Macros, Markets and Munis

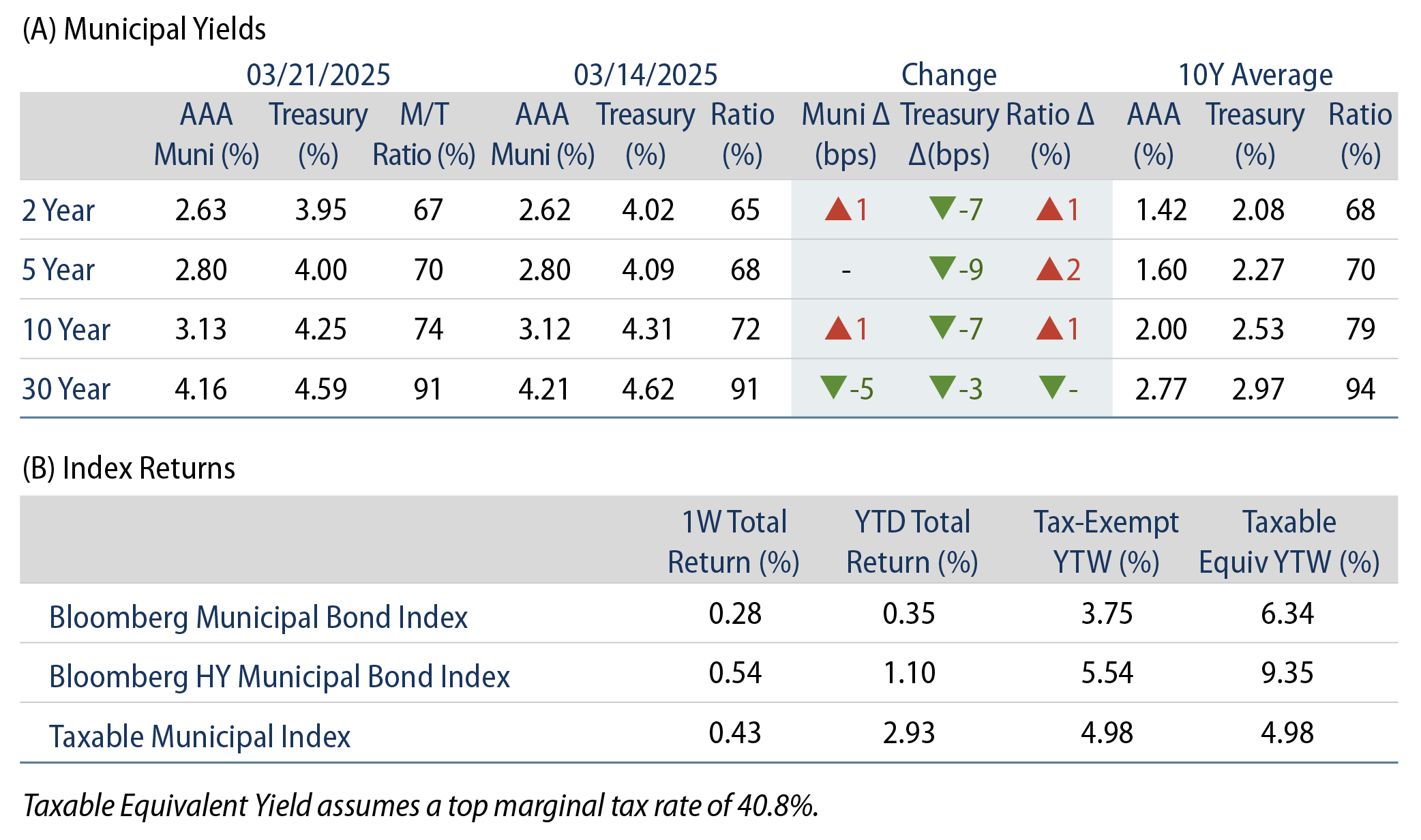

Munis posted positive returns last week. Technicals weakened as mutual funds posted a second consecutive week of outflows. Economic data was mixed: existing-home sales came in above expectations while initial jobless claims ticked up modestly from the prior period as expected. The market focused on the Federal Open Market Committee (FOMC) meeting, where the Federal Reserve left the fed funds rate unchanged but revised growth forecasts lower while still projecting 50 basis points (bps) of additional rate cuts this year. The Treasury curve rallied across the curve, while munis generally underperformed amid weaker technical conditions. The Bloomberg Municipal Index returned 0.28% during the week, the High Yield Municipal Index returned 0.54% and the Taxable Municipal Index returned 0.43%. This week we highlight state and local revenue data released by the Census Bureau earlier this month.

Elevated Supply and Fund Outflows Challenged Technicals

Fund Flows (down $373 million): During the week ending March 19, weekly reporting municipal mutual funds recorded $216 million of net outflows, according to Lipper. Long-term funds recorded $289 million of outflows, intermediate funds recorded $73 million of inflows and high-yield funds recorded $316 million of inflows. Last week’s outflows marked a second consecutive week of net outflows and led year-to-date (YTD) inflows lower to $10 billion.

Supply (YTD supply of $112 billion; up 41% YoY): The muni market recorded $11 billion of new-issue supply last week, up 7% from the prior week. YTD, the muni market has recorded $112 billion of new issuance, up 34% year-over-year (YoY). Tax-exempt and taxable issuance are up 41% and 34%, respectively, though tax-exempt issuance has comprised the vast majority (94%) of YTD supply. This week’s calendar is expected to remain elevated at $10 billion. The largest deals include $1.5 billion Los Angeles Airport Department and $1.2 billion Salina Economic Development Authority transactions.

This Week in Munis: State and Local Revenues Remain Resilient

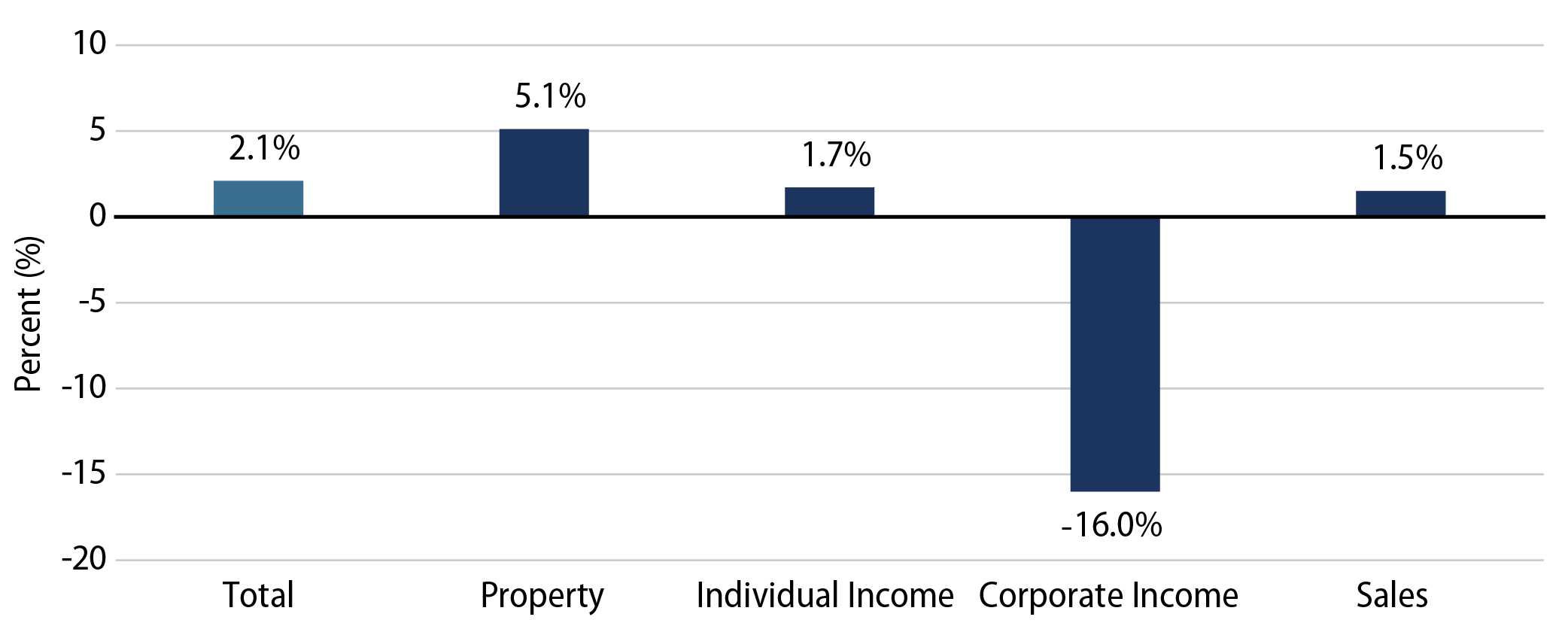

The Census released 4Q24 state and local tax collection estimates earlier this month, indicating continued revenue growth for state and local governments. Fourth quarter major state and local government tax collections grew 2.1% from 4Q23 levels to $632 billion. Among the major state revenue sources, individual income taxes increased 1.7%, corporate income tax collections declined 16%, and sales tax collections increased 1.5% YoY. Property tax collections, the primary source of revenues for local governments, increased 5.1% YoY to $320 billion.

Calendar year 2024 collections increased 4.5% YoY to $2.1 trillion, marking a record high level, according to Census data. On a 12-month trailing basis, individual income tax collections increased 4.9% YoY, corporate income tax collections declined 0.4% YoY and sales tax collections increased 1.5% YoY. The 12-month rolling property tax collections also trended higher, growing 7.7% YoY.

From a state perspective, the Census Bureau estimates that the majority of states recorded revenue increases in 2024, with total state tax collections increasing 3.9% during the year. California (+23% YoY), Nebraska (+20%) and Nevada (+16%) recorded the highest growth in estimated tax revenue, while the Census estimated that Alaska (-20%), Oregon (-11%) and West Virginia (-10%) recorded the greatest YoY tax collection declines.

The continued growth of tax collections highlights the strength of municipal credit despite broader market volatility. We expect that a strong labor market and consumer spending will support tax collections and municipal credit conditions over the medium term. We also anticipate that these direct revenue sources will play a more critical role in state and local budgets, particularly if federal spending reductions extend more broadly to municipal credit.

Municipal Credit Curves and Relative Value

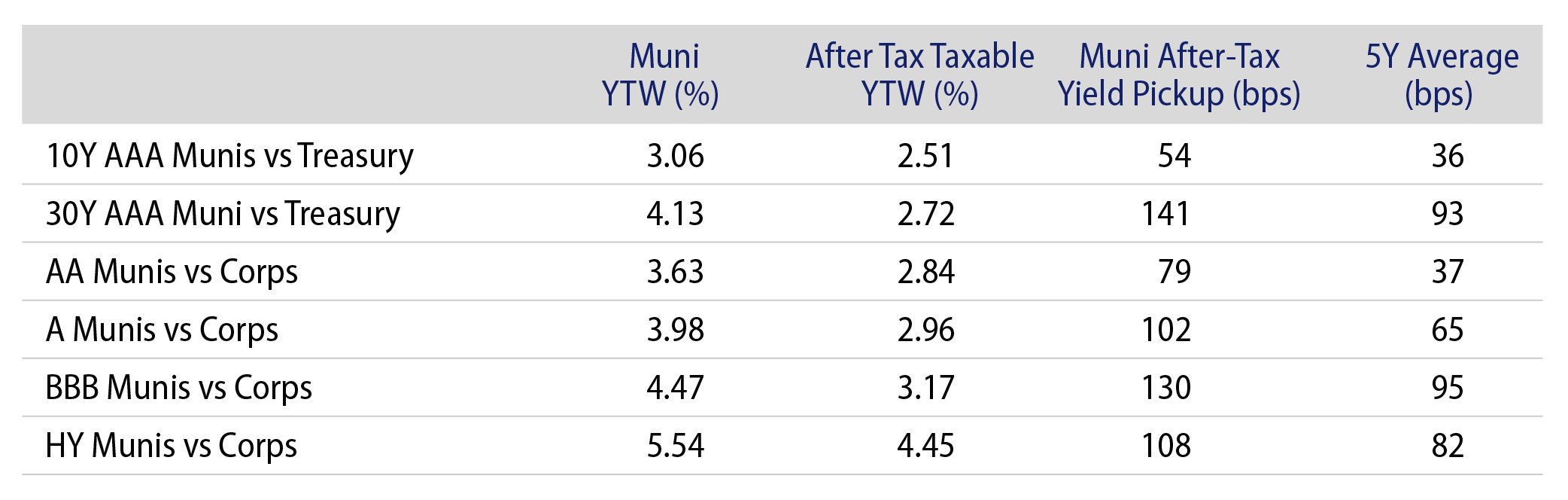

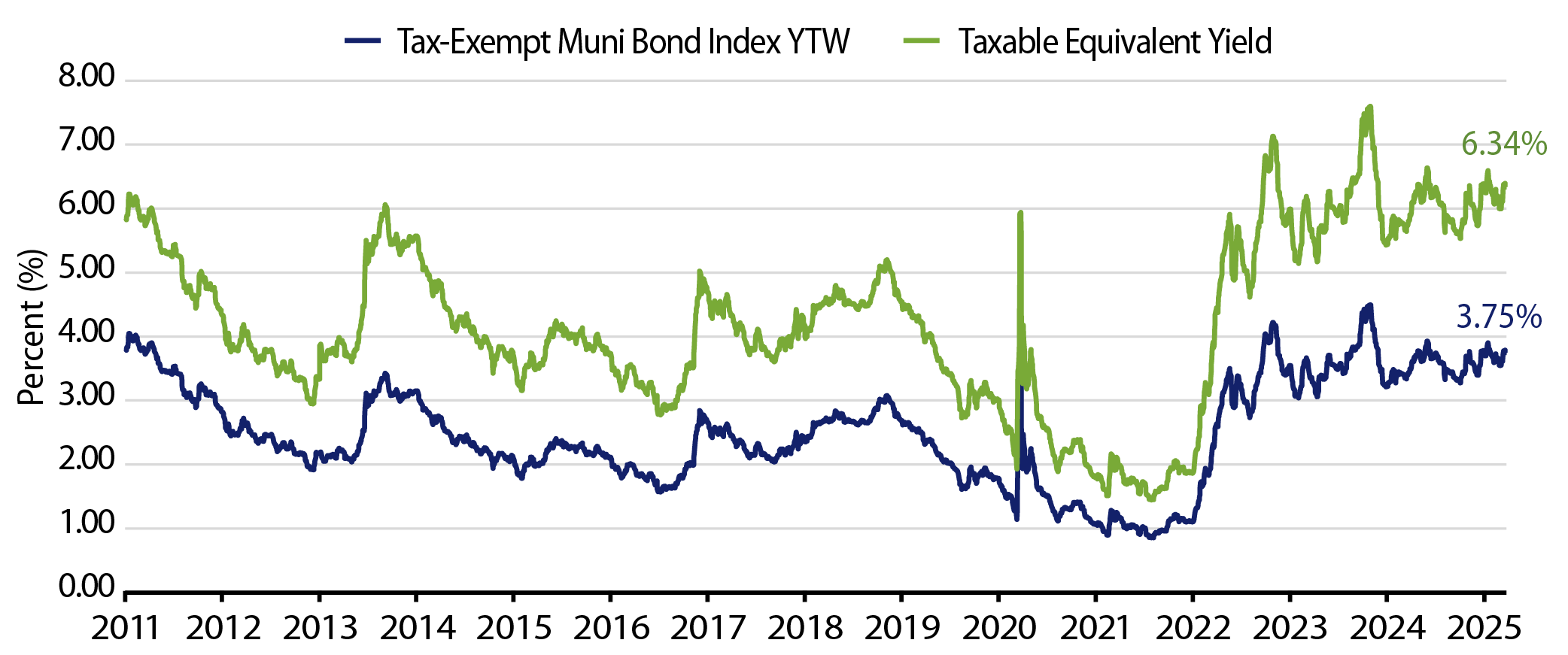

Theme #1: Municipal taxable-equivalent yields and income opportunities remain above decade averages.

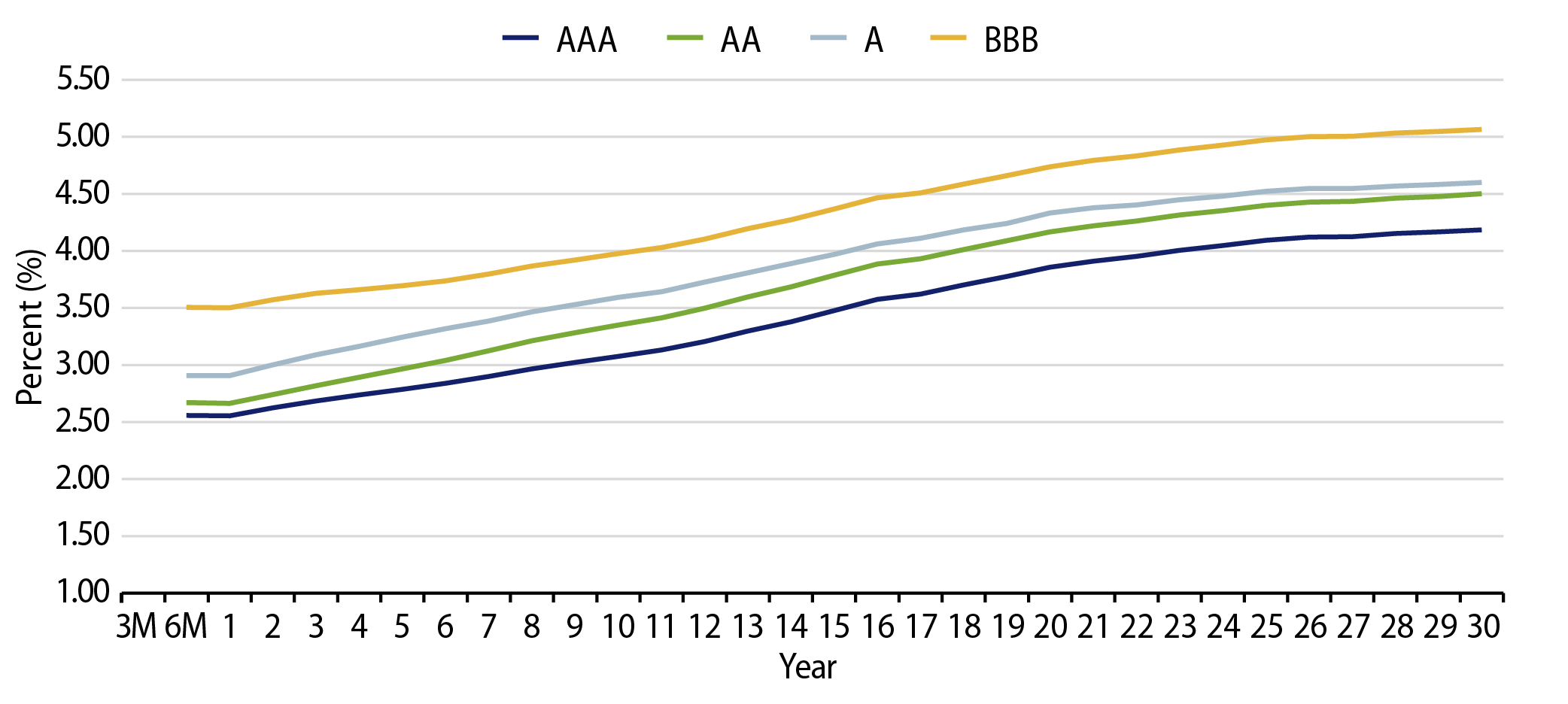

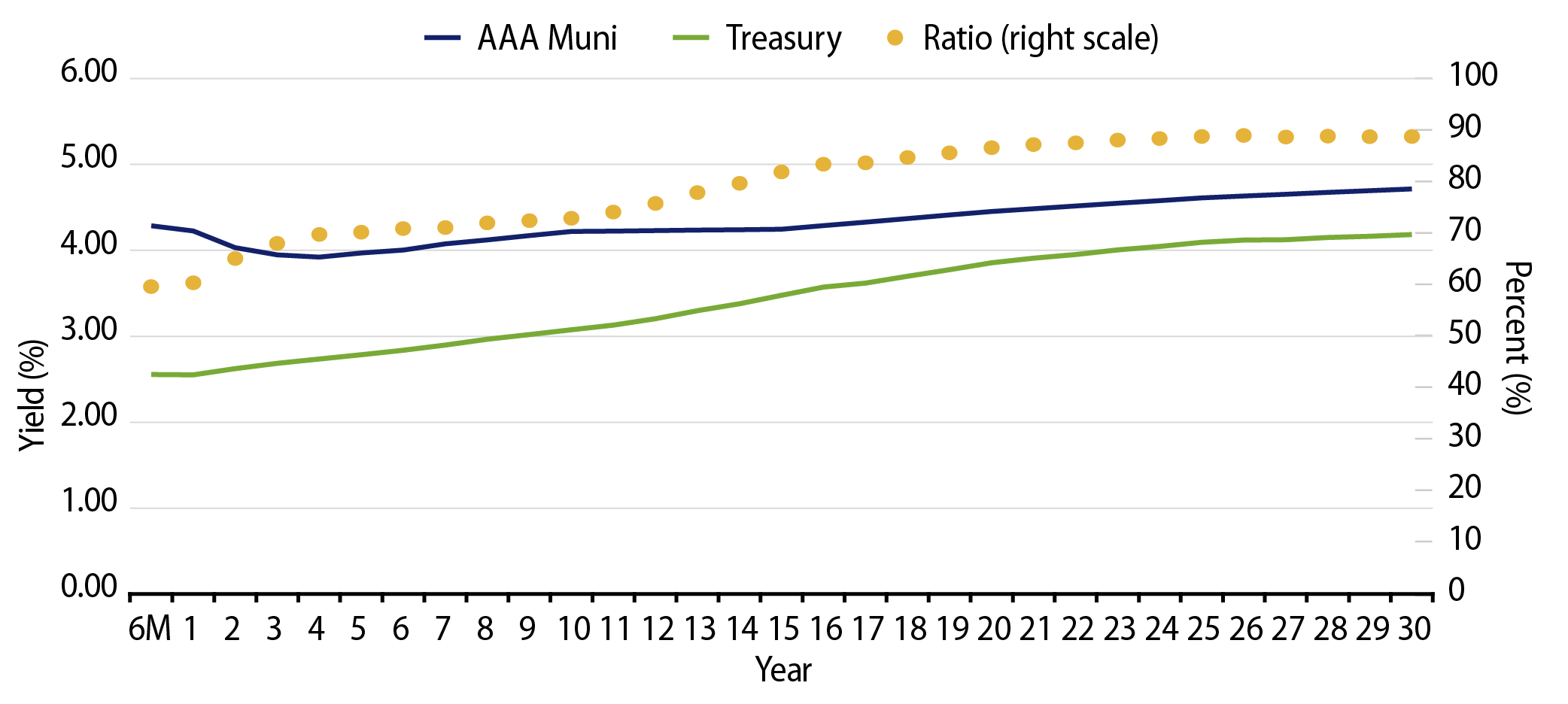

Theme #2: The muni curve has steepened, offering better value in intermediate and longer maturities.

Theme #3: Munis offer attractive after-tax yield pickup versus longer-dated Treasuries and investment-grade corporate credit.