Investment-Grade Municipals Posted Negative Returns Last Week

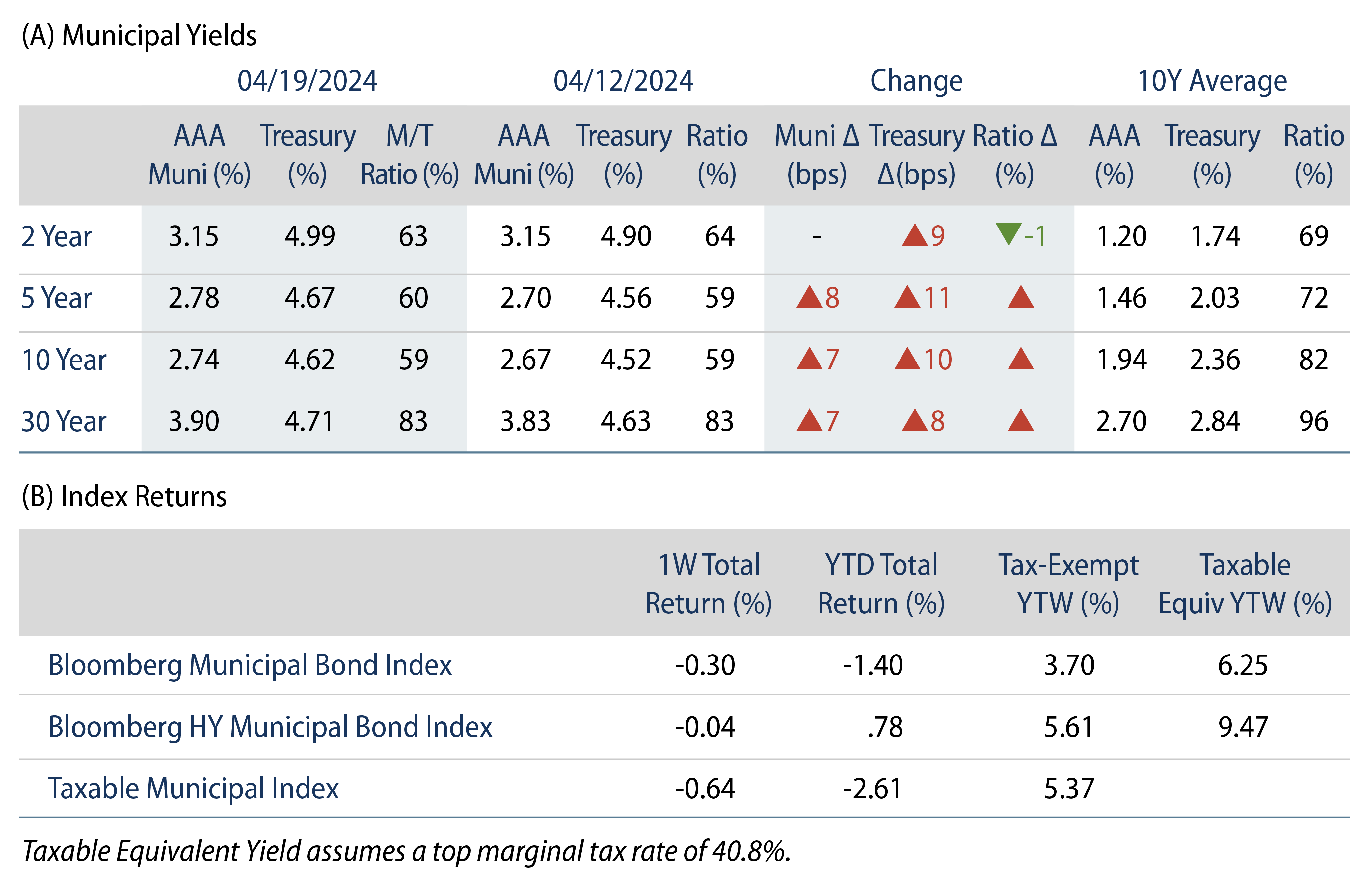

Investment-grade munis posted negative returns last week as yields moved higher across the curve in sympathy with Treasuries, which moved higher on strong retail sales data and more hawkish policy rhetoric. Meanwhile, muni technicals weakened as muni mutual funds posted outflows amid a growing new-issue calendar. The Bloomberg Municipal Index returned -0.30% during the week, the High Yield Muni Index returned -0.04% and the Taxable Muni Index returned -0.64%. This week we highlight themes from the New York state budget passed over the weekend.

Technicals Waned on Fund Outflows

Fund Flows: During the week ending April 17, weekly reporting municipal mutual funds recorded $1.5 billion of net outflows, according to Lipper. Long-term funds recorded $934 million of outflows, intermediate funds recorded $231 million of outflows and high-yield funds recorded $48 million of outflows. Short-term funds recorded $200 million of outflows. This week’s outflows lead estimated year-to-date (YTD) net inflows lower to $9.2 billion.

Supply: The muni market recorded $8.6 billion of new-issue volume last week, down 7% from the prior week. YTD issuance of $124 billion is 40% higher than last year’s level, with tax-exempt issuance 51% higher and taxable issuance 31% lower year-over-year. This week’s calendar is expected to jump to $13.5 billion. Largest deals include $3.0 billion Los Angeles Unified School District and $2.2 billion Brightline Florida Passenger Rail transactions.

This Week in Munis: NY Passes Budget

Over the weekend New York lawmakers passed a fiscal year 2025 (FY25) budget, nearly three weeks later than expected. The $237 billion budget is 3.5% larger than the FY24 budget and includes several key spending initiatives, including $2.4 billion toward New York City’s efforts to manage the migrant crisis, $435 million for climate resiliency projects and $500 million for housing projects. The state comptroller also released tax collection data from the past year. FY24 (which ended March 31, 2024) tax collections amounted to $106 billion, down from prior year levels but still outperformed the most recent budgetary estimates. Looking ahead, the FY25 budgetary tax collection forecasts signal relatively conservative revenue growth of 1.1%. Notably the budget does not include personal or corporate tax increases, and plans to maintain reserve levels above 15%. The state projects budget gaps from FY26 through FY28, although these gaps are projected to be narrower than those estimated at mid-year FY24.

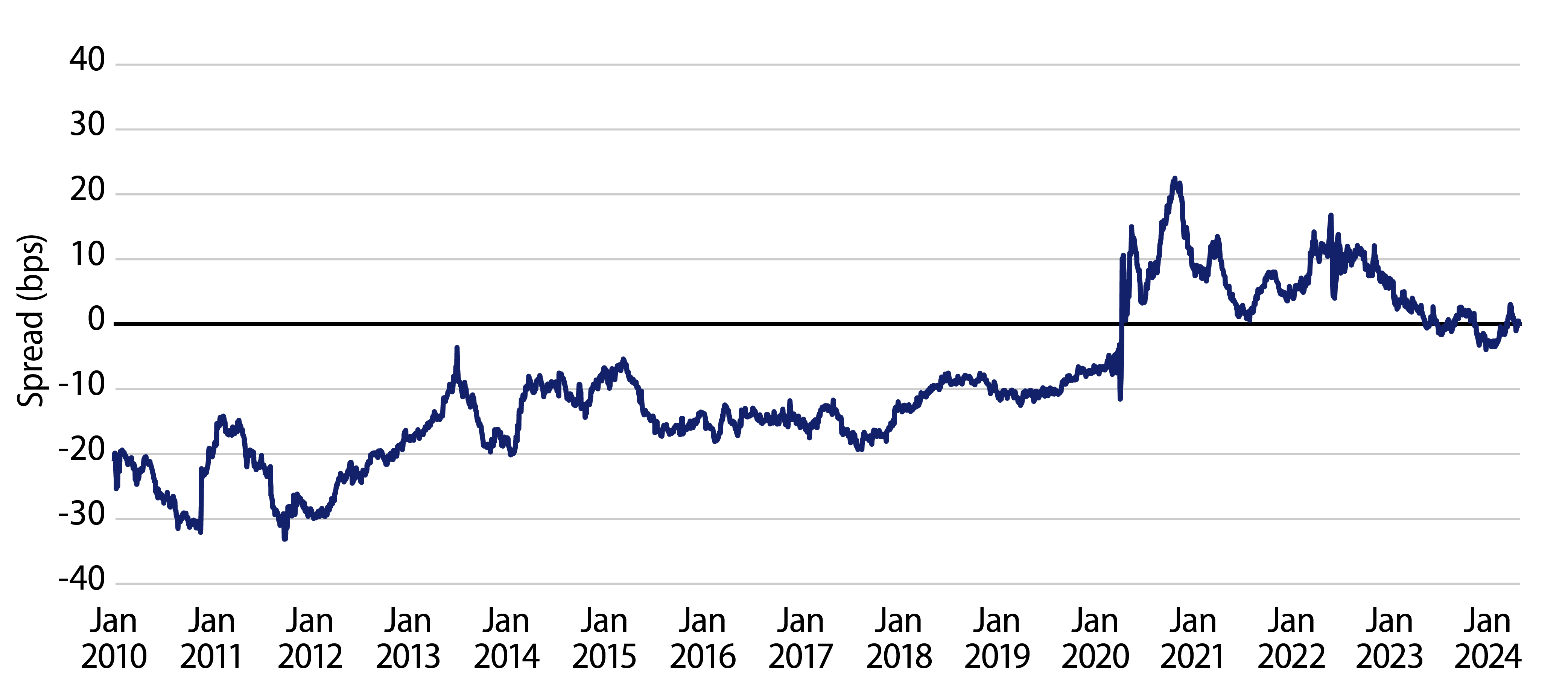

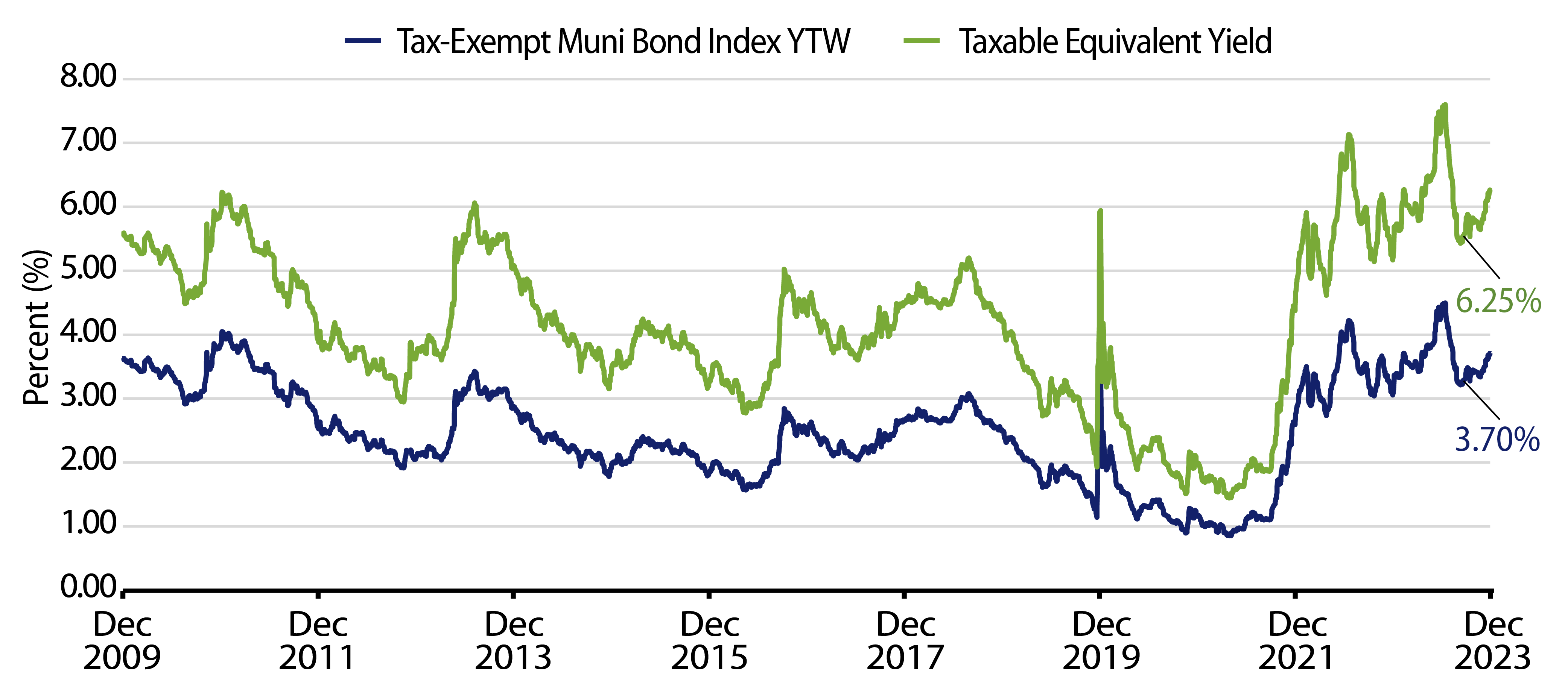

Considering strong revenue levels and cash balances, Western Asset believes that New York has the ability to navigate these gaps and that the state securities provide compelling value. The Bloomberg New York Municipal Index has historically traded at lower absolute yields than national index yields, partially driven by elevated demand from an investor base subject to high marginal rates. Ever since the pandemic-driven volatility seen in 2020, New York muni yields have traded on par or higher than national levels that do not benefit from the New York state tax exemption. Last week, the Bloomberg New York Index average yield-to-worst (YTW) reached 3.70%, which is up to 8.13% on a taxable equivalent basis for a New York City residents subject to the top marginal tax rate. We expect this value proposition could lead to tighter relative spreads and a reversion to historical trends.

Municipal Credit Curves and Relative Value

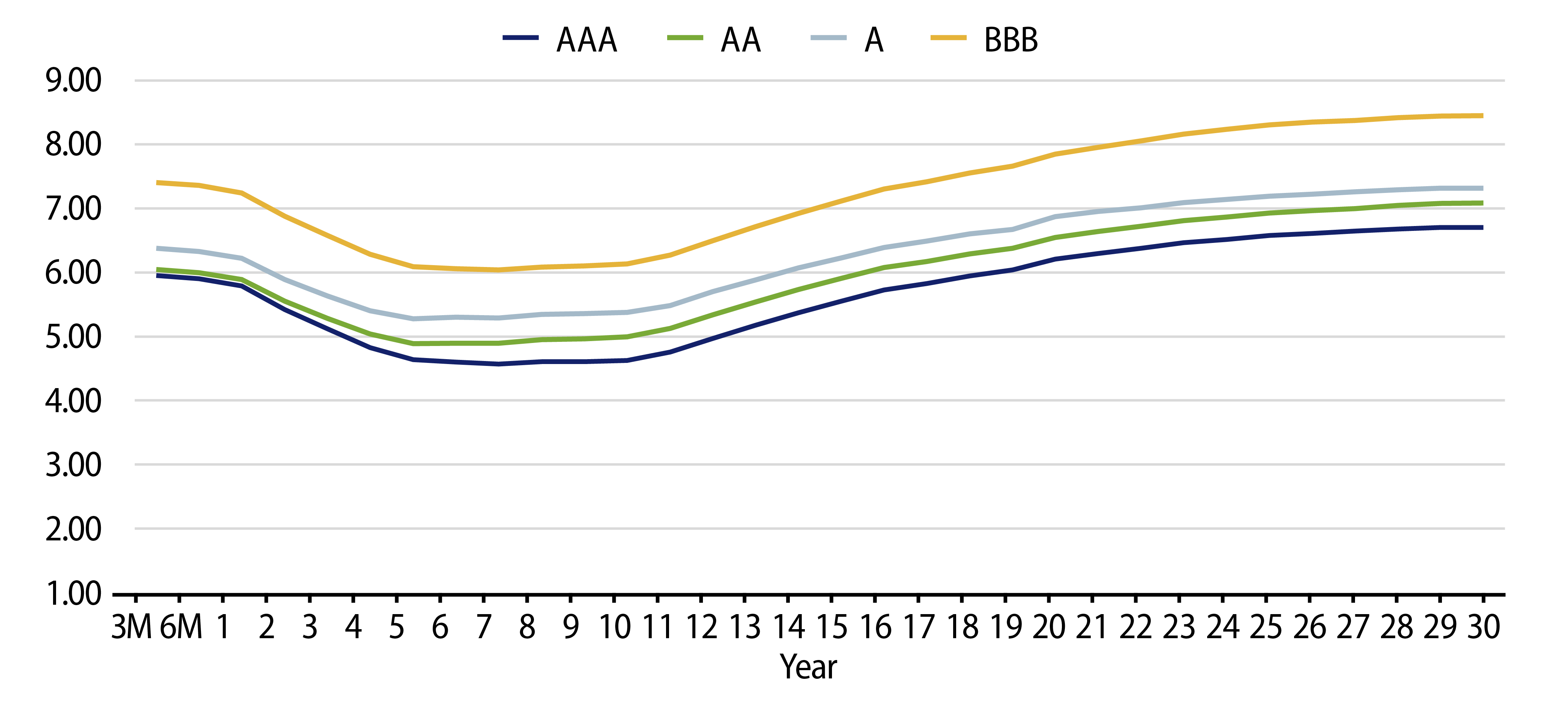

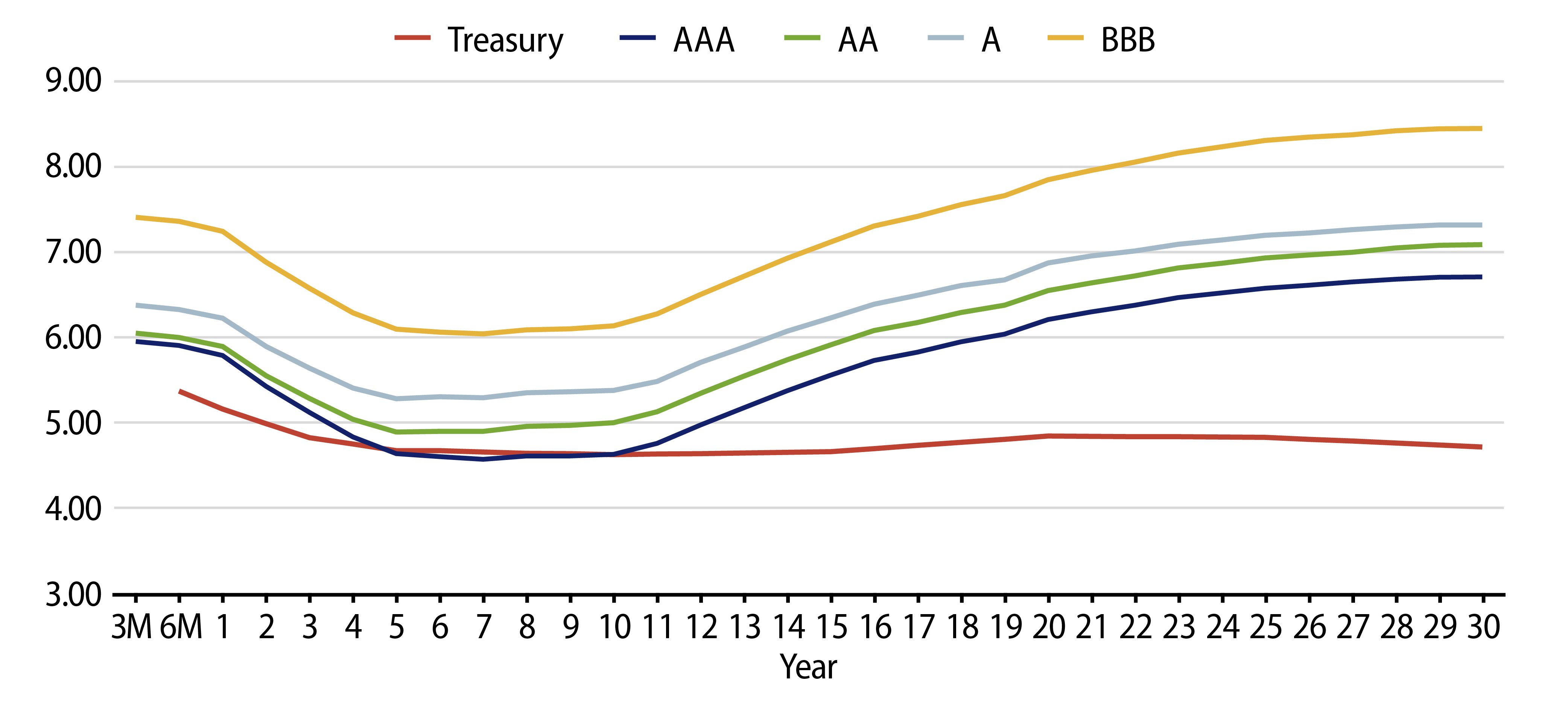

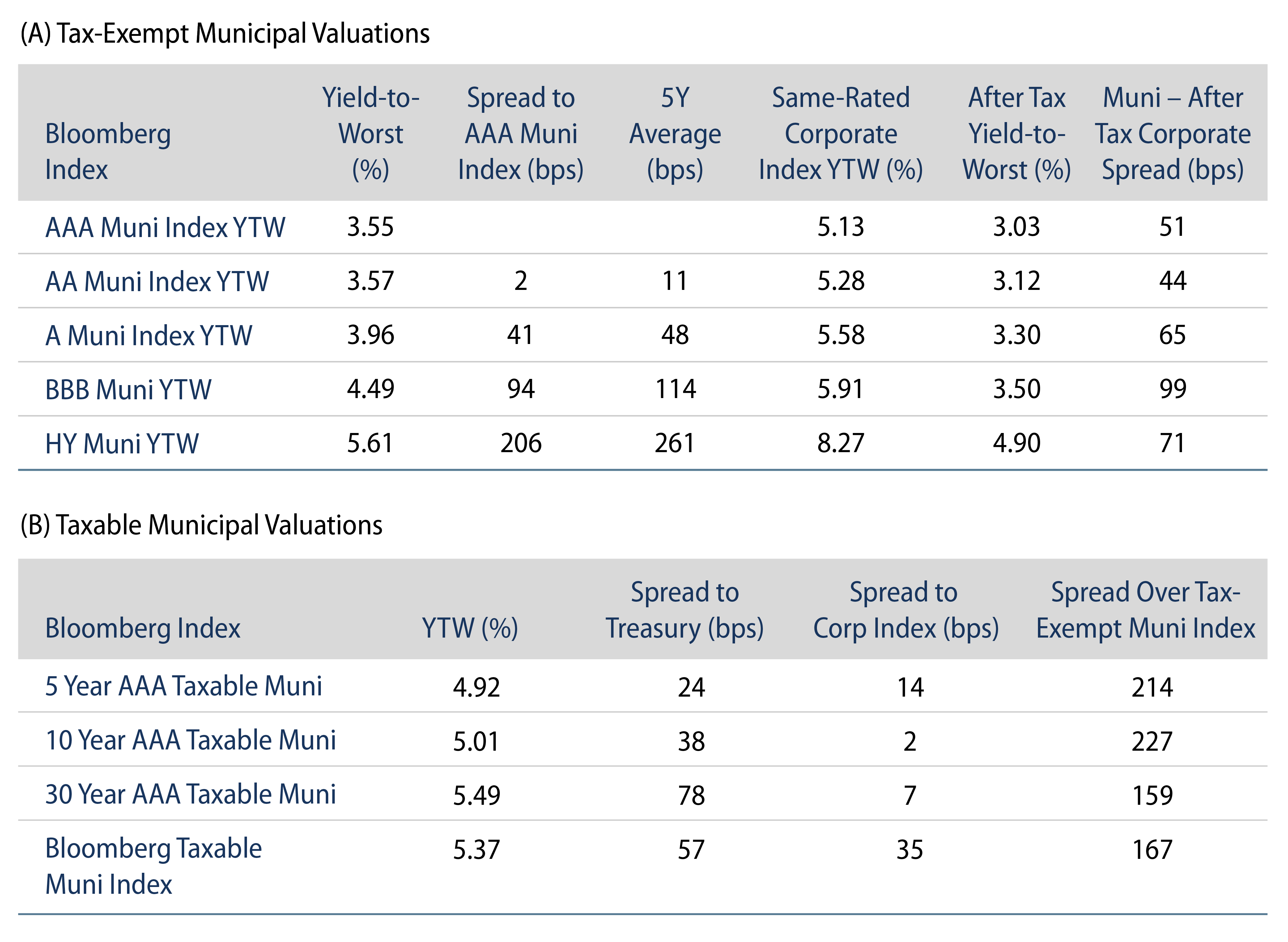

Theme #1: Municipal taxable-equivalent yields are above decade averages.

Theme #2: The inverted yield curve suggests less relative value in 5- and 10-year maturities.

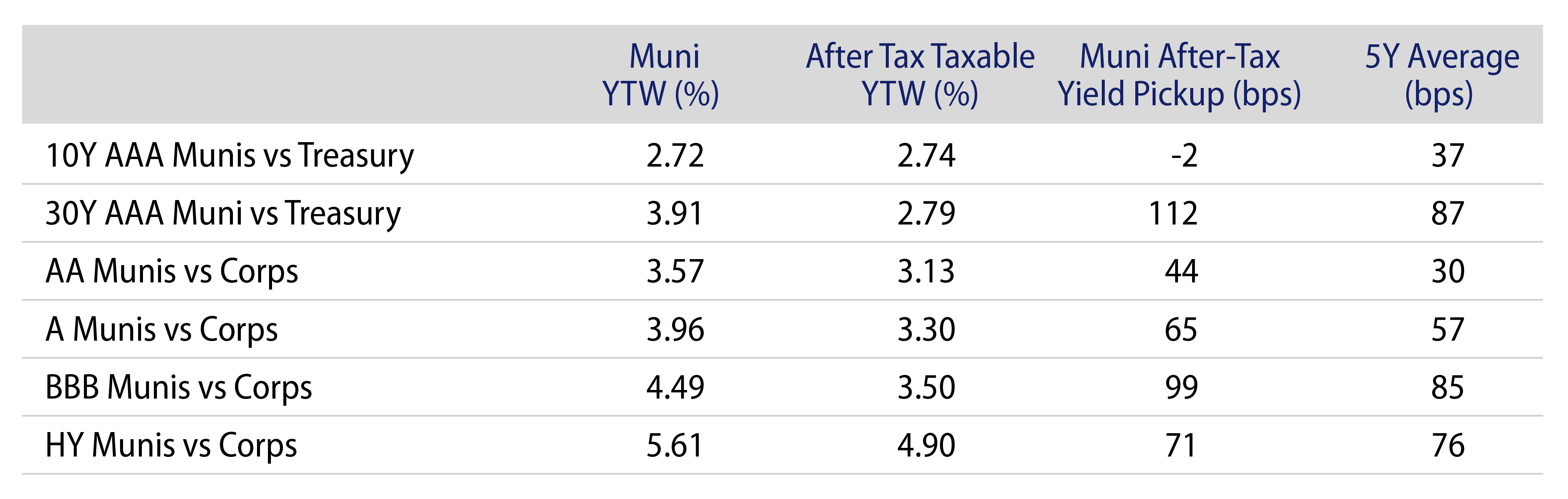

Theme #3: Munis offer attractive after-tax yield pickup versus long Treasuries and corporate credit.