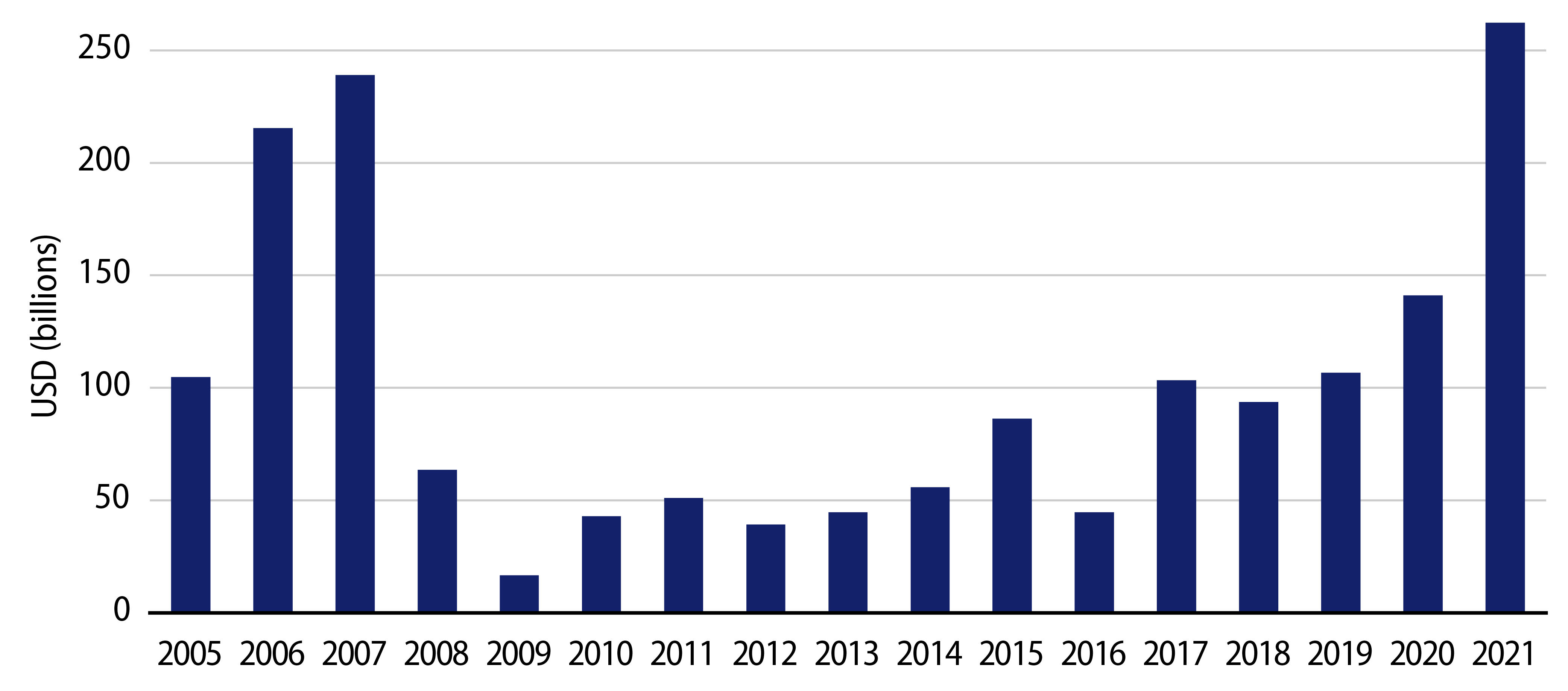

Private equity leveraged buyout (LBO) volumes are running at record highs for 2021 (year to date), according to Bloomberg. This remarkable wave of LBO activity appears to show no sign of abating. Indeed, private equity houses are currently maintaining near record high levels of dry powder, according to data from Preqin. Moreover, with the iBoxx EUR High Yield Corporate Index trading at a yield of 3.2%, dealmakers continue to benefit from ample availability of cheap leveraged credit.

The implications for fixed-income investors can at times be frightening. In a recent case, solid investment-grade-rated bonds issued by an established UK household name, subject to an LBO bid, dropped by around 20 points as investors realized their bonds would almost certainly move deep into high-yield territory. Illustratively, in a generic investment-grade portfolio comprised of around 200 bonds with an average spread of, say, 100 bps, one such event could wipe out around 10% of the annual aggregate portfolio carry return almost immediately.

It may be difficult, if not impossible, to entirely shield a credit portfolio from LBO risk but we can certainly try. Surely, the first line of defence is sector and issuer selection. In this context, “equity stories,” to the extent that they manifest themselves in prolonged equity underperformance/de-rating, can often turn into credit stories, and can therefore be viewed as early warning signs. Take the telecoms sector, for example. For years investors complained about weak revenue growth and, accordingly, telecoms sector equities performed poorly. Interestingly, while European telecoms operators trade at approximately 6x EBITDA valuation multiples, we note a recent abundance of sale transactions involving telecoms infrastructure assets (typically wireless towers or fiber) at 20x-25x EBITDA multiples. Integrated operators have arguably been slow to recognize the opportunity to separate/breakup such infrastructure assets from their customer-facing business, thus leaving themselves vulnerable to opportunistic M&A approaches, including from private equity. In our view, similar dynamics (i.e., disappointing equity performance, coupled with hidden value/asset sale opportunities) exist in other sectors, including parts of retail and media, to name but a few.

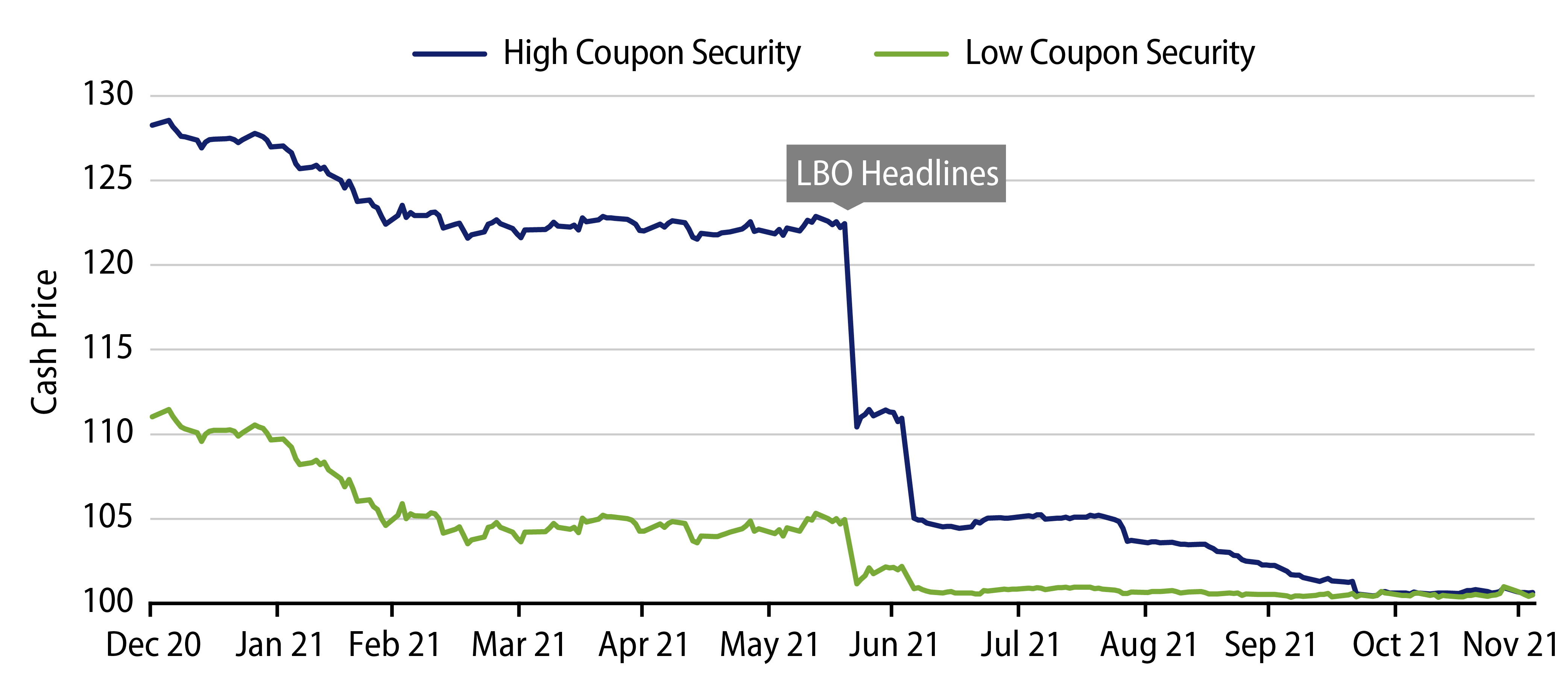

Admittedly, none of this is an exact science and investors will make sector/issuer selection mistakes along the way. However, one way to pre-manage the downside risk is to stay thoughtful around high cash price bonds. Given that standard investment-grade change of control covenants comprise investor put optionality at par, higher coupon/cash price bonds will typically be most exposed to the downside. In the same case as alluded to earlier, owners of one of the lower cash price securities issued by the same company would have incurred only half the losses.

Of course, none of this matters should the relevant bond documentation not contain customary change-of-control language. Without a doubt, the numerous recent event risk calamities serve as a useful reminder that non-standard covenants need to be taken into consideration when investors price risk, even in the concurrent absence of LBO-type news flow. Western Asset believes that with event risk high, diligent fundamental research combined with a keen focus on downside risks are essential in avoiding credit ‘Oh No!’s.