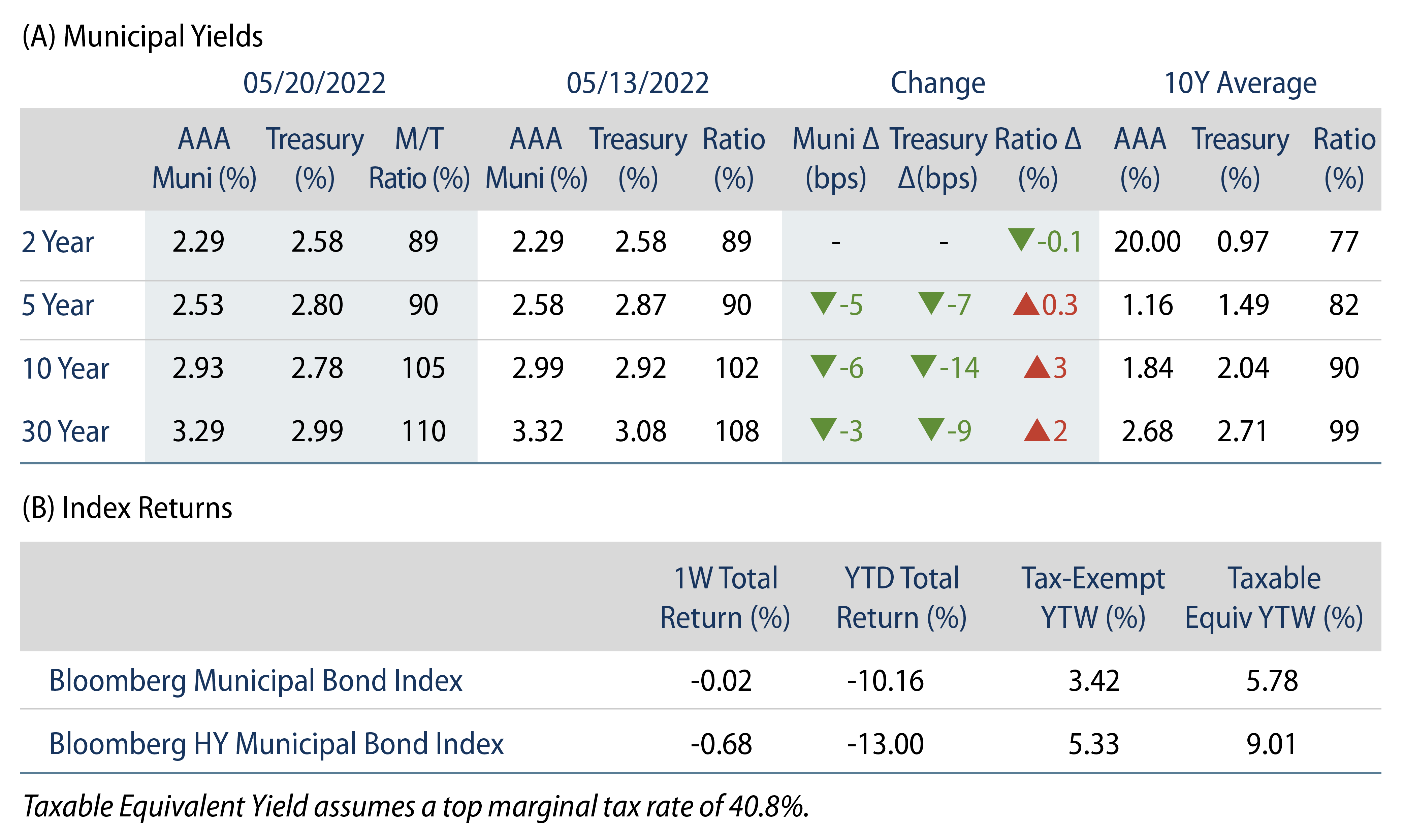

High-Grade Municipal Yields Declined During the Week

Muni yields trailed Treasuries lower last week, but major municipal indices posted negative total returns on spread widening. Munis underperformed the Treasury rally, resulting in Municipal/Treasury ratios exceeding 110% in 30-years. High-grade municipal yields moved 3-6 bps lower across the curve. Meanwhile, municipal mutual funds recorded a 19th consecutive week of net outflows. The Bloomberg Municipal Index returned -0.02%, while the HY Muni Index returned -0.68% as credit spreads widened. This week we highlight and evaluate tax-exempt relative value that has emerged amid underperformance so far year to date (YTD).

Weak Technicals Remain, Driven by Fund Outflows

Fund Flows: During the week ending May 18, weekly reporting municipal mutual funds recorded $2.7 billion of outflows, according to Lipper. Long-term funds recorded $2.3 billion of outflows, high-yield funds recorded $743 million of outflows and intermediate funds recorded $375 million of outflows. The week’s fund outflows extend the current outflow streak to 19 consecutive weeks, and contribute to $59 billion of YTD net outflows.

Supply: The muni market recorded $9.4 billion of new-issue volume, down 37% from the prior week. Total YTD issuance of $166 billion is 5% higher than last year’s levels, with tax-exempt issuance trending 15% higher year-over-year (YoY) and taxable issuance trending 26% lower YoY. This week’s new-issue calendar is expected to decline to $4 billion. Largest deals include $1.1 billion state of Connecticut and $268 million Katy Independent School District transactions.

This Week in Munis: Relative Value Emerges

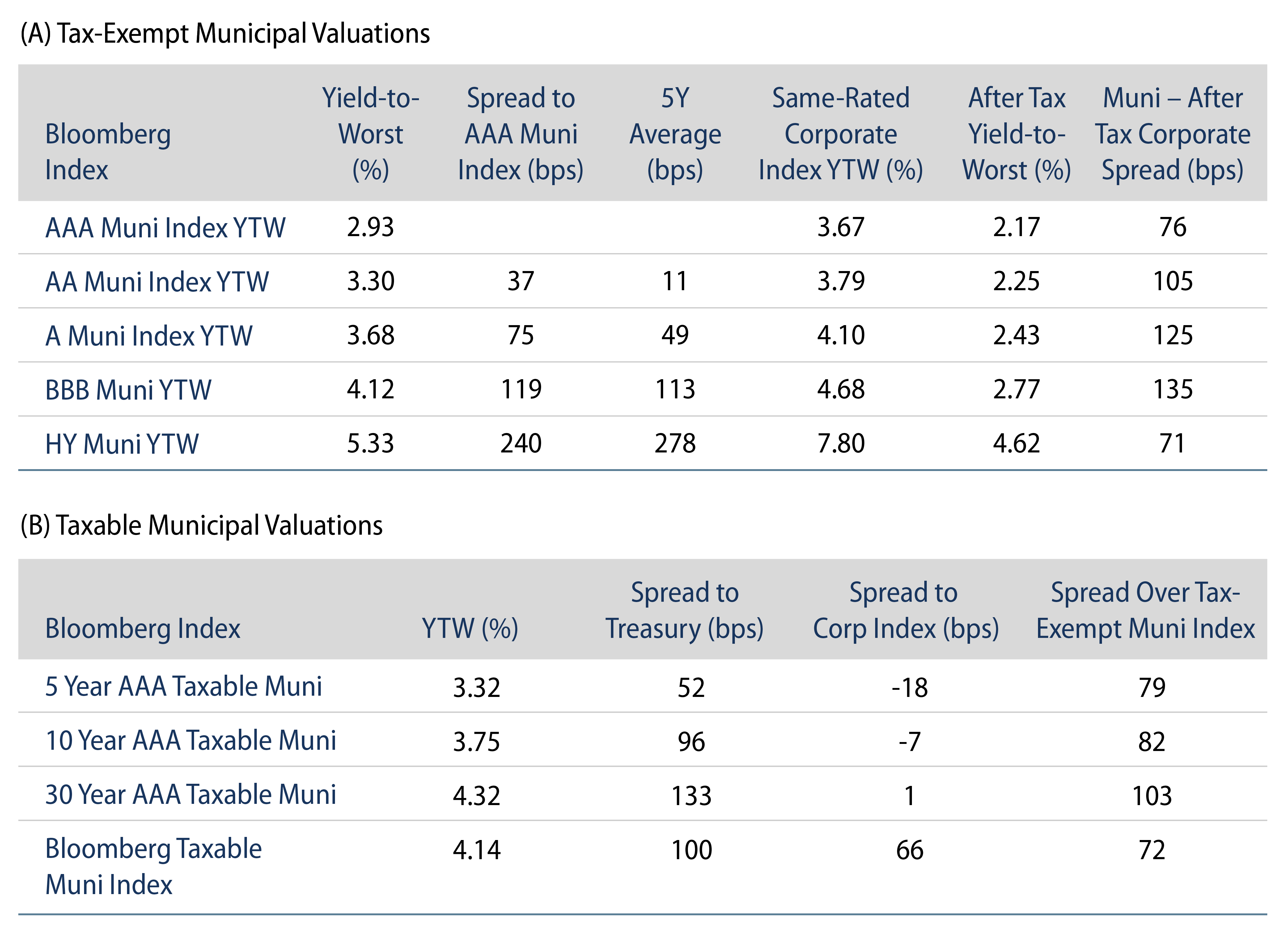

As municipals continue to underperform other high-grade fixed-income sectors YTD, this week we highlight the relative value proposition that has emerged for income seekers subject to tax rates.

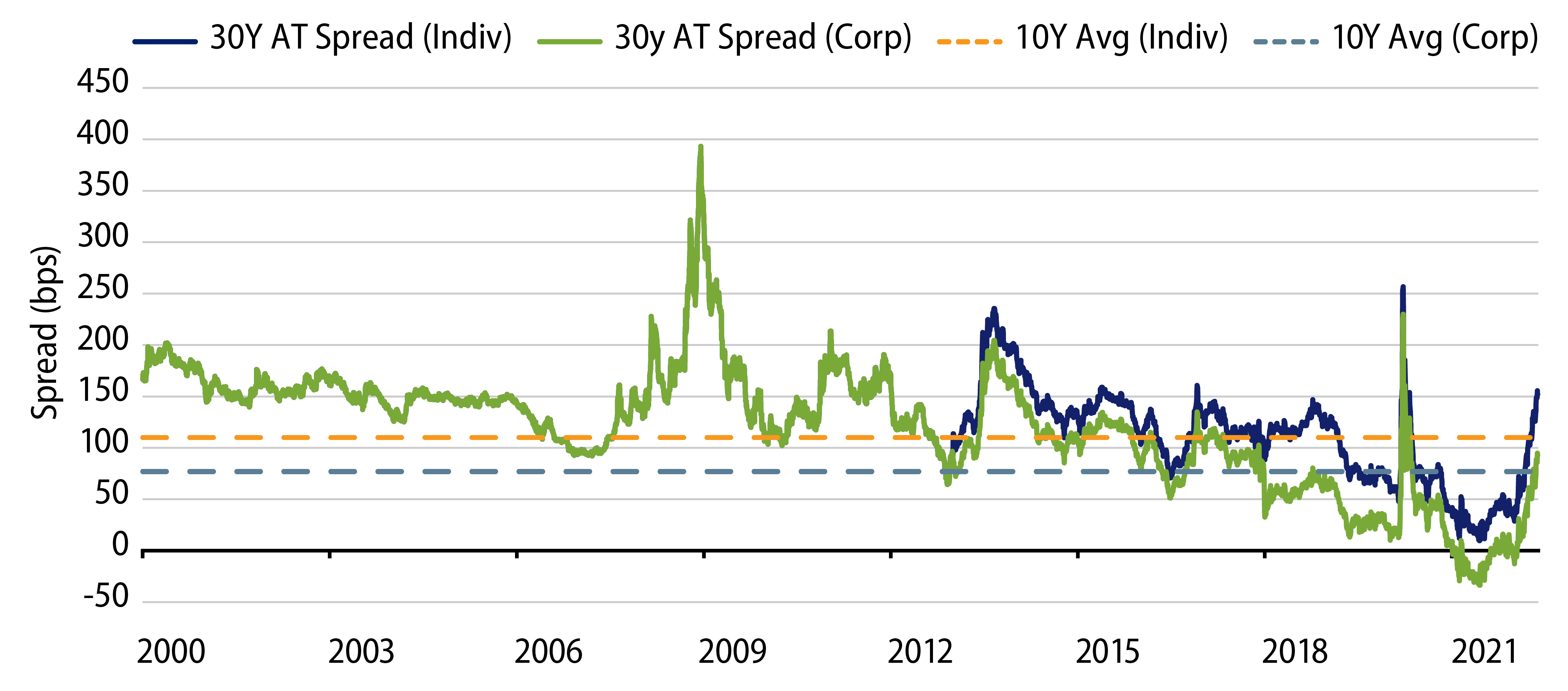

AAA Municipals Versus Treasuries. Perhaps the most referenced cross-asset relative value metric within the municipal market is the Municipal/Treasury ratio. As a fixed-income manager serving clients with a variety of tax rates, Western Asset also references the spread of the AAA Muni yield vs. the comparably structured Treasury yield after taxes, considering a variety of client tax rates (Exhibit 1). Notably in 2021, strong municipal outperformance drove after-tax relative value of munis vs. Treasuries to negative levels for the first time. Amid the volatility and the muni underperformance we observed thus far this year, 10- and 30- year Municipal to after-tax Treasury spreads have risen to the highest level since the 2020 pandemic drawdown period, and now exceed 10-year average levels. All else equal, an individual subject to the highest marginal tax bracket would receive an after-tax yield benefit of 150 bps by choosing a 30-year municipal vs. a comparable 30-year Treasury security.

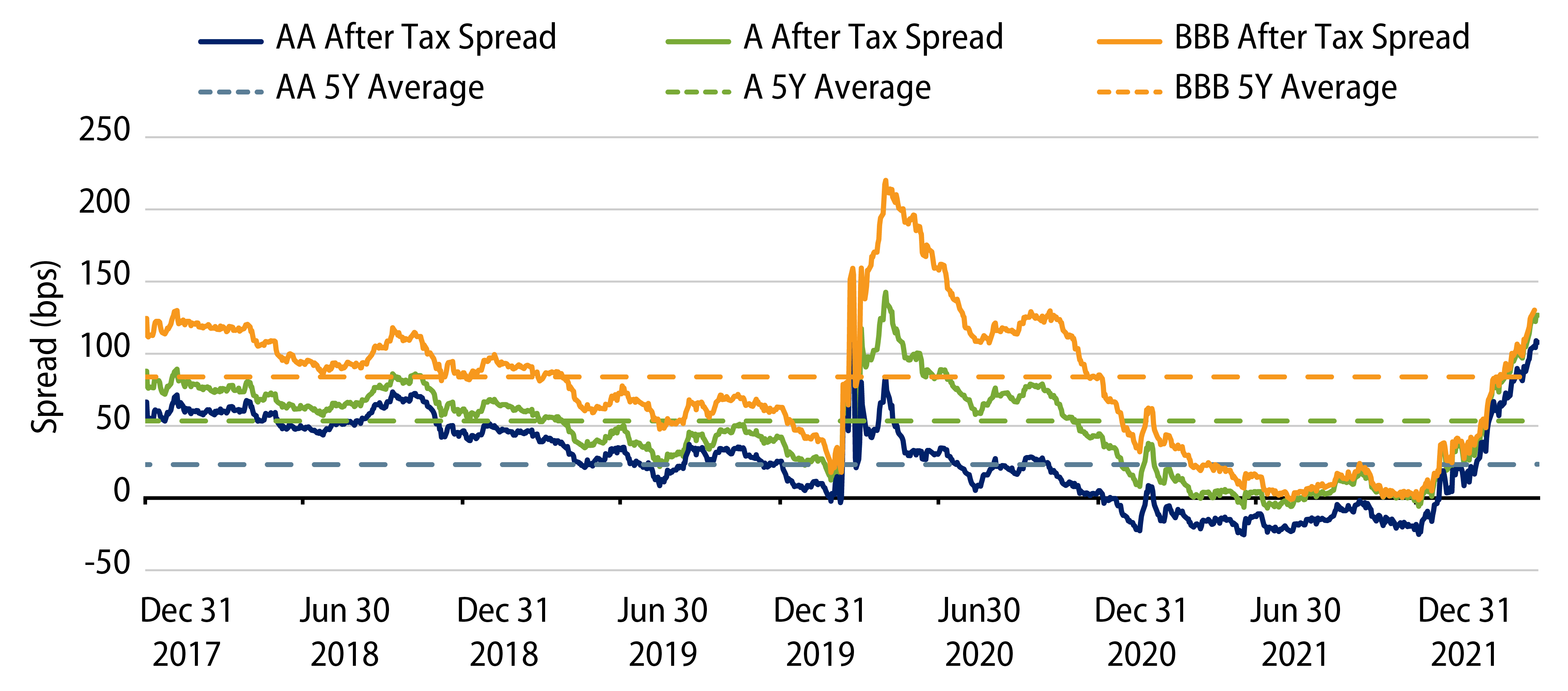

Municipals Versus Corporates. The relative value of the credit-oriented segment of the municipal market can be assessed against like-quality rated cohorts of taxable markets. Exhibit 2 demonstrates the spread between the AA, A and BBB Bloomberg municipal yields versus the respective Bloomberg corporate index. Over the past decade, the tax-exempt structure of the municipal market has provided 23-84 bps of average incremental after-tax yield versus the respective Bloomberg corporate index. At the end of 2021, for the first time, municipal-to-after tax corporate spreads reached negative levels across investment-grade credit cohorts, implying that a taxpayer in the highest marginal tax rate would be better off on an after-tax yield basis in the taxable asset class. This year’s volatility and muni underperformance has since increased the after-tax spread back to positive levels, and well above historical averages.

The relative value proposition versus corporates was certainly apparent in the market last week at the issuer level as Duke Energy, an issuer that accesses tax-exempt and taxable municipal markets, priced a new tax-exempt issue in the municipal market at a 4.25% tax-exempt yield-to-worst, higher than the similarly structured taxable yield of 4.17%. For an individual taxpayer in the top tax bracket, the relative value of the same-obligor municipal security represents an after-tax yield pick-up of 178 bps.

The path of inflation and interest rates is uncertain, which can continue to challenge valuations across asset classes. However, when considering YTD municipal underperformance compared to taxable assets, municipals screen increasingly attractive for income-seeking individuals and corporations subject to federal income taxes. In a market that is searching for demand to return to the asset class, this relative value proposition is just one factor that can attract both individual and institutional crossover buyers.