Consumer spending rose 0.1% in November, and with a 0.1% increase in the price index for consumption, that left real consumer spending unchanged on the month. There were some upward revisions to previous months’ data, and the upward revision to September consumption accounted for most of the revision announced yesterday to 3Q GDP growth.

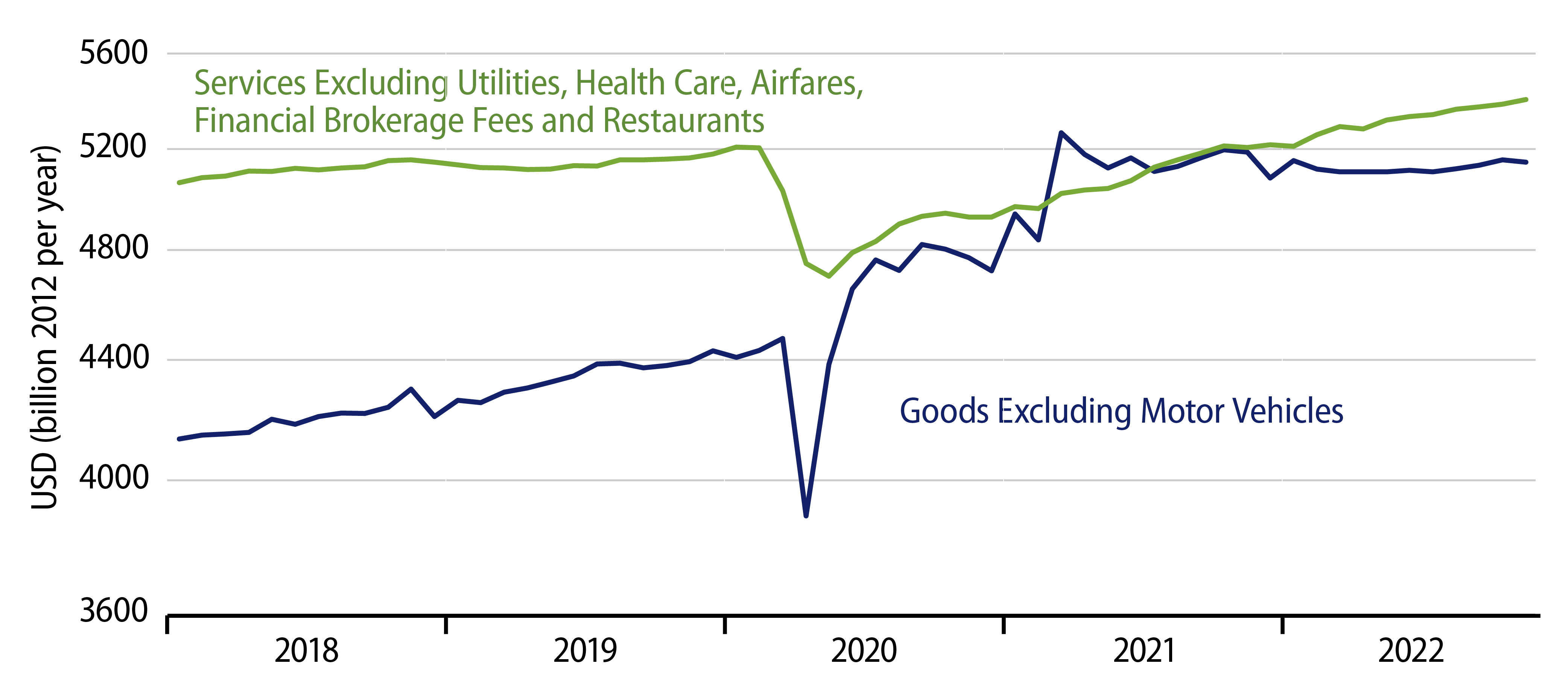

Interestingly enough, the upward revisions to consumer spending were all in services. Consumer spending on goods was actually revised down substantially, though obviously not as substantially as services spending was revised up, and real goods consumption fell in November on top of that. The movements in “basic” goods and services spending are shown in the accompanying chart.

The net effect of the revisions and November swings is to bring consumer trends right back to the story that was in place up until this fall. That is, from March 2021 through summer 2022, real consumption of goods had been flat to down slightly, while services spending grew modestly. Data for September and October appeared to reverse those trends, with goods spending picking up some and services spending decelerating.

Well, the revisions announced today erased the goods spending gains and fortified the services gain. So, goods spending is back on essentially the same flat-to-down path it previously had evinced, and services are back to their previously apparent growth trend. Overall, total consumer spending is growing steadily at about the same trend rate as it displayed prior to Covid. So, the supposedly excessive growth in demand that was said to fuel inflation over 2021-2022 is gone, but neither have consumers slowed in response to the Fed’s ministrations.

Rather, for now, the effects of Fed rate hikes are confined to homebuilding and, lately, the manufacturing sector. Obviously, that could change in the months ahead, but current facts on the ground are a consumer hanging in there.

Much of that tenacity reflects the fact that job growth continues to be positive and, with it, incomes are increasing. Also announced today was a 0.4% rise in personal income in November. With headline Personal Consumption Expenditures (PCE) inflation at 0.1% in October and core inflation between 0.1% and 0.2%, real personal incomes eked out a modest gain. That is heartening to those hoping the consumer holds up, but who knows how the currently Grinchy Fed will react to real consumer incomes still rising (even if it is lower inflation that is allowing that real income growth). Incomes did rise enough to allow personal saving to pick up a bit in November.

Happy holidays to all our readers and best wishes for the New Year 2023!