Macros, Markets and Munis

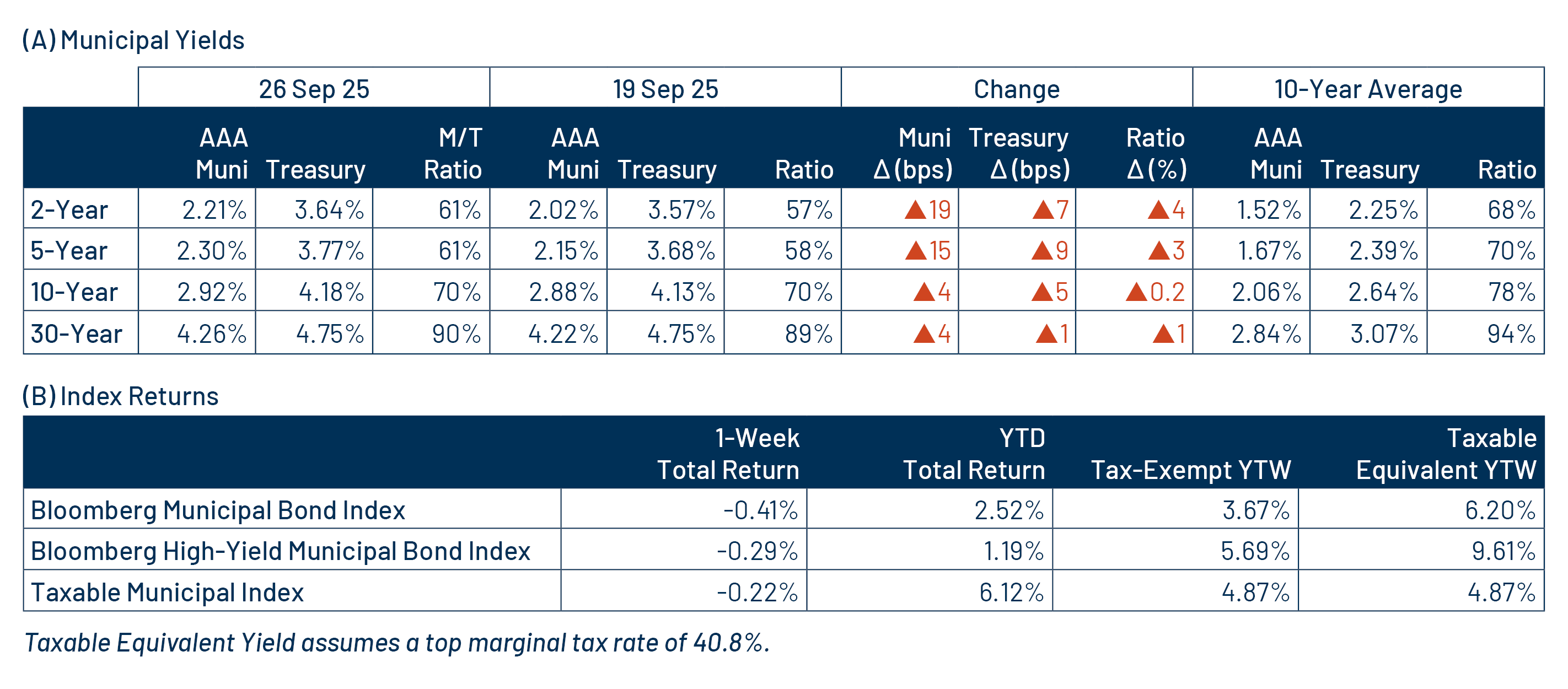

Munis posted negative returns and underperformed taxable fixed-income last week as Treasuries moved higher across the yield curve. High-grade munis moved higher in sympathy with Treasuries but generally underperformed as technicals weakened amid fund outflows and an elevated supply. From an economic data perspective, inflation showed signs of continued cooling last week with core Personal Consumption Expenditures (PCE) increasing 0.2% month-over-month in August, down from 0.3% the prior month. However, stronger-than-anticipated data associated with increasing home sales, higher durable goods orders and upward revisions to 2Q25 GDP data quelled fixed-income market optimism and lowered the elevated expectations of year-end rate cuts. This week we touch on the long-end rally observed so far this month.

Technicals Weaken Amid Heavy New-Issue Supply and Modest Fund Outflows

Fund Flows ($18 million of net outflows): During the week ending September 24, weekly reporting municipal mutual funds recorded a modest $18 million of net outflows, according to Lipper. Long-term funds recorded the majority of the outflow at $346 million. Intermediate and short-term categories recorded $255 million and $29 million of inflows, respectively. Last week’s outflows led year-to-date (YTD) inflows lower to $29 billion.

Supply (YTD supply of $431 billion; up 21% YoY): The muni market recorded $18 billion of new-issue supply last week, over double the prior-week’s level. YTD new-issue supply of $431 billion is 21% higher than the prior year, with tax-exempt issuance up 22% year-over-year (YoY) and taxable issuance up 1% from prior year levels. This week’s calendar is expected to decline to $9 billion. The largest deals include $1.7 billion Texas Transportation Financing Corporation and $813 million Los Angeles Department of Water and Power (Power System) transactions.

This Week in Munis: Long-End Rallies

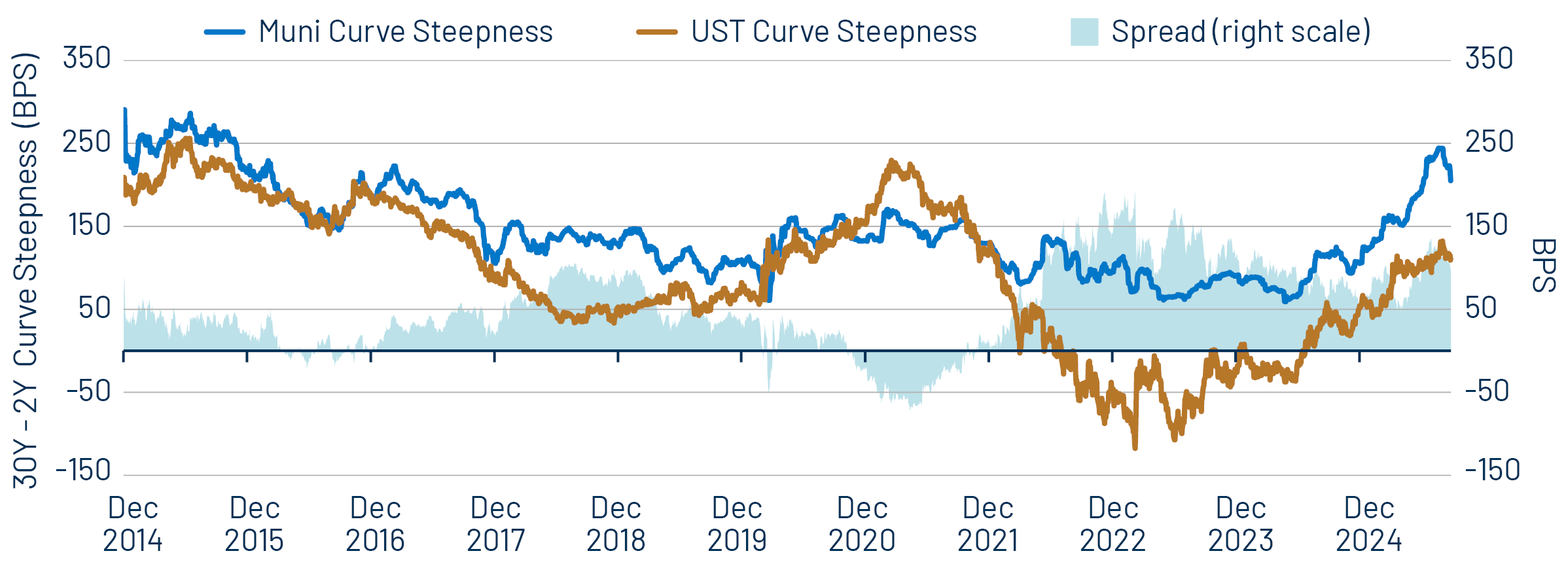

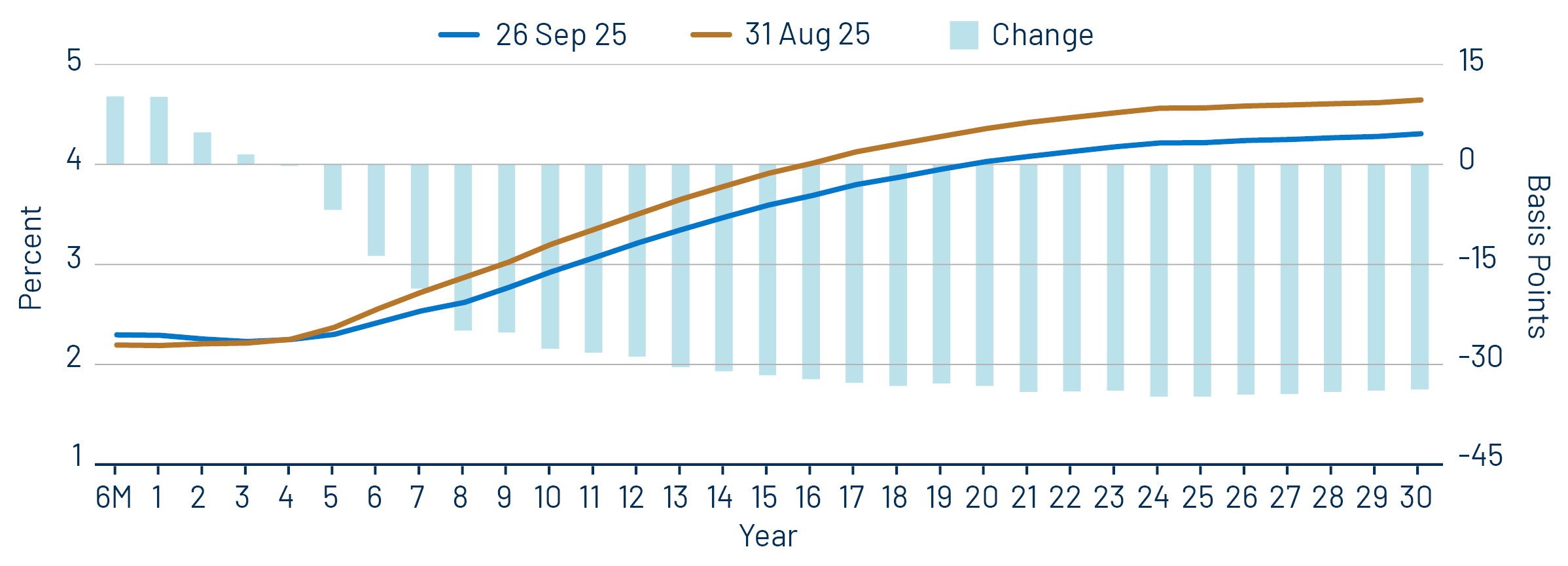

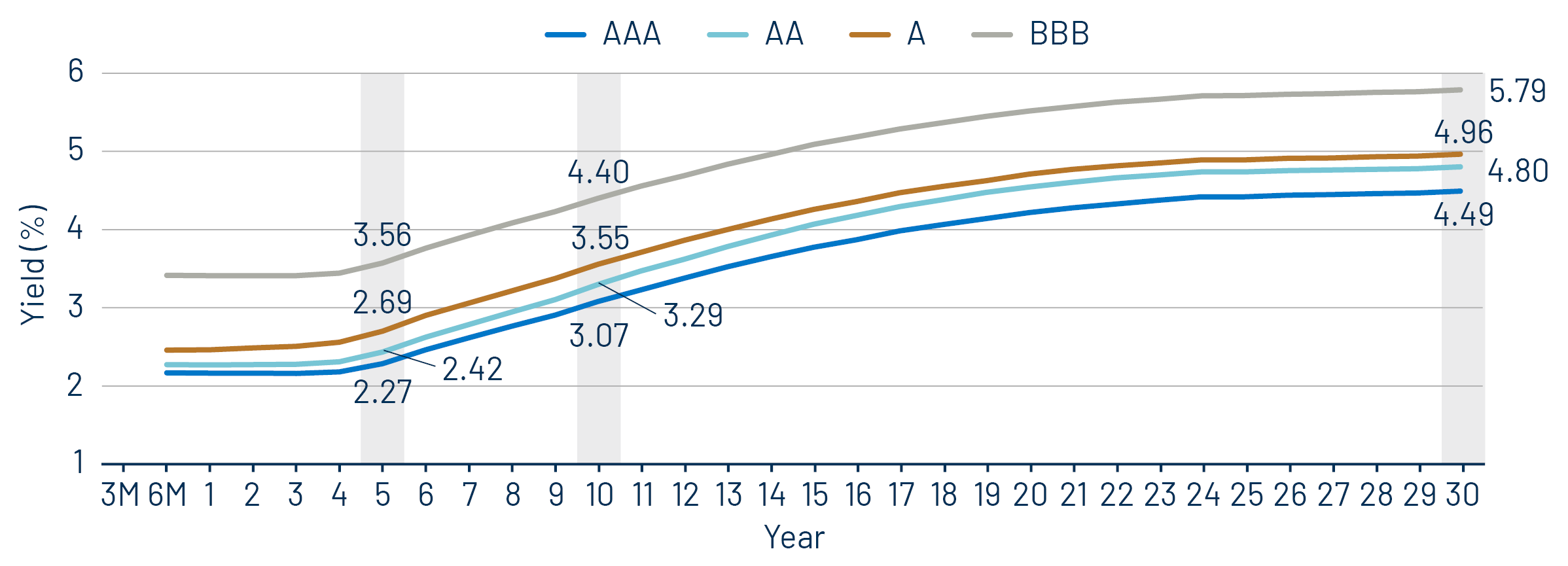

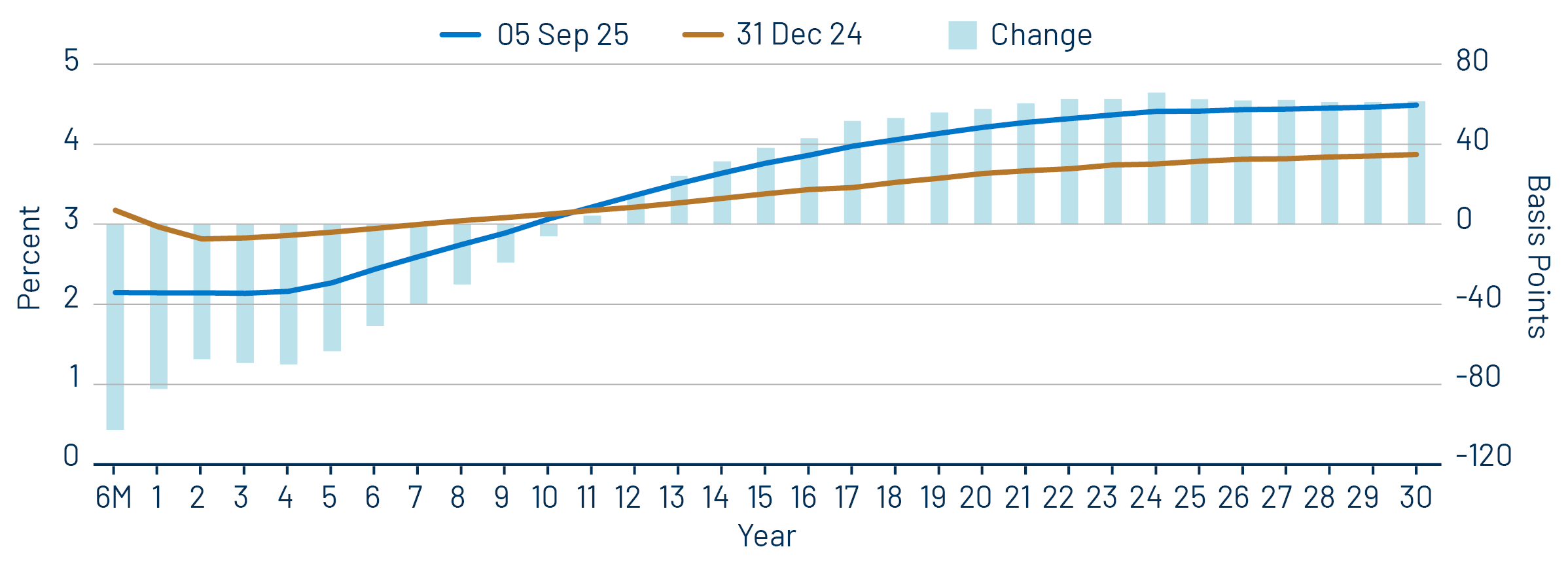

A key theme in the municipal bond market this year has been the steepening yield curve, which diverged from trends in other fixed-income markets. From the start of January through August, the Bloomberg BVAL callable AAA Municipal Yield Curve moved 61 bps lower in 2-year maturities and 77 bps higher in 30-year tenors, leading the 2s30s spread to 244 basis points (bps), well above its 10-year average of 136 bps. By comparison, the Treasury curve moved lower in most maturities during the same period. As a result of the curve steepening, YTD returns varied widely through August 31, the Bloomberg 5-Year Municipal Bond Index returned 4.01%, while the Bloomberg Long Bond Index returned -3.59%.

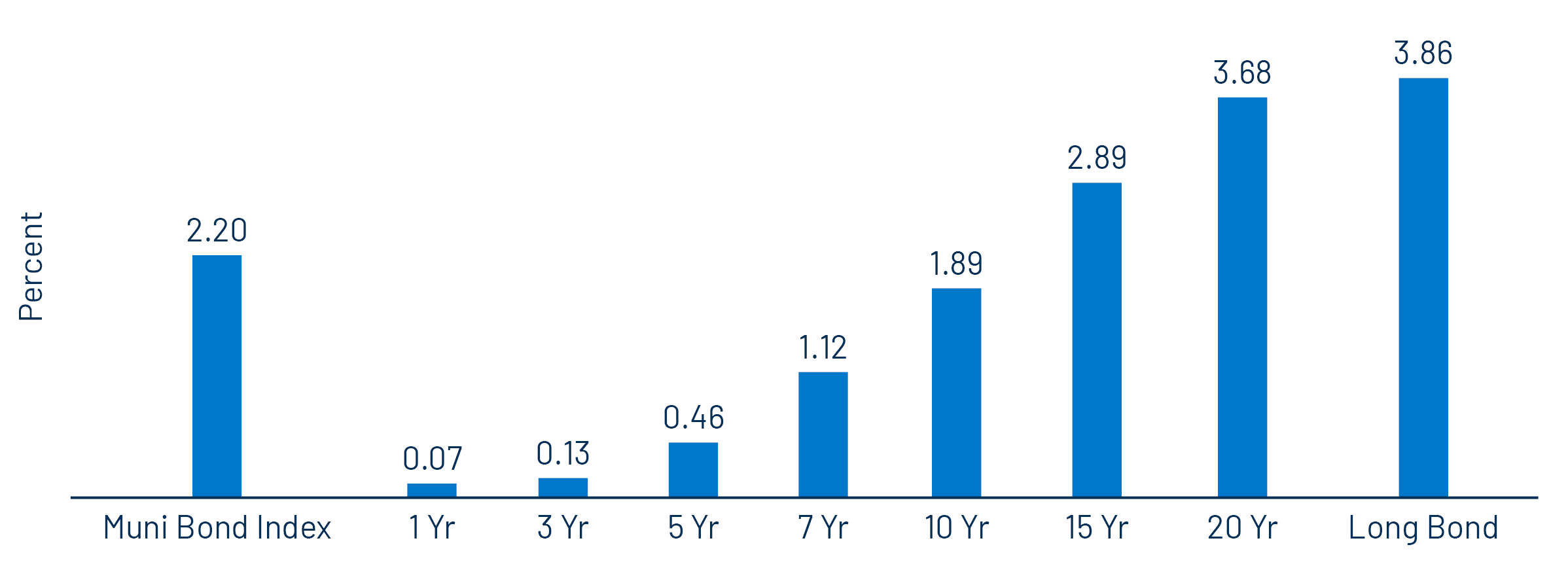

As the Federal Reserve (Fed) telegraphed a rate cut in September, the municipal bond yield curve significantly reversed the steepening observed earlier in the year. From September 1 to September 26, the AAA municipal yield curve 2-year yield rose 5 bps to 2.26% while the 30-year yield fell 34 bps to 4.31%. As a result of the curve flattening, longer maturities outperformed, with the Bloomberg Long Municipal Bond Index (22+ Year) returning 4.07% for the month to date, retracing all the negative performance accumulated by the index this year. Meanwhile, the Bloomberg 1-Year Muni Bond Index significantly underperformed, returning just 0.07% during the month.

The strong performance of longer-term munis is indicative of investors seeking higher income ahead of anticipated Fed rate cuts. According to Lipper, the long category municipal mutual funds recorded more flows than any other category in 2025. Western Asset believes that longer maturities continue to offer attractive relative value for long-term investors, considering elevated absolute muni yield levels and rolldown opportunities from the curve, which remains relatively steep versus taxable fixed-income markets.

Municipal Credit Curves and Relative Value

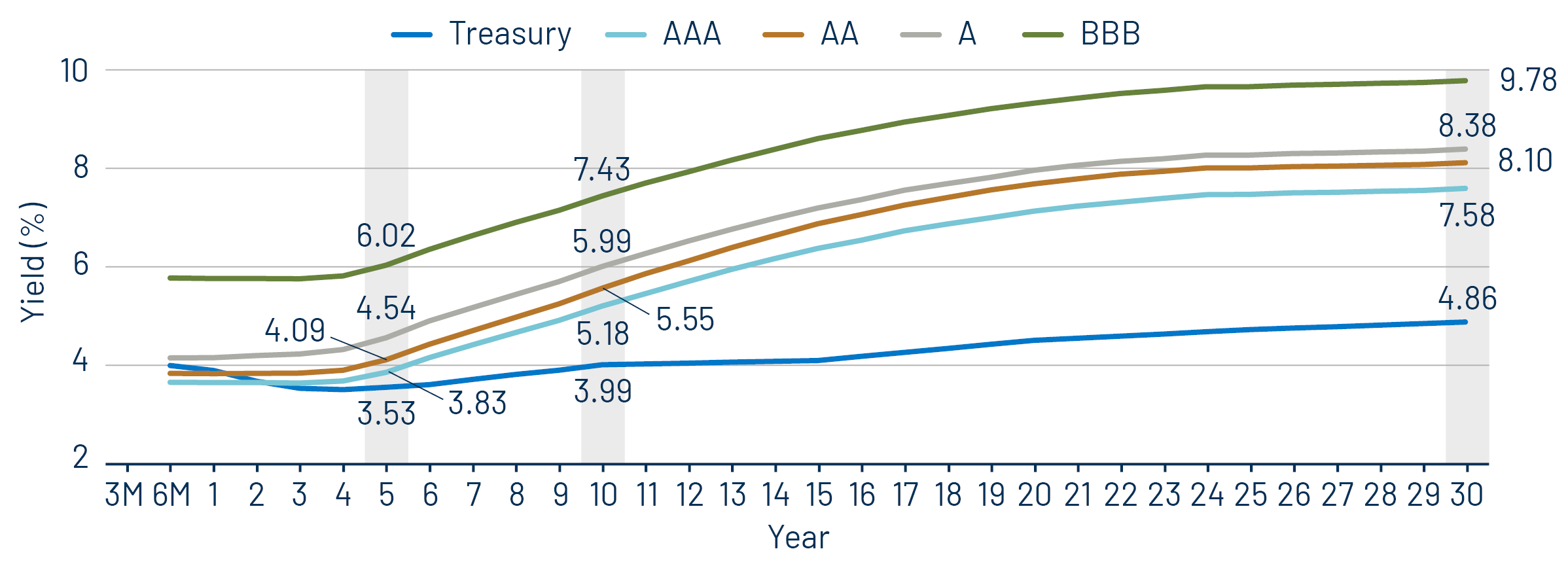

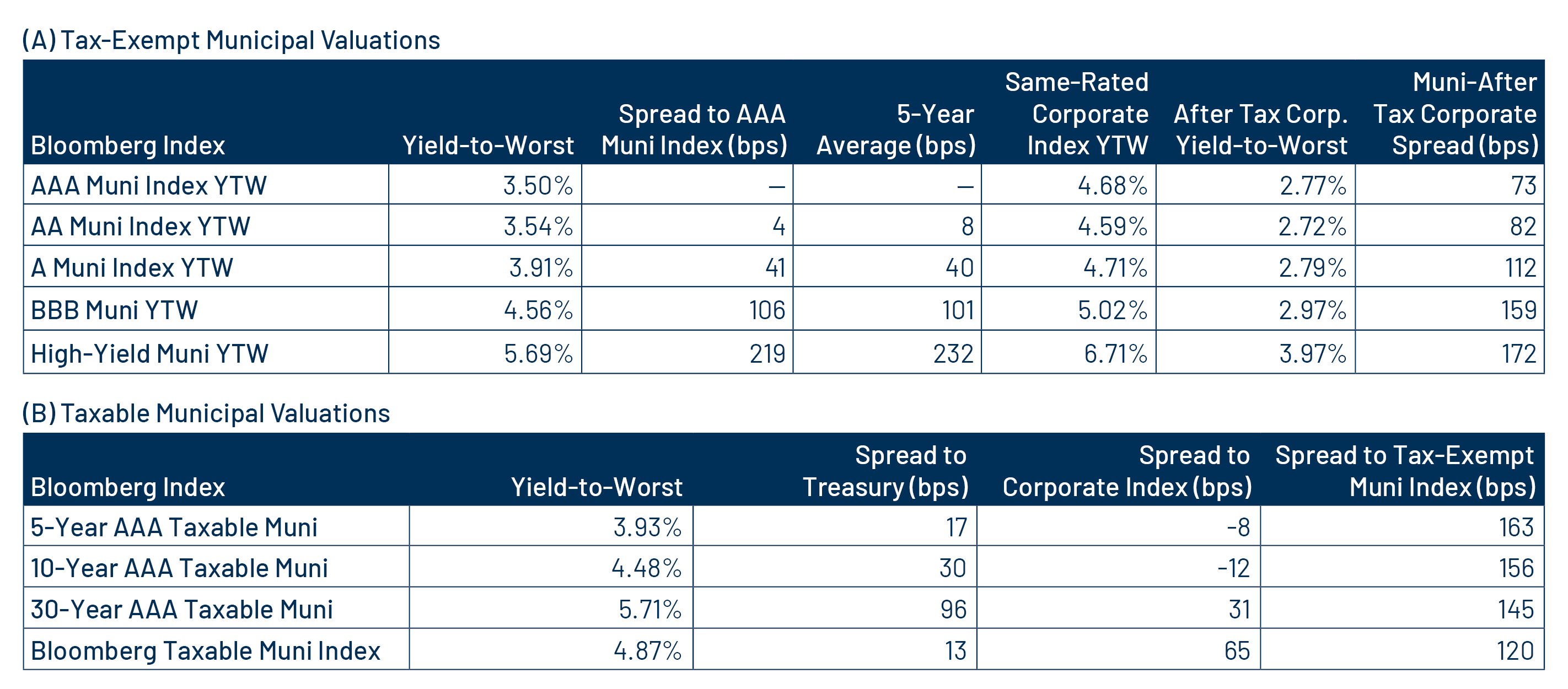

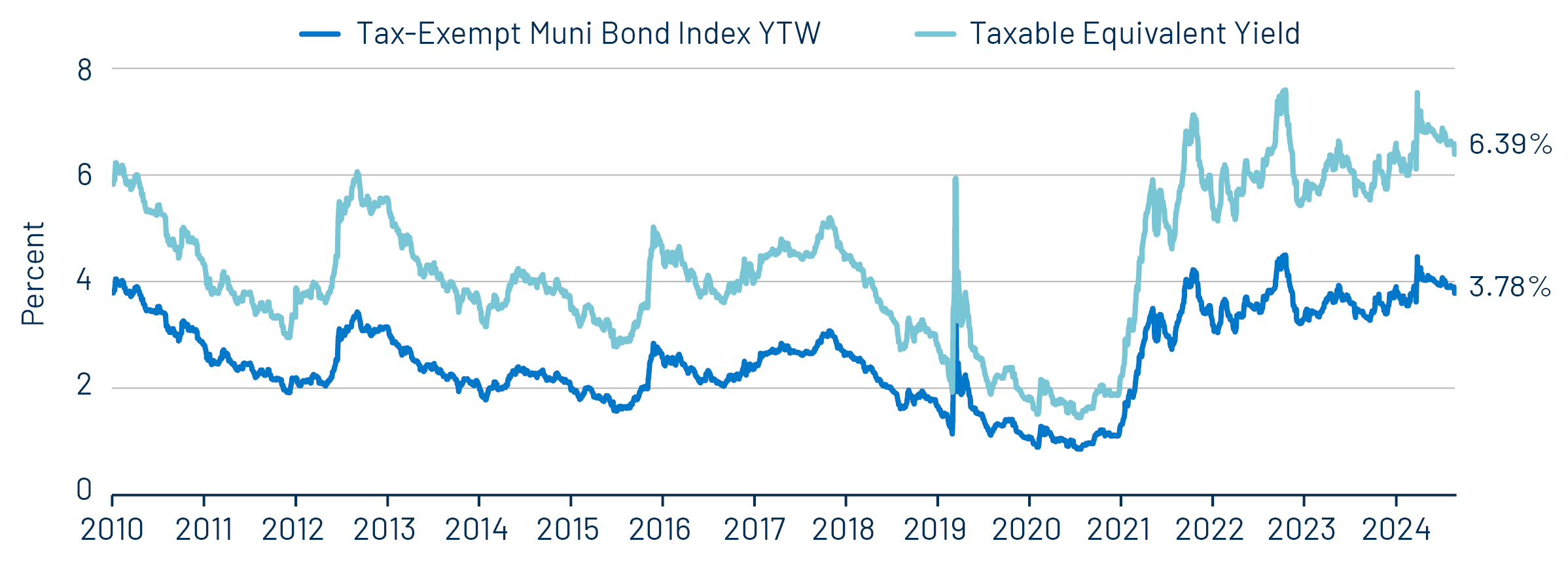

Theme #1: Municipal taxable-equivalent yields and income opportunities remain near decade-high levels.

Theme #2: The AAA muni curve has steepened this year, offering better value in intermediate and longer maturities.

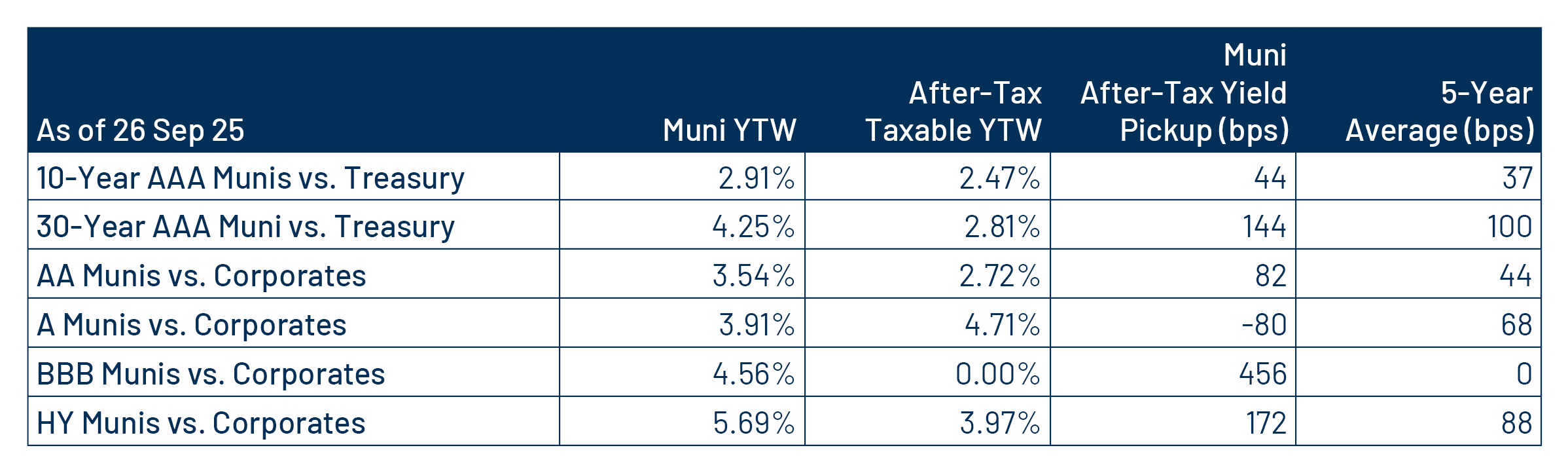

Theme #3: Munis offer attractive after-tax yield compared to taxable alternatives.