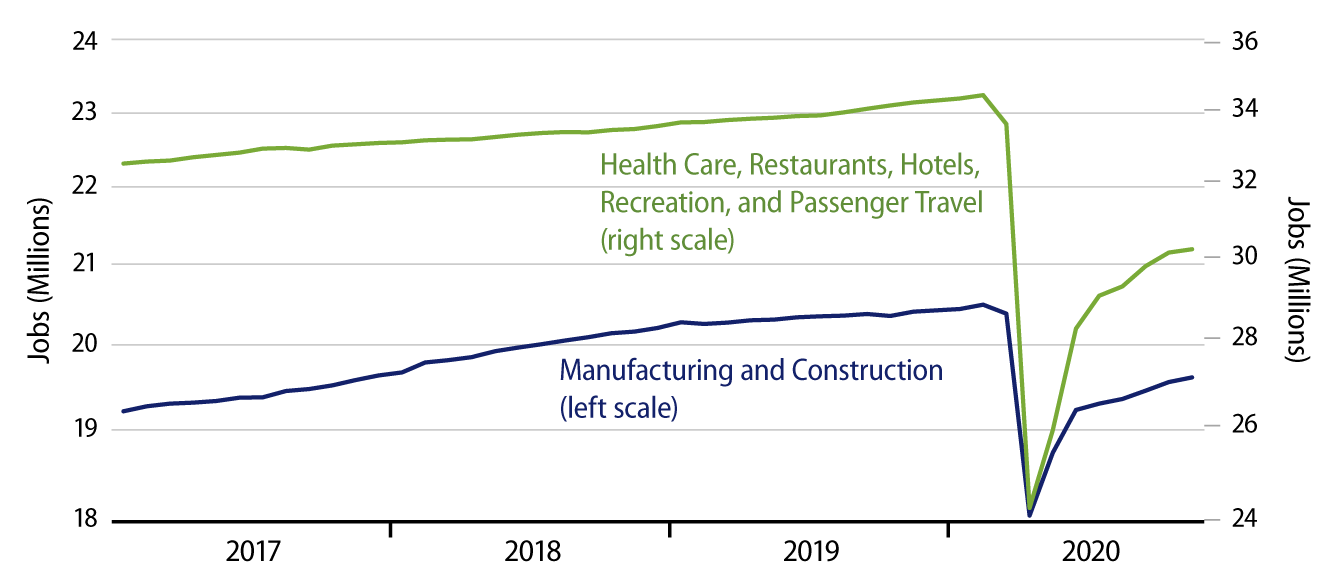

For restaurants, the 17,000 jobs lost in November followed a gain of 192,000 in October, as well as an October levelling off in restaurant sales. Here, it seems to be the case of restaurants already having recovered as much as they can given the heavy constraints government require them to operate under, as well as the specter of further shuttering due to the current Covid surge.

Another area where November job growth was softer was retailing, and this is what the “Christmas past” in our title refers to. Remember, these are all seasonally adjusted data. In retailing, stores would normally be ramping up hiring in November in preparation for Christmas selling—but 2020 is not a normal year. Before seasonal adjustment, retail jobs rose 302,000 in November, but this is less than what has happened in the past, so on a seasonally adjusted basis, retailing was announced as losing 35,000 jobs.

Elsewhere, job gains were pretty decent. Manufacturers are not rehiring workers as rapidly as we would like, but the pace is upward and steady. The same is true in construction.

In summary, in most sectors of the economy, recovery continued at a decent pace in November. There was notable slowing in business services, restaurants and retailing. We’ll have to wait and see whether the business services slowing is for real or a statistical blip. The restaurant and retailing slowing are likely for real and reflect Covid realities.