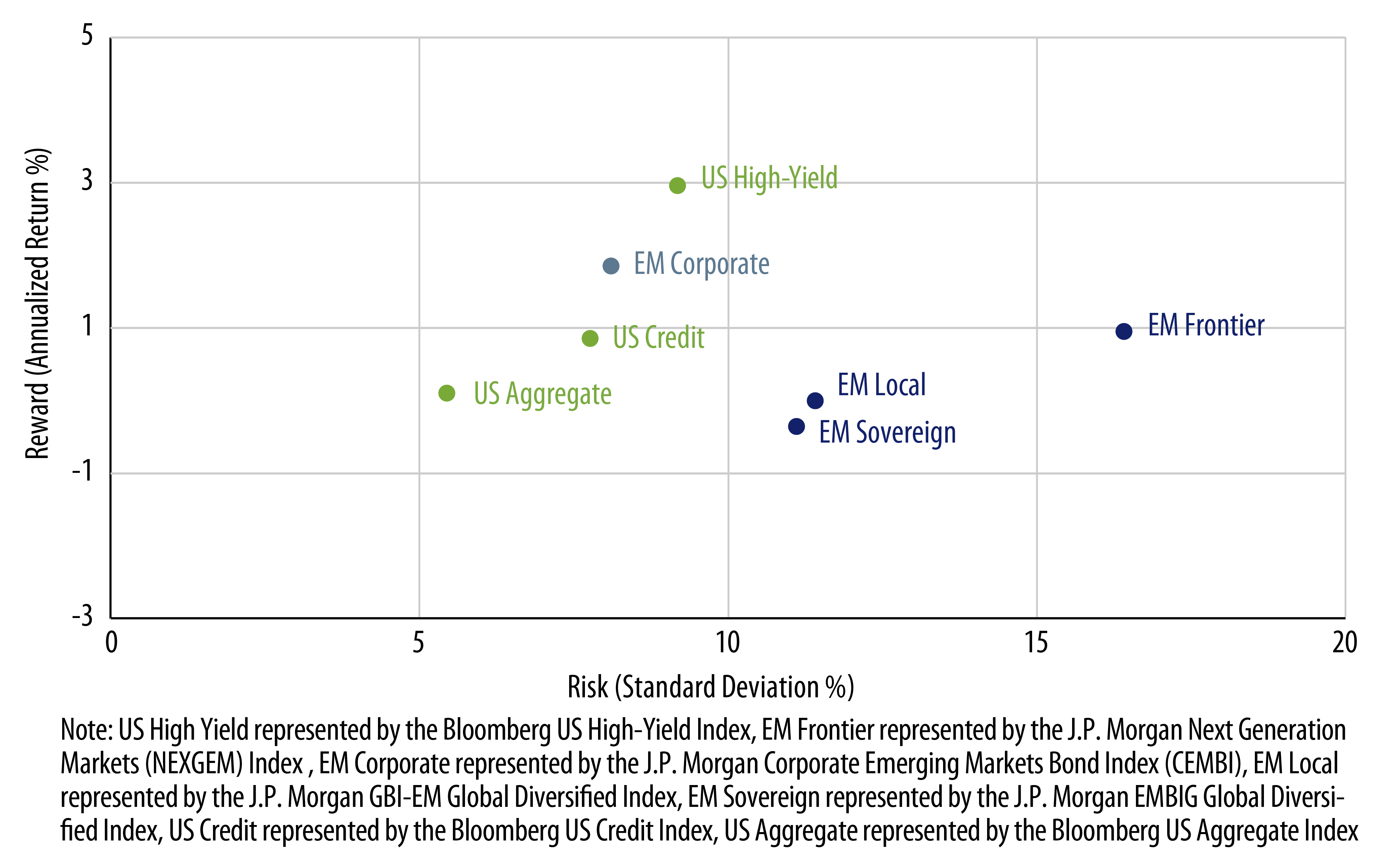

While emerging market (EM) bonds have exhibited elevated volatility in recent years due to the after-effects of COVID-19 and global central bank tightening, EM corporate bonds have been a bright spot in the fixed-income asset class. Risk-adjusted returns for EM corporates compare favorably to other fixed-income investments (Exhibit 1). There are fundamental reasons for EM corporates’ recent performance, as well as some structural challenges to consider when lending to companies in developing markets.

Sources of Resilience

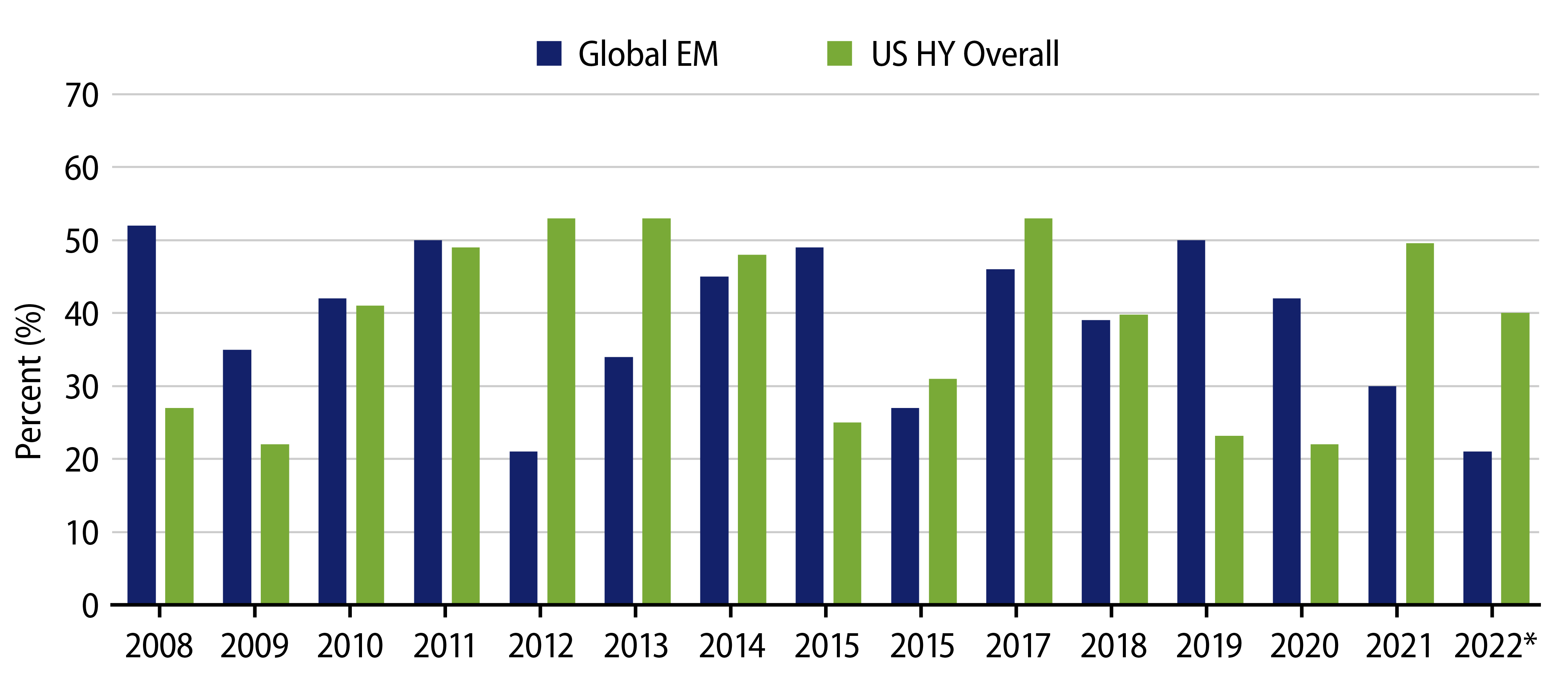

Why have EM corporates been able to outperform among increased funding costs and messy global growth? Rather than being a levered version of their respective sovereigns, corporate debt issuers in EM countries have adapted over time to be able to weather political and economic stress. Given that their macroeconomic backdrops can be more uncertain than in the US, EM companies often run their balance sheets with less debt than their developed market (DM) peers (Exhibit 2). Also, EM indices contain significant exposure to companies with access to hard currency revenues. For reasons like these, even corporates in countries with challenged sovereign fundamentals such as Argentina and Turkey have generated resilient returns in recent years.

Structural Deficiencies

For EM bond investors, the defensive characteristics of corporate bonds can be very attractive; however, one large difference exists between DM and EM credit: the ability for bondholders to use structure to protect downside credit risk. For both DM and EM investment-grade debt, structure does not often come into play given the typical use of unsecured debt with limited covenants. But when delving into the below-investment-grade space, tools typically used by DM creditors to limit downside (e.g., security, structural seniority and covenants) are more difficult to harness in EM given less developed legal and regulatory environments. And using domestic bankruptcy systems to improve recoveries can be much more challenging for EM, as some investors in insolvent companies in bellwether EM countries such as Brazil and Mexico have, to their dismay, discovered.

Working Around Structure Limits

Despite the aforementioned constraints, EM countries are able to offer a robust high-yield investment universe consisting of newly issued below-investment-grade-rated credits as well as fallen angels. The market over time has adjusted to concerns about credit downside by being more conservative with underwriting across countries, sectors and leverage levels, as well as by de-emphasizing market participants (e.g., private equity) who would typically use structure-aided financial engineering to boost returns. The result across the EM high-yield corporate market is that recoveries in the event of bond defaults are remarkably similar to US high-yield recoveries despite the potential difficulty in EM countries of legally collecting on defaulted debts (Exhibit 3). At Western Asset, we use our deep sovereign research capabilities to understand country-level economic trends and political developments in seeking to limit exposure to credits with the potential for low recoveries. We also emphasize credit characteristics unique to EM corporates that can influence default risk such as uncertain regulatory frameworks and mismatches between hard currency debt and domestic revenues.

Implications for EM Private Credit

Private credit has been a popular allocation for institutional investors in recent years given high floating-rate yields and optically stable returns. While extending private credit into EM could be an appealing target for investors, we would note that the structural advantages of private credit (e.g., liens, covenants, ability to foreclose) do not necessarily apply to EM investments, for the reasons cited earlier. As a result, we do not expect a similar shift in EM economies from public markets to private markets like what is currently being observed in the US below-investment-grade market. We do expect to see some private transactions marketed for higher-quality EM issuers and/or credits with unique characteristics such as offshore export revenues that could lend themselves to structuring. However, in general, Western Asset continues to believe in the benefits of public market EM corporate exposure, such as disclosure, price discovery and liquidity.