Headline retail sales rose 3.8% in January, with a -0.1% revision to the December sales estimate. The “control” sales measure excludes sales at car dealers, building material stores, gas stations and restaurants, as those sectors are frequented by businesses as much as consumers. That measure saw a 4.8% January rise, with the December sales estimate revised by -0.5%.

When are 3.8% and 4.8% increases NOT a sign of strength? When they were preceded by December declines as sharp as were reported a month ago. Net of revisions, headline sales are now estimated to have declined 2.5% in December, prior to the January 3.8% rebound. Control sales are now reported to have declined 4.0% in December before the 4.8% January rise.

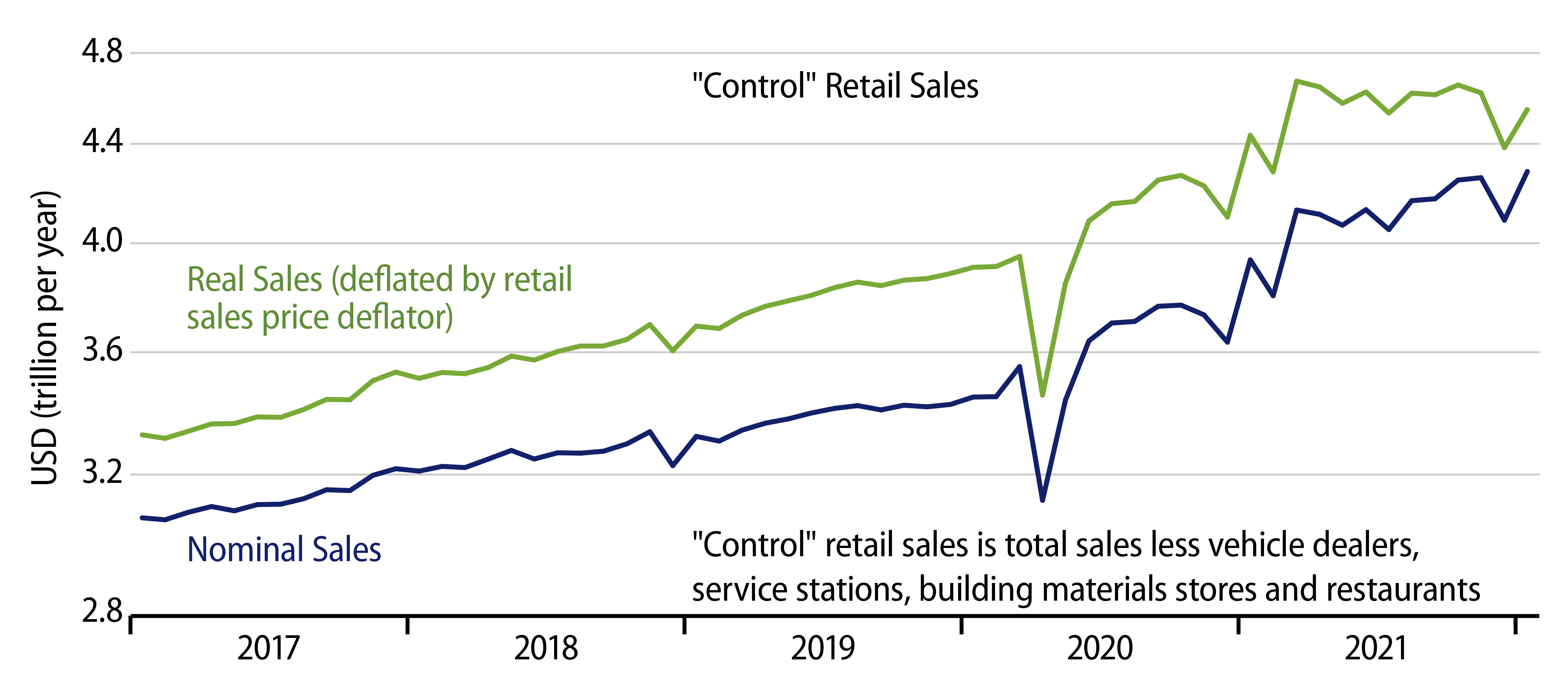

And then there are price effects. Whereas the Census Bureau produces these retail sales estimates, the Bureau of Economic Analysis releases retail price deflators through December, and we can augment those with January Consumer Price Index data from the Bureau of Labor Statistics to produce estimates of real retail sales. Real control sales are shown in the chart (green line), along with the nominal levels for that aggregate (blue line).

As you can see in the chart, the January control sales gains were not nearly enough to fully offset the December declines when price effects are allowed for. The same goes for headline sales. Adjusting for likely price changes, real control sales declined by 5.1% in December, followed by only a partial, 3.7% rebound in January. Real headline sales declined 3.1% in December, followed by a 3.1% partial rebound. (By the arithmetic of compounding, a 3.1% rise does NOT fully offset a 3.1% decline.)

In commenting on the December sales data last month, we stated that the December sales declines likely reflected omicron-induced softness but that it was also the case that sales had been flatlining for the previous eight months. This is obviously still the case. Even with the January bounce, real sales levels remained below the flat levels of April-November, suggesting further softness due to omicron effects.

These declines will likely be reversed in coming months, as Covid cases continue to wane, and shoppers buy in March and April merchandise they were not able to purchase over December-February. However, once said “consumer restocking” is complete, real retail sales trends are likely to remain on the zero-growth trend seen since March 2021.

Early media and Wall Street reports we have seen described today’s January sales gains as a “surge.” In view of the December declines and allowing for price effects, that description is grossly inaccurate. Sales remained depressed through January thanks to lingering omicron effects, and those declines were on top of trends that had been soggy for many months prior to omicron.