Municipals Posted Negative Returns

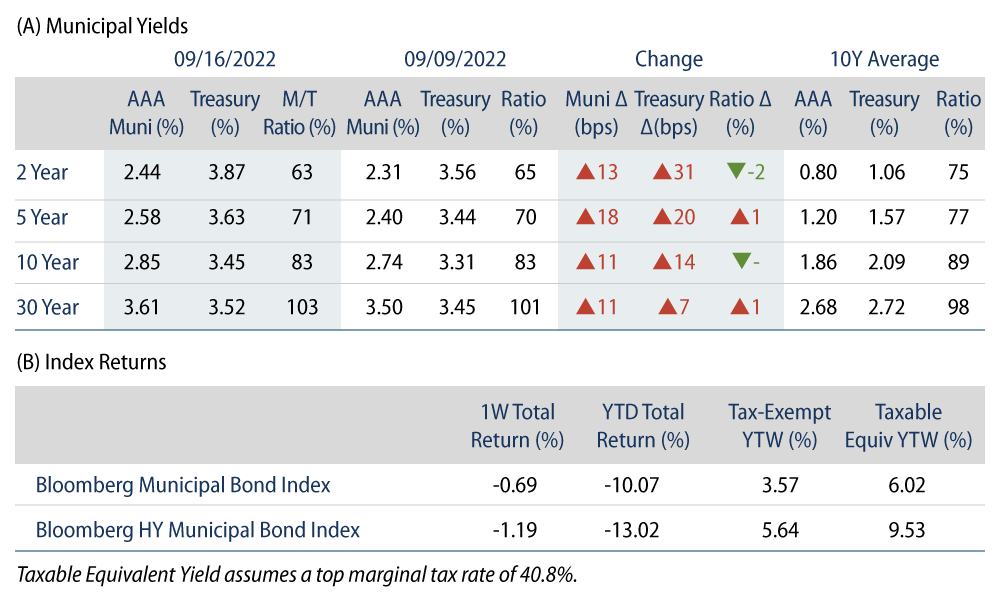

Municipals posted negative returns last week amid continued rate volatility. Municipal performance versus Treasuries was mixed across the curve, as ratios remained steady. High-grade municipal yields moved 11-18 bps across the curve as market technicals weakened amid increasing fund outflows and supply conditions. The Bloomberg Municipal Index returned -0.69% while the HY Muni Index returned -1.19%. This week, we highlight second-quarter state and local tax revenue collections.

Technicals Remain Challenged Amid Ongoing Mutual Fund Outflows

Fund Flows: During the week ending September 14, weekly reporting municipal mutual funds recorded $1.4 billion of net outflows, according to Lipper. Long-term funds recorded $594 million of outflows, high-yield funds recorded $267 million of outflows and intermediate funds recorded $312 million of outflows. The week’s outflows mark the sixth consecutive week of outflows and extend year-to-date (YTD) outflows to $86 billion.

Supply: The muni market recorded $8.9 billion of new-issue volume, up 32% from the prior week. Total YTD issuance of $285 billion is 9% lower than last year’s levels, with tax-exempt issuance trending 2% higher year-over-year (YoY) and taxable issuance trending 44% lower YoY. This week’s new-issue calendar is expected to decline to $2 billion. Larger deals include $549 million San Diego Unified School District and $120 million Louisville And Jefferson County Water and Sewer transactions.

This Week in Munis: Second-Quarter Revenues Remain Resilient

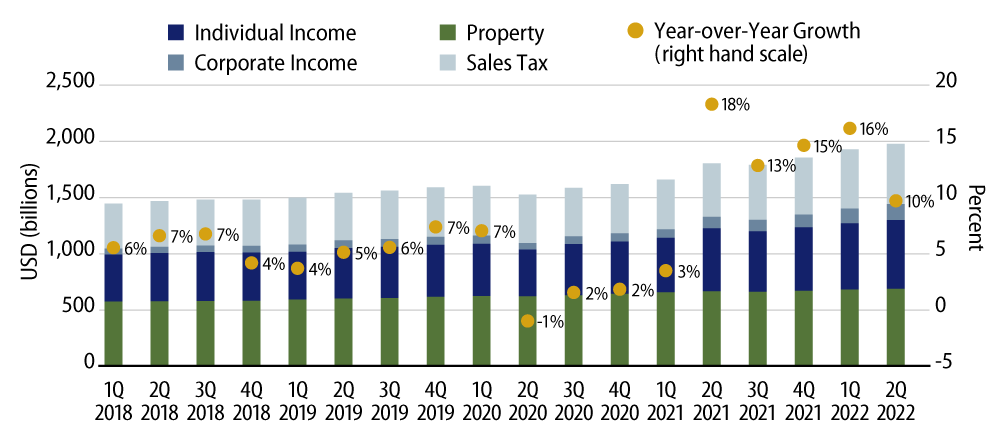

Earlier this month, the Census released state and local tax revenue collections for the second quarter of 2022. Second-quarter state and local tax collections continue to highlight strong YoY growth, up 11% from the prior year to $532 billion. Individual income tax collections increased 12% to $203 billion, corporate income tax collections increased 29% to $55 billion, property tax collections increased 6% YoY to $124 billion and sales tax collections increased 7% to $150 billion.

2Q22 tax collection data also reflects the end of fiscal-year 2022 for many municipalities, and trailing 12-month collections were consistent with the YoY growth trends we’ve observed in the second quarter. 12-month trailing total state and local tax collections increased 10% from the 12 months through June 2021 to $2.0 trillion. Within this figure, trailing 12-month individual income tax collections increased 9% to $611 billion, corporate income tax collections increased 41% to $144 billion and sales tax collections increased 12% to $534 billion.

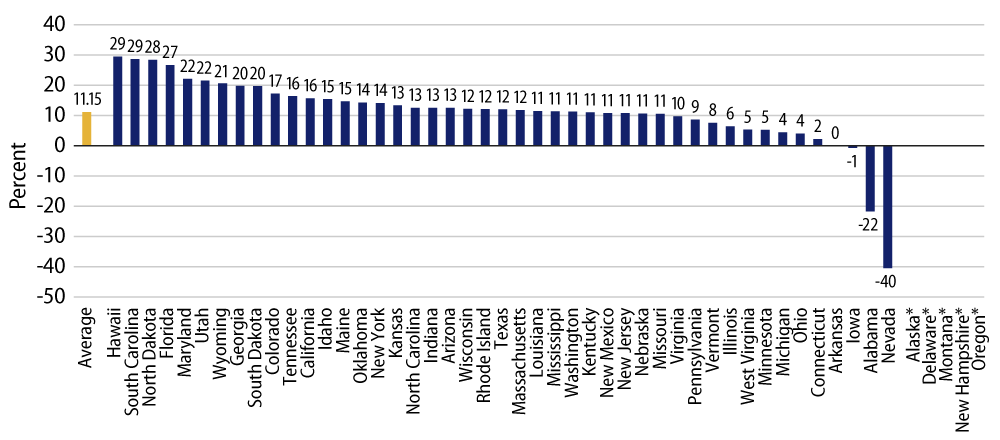

At the state level, total tax collections increased 11% from 2Q21 to $449 billion in 2Q22. The largest components of state tax collections, individual income tax collections (42% of total state collections) and sales tax receipts (27% of total tax collections), were 12% and 26% higher YoY, respectively. Inflationary pressures have contributed to strong YoY growth in 12-month trailing sales tax receipts. Hawaii (+29%), South Carolina (+29%), North Dakota (+28%) and Florida (+27%) observed particularly high growth rates in sales taxes. Florida was a particular beneficiary of this growth considering the lack of state income tax, and higher reliance on sales tax revenues.

While a tight labor market, strong consumer and recent inflation have all supported muni income and sales tax collections, we remain cautious on the potential for revenues to slow, considering inflationary and interest-rate headwinds that could challenge overall economic growth. Despite the recent market volatility observed this year, relatively tight credit spreads continue to indicate that the fundamental revenue improvement has been largely priced into market valuations. Western Asset believes muni investors are better compensated on a risk-adjusted basis in higher-quality securities, and that incremental value can be better exploited in structural factors.