Munis Posted Positive Returns Last Week

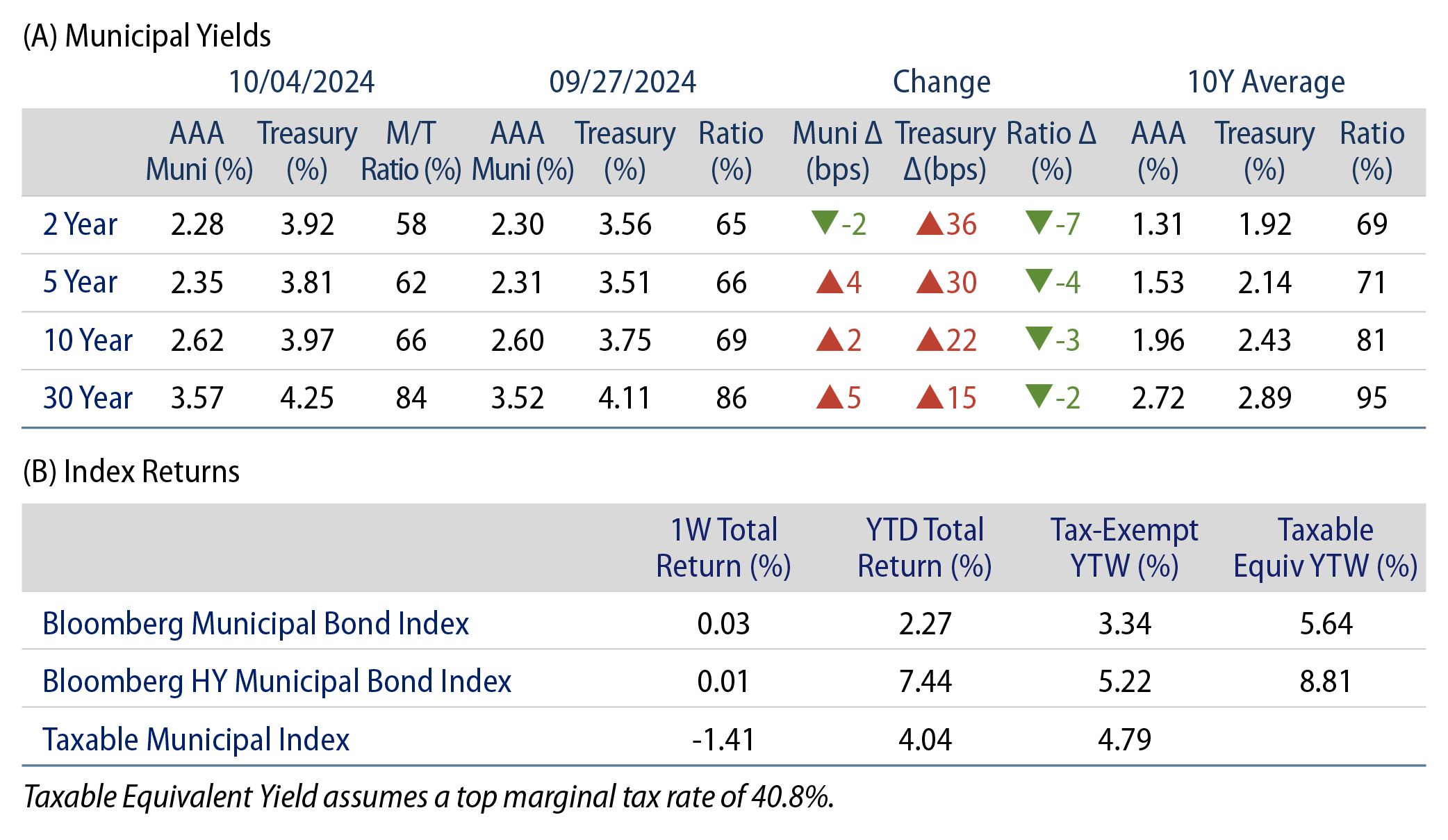

Municipals posted positive returns last week and outperformed Treasuries as Treasury yields moved higher across the curve amid stronger-than-anticipated employment data. Meanwhile, the high-grade muni yield curve steepened during the week, and supply and demand trends remained elevated. The Bloomberg Municipal Index returned 0.03% during the week, the High Yield Muni Index returned 0.01% and the Taxable Muni Index returned -1.41%. This week we highlight muni exposure to climate risks following the damage caused by Hurricane Helene.

Muni Inflows and Elevated Supply Persist

Fund Flows (up $ 1.6 billion): During the week ending October 2, weekly reporting municipal mutual funds recorded $1.9 billion of net inflows, according to Lipper. Long-term funds recorded $1.6 billion of inflows, intermediate funds recorded $143 million of inflows and high-yield funds recorded $602 million of inflows. This week’s inflows lead estimated year-to-date (YTD) net inflows higher to $28 billion.

Supply (YTD supply of $386 billion, up 45% YoY): The muni market recorded $13 billion of new-issue volume last week, down 18% from the prior week. YTD issuance of $386 billion is 45% higher than last year’s level, with tax-exempt issuance 48% higher and taxable issuance 14% higher year-over-year (YoY). This week’s calendar is expected to remain elevated at $12 billion. Largest deals include $2.7 billion New Jersey Transportation Trust and $1.5 billion State of New York transactions.

This Week in Munis: Helene Highlights Climate Costs

At the end of September, Hurricane Helene made landfall in the southeastern US and caused significant wind and flooding damage across Florida, Georgia, South Carolina, North Carolina and Tennessee. Moody’s estimates that the storm may have contributed to over $30 billion in damage.

Various incidents of climate change such as Hurricane Helene can cause significant damage for state and local governments to address, though municipalities have various tools to offset the credit implications of these storms. In the short term, municipal liquidity and financials can be pressured due to the costs of cleanup, increased need for governmental assistance and rebuilding needs. However, over the long term, communities and underlying credits can emerge stronger as a result of longer-term recovery efforts supported through FEMA and other forms of insurance reimbursement that can be stimulative.

While there have been no municipal defaults as a direct result of a natural disaster, we have observed that the costs of natural disasters can exacerbate challenges for governments that are already facing fiscal stress, perhaps most exemplified by Puerto Rico’s damage from hurricanes Irma and Maria as the island was already entering a restructuring process. Severe storms have also impacted certain municipal utility systems that have faced issues grappling with higher capital expenditures associated with serving expanding populations. These increased costs have been supported by increases in revenues through federal infrastructure funding and rate increases that can ultimately be directed toward infrastructure expansion, modernization and resiliency efforts.

While isolated, the adverse municipal credit conditions linked to climate events underscore the value of independent credit analysis and active management, particularly as the frequency and costs of natural disasters increase. Western Asset’s municipal team evaluates the frequency and potential for significant events, in conjunction with governance and the potential for municipalities to withstand these events, including the maintenance of adequate liquidity, access to markets and commitment to appropriate resiliency efforts.

Municipal Credit Curves and Relative Value

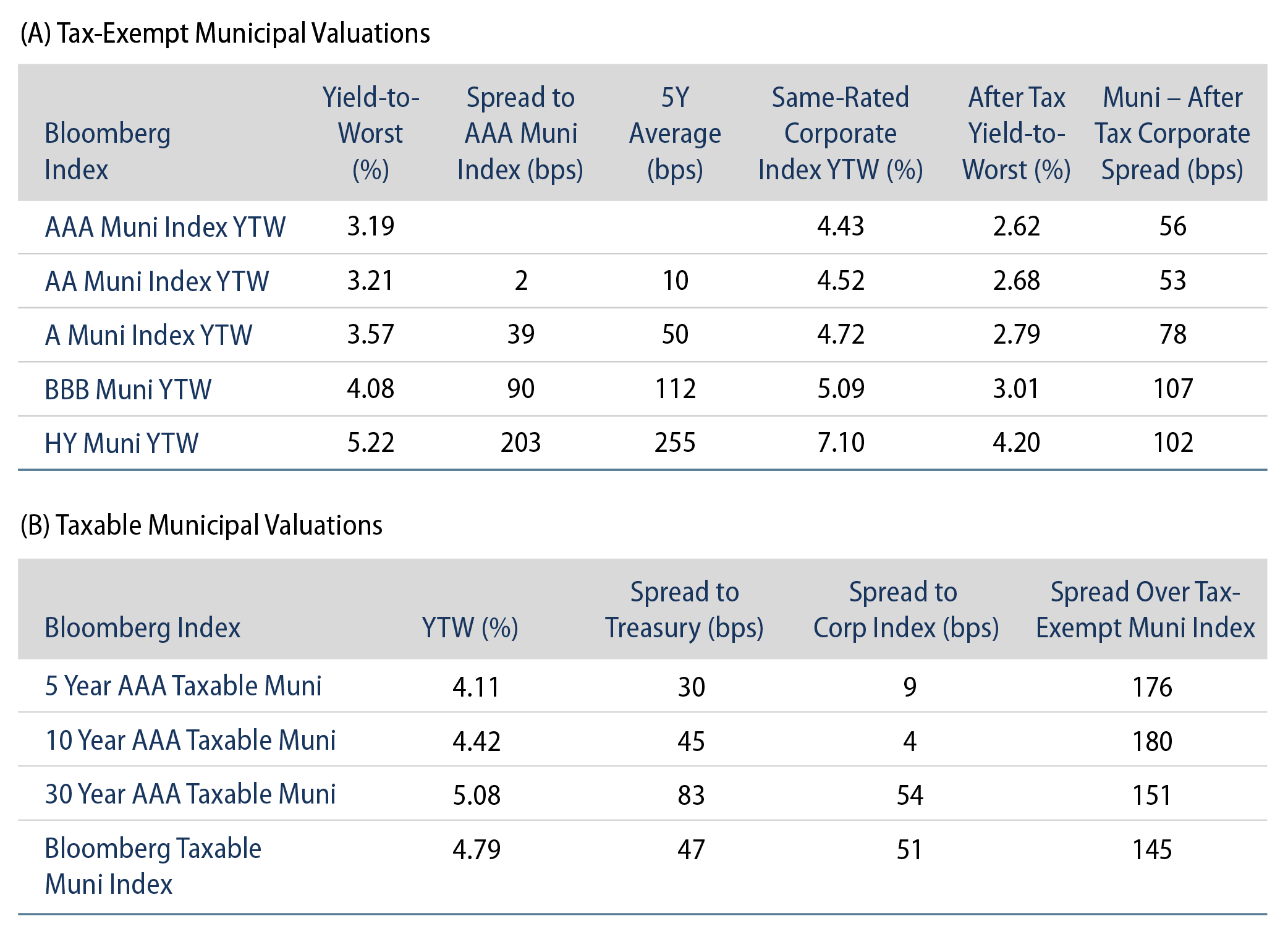

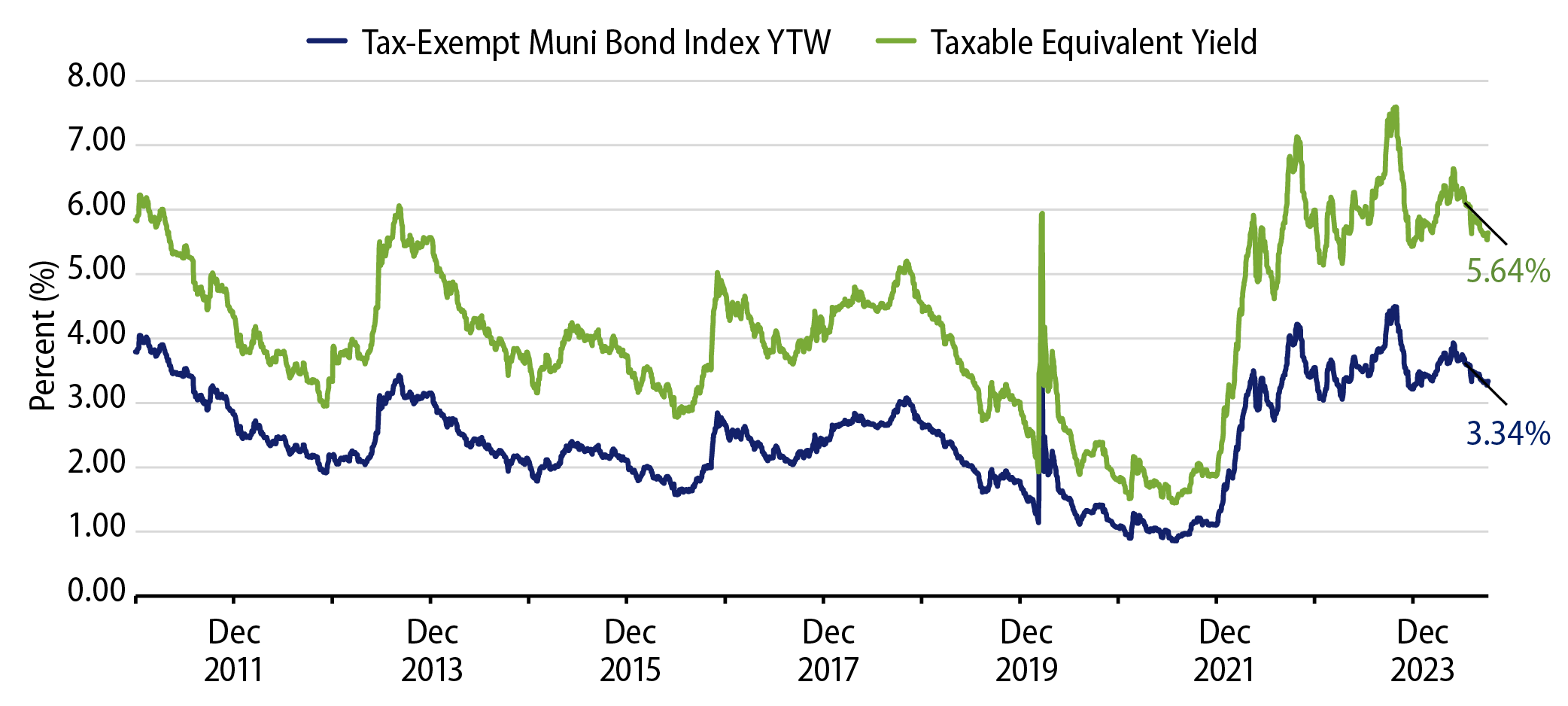

Theme #1: Municipal taxable-equivalent yields remain above decade averages.

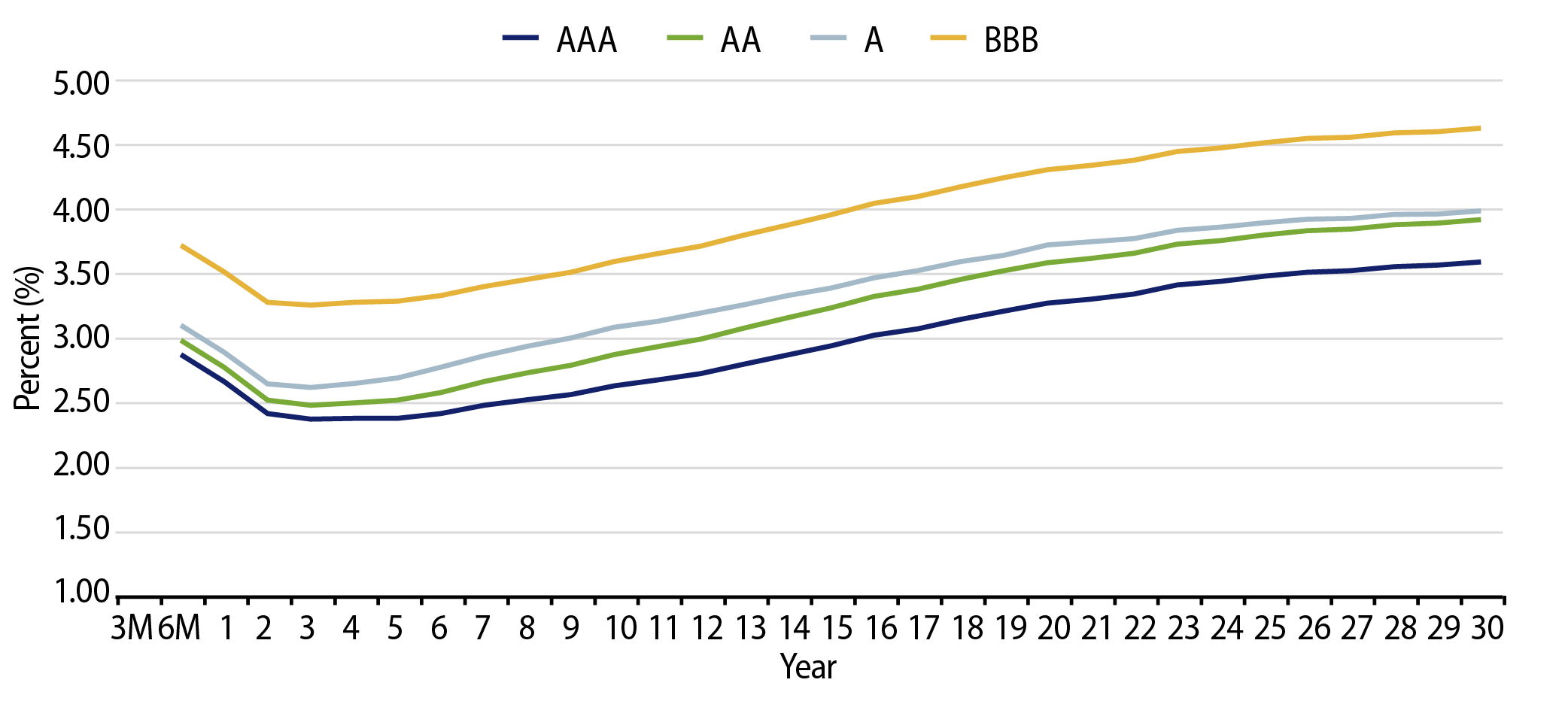

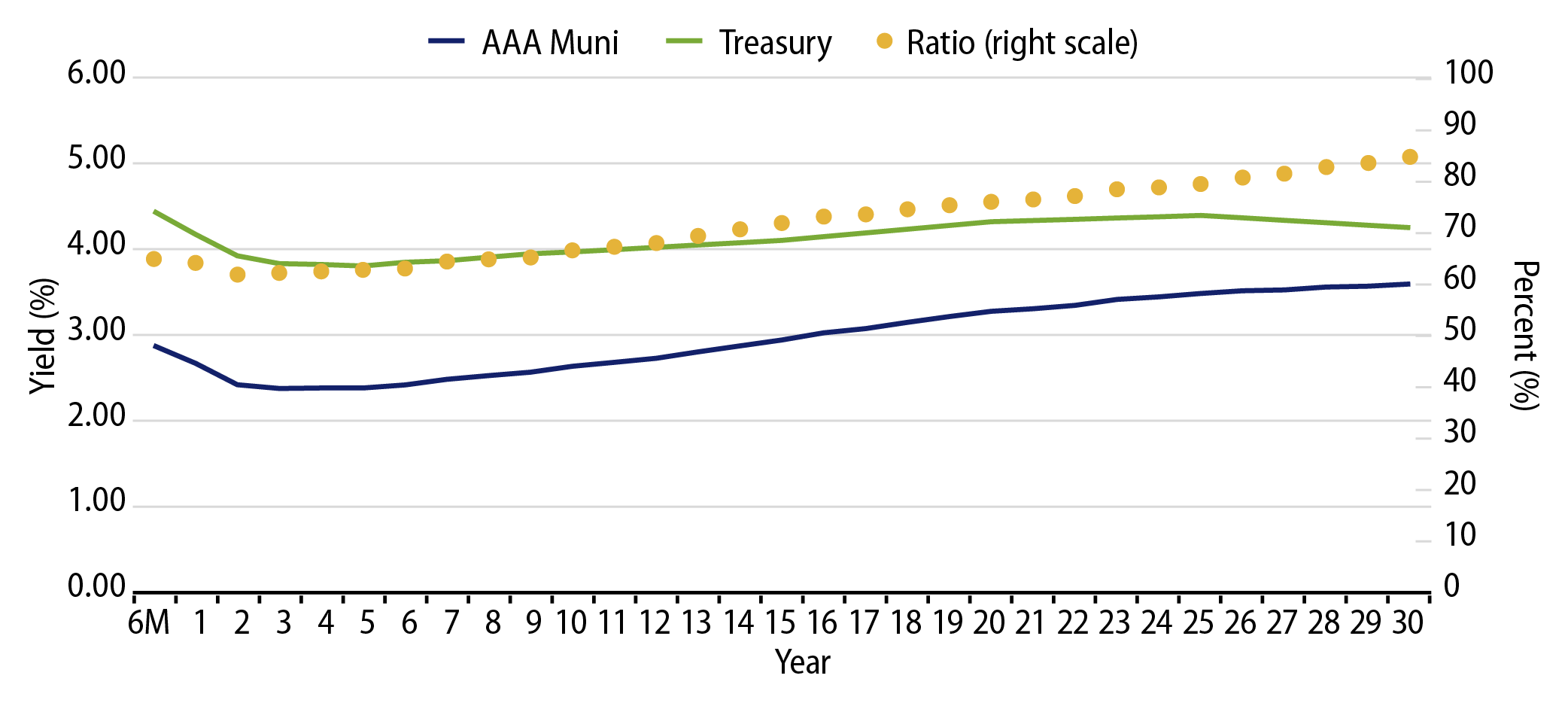

Theme #2: The muni yield curve has largely disinverted, offering better rolldown opportunity in intermediate maturities.

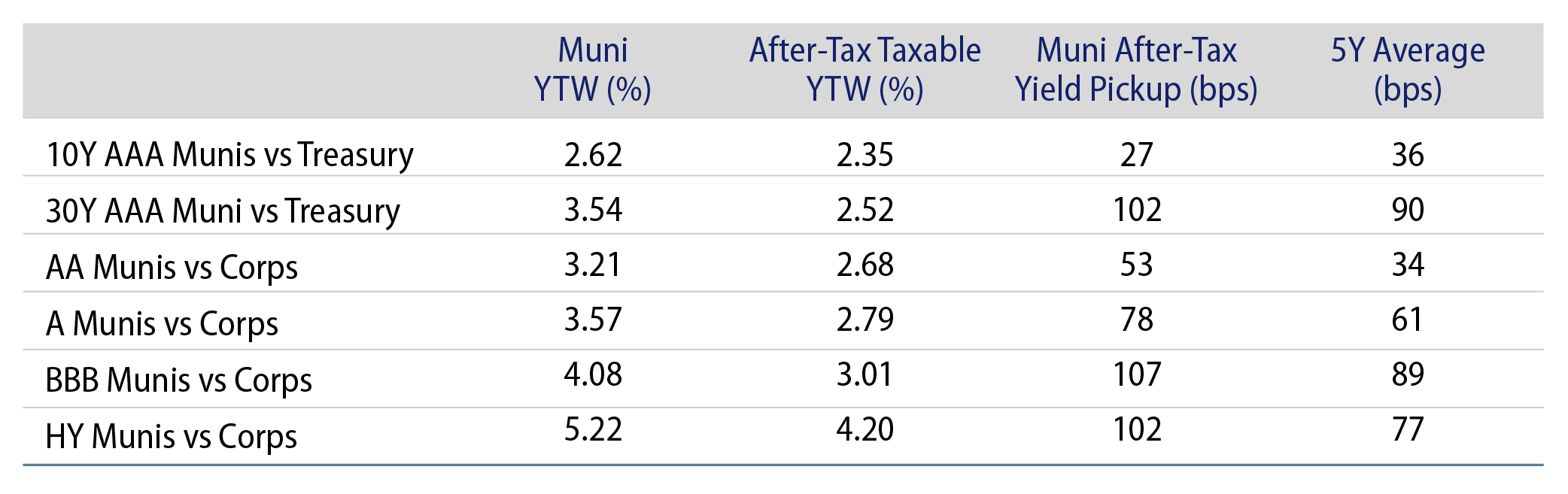

Theme #3: Munis offer attractive after-tax yield pickup versus longer-dated Treasuries and investment-grade corporate credit.