Performance Overview

Municipals posted positive returns as rates rallied in July.

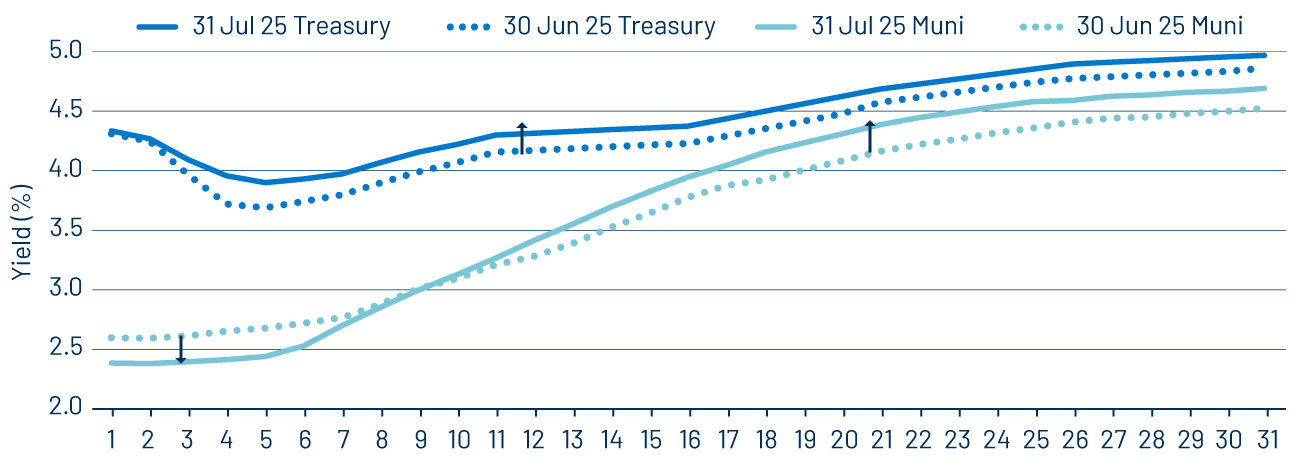

In July, fixed-income yields generally moved higher amid stronger than expected economic data. Second quarter GDP rose 3.0% quarter-over-quarter, well above consensus expectations of 2.6%. Consumer Price Index (CPI) and Personal Consumption Expenditures (PCE) data also exceeded expectations, reducing the likelihood that the Federal Reserve would reduce interest rates at month end. While Treasury yields moved higher across the curve, the AAA municipal yield curve steepened, with yields moving lower in short maturities and higher in longer maturities.

Supply and Demand Technicals

Muni supply remains at a record pace this year.

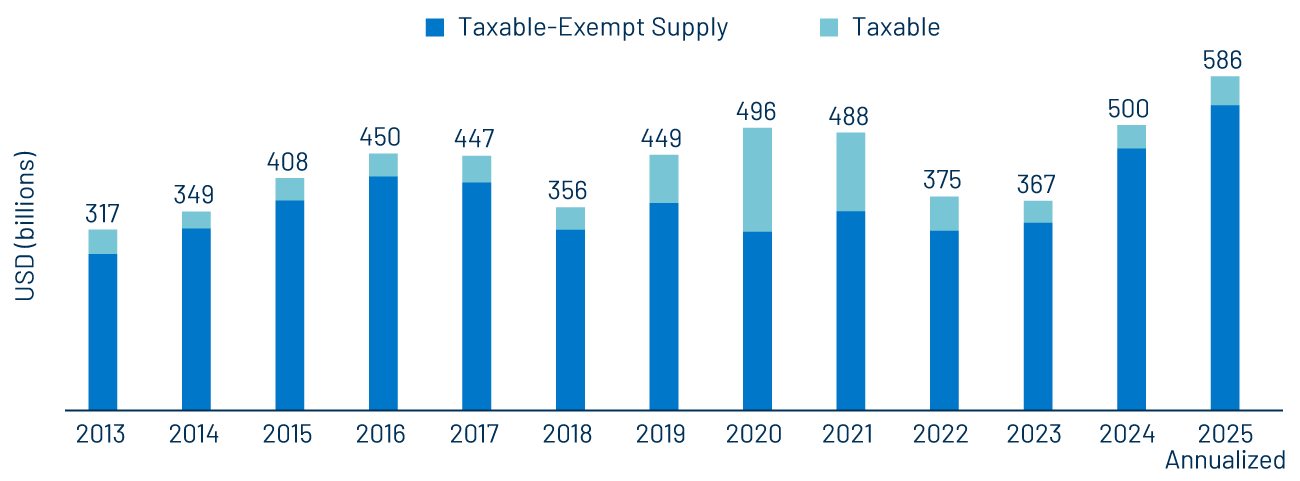

Municipal supply maintained a record pace, as July supply increased 18% from July 2024 levels to $57 billion. Year-to-date (YTD) municipal issuance totaled $342 billion, 22% higher than the record levels of the prior year. Tax-exempt supply increased 22% year-over-year to $313 billion YTD. Taxable municipal issuance totaled $29 billion this year, a 20% increase compared to last year.

Municipal demand remained positive as ICI reported that weekly reporting municipal mutual funds recorded $7 billion of net inflows. Short duration and intermediate categories recorded the majority of net inflows during the month. July’s net inflows increased YTD net inflows to $25 billion.

Fundamentals

High-yield credit spreads remain near decade tights.

Traditional state and local municipal credit continues to benefit from elevated tax collections and cash balances that have supported upgrades that outpaced downgrades this year. However, select high-yield issuers were mentioned by name in the headlines during the month. On July 30, a top-10 issuer in the High Yield Muni Index, Brightline Trains, was downgraded to B by the agency. Note that this issue was originated in 2024 with a BBB- rating by Fitch. This is an example of potentially concentrated positions within high-yield portfolios that we believe underscore the value of diligent credit research, particularly in a tight credit spread environment where compensation for risks is less than what was observed in the past.

Valuations

For high taxpayers, municipals offer above-average after-tax relative value compared to their taxable counterparts.

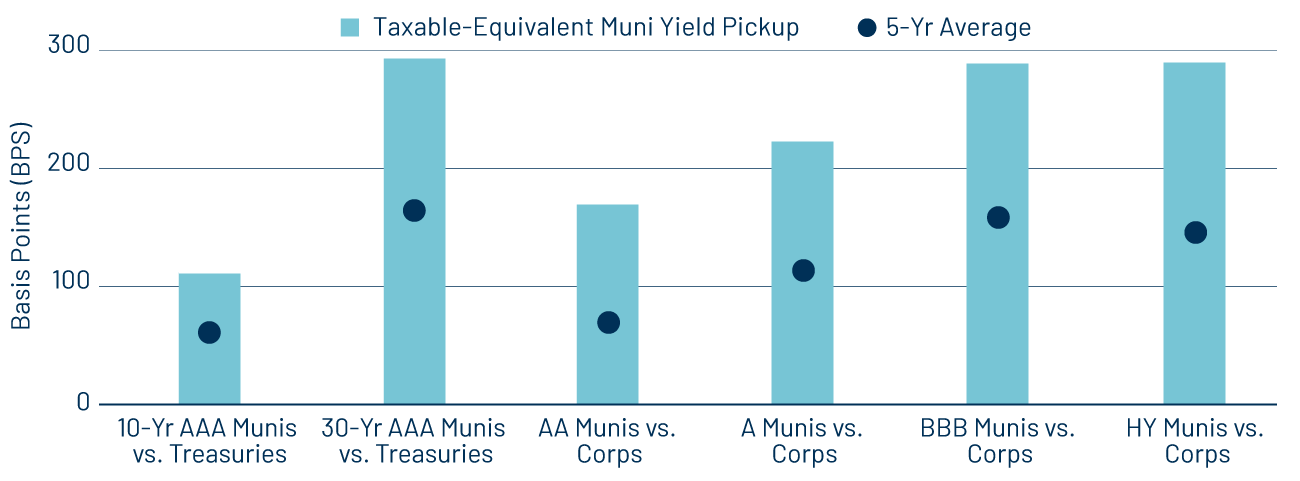

Record supply conditions and negative muni performance YTD have resulted in improved tax-exempt income opportunities and relative valuations. The Bloomberg Muni Bond Index average yield-to-worst of 3.98% at month end, which is 6.72% on a taxable-equivalent basis for top taxpayers. Across the curve and credit spectrum, municipal credit currently offers 100-290 basis points of taxable-equivalent yield pickup versus like-structured Treasuries and corporate counterparts. Given the tighter spread conditions, we anticipate that credit selection will be increasingly influential in achieving this relative value across credit cohorts.