Despite the strong returns for emerging market (EM) fixed-income during 2023 (Exhibit 1), one thing has eluded industry practitioners in recent quarters—a compelling relative value argument for higher quality EM bonds. As we’ll discuss here, we believe that there are reasons to dust off EM investment-grade (IG) bonds as a core allocation, given that they appear poised to generate strong carry as well as potential upside from lower interest rates.

In Search of Relative Value

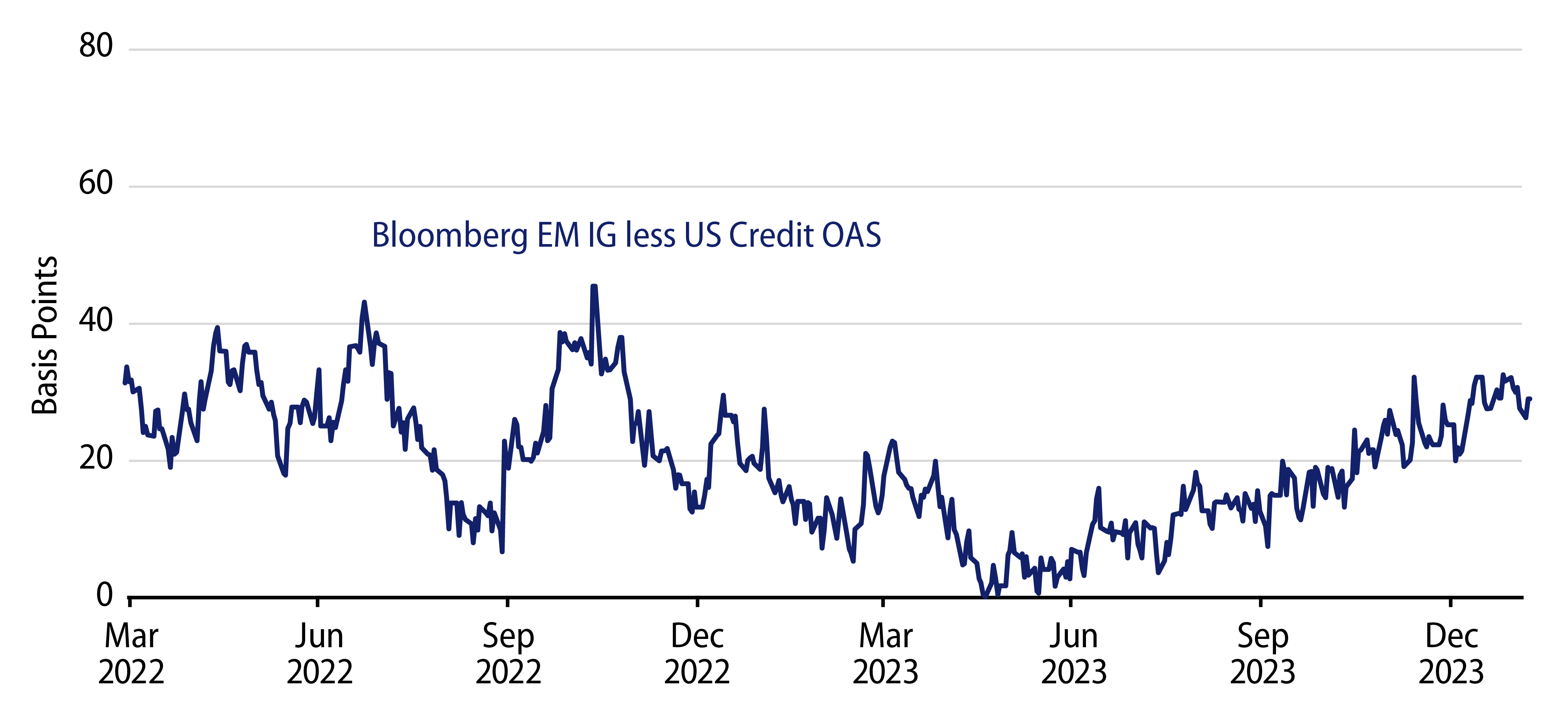

Historically, IG-rated EM debt has been a strategic allocation for global bond funds, institutional accounts and insurance portfolios, as it typically offers both diversification and additional spread. Despite headwinds to EM fundamentals from the pandemic and central-bank-induced tightening of financial conditions, in recent years we saw an unusual compression of EM IG spreads relative to US credit (Exhibit 2), making the case for EM more challenging. Why did this countercyclical spread compression occur? We attribute it to technicals; during 2022 and the first half of 2023, we saw strong levels of US IG primary issuance that forced spread concessions, which contrasted with negative net issuance of EM IG debt.

The good news for EM professionals and value-seeking investors is that despite strong performance from EM assets over the past 12 months, valuations for EM IG bonds have steadily improved relative to US credit since mid-2023. This trend has accelerated in recent months as a renewed EM primary calendar has come with spread concessions, keeping EM spreads from compressing as much as their US peers. This contrasts with US high-grade issuance printed on top of secondary spreads, in response to unrelenting inflows to that asset class. While those of us in EM would appreciate seeing similar inflows, the counter is that our more balanced technicals have led to the better valuations we’re seeing today—a 30-basis-point spread advantage that represents approximately a one-third premium versus US IG index spreads.

Tapping the Primary Market

While we continue to believe that most EM asset classes are set up for strong 2024 performance on the back of strong starting yields and the potential for lower rates, we also believe the valuation opportunity described earlier can help those investors with a higher quality orientation, and who may have been priced out of the EM market in recent years. Western Asset is taking advantage of the cheapening of EM IG spreads by participating in 2024’s robust supply calendar, which was kicked off as usual by Mexico sovereigns issuing $6.5 billion of new 10- and 30-year bonds on January 2. As the first quarter has progressed, we have been encouraged by the breadth of issuers coming to the market, which, after a slow couple of years for issuance, adds to our investment universe and increases diversification as well as the potential for excess returns. Overall, given the recent strength, but historical tightness, of US IG spreads, we are seeing more clients interested in participating in the current opportunity in EM IG.

Monitoring Fallen-Angel Risk

While all credit professionals are familiar with the risk of a fallen angel, investing in EM IG comes with additional sovereign-level considerations such as politics and fiscal policy that can impact an issuer’s ratings trajectory. As we noted in a previous blog, Emerging Markets as an Extension of US Credit, historical ratings migration trends for EM issuers are comparable to that of the US, but we would be remiss not to acknowledge previous sovereign fallen angels such as Brazil that impacted developed market (DM) bond investors. As a result, Western Asset’s EM investment process places a premium on sovereign-level fundamental analysis in an effort to ensure that the value we’re currently seeing in EM IG sovereign and corporate bonds isn’t eroded by ratings downgrades.