Macros, Markets and Munis

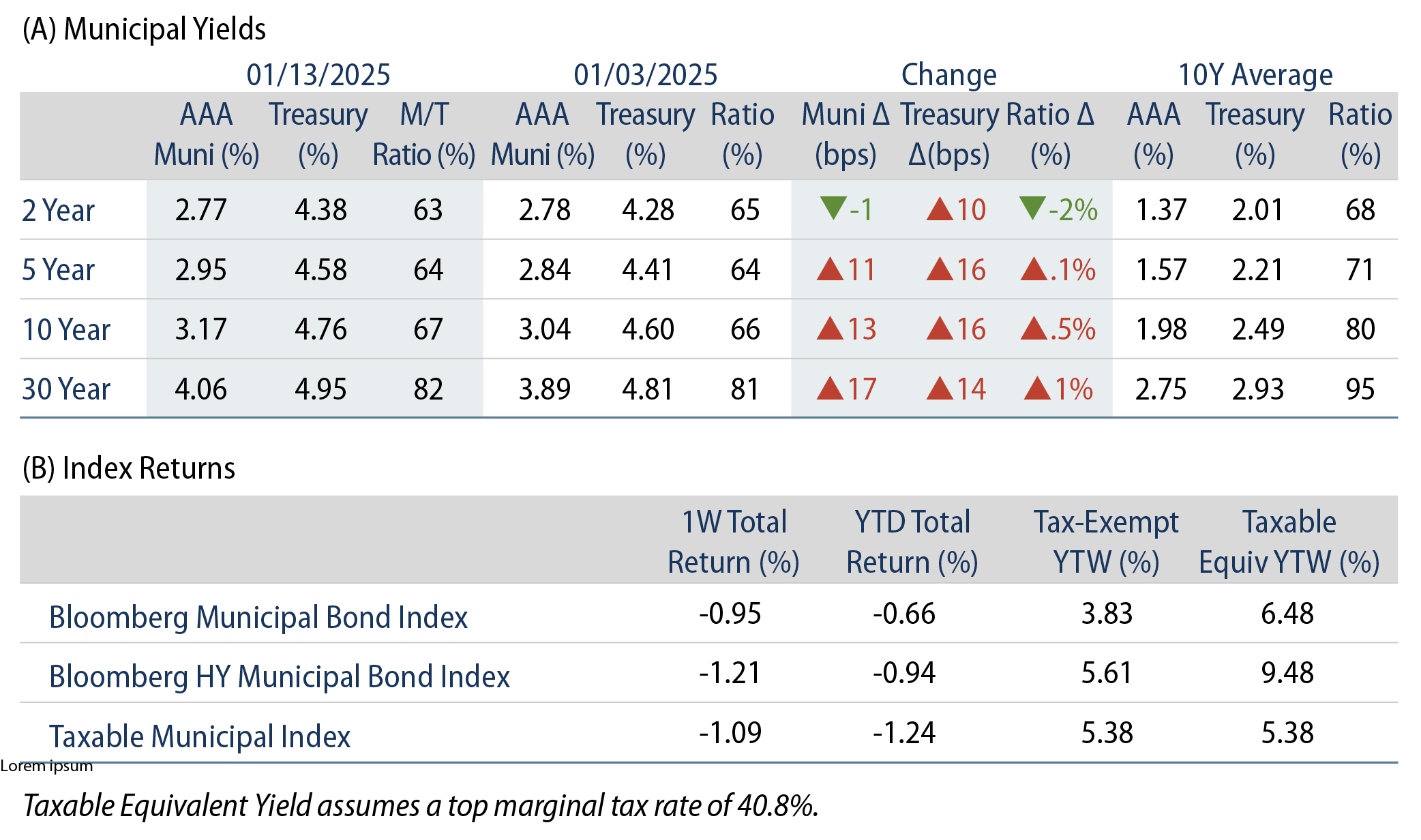

Muni yields moved higher last week in sympathy with Treasuries and performed in line with their taxable credit counterparts. Munis posted negative returns as fixed-income yields moved higher following the release of strong labor data. The JOLTs report highlighted greater-than-expected job openings and initial jobless claims declined. The nonfarm payrolls report came in above expectations and at higher levels than seen in prior months. All told, Treasury rates moved 10-14 basis points (bps) higher across the yield curve, reducing market-implied probabilities of future Federal Reserve rate cuts through the end of this year. Meanwhile, technicals strengthened as fund flows turned positive. This week we highlight key muni-related themes to monitor in 2025.

Technicals Strengthen as Fund Flows Turn Positive

Fund Flows (up $842 million): During the week ending January 8, weekly reporting municipal mutual funds recorded $842 million of net inflows, according to Lipper. Long-term funds recorded $532 million of inflows, intermediate funds recorded $57 million of inflows and high-yield funds recorded $527 million of inflows. This week’s outflows end a four-week streak of consecutive inflows.

Supply (YTD supply of $7 billion): The muni market recorded $7 billion of new-issue supply to begin the year, predominantly comprised of tax-exempt issuance. This week’s calendar is expected to jump to $14 billion. The largest deals include $1.3 billion Triborough Bridge and Tunnel Authority and $984 million Central Valley Energy Authority transactions.

This Week in Munis: 2025 Outlook

In last week’s issue, we highlighted the 2024 municipal market review. In this week’s issue, we highlight key themes that we are following as we begin 2025. We expect that attractive tax-exempt income opportunities will bode well for the muni asset class. However, we recognize the potential for near-term rate uncertainty and technical drivers which can contribute to volatility and create value for active management this year.

Technicals: Will supply remain elevated?

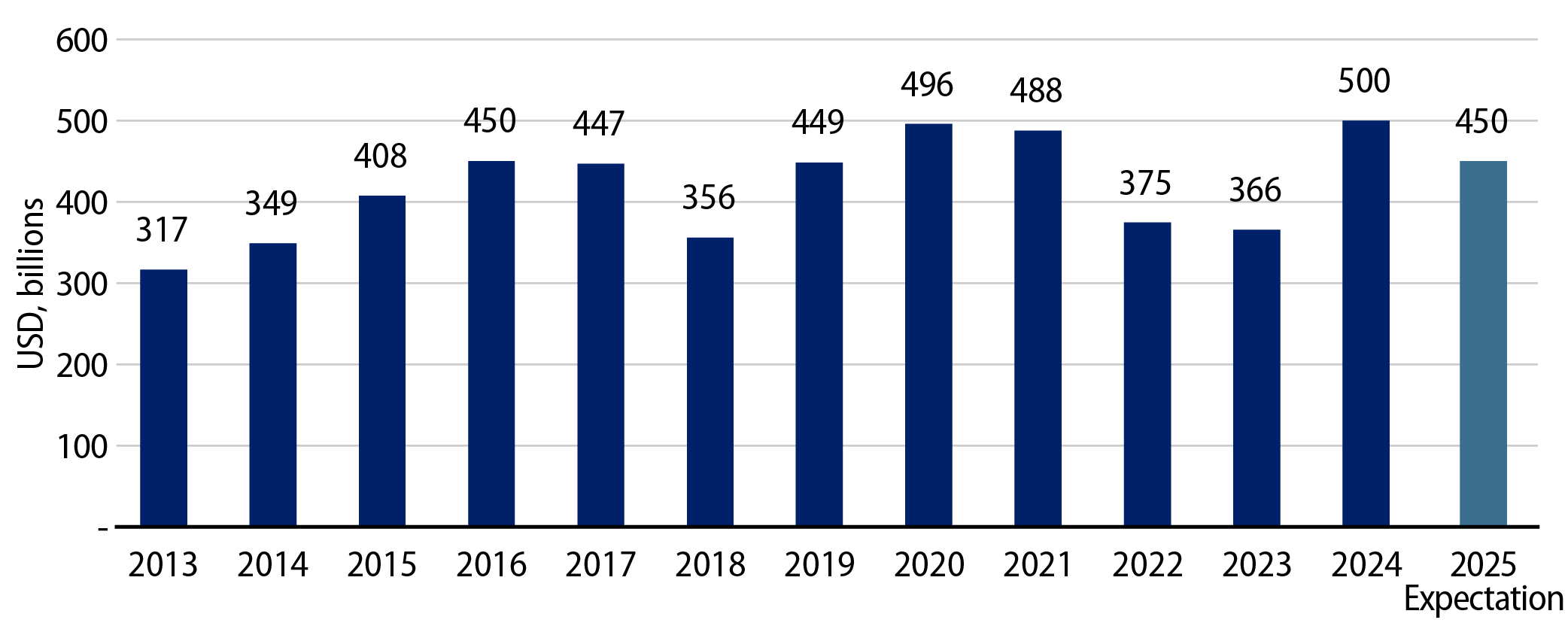

In 2024, the municipal new-issue supply reached record levels, increasing 36% year-over-year (YoY) to $500 billion. The majority of the supply uptick was driven by tax-exempt issuance, which increased 40% YoY to $460 billion as issuers took advantage of the tax exemption at higher nominal rates. Taxable issuance was higher by 6% YoY at $40 billion.

Looking at 2025, most market participants are expecting another elevated supply year, driven by ongoing refunding activity. Western Asset anticipates supply will reach approximately $450 billion, which could be well absorbed by expected maturities, coupon payments and the potential for an uptick in demand as investors turn to the municipal market for attractive after-tax income opportunities.

Fundamentals: Will the favorable muni credit cycle persist?

In 2024, municipal credit fundamentals maintained the post-pandemic momentum and continued to strengthen. Strong US economic conditions, including favorable labor and real estate markets, contributed to record tax collections. Rating agency upgrades outpaced downgrades for a fourth consecutive year, albeit at a slower pace than levels recorded in recent years.

Western Asset expects US economic conditions to remain favorable and supportive of tax collections in 2025, which could be further bolstered by fiscal policy implications such as the potential extension of the Tax Cuts and Jobs Act. While Western Asset anticipates that municipal credit will be well supported by these conditions, we expect the pace of upgrades relative to downgrades will continue to slow. We expect lower investment-grade and high-yield to offer value given the favorable backdrop, but at tighter credit spreads, and credit selection will require additional scrutiny.

Valuations: Will there be a better entry point?

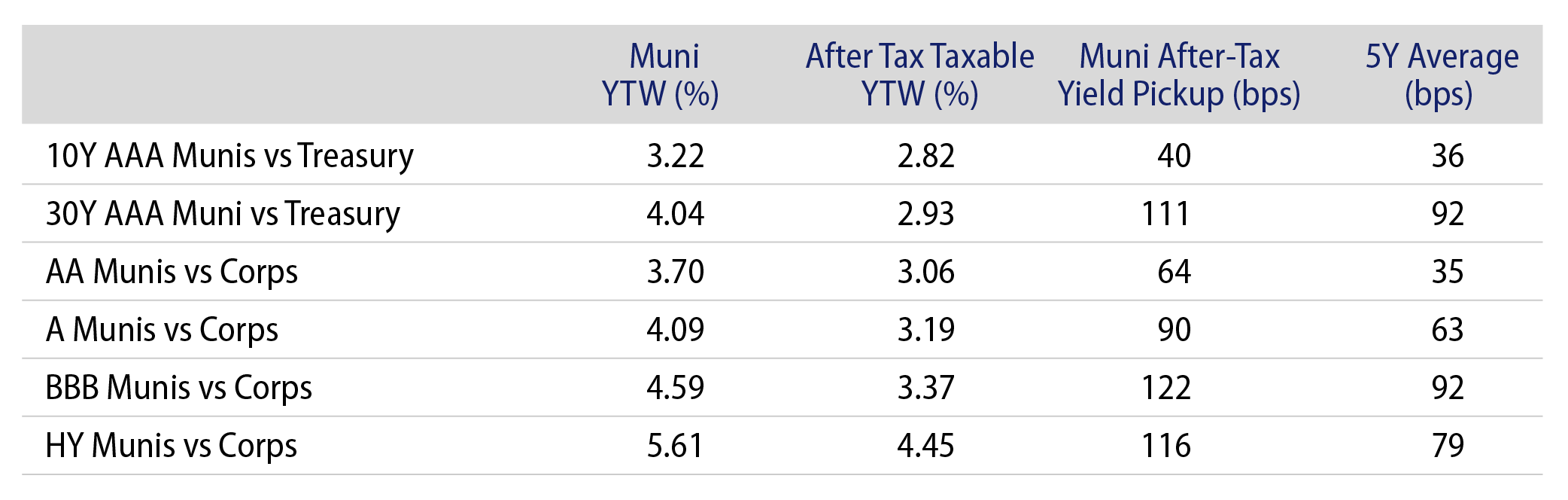

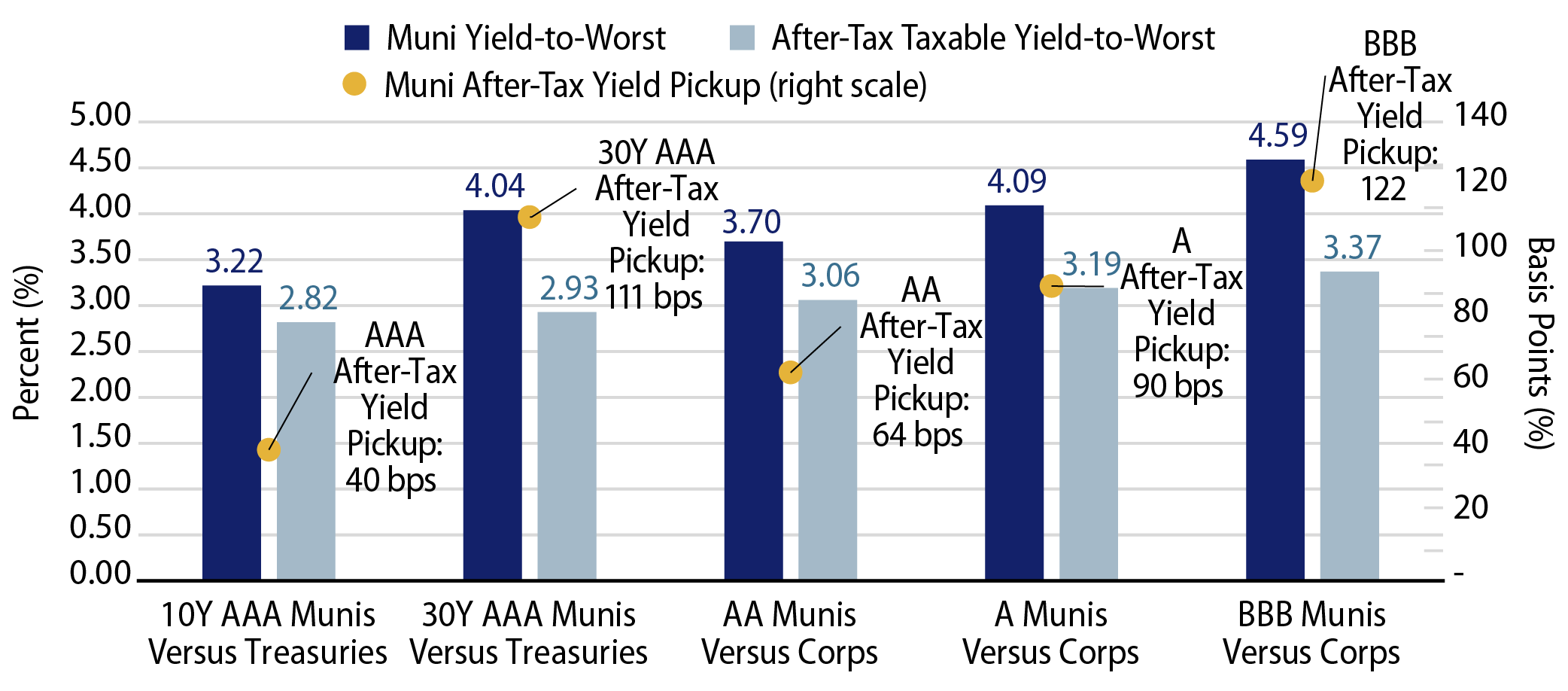

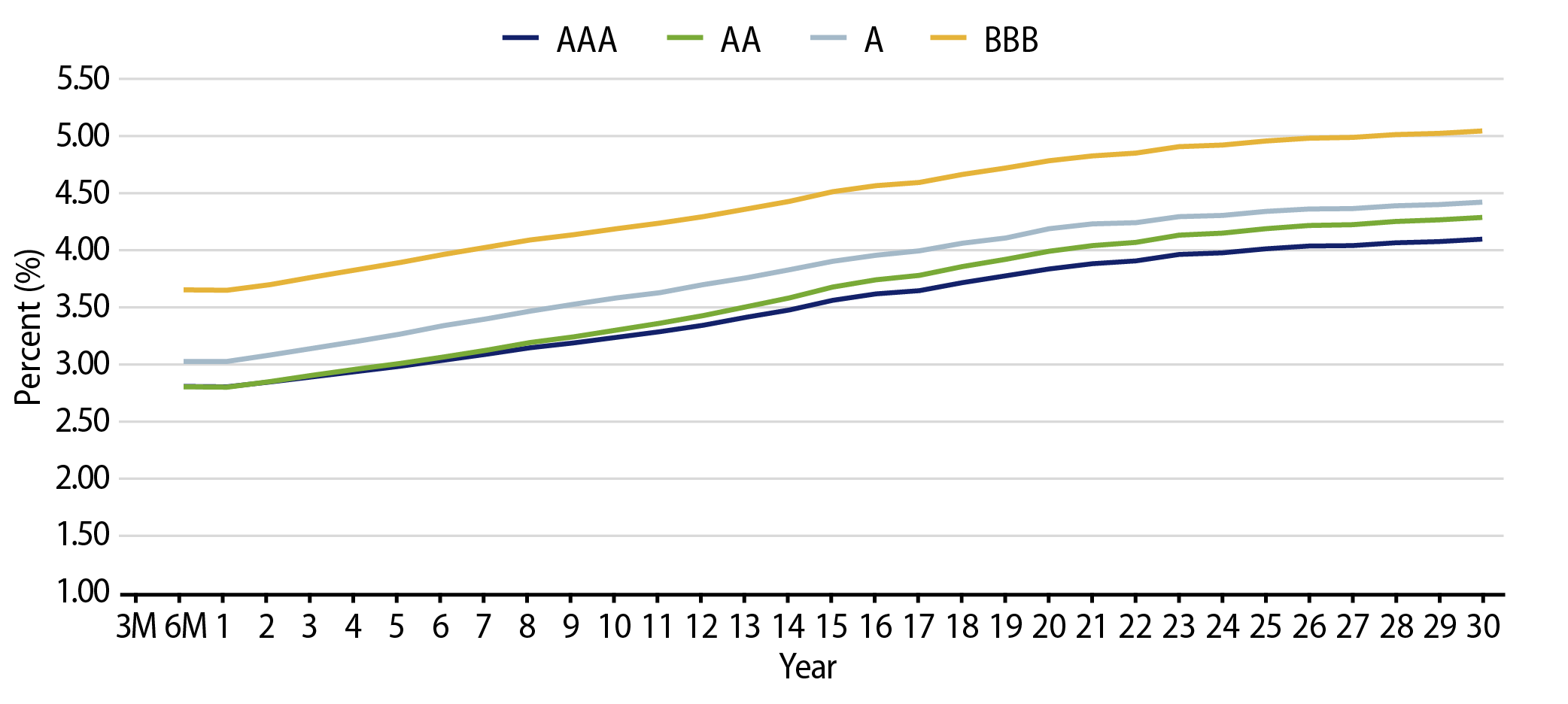

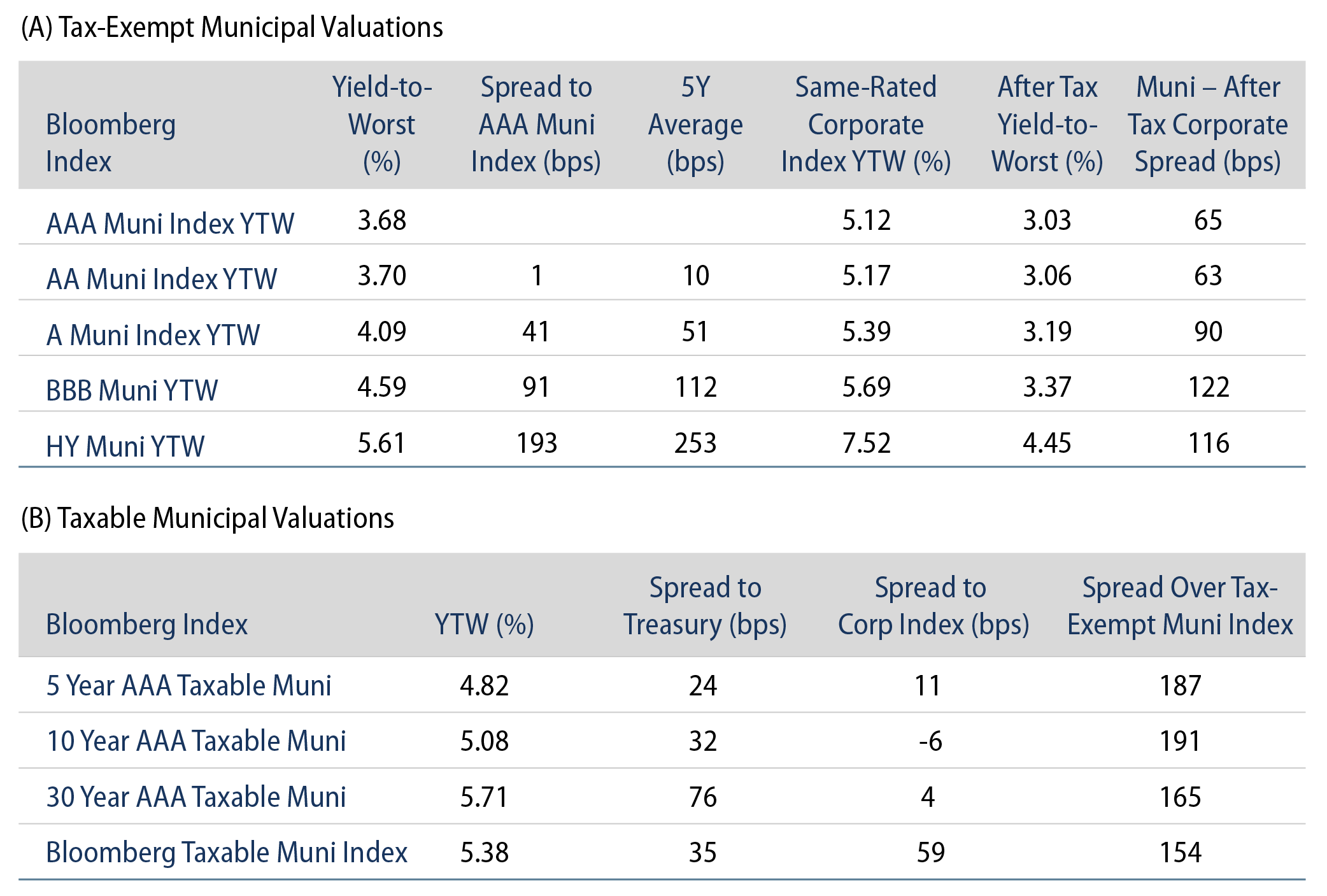

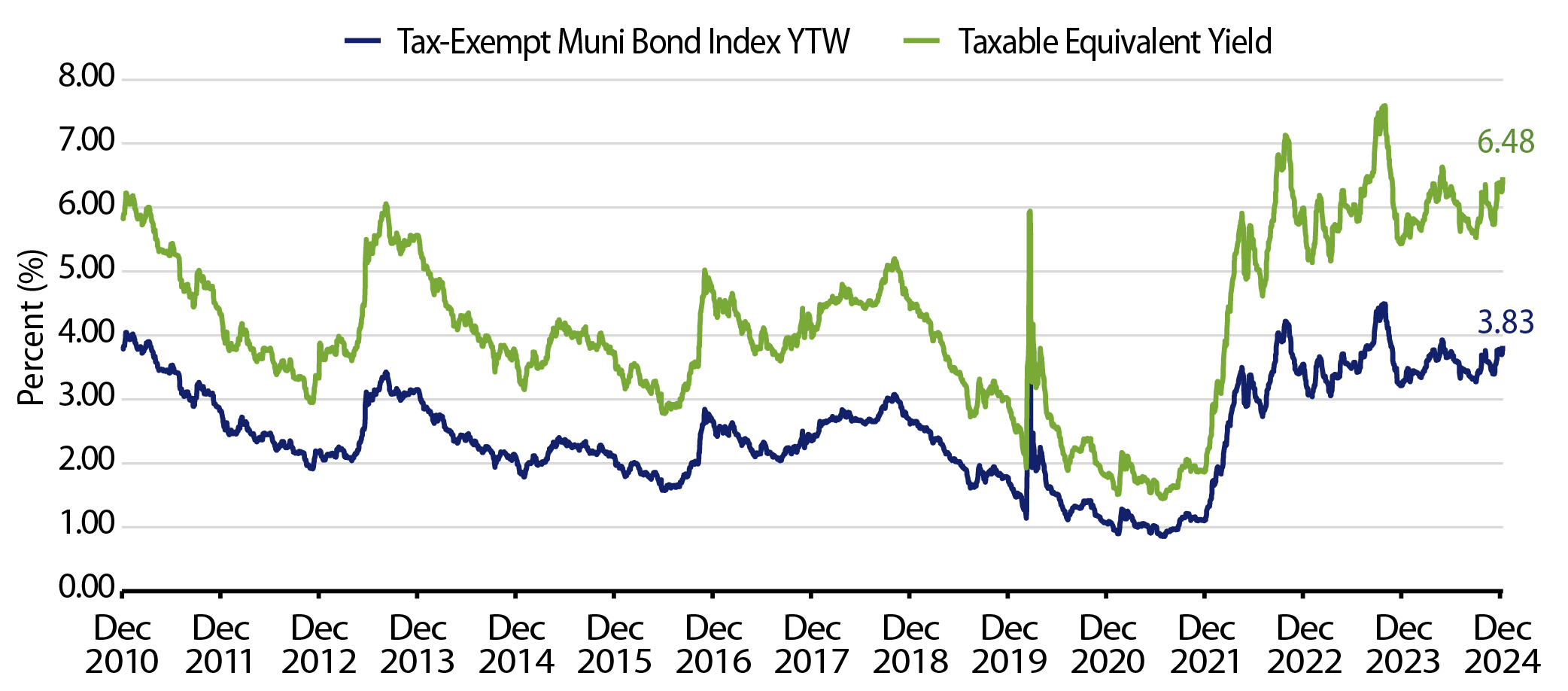

Elevated interest-rate volatility and record supply levels in 2024 contributed to higher income opportunities and improved relative valuations of the municipal asset class by year-end. The Bloomberg Municipal Bond Index Yield to Worst ended the year 52 bps higher at 3.74% YoY (which is 6.32% on a taxable-equivalent basis), above the 28 bps and 38 bps increases of the Bloomberg Corporate and Treasury Indices, respectively. As of January 10, municipals offered 40-122 bps of after-tax yield pickup versus comparable Treasury and corporate counterparts, across curve and credit cohorts, which exceed five-year averages.

Western Asset expects that current valuations will reward long-term municipal investors. Strong economic data, in conjunction with the uncertain policies of the upcoming administration, could contribute to bouts of volatility in 2025. However, volatility associated with strong economic conditions would likely coincide with improving credit fundamentals and be limited by improved technical factors should supply decline and demand remain persistent. Considering the near decade-high tax-exempt income levels offered, Western Asset believes current levels represent an attractive entry point, and that active management should help investors capitalize on volatility that may arise in the year.

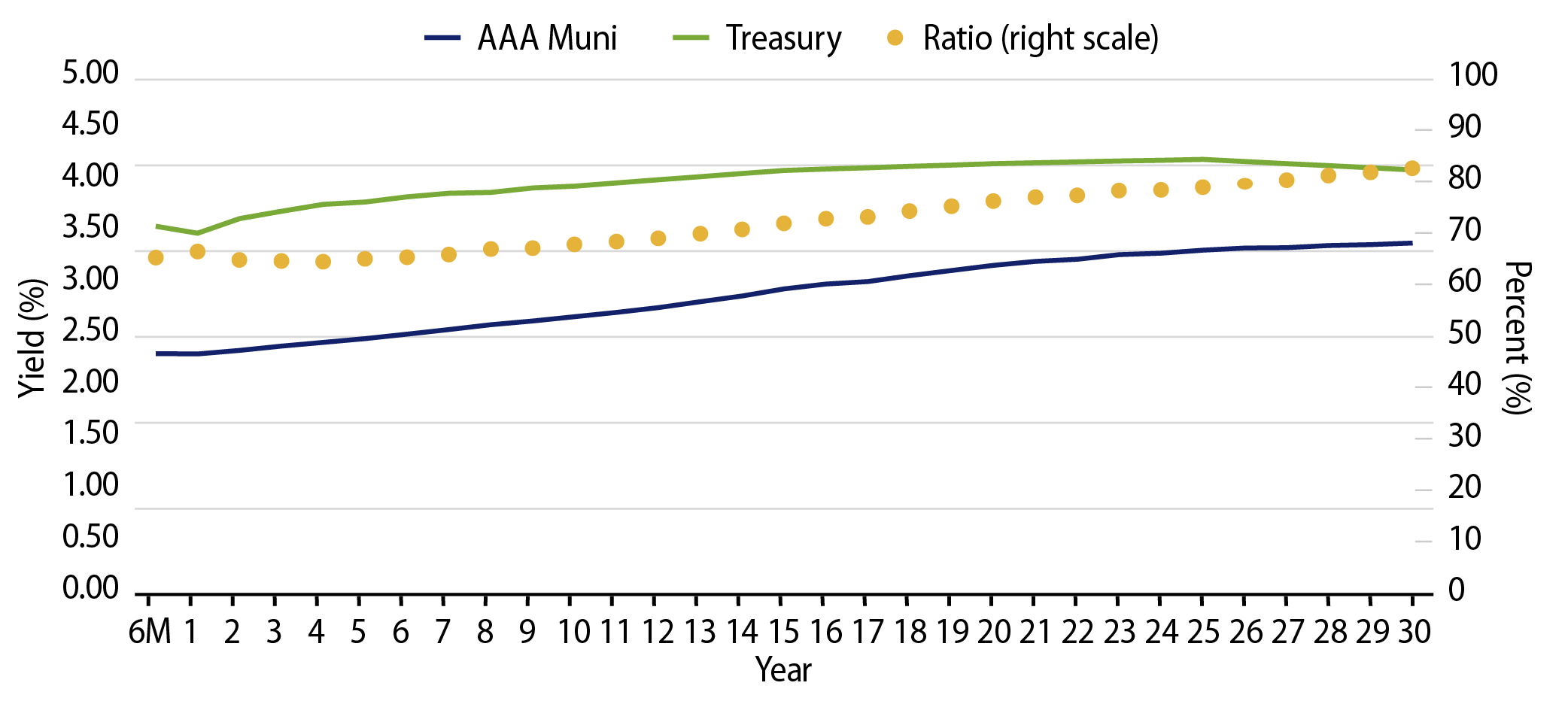

Municipal Credit Curves and Relative Value

Theme #1: Municipal taxable-equivalent yields remain above decade averages.

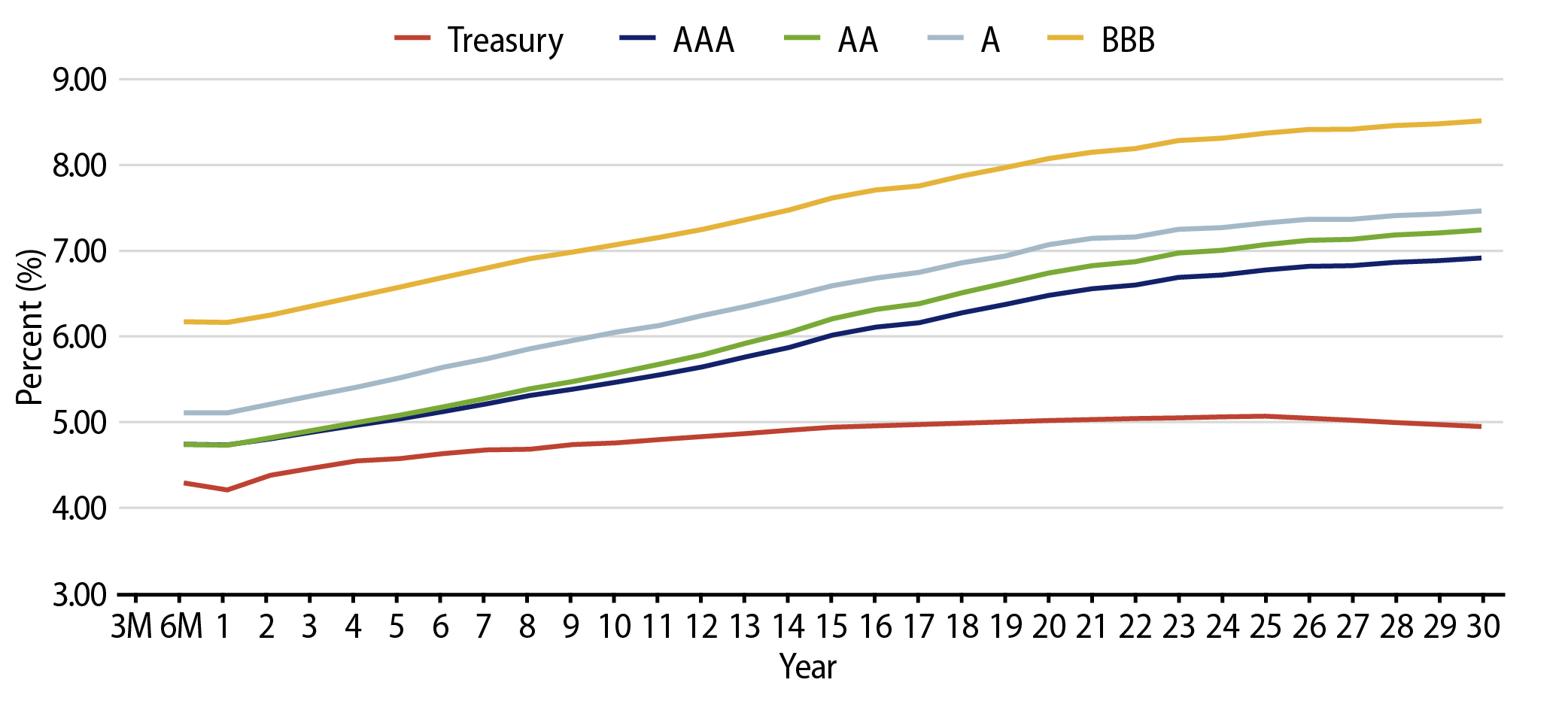

Theme #2: The muni curve has largely disinverted, offering better value further out the curve.

Theme #3: Munis offer attractive after-tax yield pickup versus longer-dated Treasuries and investment-grade corporate credit.