Macros, Markets and Munis

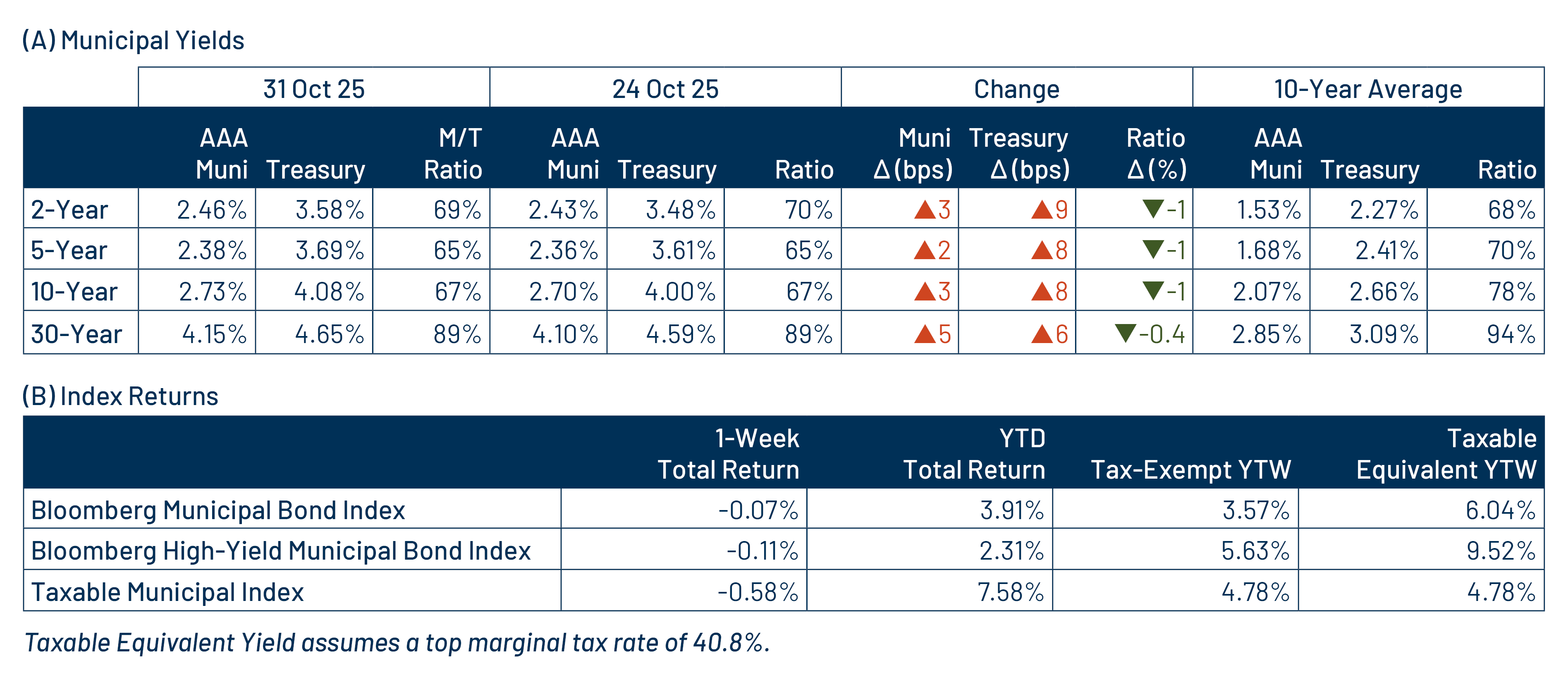

Munis posted negative returns last week, but outperformed Treasuries. The Treasury curve sold off during the week, moving 6-8 bps higher across the curve. The high-grade muni curve also moved higher, but outperformed amid improving technical factors, rising 2-5 bps higher across the curve. Meanwhile, muni technicals were supported by slowing supply and steady demand. Amid the ongoing federal government shutdown that continues to limit data releases, the primary focus of the markets last week was on the Federal Reserve (Fed), which cut the fed funds rate by 25 bps while also announcing an end to quantitative tightening. Notably, there were two dissents within the Federal Open Market Committee, with one member advocating for a 50-bp cut and another advocating that rates remain unchanged, and Fed Chair Jerome Powell made hawkish comments emphasizing that a December cut was not a “foregone conclusion.” This week we touch on strong October muni performance.

Supply Increased to Near Record Levels While Demand Remained Positive

Fund Flows ($720 million of net inflows): During the week ending October 29, weekly reporting municipal mutual funds recorded $720 million of net inflows, according to Lipper. Long-term funds recorded $567 million of inflows, intermediate funds recorded $177 million of inflows and the short-term category recorded $36 million of outflows. Last week’s inflows led year-to-date (YTD) inflows higher to $37 billion.

Supply (YTD supply of $490 billion; up 15% YoY): The muni market recorded $8 billion of new-issue supply last week, down $10 billion from the prior week’s level. YTD new-issue supply of $490 billion is 15% higher than the prior year, with tax-exempt issuance up 16% year-over-year (YoY) and taxable issuance up 6% YoY. This week’s calendar is expected to pick back up to $11 billion. The largest deals include $2.6 billion Southeast Energy Gas Prepay (JP Morgan) and $561 million Sullivan County Resort Facilities transactions.

This Week in Munis: Munis Play Catch-Up In October

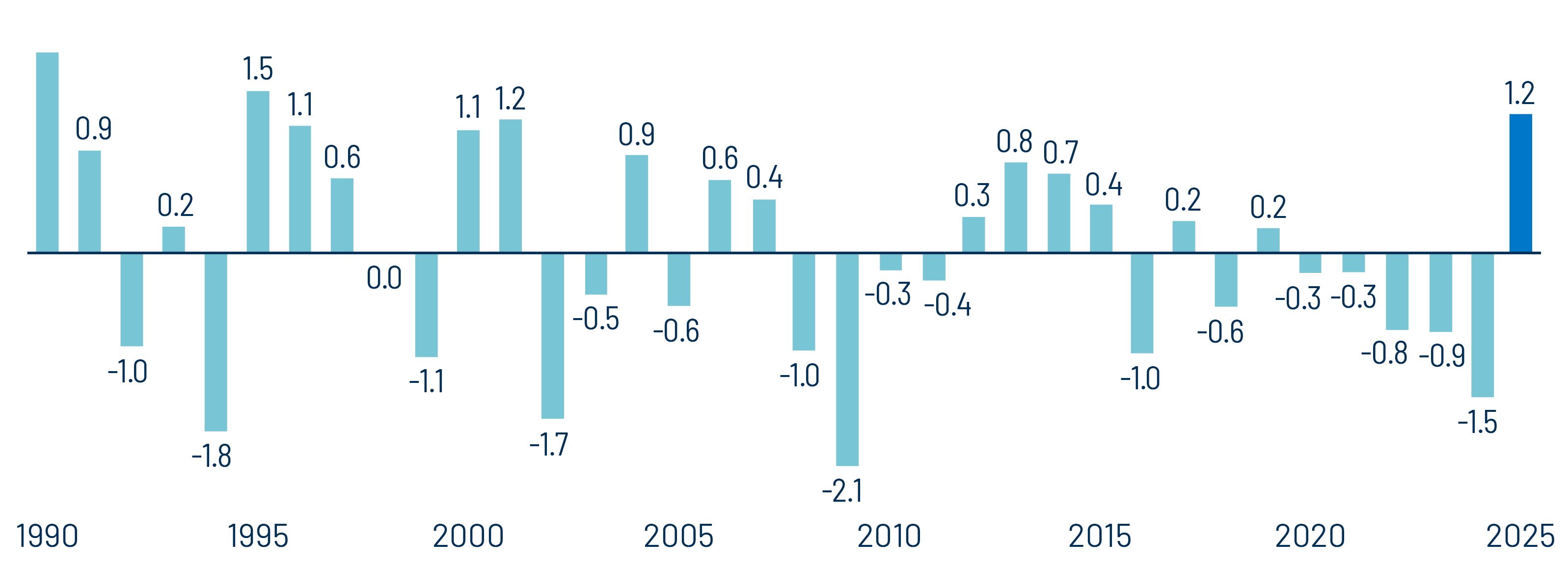

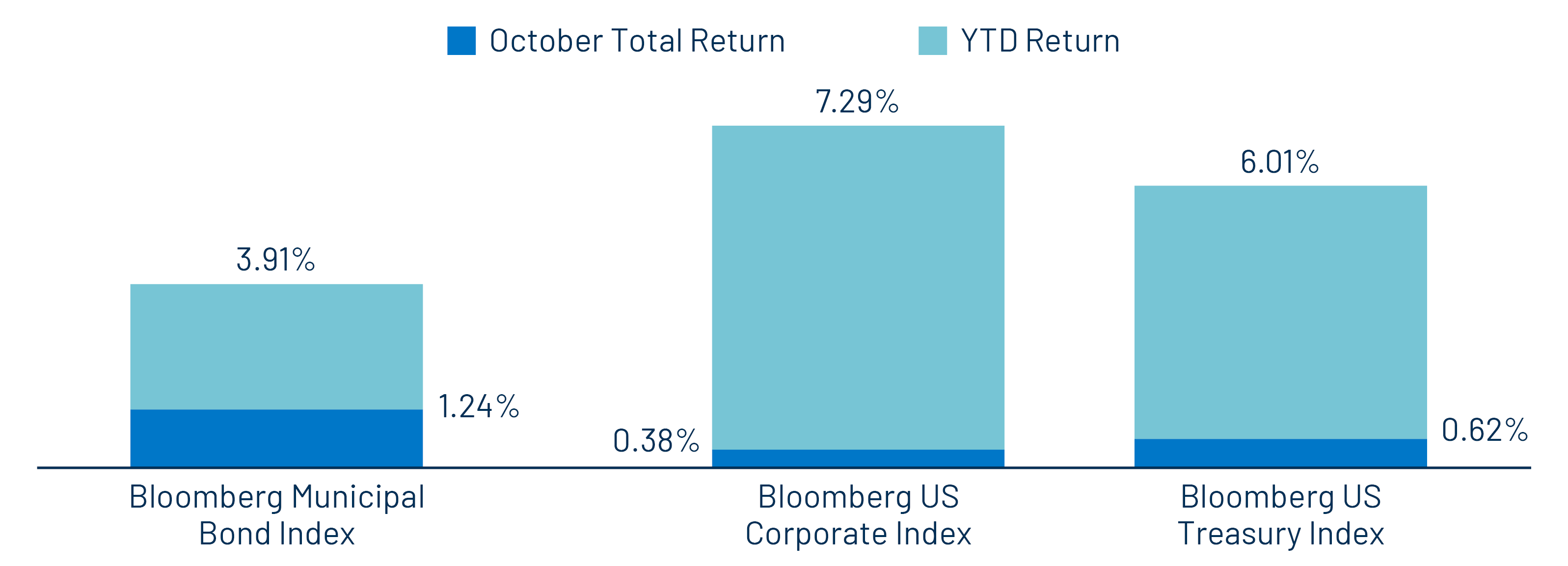

Heading into the month of October, municipals had significantly underperformed taxable fixed-income sectors in 2025. YTD through September 30, the Bloomberg Municipal Bond Index returned 2.64%, below half the return of the Bloomberg U.S. Treasury Index return of 5.36% and the Bloomberg US Corporate Index return of 6.88%. October’s Municipal Bond Index total return of 1.24% bucked the historically negative average October return since 1990, marked the highest October total return since 1990, and was nearly double the respective Treasury and Corporate Index returns of 0.62% and 0.38%, respectively. The strong monthly return brought the Muni Index YTD return to 3.91%, still lower than the 6.01% and 7.29% of the Treasury and Corporate Index returns, respectively (Exhibit 2).

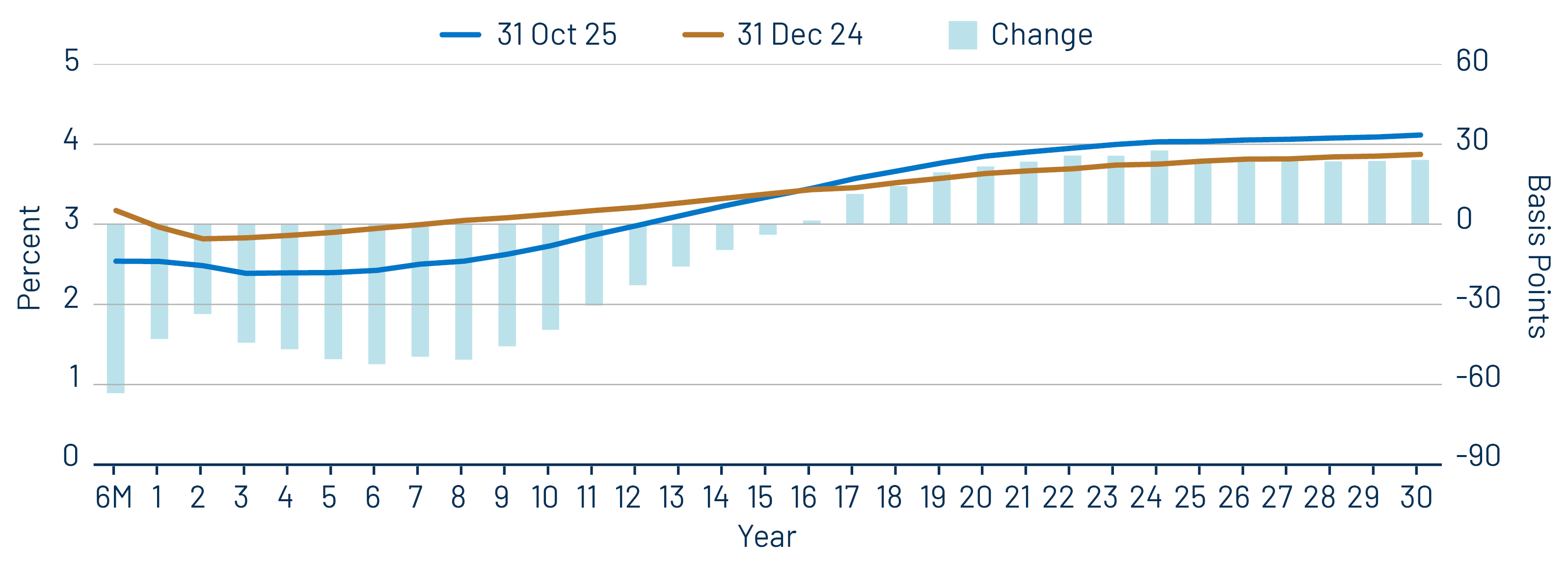

The favorable October performance this year reflects ongoing positive sentiment from individual investors seeking higher after-tax yields in the municipal market, particularly in longer-duration maturities, as the Fed\ continued its rate-cutting cycle. Lipper data shows municipal mutual funds recorded approximately $8 billion in net inflows during October, with the majority ($4.4 billion) directed to long-end category funds. This demand extended the long-end outperformance observed in September, with maturities beyond 10 years generally leading returns as the curve continued to flatten.

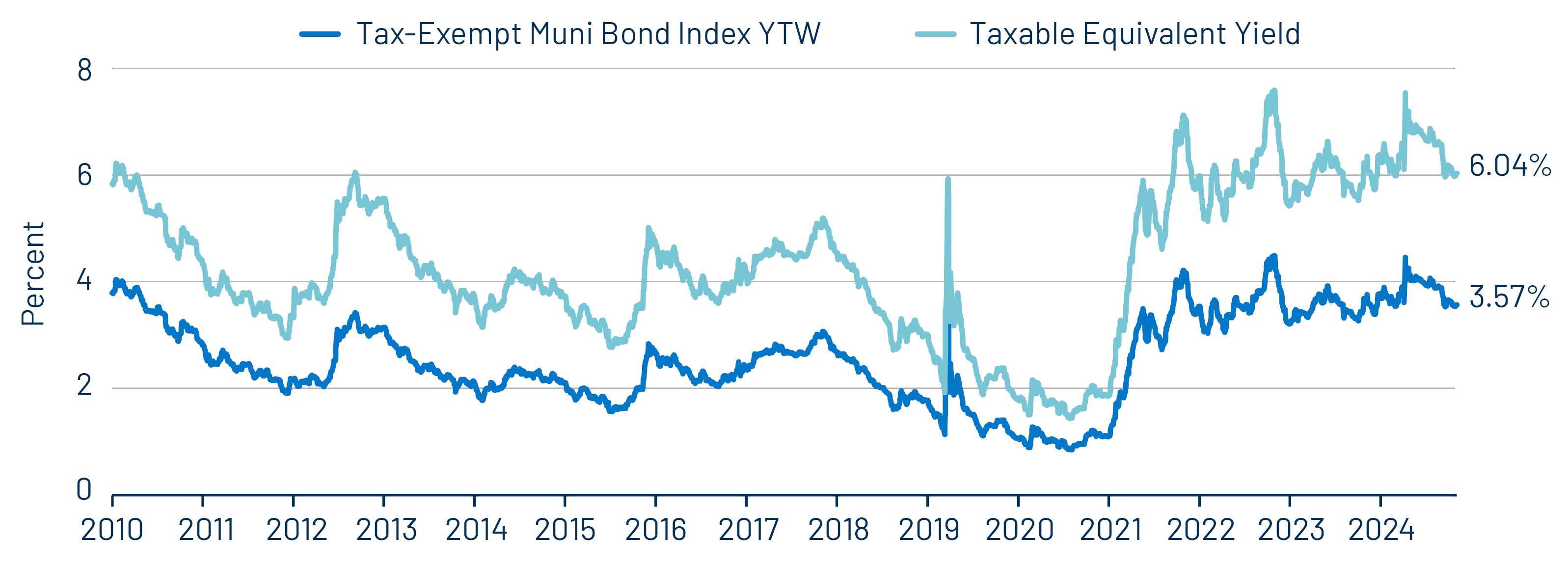

Despite the muni market narrowing the performance gap during the month, tax-exempt income levels remain near generational highs, and the relative YTD underperformance continues to offer potential demand catalysts, especially as the Fed is expected to continue its rate-cutting cycle into 2026. Sustained inflows, combined with the likelihood of seasonally lower supply heading into the holidays, support a constructive outlook for munis to gain further ground versus taxable counterparts. Western Asset believes investors are well positioned to capitalize on this year’s elevated supply-driven valuations, which may not persist at the same level through 2026.

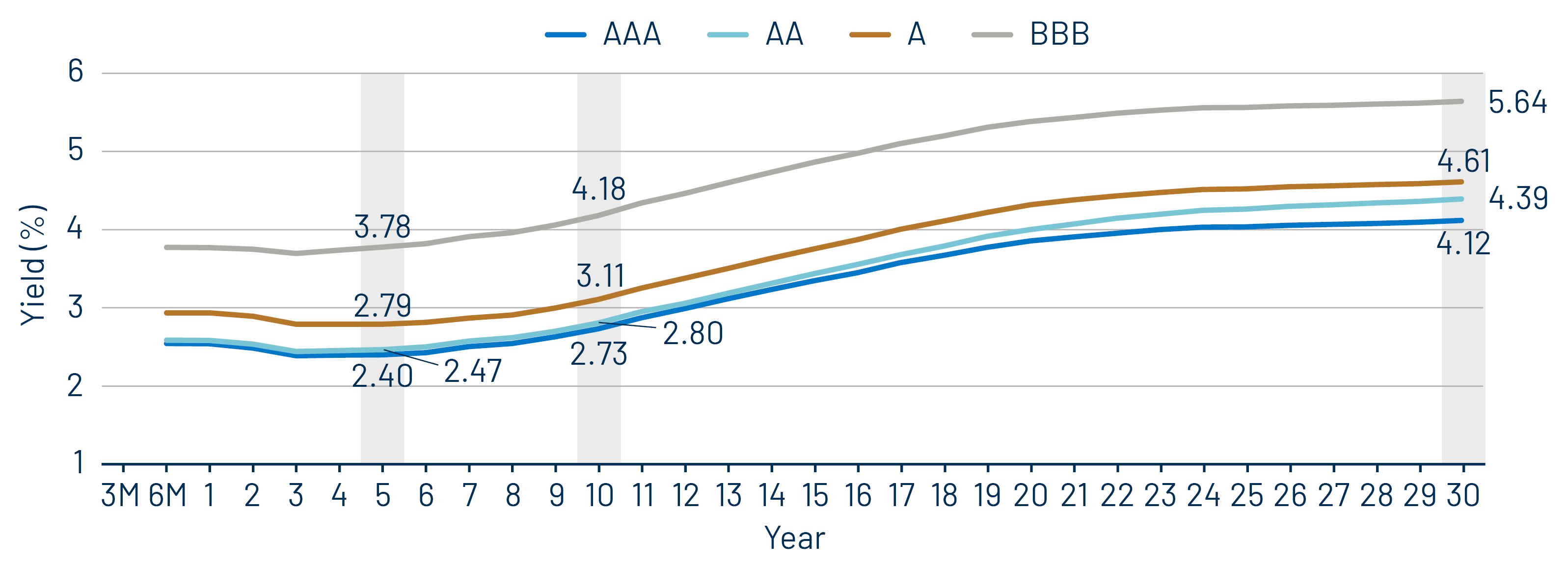

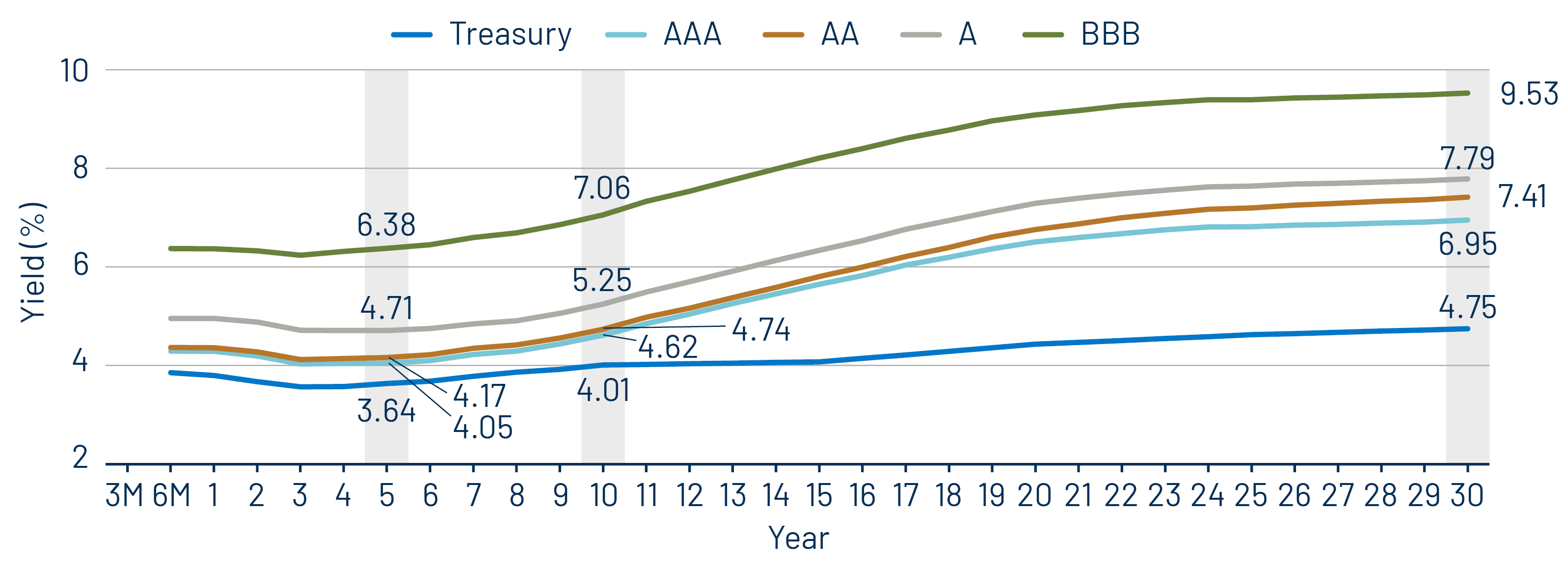

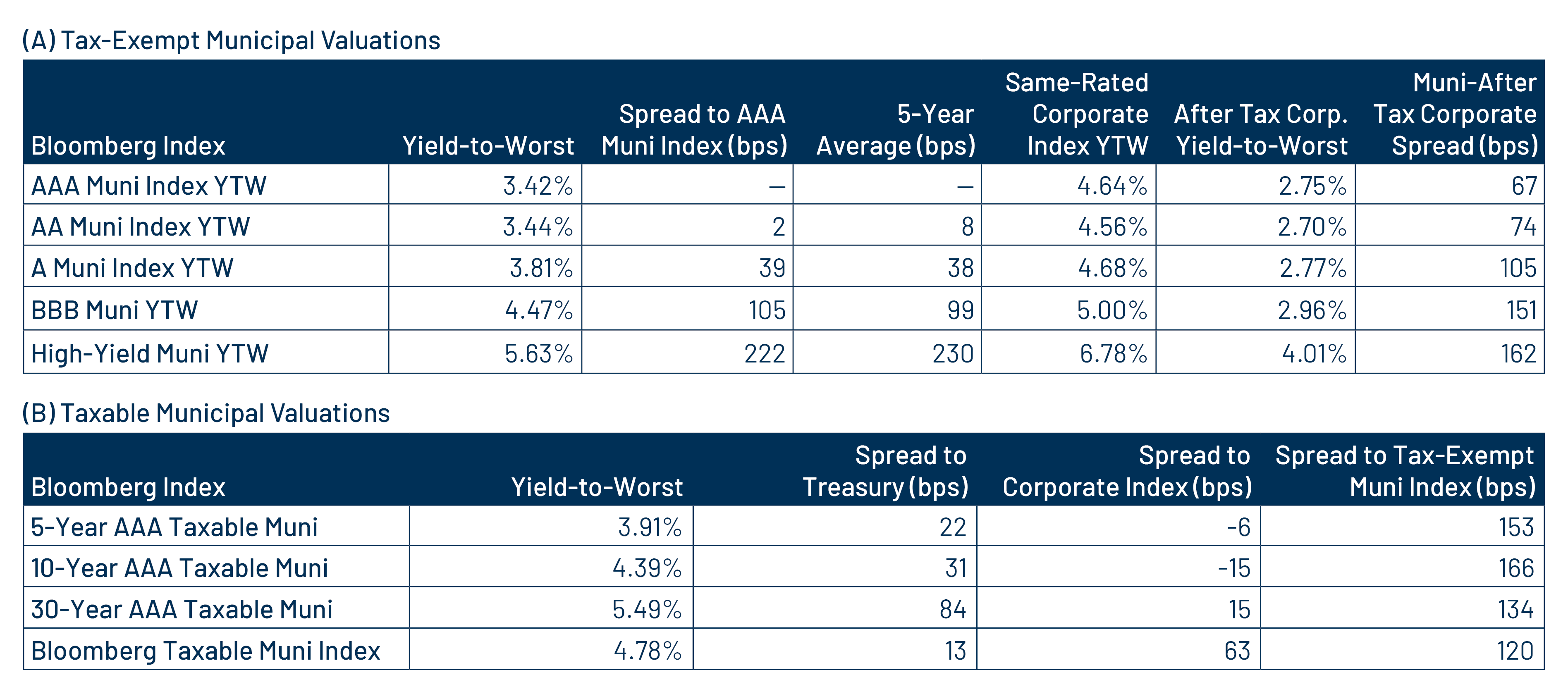

Municipal Credit Curves and Relative Value

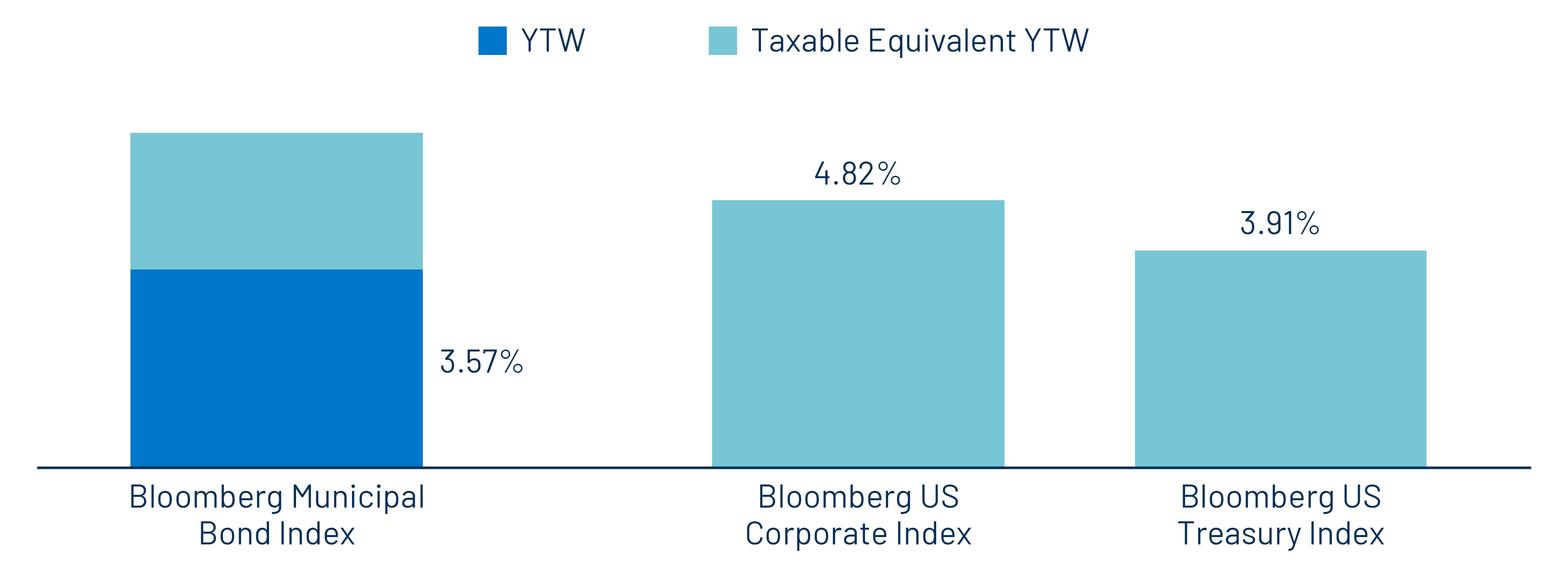

Theme #1: Municipal taxable-equivalent yields and income opportunities remain near decade-high levels.

Theme #2: The AAA muni curve has steepened this year, offering better value in intermediate and longer maturities.

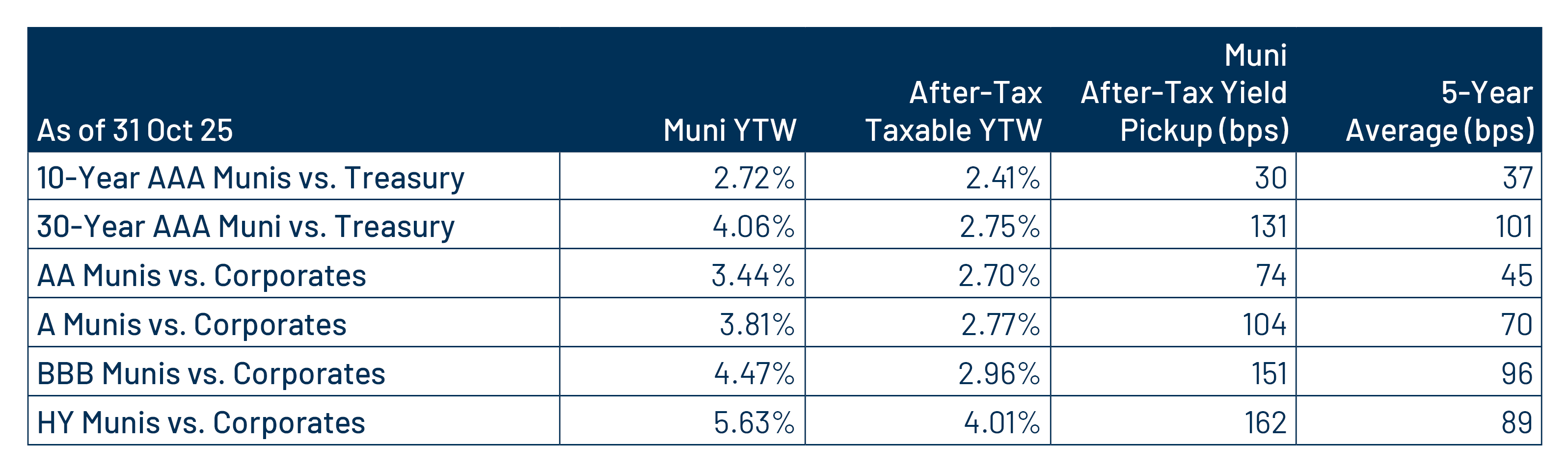

Theme #3: Munis offer attractive after-tax yield compared to taxable alternatives.