Macros, Markets and Munis

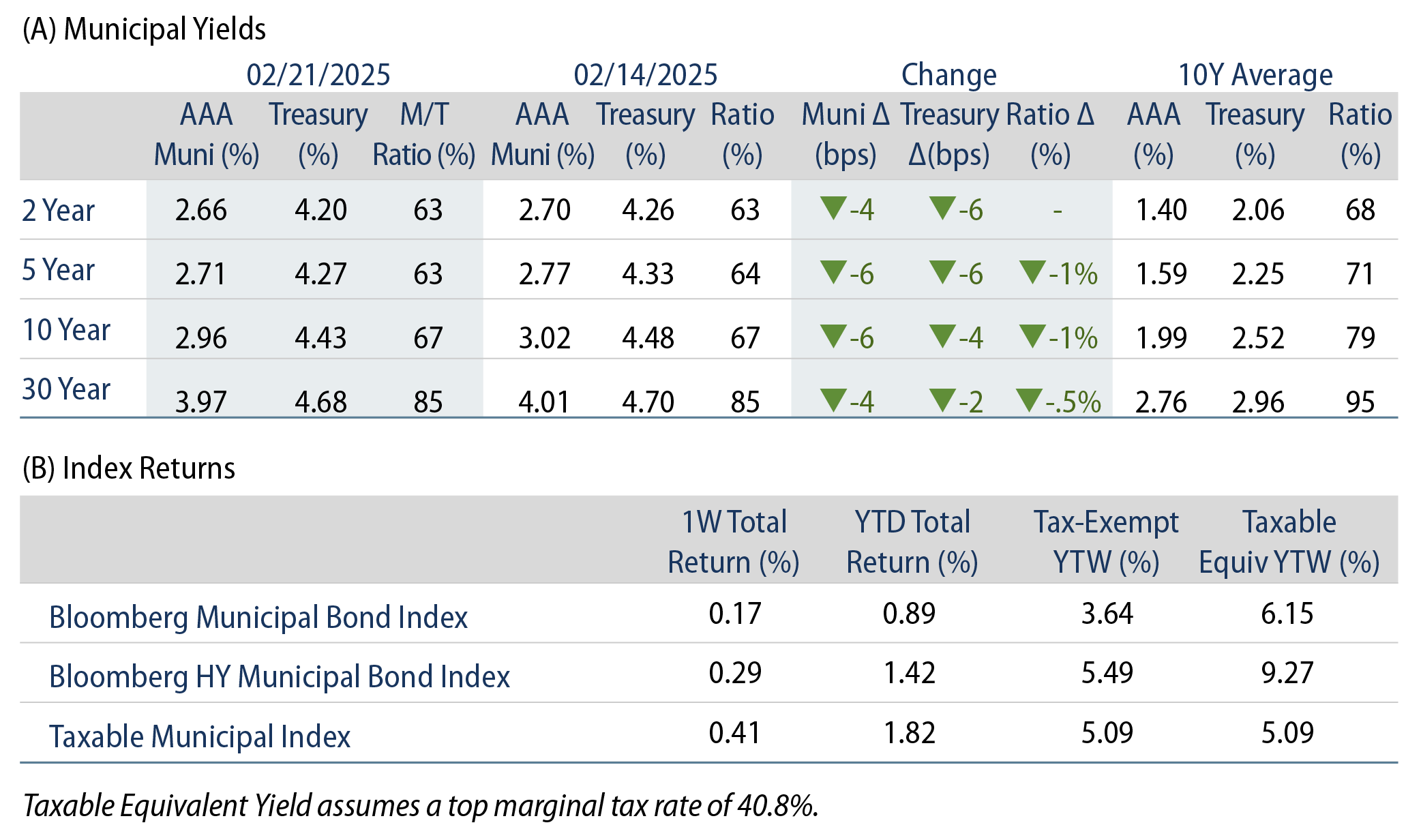

Muni yields moved lower with Treasuries last week and modestly outperformed amid a fifth consecutive week of fund inflows and strong supply levels. Fixed-income yields rallied due to weaker-than-expected economic data. Initial jobless claims were above forecasts, and the University of Michigan Sentiment Index declined from the prior levels and came in below expectations. This week we touch on the Illinois budget proposal released last week.

Supply and Demand Remain Positive

Fund Flows (up $546 million): During the week ending February 19, weekly reporting municipal mutual funds recorded $546 million of net inflows according to Lipper. Long-term funds recorded $452 million of inflows, intermediate funds recorded $9 million of inflows and high-yield funds recorded $184 million of inflows. Last week’s inflows marked a fifth consecutive week of inflows and led year-to-date (YTD) inflows higher to $7 billion.

Supply (YTD supply of $69 billion; up 40% YoY): The muni market recorded $10 billion in new-issue supply last week, down 20% from the prior week. The muni market has recorded $69 billion in new issuance YTD, up 40% year-over-year (YoY). This week’s calendar is expected to decline to $8 billion. The largest deals include $600 million New York City Water Finance Authority and $600 million Pennsylvania Turnpike transactions.

This Week in Munis: Illinois Budget Proposal

Last week, Illinois Governor Pritzker presented his State of the State address and fiscal year (FY) 2026 budget proposal, which highlighted the continued fiscal improvement of the state. Favorably, the budget release indicated a larger-than-expected surplus in FY25, driven by strong income tax collections, which came in 7.9% higher than prior year levels (FY24) and 4.0% above initial expectations.

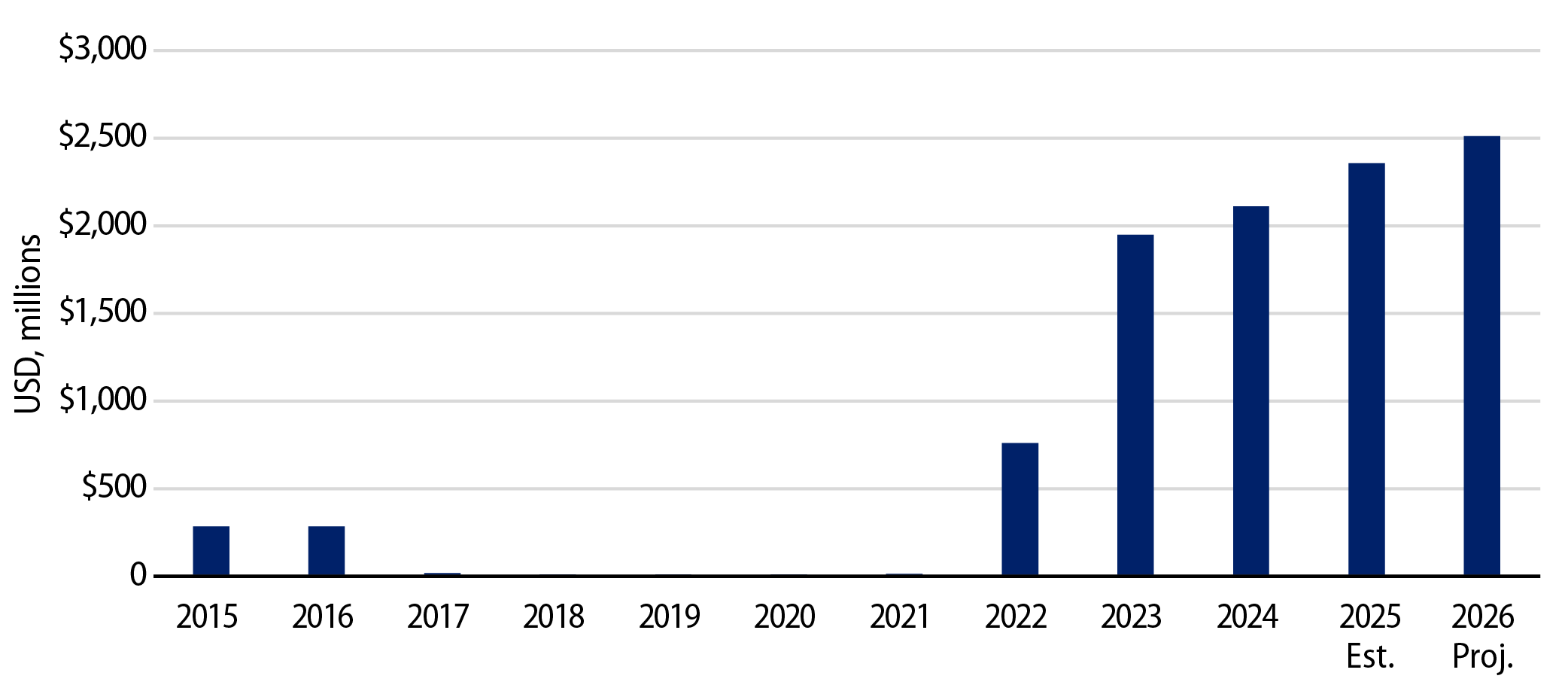

The $55 billion FY26 budget represented relatively conservative spending growth, just 2.5% higher than prior year levels. Key outlays include increased funding for early childhood and K-12 education, health and human services, and public safety. The administration also proposed adjusting the state pension fund contributions to 100% statutory funding status (up from the current 90%). The budget anticipates 2.9% revenue growth for the upcoming year, contributing to a $218 million surplus. The state plans to improve its reserve profile by adding a $154 million contribution to the Budget Stabilization Fund, leading to an anticipated total of $2.5 billion (5% of general fund revenues), well above the depleted levels observed for much of the past two decades.

Rating agencies and the market have taken note of Illinois' fiscal improvement. Since 2020, Illinois has recorded 12 positive ratings and outlook actions to A-/A3 Stable Outlook from BBB-/Baa3 (Negative Outlook). Moreover, the state’s general obligation debt has consistently outperformed the broader municipal bond index over the past decade, as the Bloomberg Illinois Index returned 3.0% annually compared to the 2.3% return of the Bloomberg Muni Bond Index. Illinois will continue to grapple with elevated debt levels, but this budget release is another sign that the state continues to make incremental progress in addressing these long-term issues. Western Asset continues to find value in the State of Illinois debt complex, and we anticipate that the improved health and budget initiatives (such as school funding) will also support other large issuers within the state.

Municipal Credit Curves and Relative Value

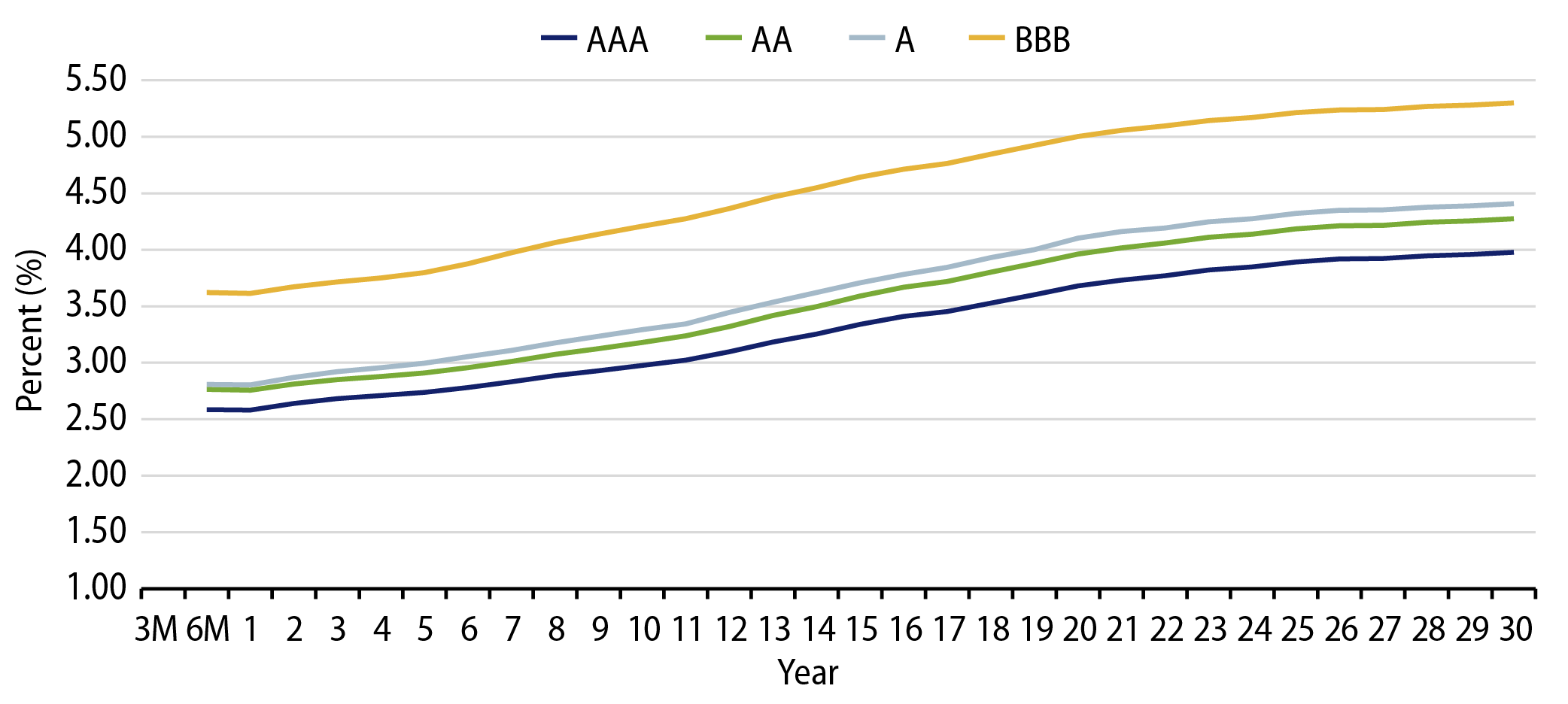

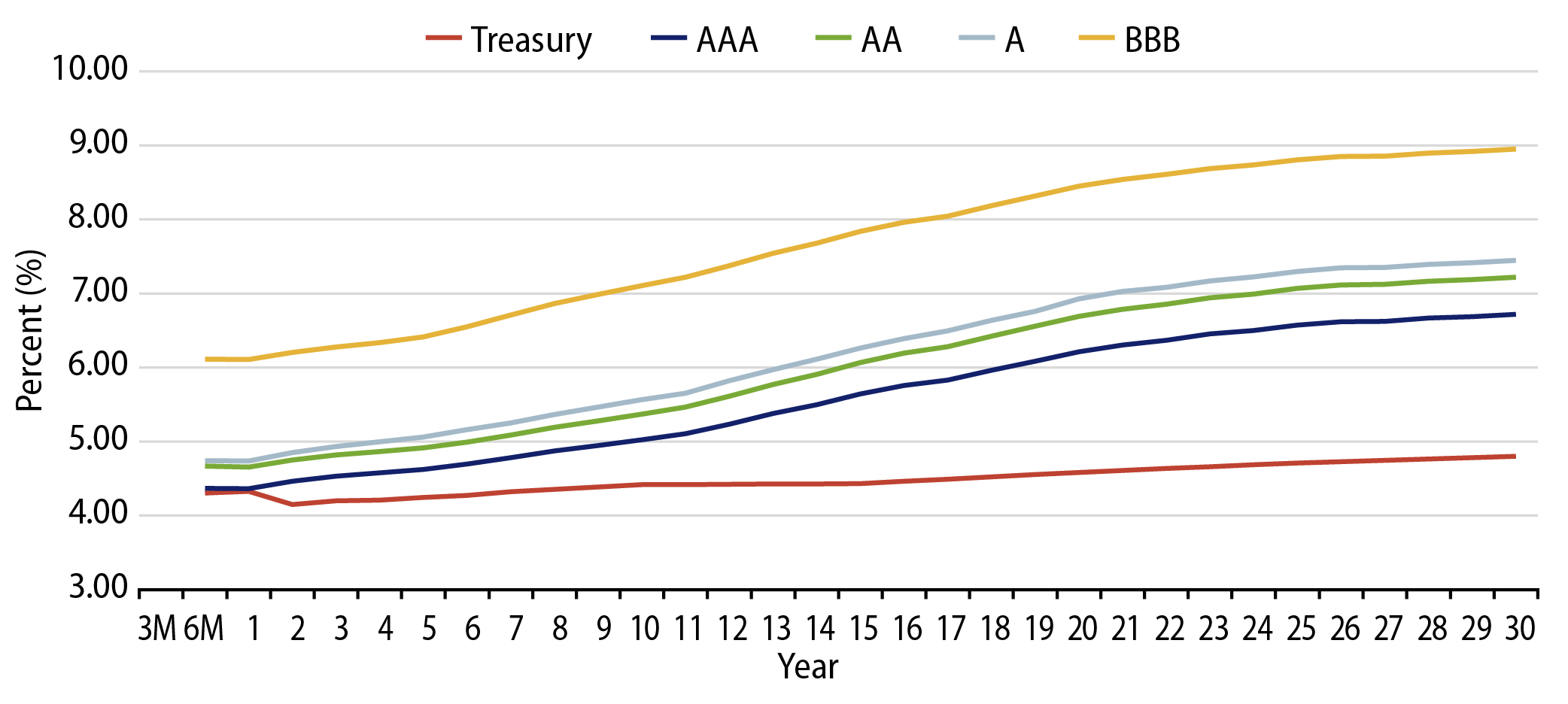

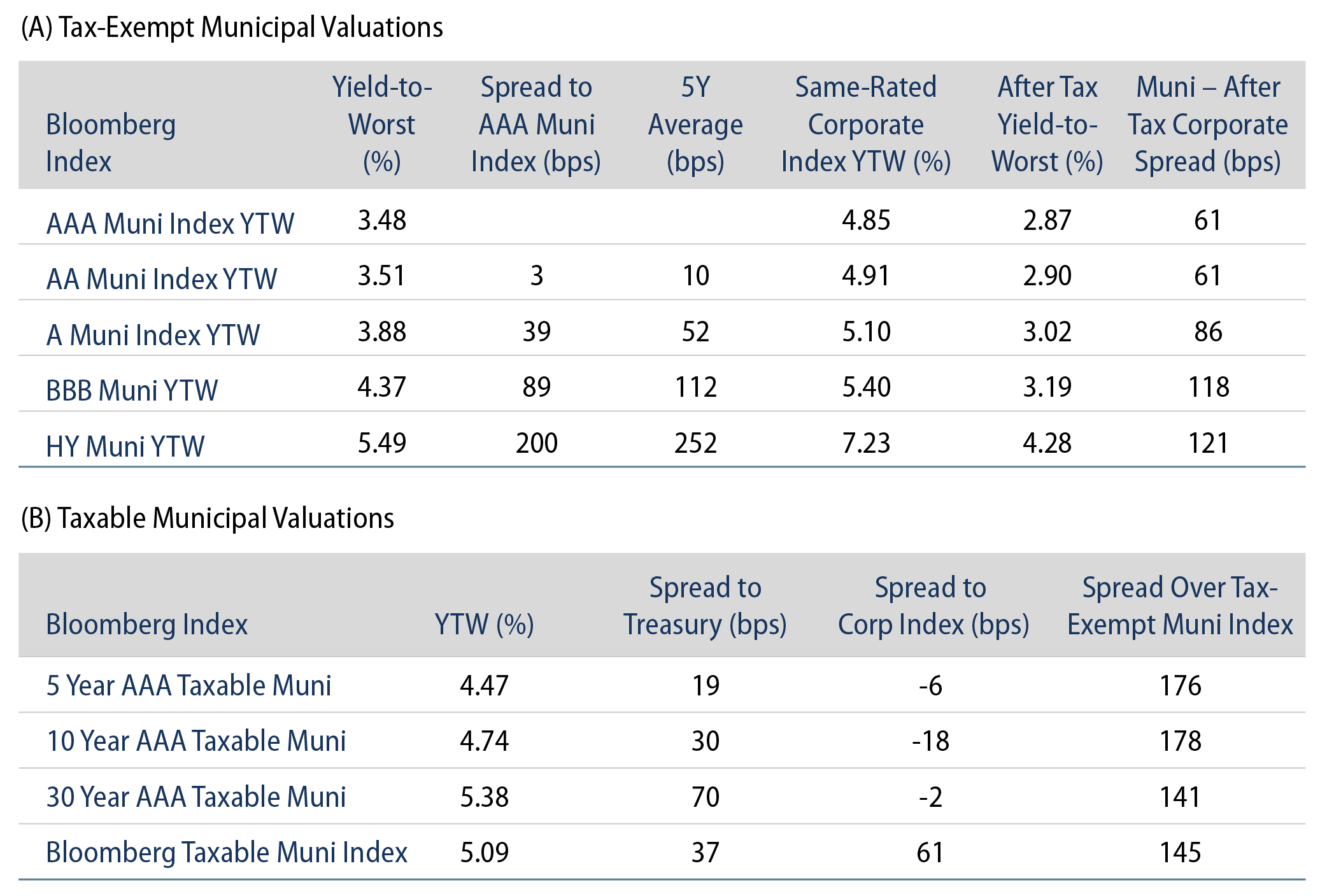

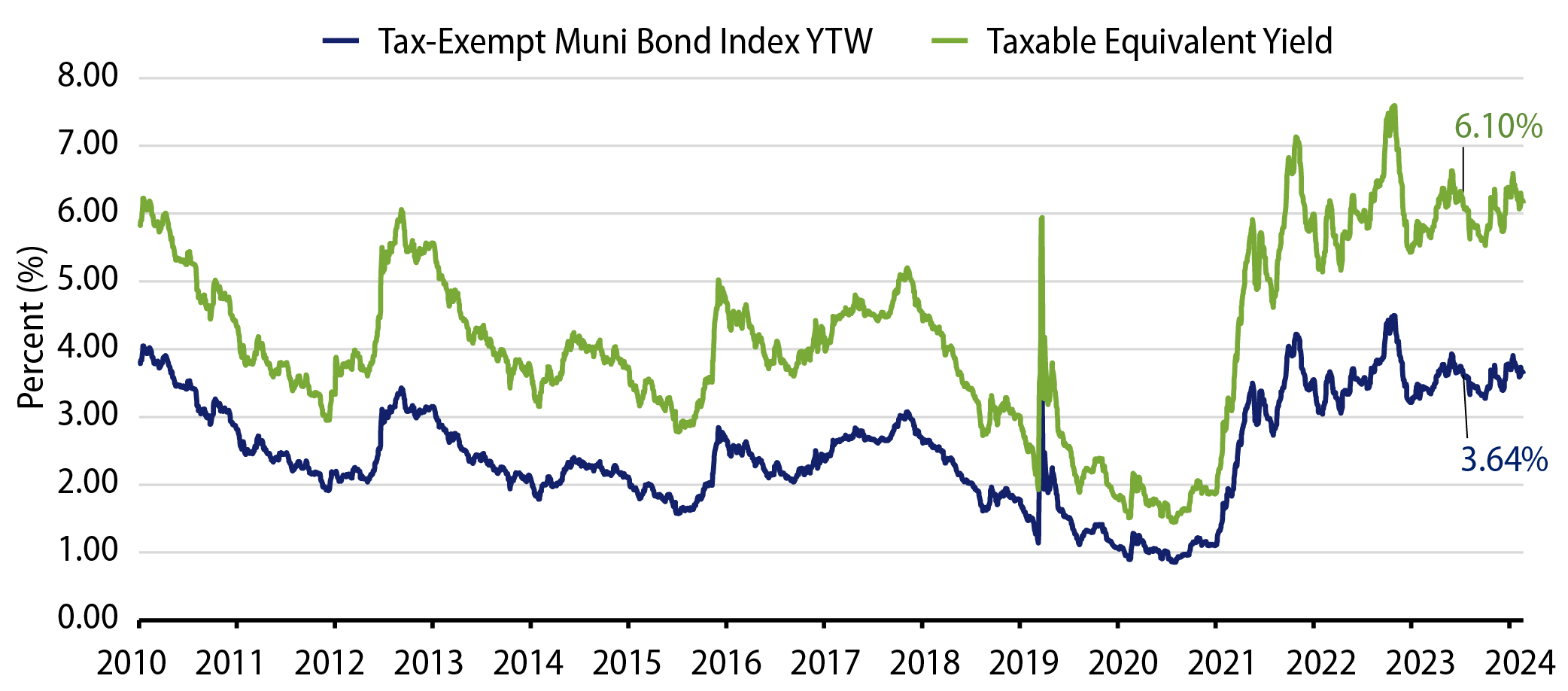

Theme #1: Municipal taxable-equivalent yields and income opportunities remain above decade averages.

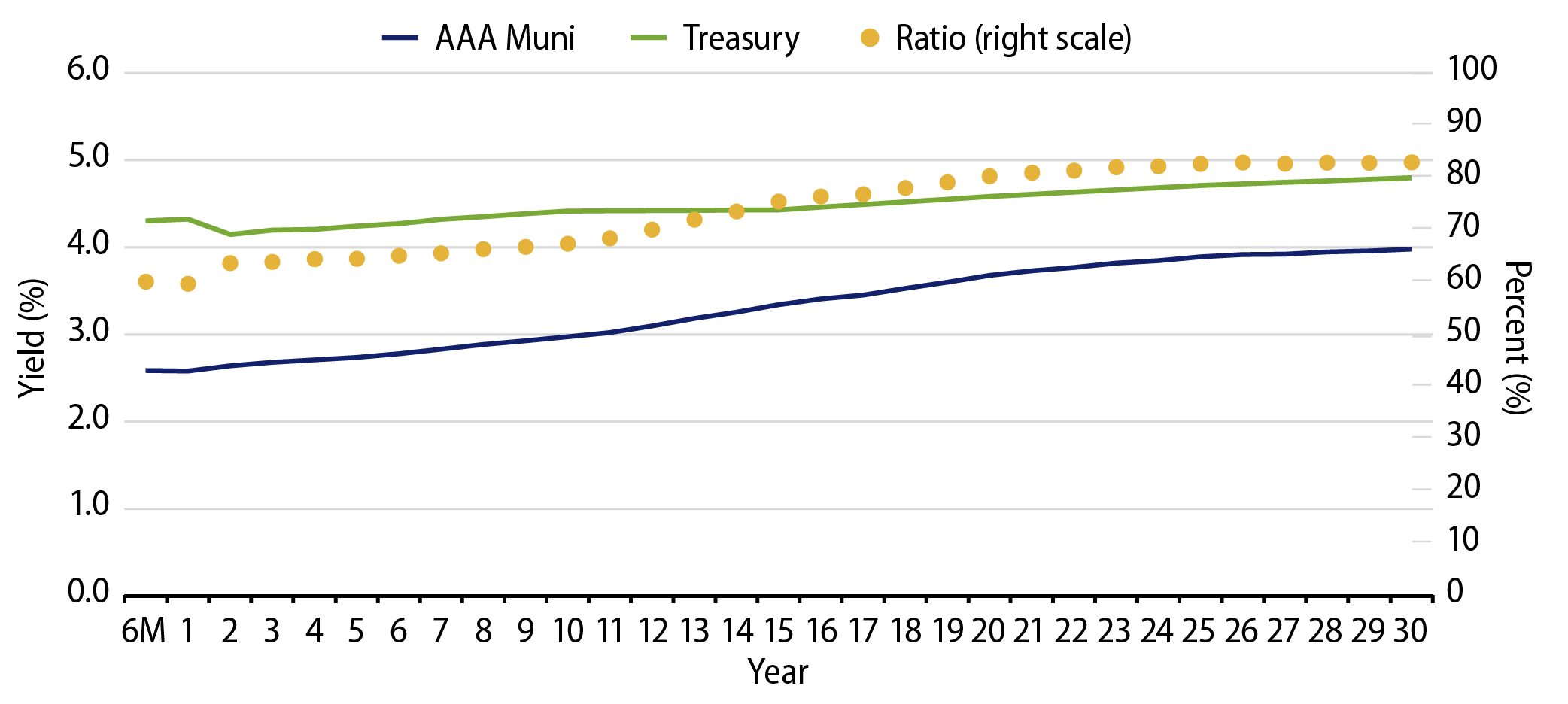

Theme #2: The muni curve has steepened, offering better value in longer maturities.

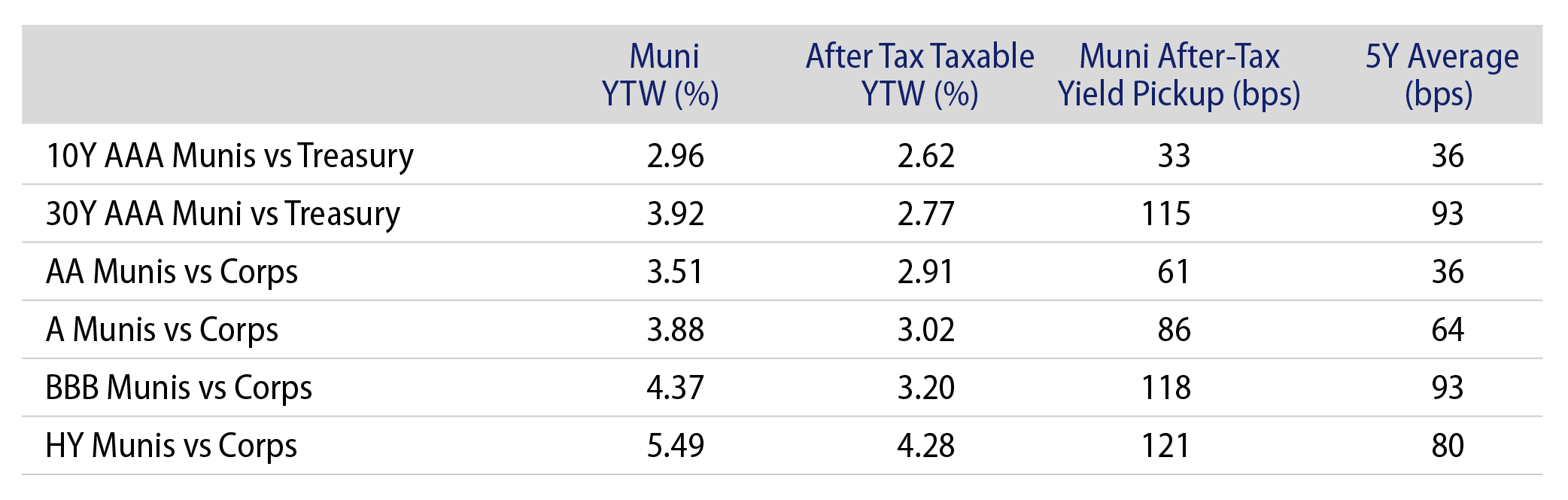

Theme #3: Munis offer attractive after-tax yield pickup versus longer-dated Treasuries and investment-grade corporate credit.