Macros, Markets and Munis

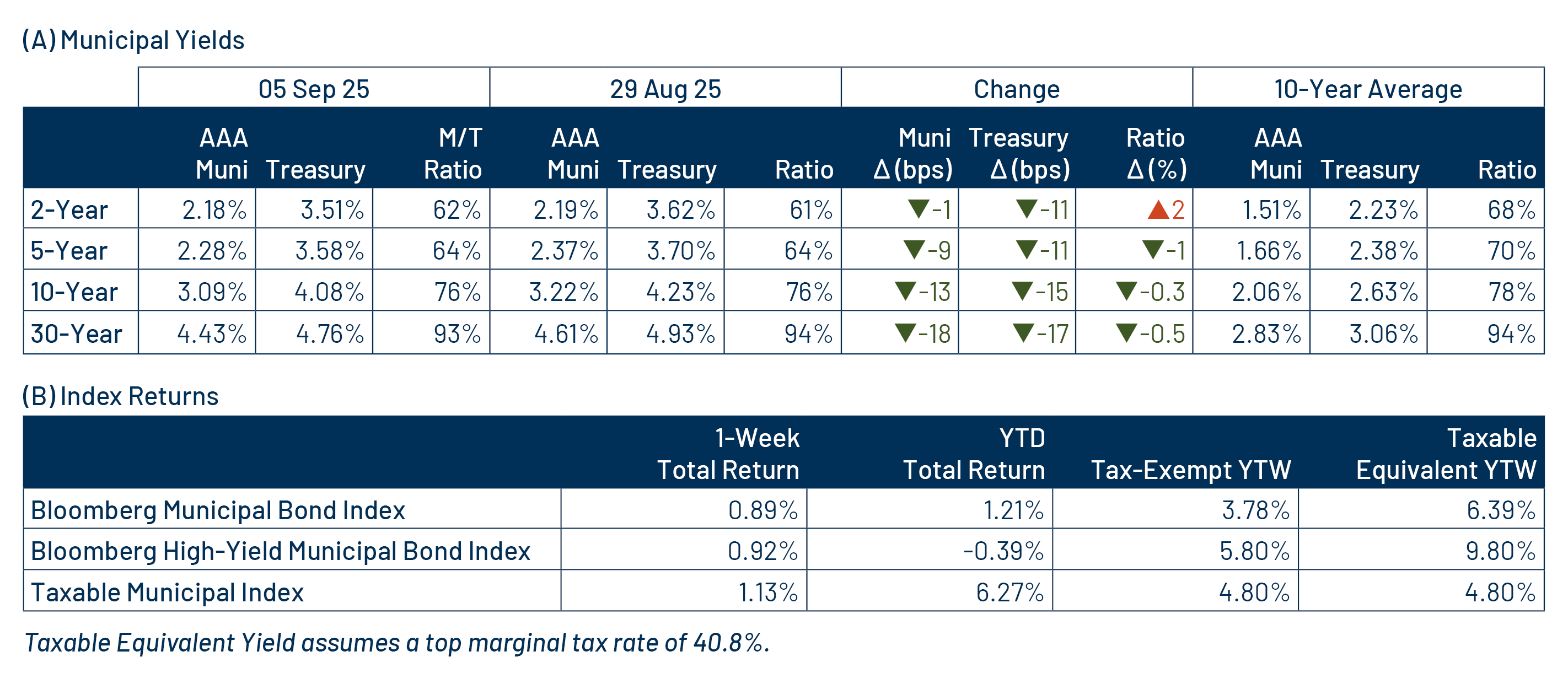

Munis posted positive returns along with other fixed-income markets last week. Treasuries rallied across the yield curve, fully pricing in a cut for September’s Federal Open Market Committee meeting. Munis followed Treasuries lower, modestly outperforming in longer maturities but underperforming in shorter maturities. Following the Labor Day holiday, fixed-income markets shifted their focus to labor market data, which indicated ongoing softening. Earlier in the week, job openings remained stable, though hiring rates stayed below 4.0%. This was followed by the release of ADP private payrolls data, which declined from prior months’ levels and fell below expectations, ultimately culminating in Friday’s nonfarm payrolls gain of 22,000 jobs which declined from July levels and fell below expectations. Meanwhile, municipal demand remained positive amid elevated new-issue supply. Following last week’s Labor Day holiday and the weak jobs report, we check in on state and local payroll data.

Muni Funds Post Outflows as Supply Remained Elevated

Fund Flows ($672 million of net inflows): During the week ending September 3, weekly reporting municipal mutual funds recorded $672 million of net inflows, according to Lipper. Long-term, intermediate and short-term categories recorded $315 million, $192 million and $55 million of inflows, respectively. Last week’s inflows led year-to-date (YTD) inflows higher to $25 billion.

Supply (YTD supply of $395 billion; up 20% YoY): The muni market recorded $9 billion of new-issue supply last week, up 21% from the prior week. YTD new-issue supply of $395 billion is 20% higher than the prior year, with tax-exempt issuance up 22% year-over-year (YoY) and taxable issuance up 1%, respectively. This week’s calendar is expected to remain elevated at $12 billion. The largest deals include $1.4 billion Dallas Fort Worth Airport and $1 billion Atlanta Airport transactions.

This Week in Munis: State and Local Payrolls

On Friday, the Bureau of Labor Statistics reported nonfarm payroll growth of 22,000 jobs for the month of August, down from the prior month’s growth rate of 73,000 jobs and falling short of expectations by 53,000 jobs. State and local payrolls were not supportive of overall job growth during the month, with seasonally adjusted figures largely unchanged, reflecting a modest 1,000 jobs decline in municipal payrolls during the month.

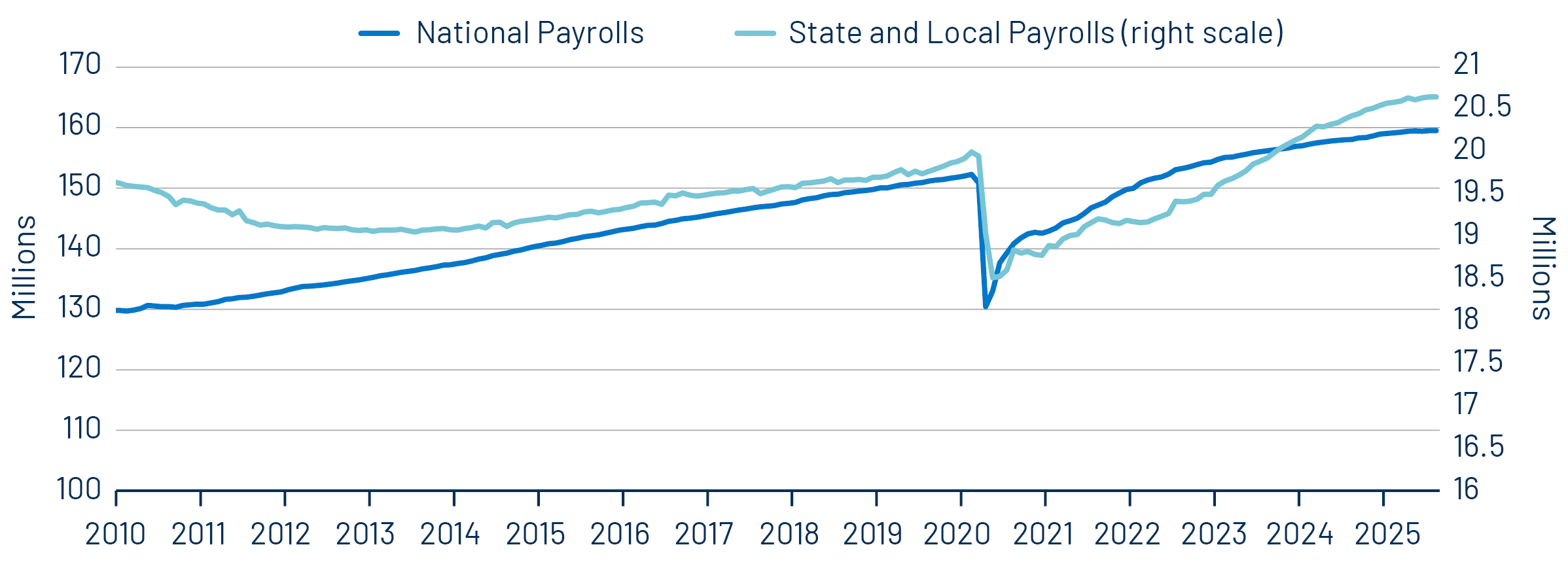

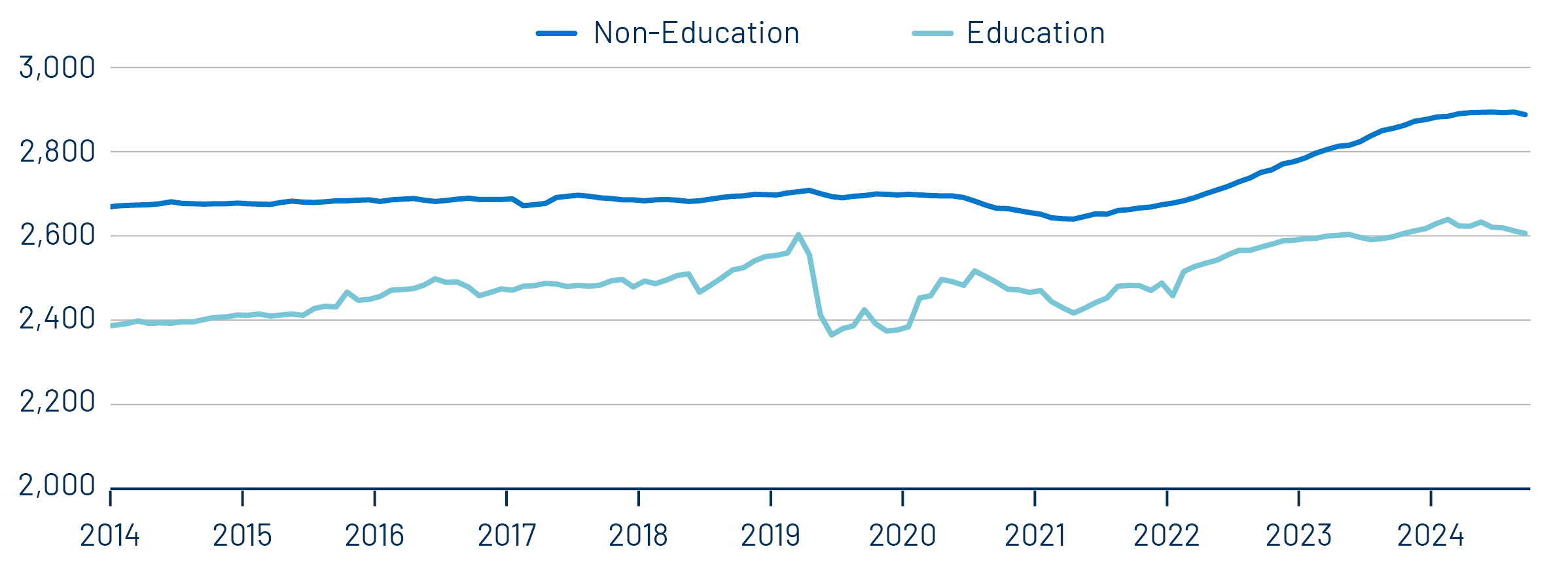

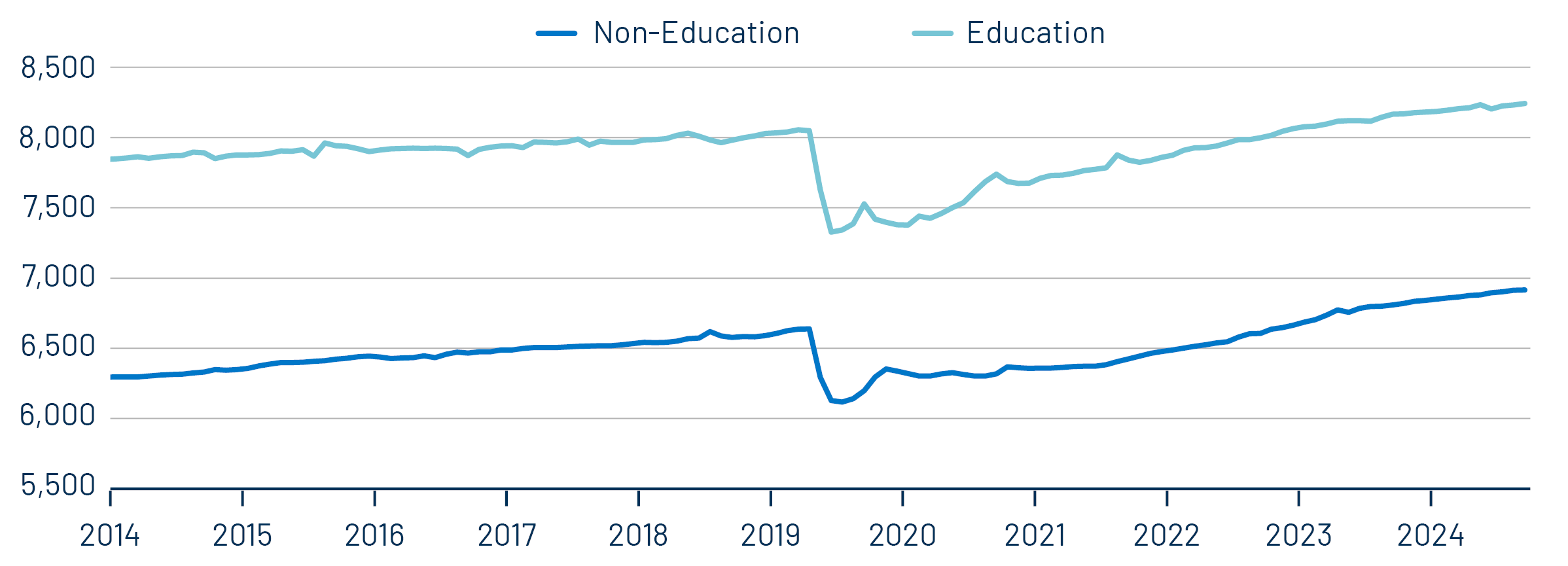

Over the past year, state and local job growth has exceeded the national payroll growth rates. From August 2024 to August 2025, seasonally adjusted national payrolls increased 0.9% to 159.5 million. State and local payrolls edged out national growth rates, growing 1.1% to 21 million. Across the sub-components of state and local employment, state education jobs increased 0.3% YoY while non-education jobs increased 1.1% YoY. Hiring was more robust at the local level, with local education payrolls increasing 0.9% YoY and local non-education payrolls increasing 1.6% YoY.

While state and local payrolls have been additive to the overall job picture during the past year, hiring from state and local governments has lagged the pandemic recovery. National employment levels remain approximately 6% above pre-pandemic high levels, while state and local payrolls remain just 3% above pre-pandemic highs. The relatively prudent hiring bodes well for state and local municipal governments which have enjoyed record tax revenue collections but will now need to contend with the prospects of slower economic growth and decreased federal aid ahead.

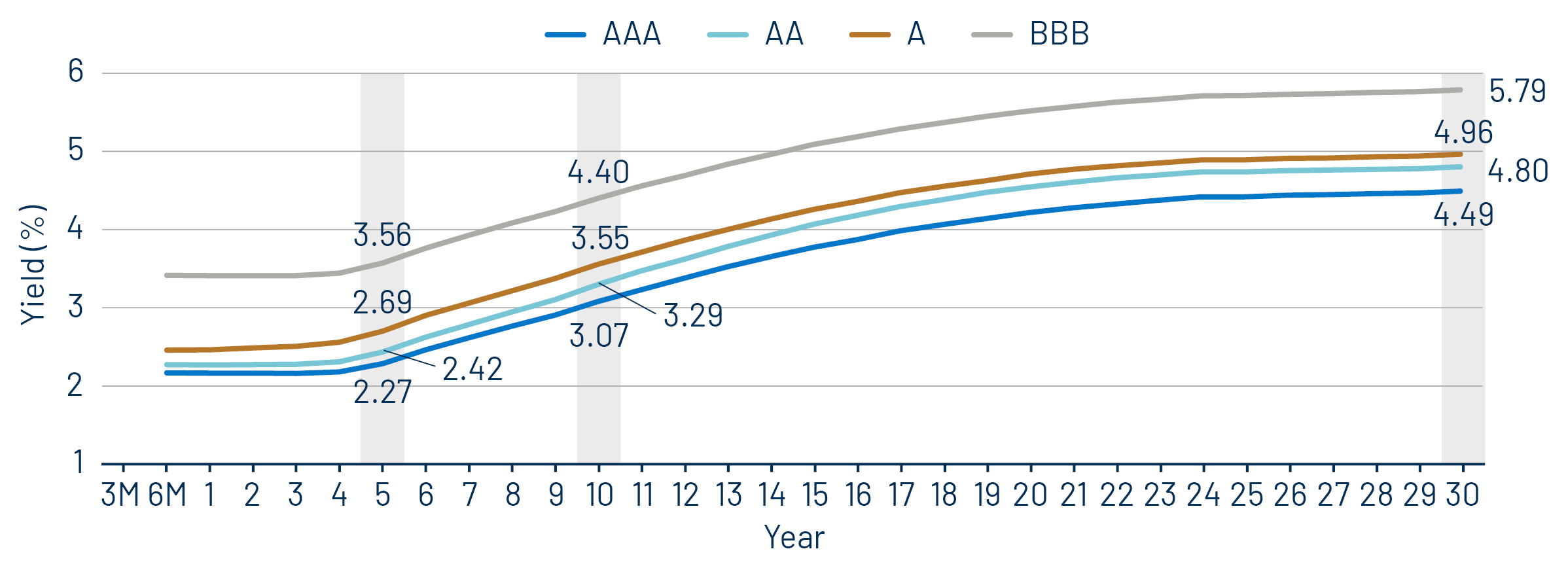

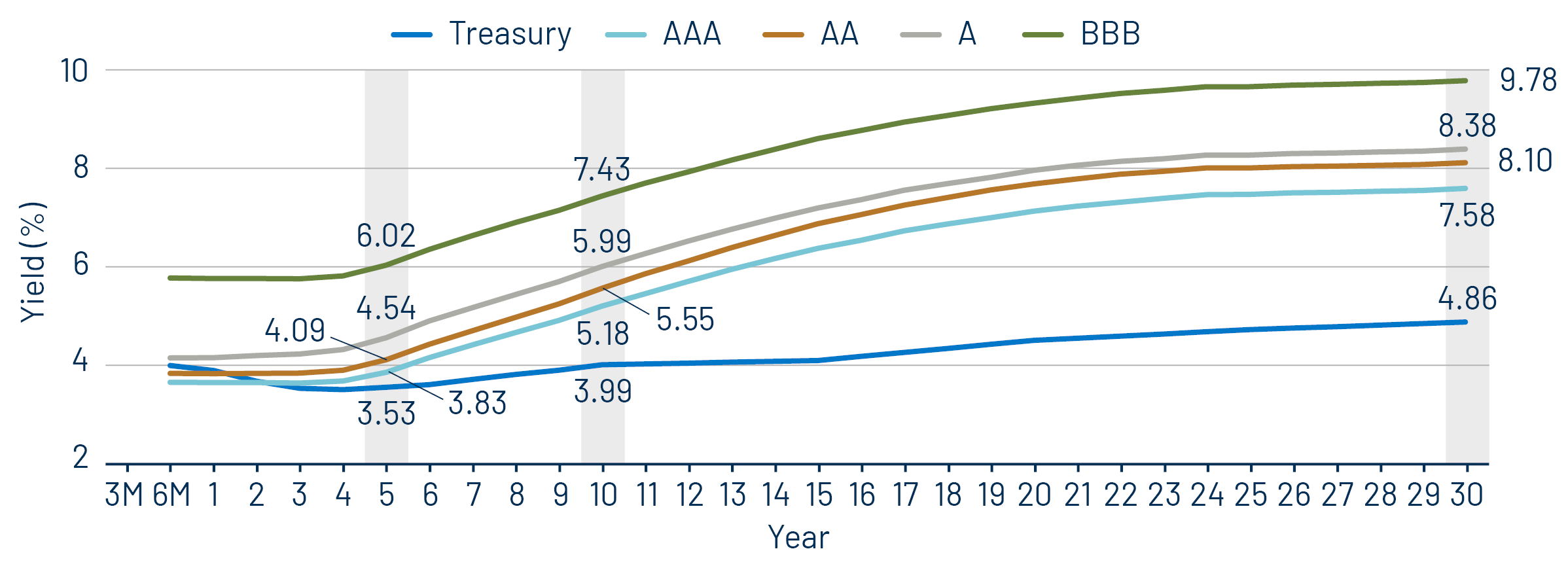

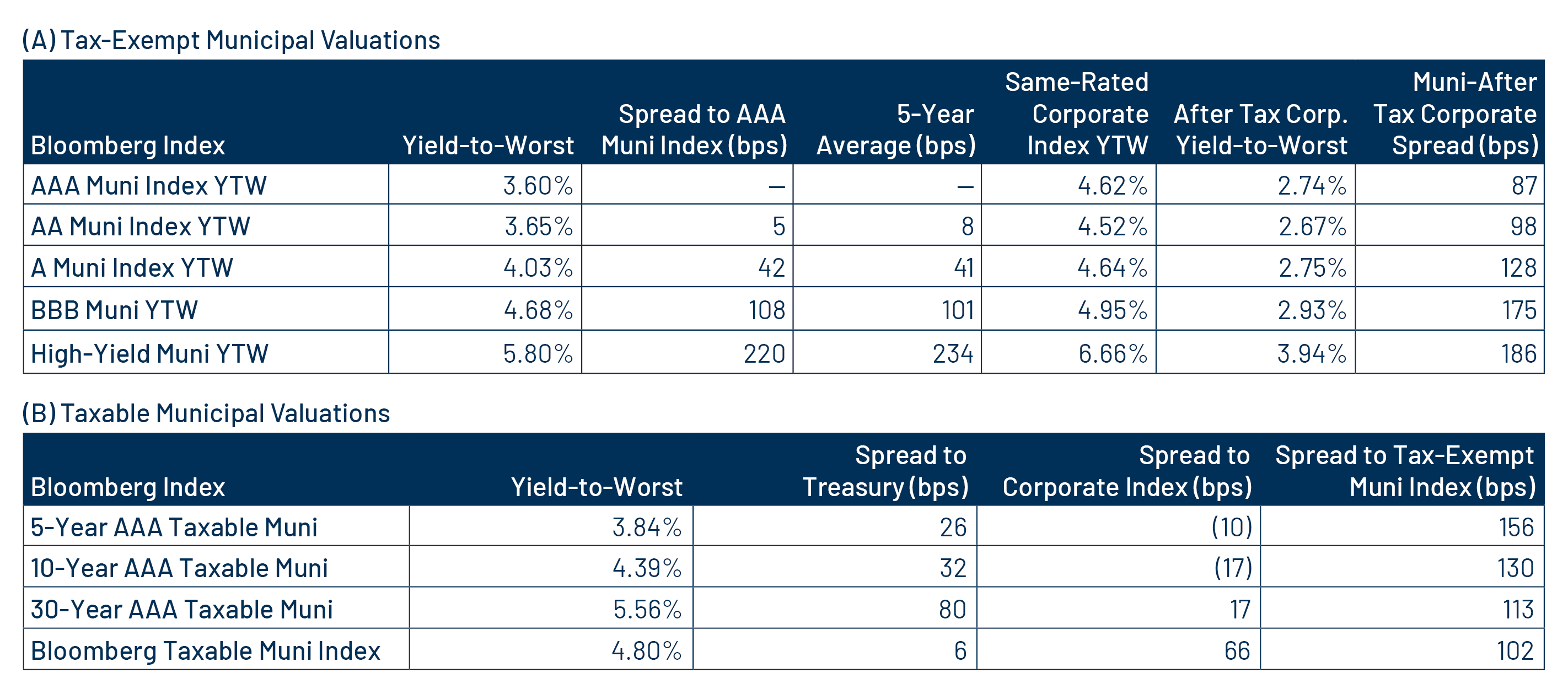

Municipal Credit Curves and Relative Value

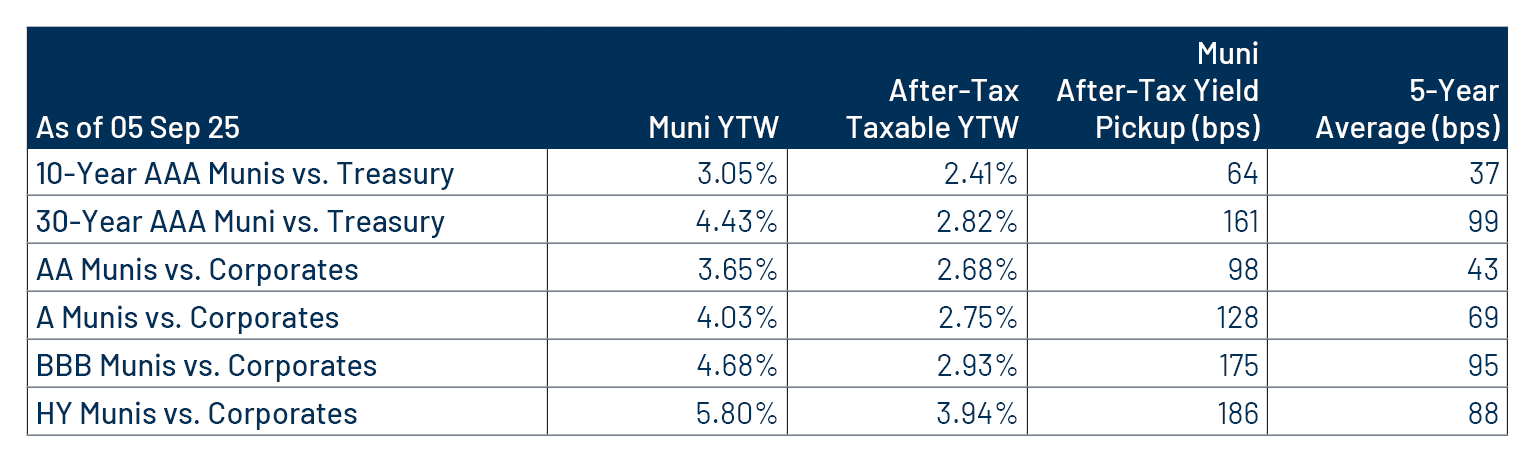

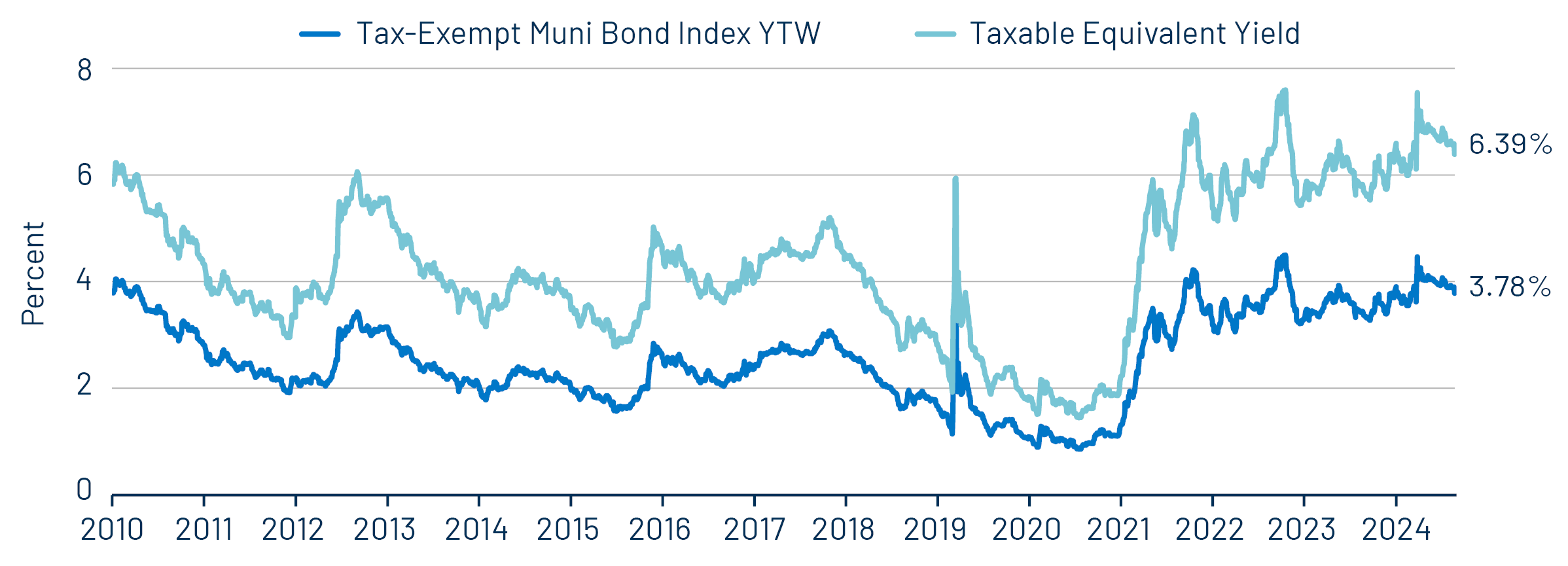

Theme #1: Municipal taxable-equivalent yields and income opportunities remain near decade-high levels.

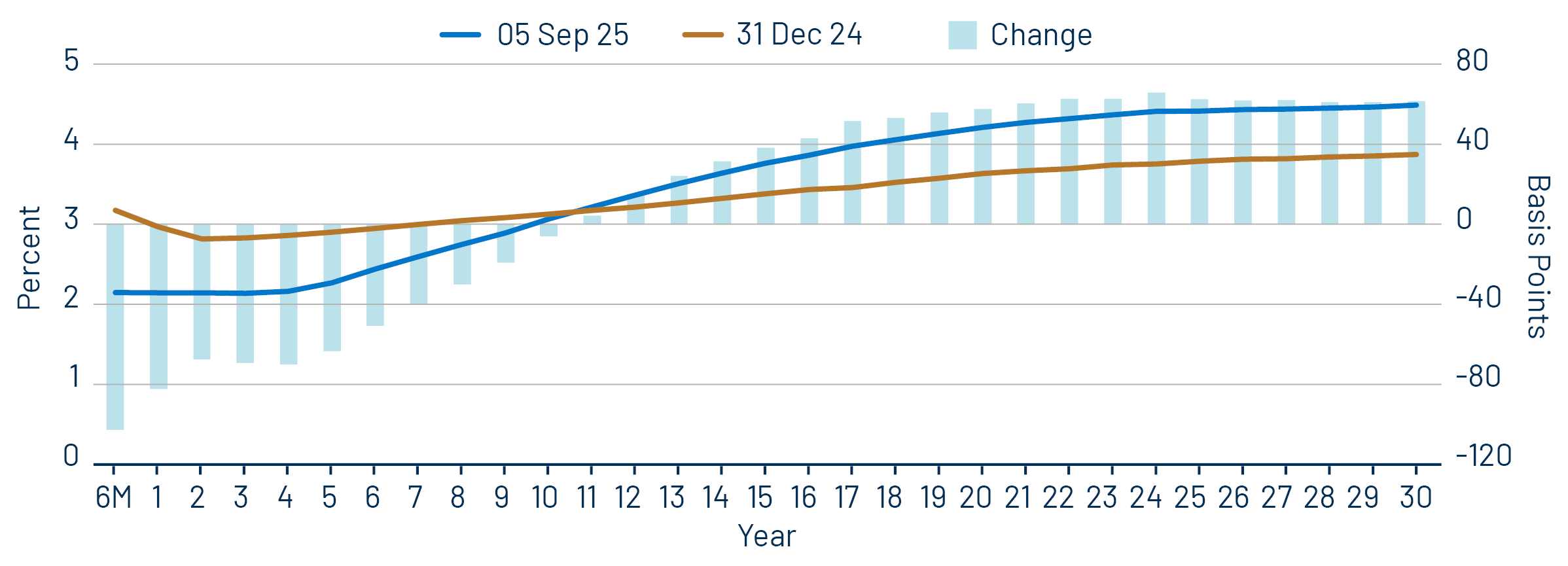

Theme #2: The AAA muni curve has steepened, offering better value in intermediate and longer maturities.

Theme #3: Munis offer attractive after-tax yield compared to taxable alternatives.