Headline retail sales rose 0.3% in February, on top of a +1.0% revision to the January sales. For the more widely watched “control” sales measure, which excludes sales at vehicle dealers, building material stores, gas stations and restaurants, sales declined by 1.2%, though with a +1.4% revision to January.

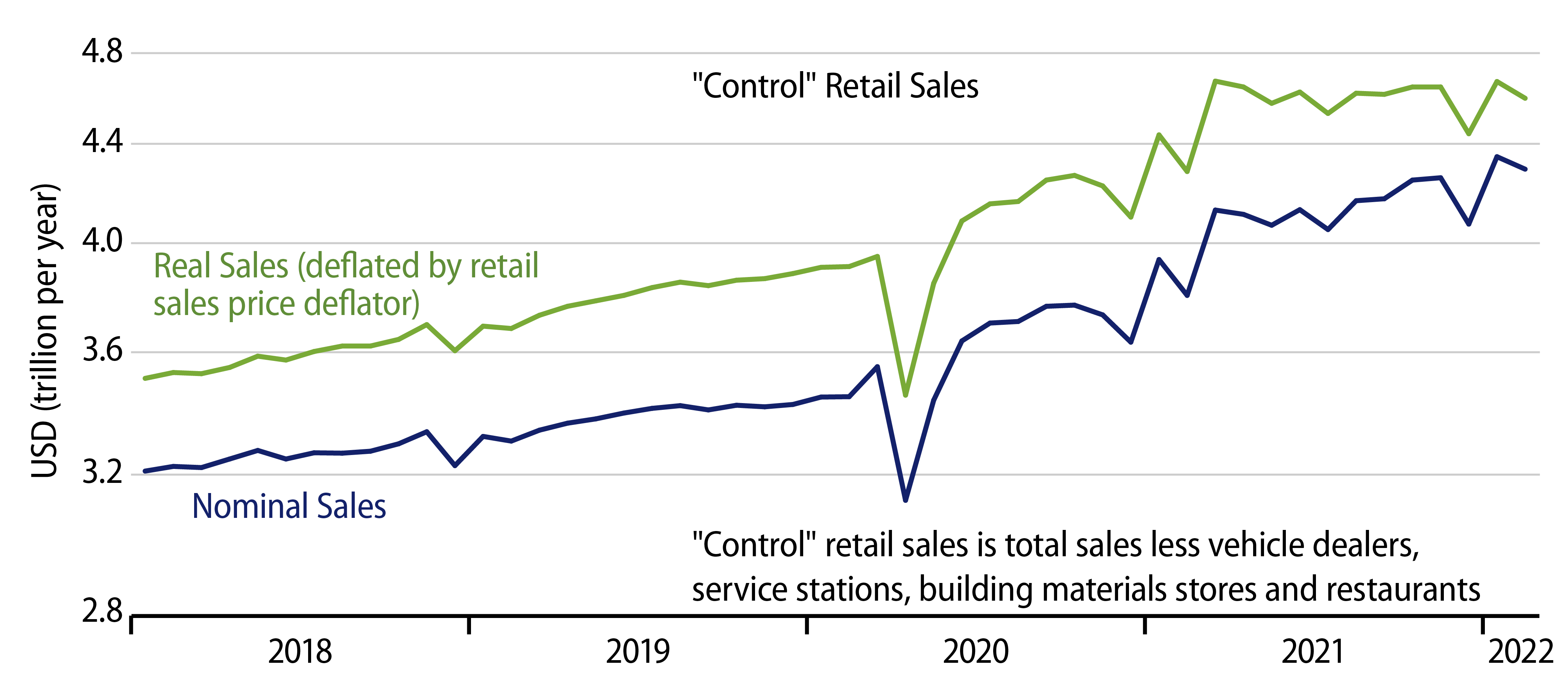

Contrary to the media and Street reports we are hearing this morning, we read this retail sales news as continuingly weak. As commented a month ago, upon adjusting for price changes, the January sales gains were NOT sufficient to fully offset the declines seen in December. This continues to be the case even with the upward revisions to January sales announced this morning. What is more, February sales show a decline upon adjustment for inflation, whatever sales aggregate you look at.

Furthermore, all the February gain in nominal headline sales and then some occurred at gas stations, where prices are obviously surging. So, even in nominal terms, sales declined in February for any aggregate excluding gas stations.

In last month’s analysis, we attributed the December/January softness in sales to the effects of the Covid omicron variant surge and related restrictions imposed by local governments. We also suggested that shopping NOT completed in December was likely to be accomplished in January or February, in addition to normal January/February shopping. In other words, retail sales levels for 1Q should be enough above those of November to fully offset the December declines.

As seen in the chart, this has not occurred even for nominal sales. That is, it is clear in the chart that the average level of nominal sales for the last three months is substantially below the November level. (In fact, it is 0.9% below that level.) Adjusted for price increases, real sales on average over the last three months are down 1.7% from November.

There is growing reason to believe that more than omicron is going on here. Data released late last month show real wage incomes declining on net for the last four months. Total real incomes had been declining since March 2021 thanks to waning Covid aid from the federal government, but the declines since September occurred for real wage income. What’s more, despite the robust February job gains, real wage income likely declined again last month, thanks to declining workweeks, flat hourly wages and continuing inflation. Furthermore, January consumer spending data showed flat real spending on services since October, alongside the net declines in real goods spending indicated by retail sales.

So, besides any effects of omicron restrictions, rising prices also appear to have exerted a drag recently on both household incomes and consumer spending. If recent inflation were indeed driven by Federal Reserve (Fed) policy the way some claim, Fed stimulus would be pushing up both incomes and nominal spending just as fast—or faster—than the concomitant rise in prices. This is not happening. Our take is that the emerging slowing in consumer spending is working to slow both economic growth as well as inflation.