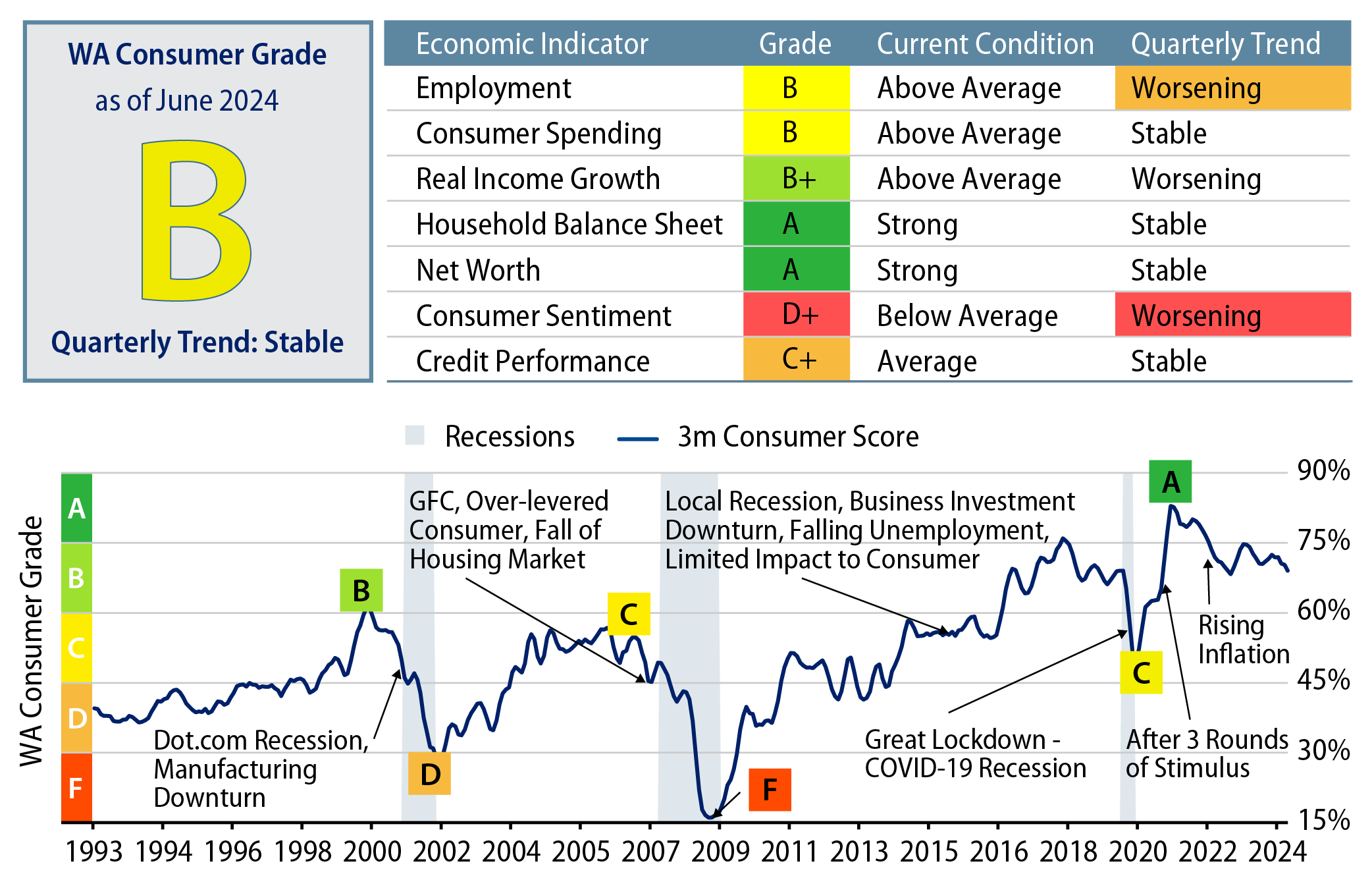

Here we introduce the Western Asset US Consumer Report Card, which aims to assess the current overall relative strength of the US consumer in the context of historical periods. Each quarter, we’ll grade the US consumer by analyzing seven distinct economic indicators we consider most relevant to consumer financial health.

Our methodology rationale for creating the US Consumer Report Card first involves ranking economic indicators versus a historical dataset, with tracked periodic changes going back to 1990. We then calculate a weighted average score for each month. Assigned weights range from 24% at the highest to 10% at the lowest. Employment, consumer spending and real income growth make up 40%, while remaining indicators comprise 60%. The consumer score is mapped against letter grades, normalized for historical experience.

Overall Score: B

Trend: Stable

The US consumer is scoring solidly above average, and although the recent trend has been cooling from exceptionally strong readings during the time of peak Covid stimulus, the score is well above the average score of C+ (55%) seen from 2010 to 2019. The overall picture for consumers remains very healthy, with significant cooling required to bring it back to historical averages. This is the picture of a resilient consumer, where continued softening in housing and labor markets is not expected to lead to consumer distress. In this environment, we favor investing in high-quality consumer credit, including student loans, housing-related sectors such as solar ABS, and prime auto loans.

Employment: B

Trend: Worsening

While job growth in June was stronger than expected, the unemployment rate ticked up to 4.1%. Job openings remain elevated relative to before the pandemic, but the hiring rate continues to drop, now at about the same level as in March 2020 and 2014, when the labor market was weak. The quits rate is trending down, now at 2.1%, which is somewhat discouraging. Fortunately, the layoff rate in June remained low, at nearly at an all-time low of 0.9%.

Consumer Spending: B

Trend: Stable

Overall consumer spending momentum has largely remained stable this year, at 2.5% in June. Retail spending, while negative in May, trended positive in June. Services spending growth trended down over the past few months but remained positive. A slowdown in lower-income consumer spending is partially offset by strong spending by higher-income earners.

Real Income Growth: B+

Trend: Worsening

Real disposable income growth remains steady. It is robust at an 1.1% annualized rate in June, due to continued gains in employee compensation. However, this is a declining pace compared with 2023 trends.

Household Balance Sheets: A

Trend: Stable

Growth in consumer credit is up 1.8% on a year-over-year annualized basis, which is below long-term trends. Household leverage and debt servicing costs remain low by historical standards, despite high consumer financing rates.

Wealth/Net Worth: A

Trend: Stable

Aggregate household balance sheets have strengthened due to asset price increases. The net worth to disposable personal income ratio remains at all-time high, including among lower-income households. While cash balances for lower-income households have normalized, the year-to-date rise in asset prices provides a boost to spending growth.

Consumer Sentiment: D+

Trend: Worsening

Both University of Michigan and Conference Board consumer indices declined in June, but signals from higher-frequency consumer sentiment data looked stronger. However, this lower sentiment is clearly indicative of a decline in discretionary spending.

Credit Performance: C+

Trend: Stable

Commercial bank credit card delinquencies continued to rise in the second quarter, reflecting a riskier borrower pool, rising interest expenses and student loan payments resuming. However, credit performance is deteriorating at a slower pace than prior quarters, indicating that tighter lending standards are having the desired impact. We expect delinquency rates to rise modestly.

2Q24 Consumer Trends

Subprime consumer deterioration in auto loan delinquencies has improved in the past few months, signaling that a peak in delinquencies is likely near. The 2023 vintage is performing better than 2022 (which has been the worst over the past decade). 2023 vintage originations for prime and near-prime auto loan segments are seeing worse performance than the past few years. This deterioration, however, is much smaller in magnitude than the deterioration seen in 2022 vintage subprime auto loans.