Buried in post-crisis history and the regulations that followed lies an important secret about credit markets: the foundation for the greatest distortion drivers between price and fundamental value in fixed-income markets were created by the regulations implemented in response to the Great Depression. Excluding tax policy, the three main structural forces that shaped the markets and still impact valuations today are regulation, rating agencies and debt-weighted indices. These three forces are unique to fixed-income and create investment opportunities for active managers, especially in research-intensive sectors like high-yield credit.

Background

Following the Great Depression in the US, rules and regulations that followed for financial institutions created a divide between investment-grade securities rated BBB and above, and high-yield securities (aka speculative grade) rated BB and below. This divide’s origins trace back to regulations issued by the Comptroller of the Currency and the Federal Reserve Act governing member banks in the mid-1930s. In addition to the impact it had on banks’ investment and capital decisions, it led to further adoption by the National Association of Insurance Commissioners (NAIC), which impacted insurance companies for decades that followed.1 Many financial institutions’ and other fixed-income market participants’ investment policies are still based on these regulations today.

Why Is the Difference Between BBB and BB Important?

As a result of this divide, the pool of investors that purchase high-yield securities is at least 20x smaller than those investing in the $100 trillion+ global investment-grade market.2 This is due to constraints among the biggest investors, which include financial institutions and local governments, who are disincentivized by regulation or prohibited from purchasing high-yield securities. Given the size difference between investment-grade and high-yield investors, the divide creates additional volatility during business cycles, as the amount of securities that rise from and fall to BB ratings are very correlated to economic recoveries and recessions, respectively. For example, rating agencies typically downgrade more corporate bonds during recessions, as profits decline and leverage rises. Historically, downgrades of larger issuers with ratings that fall below investment-grade minimums (aka “fallen angels”) tend to experience deeper declines in prices and wider spreads vs. Treasuries due to coerced selling. Alternatively, companies’ security ratings that improve to minimum investment-grade standards can benefit from index inclusion (aka “rising stars”). More outperformance from rising stars usually occurs months before the actual rating upgrade and inclusion in investment-grade indices.

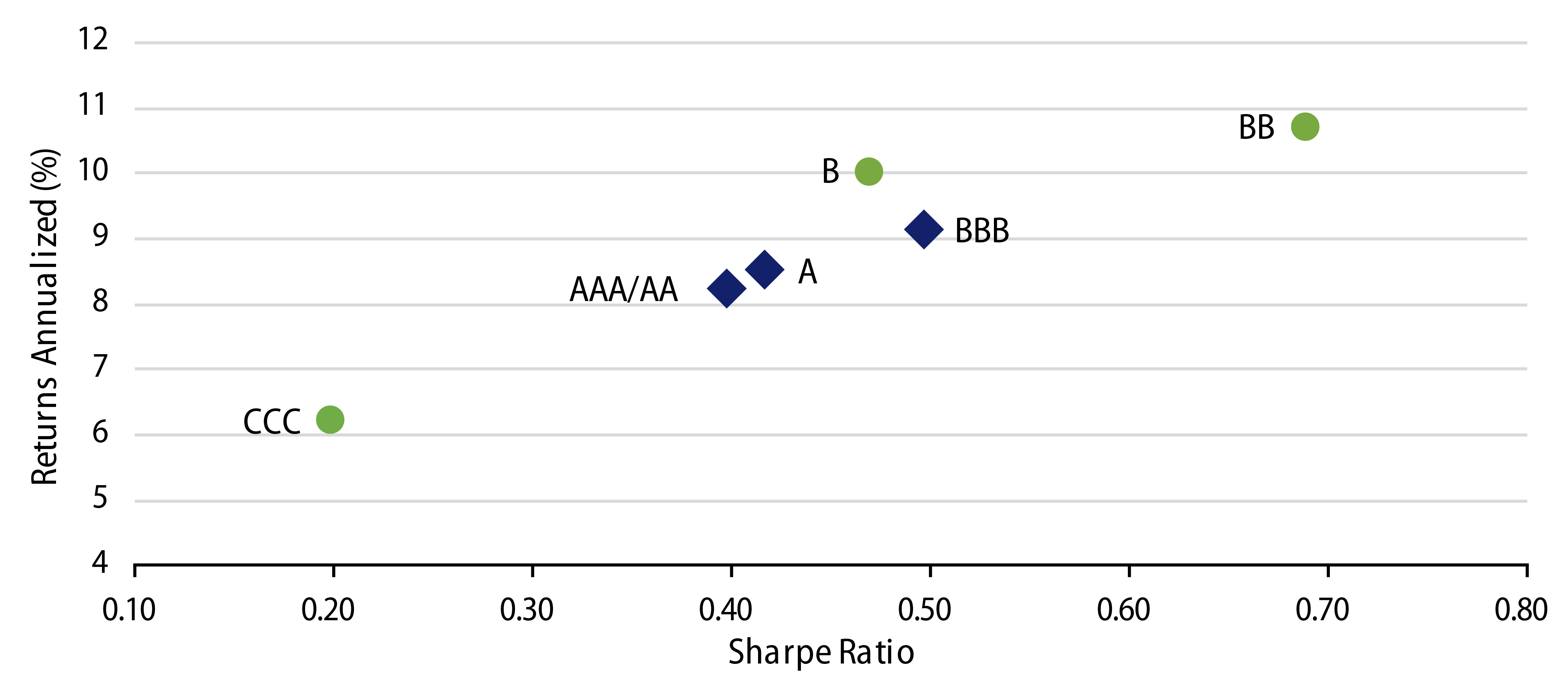

Managers focused on identifying rising stars and fallen angels, mostly with BB ratings, have historically been rewarded with attractive absolute and risk-adjusted returns (Exhibit 1). To capitalize on this structural distortion, it helps to analyze business cycles from a top-down perspective as well as perform independent analysis on companies that traverse the high-yield rating divide.

Indices—Take Note, Passive Investors

In addition to ratings, other index inclusion criteria are important for how asset managers construct portfolios. It’s worth noting that equity and fixed-income index design can be quite different, which is relevant for making active versus passive decisions. For some equity market indices, a market capitalization-weighted index approach has some merit. The larger, improving and possibly more profitable the company becomes, the more its market capitalization and index weighting increases. This design creates an investment bias to larger and improving companies in a portfolio.

To contrast, in fixed-income markets, the more debt outstanding an issuer has, the more its weighting increases—essentially creating a bias to larger borrowers. The design for equity indices can make a little more sense for passive investing, but lending more to those with the most debt outstanding is not aligned with fundamentals for credit markets.

Looking Ahead

Knowing what historically influences fixed-income participants helps us to identify opportunities and risk. Regulation, agency ratings and index design all play a consequential role in determining where valuations may differ from fundamental value. At Western Asset, our investment philosophy is based upon nearly a half-century of experience focusing on fundamental value and capitalizing on mispriced securities. We continue to see the benefits of taking an actively managed approach to fixed-income investing and especially in the analysis of credit markets. Our team of more than 70 bottom-up credit investment professionals around the world is continually identifying relatively attractive opportunities in high-yield markets. Given our top-down view of the ongoing economic recovery, and proprietary bottom-up research, we are finding opportunities in rising-star credits, cyclicals and corporate structured products.

END NOTES

1. Tracing the Origins of “Investment Grade,” Jerome Fons at Moody’s, January 2004.

2. SIFMA Capital Markets Fact Book 2021 & ICE BofA Global High Yield.