Municipal Yields Grinded Lower on Favorable Technicals

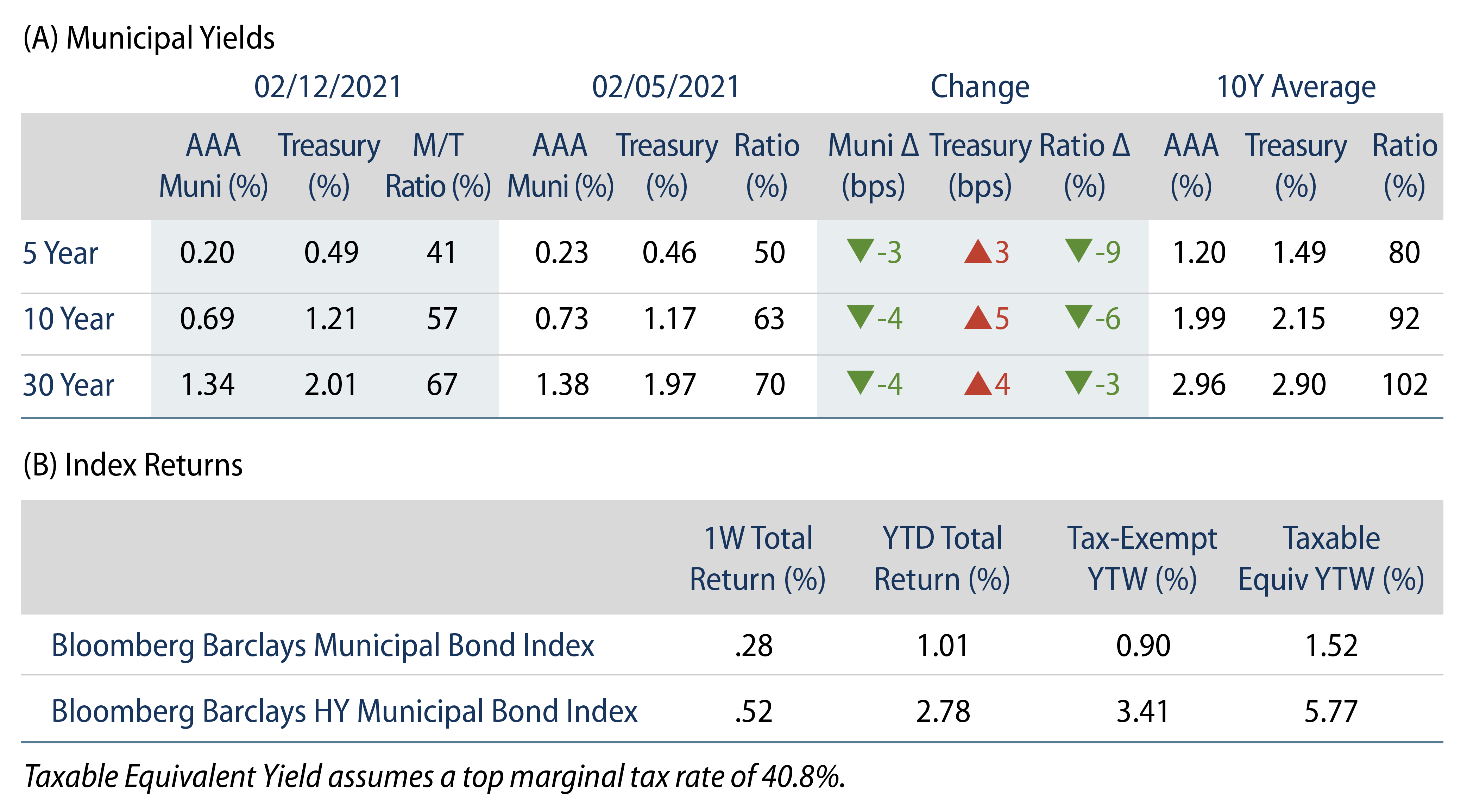

Municipal yields grinded lower, outperforming Treasuries over the week. Municipal mutual funds recorded a 14th consecutive week of inflows. AAA municipal yields moved 3-4 bps lower across the curve. Municipals outperformed Treasuries, sending Muni/Treasury ratios to record lows. The Bloomberg Barclays Municipal Index returned 0.28%, while the HY Muni Index returned 0.52%. This week we put unprecedented valuations into perspective versus history and other asset classes.

Positive Fund Flows Continue to Support Favorable Technicals

Fund Flows: During the week ending February 10, municipal mutual funds recorded a 14th consecutive week of net inflows, totaling $2.6 billion, according to Lipper. Long-term funds recorded $1.7 billion of inflows, high-yield funds recorded $832 million of inflows and intermediate funds recorded $573 million of inflows. Year-to-date (YTD) net inflows totaled $24 billion.

Supply: The muni market recorded $9.1 billion of new-issue volume during the week, up 13% week-over-week (WoW). New issuance YTD of $43.6 billion was up 11% year-over-year. This week’s new-issue calendar is expected to decline to $5.7 billion (+37% WoW) due to the holiday-shortened week. The largest deals include $818 million CO Regional Transportation District and $658 million city of Tucson transactions.

This Week in Munis: Putting Record Valuations Into Perspective

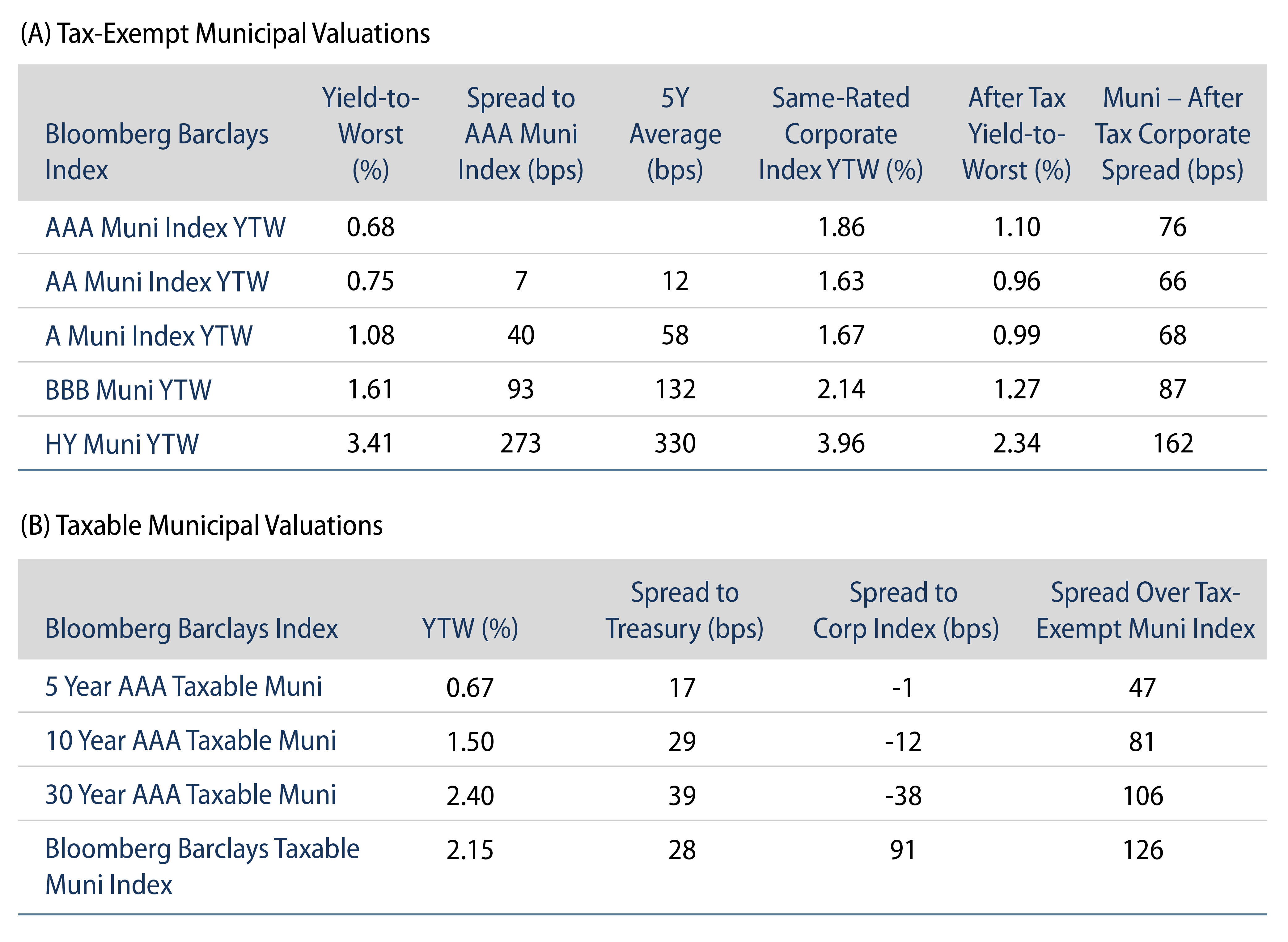

As the municipal market continues to grapple with the economic implications associated with extended pandemic conditions including large budget challenges for states and localities, it can be hard to believe the majority of the municipal market’s yields exceed pre-pandemic lows. The Bloomberg Barclay’s Municipal Bond Index yield-to-worst (YTW) touched a record-low of 0.90% this week, compared to a pre-pandemic low of 1.14%. Municipal/Treasury ratios remain near record lows, ranging from 40%-70% across the curve.

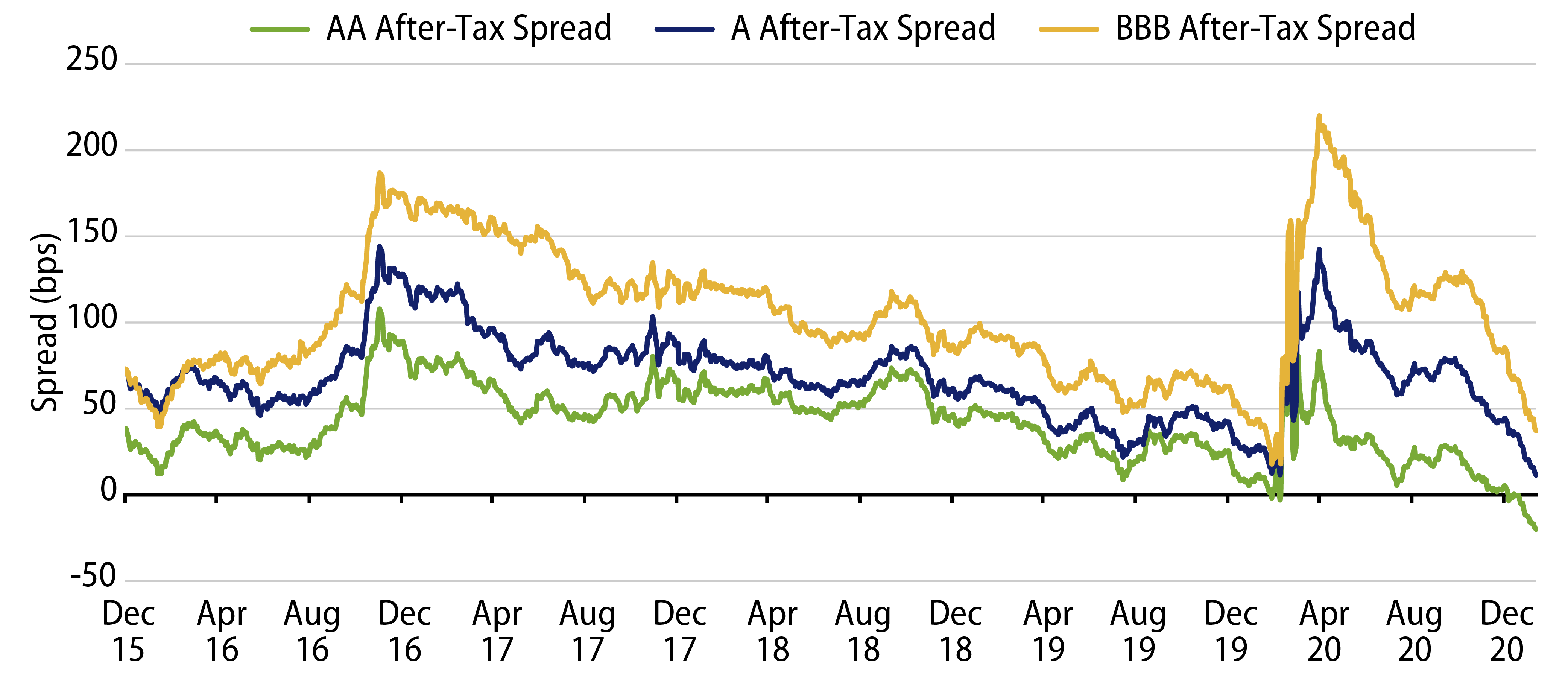

While municipals can appear overvalued on a historical basis, the lower investment-grade credit segment continues to offer relative value versus other asset classes when considering the municipal benefit of the tax exemption. The Bloomberg Barclays A and BBB municipal indices offer 13 bps and 38 bps of after-tax incremental spread versus like-rated corporate indices despite a fraction of the default rates. We believe the prospect of higher tax rates, accommodative Fed policy and demographic shifts will continue to support this relative value demand for tax-exempt debt, which could extend the over $80 billion inflow cycle observed in 40 of the last 41 weeks.

We also expect municipals to remain a ballast to a core allocation for individuals subject to federal taxes, evidenced by lower drawdown rates. Considering the Bloomberg Barclay’s 1-15 Year Muni Index as a proxy, when historical month-end starting investment yields were below 3.0%, less than 10% of the following 132 12-month periods resulted in a negative return. The average subsequent return was 3.46%, and the maximum 12-month drawdown was -2.01%, not considering the tax benefit of the asset class. Given the favorable forward-looking prospects of aging demographics and the prospect of higher taxes, we anticipate municipals will continue to serve as a relatively attractive core component of an asset allocation on a risk-adjusted basis.