Real gross domestic product (GDP) was reported today as declining at a 4.8% annualized rate. Crazily enough, this sharp decline was right in the middle of an extremely wide range of expectations. Yesterday, we saw guesstimates of the GDP number ranging from -11.2% to -1.0%.

Essentially ALL the GDP decline came from one component: consumer spending on services. Sure, there were also sharp declines in production of motor vehicles, reflecting the mid-March shutdown of car factories and equipment investment. However, these were offset by gains in construction and a sharp decline in imports, which serves to boost GDP.

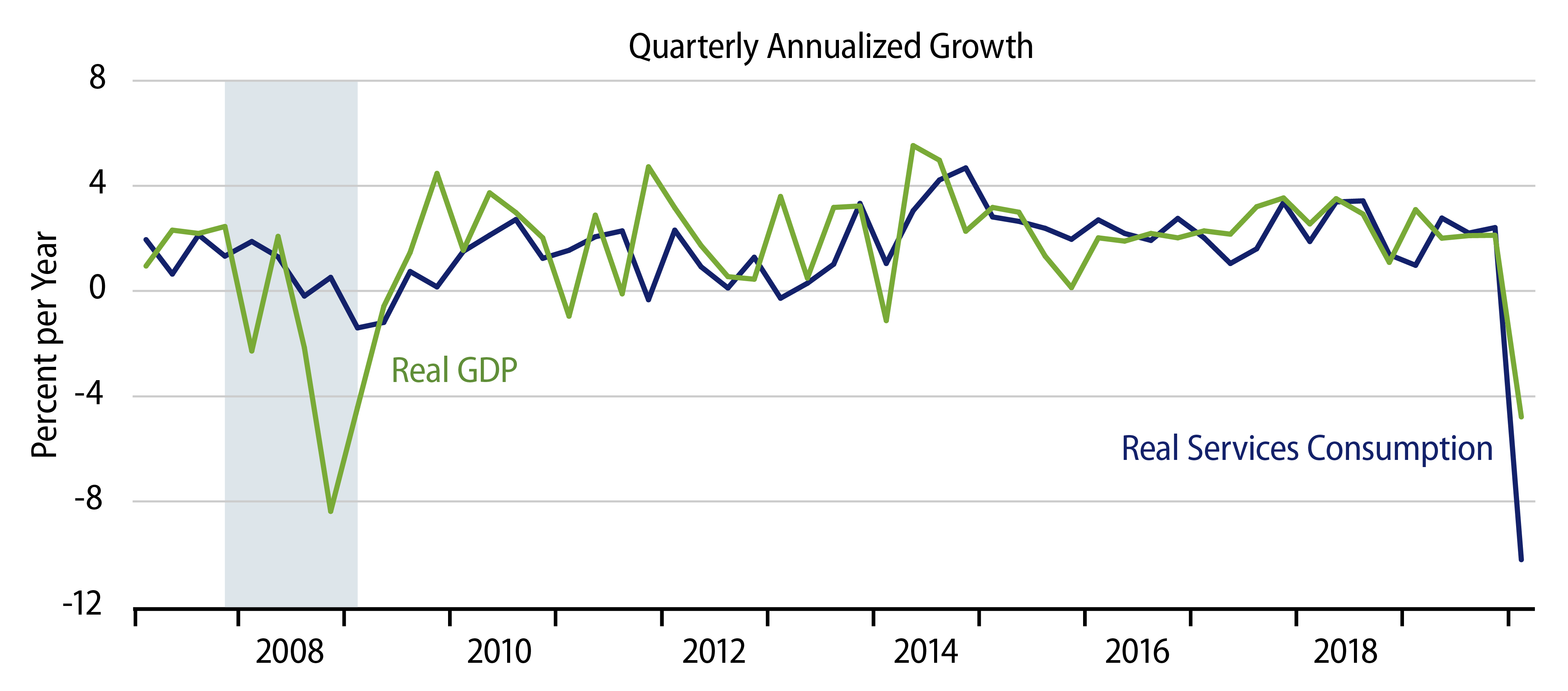

That the decline in services consumption was as huge as it was and that it was essentially equal to the overall dollar decline in GDP is a testament to how utterly strange the current economy is. Consumption of services is typically the most stable component of GDP. Even during the global financial crisis of 2007-09, the quarters with the sharpest declines in GDP saw only slight declines in services consumption. In contrast, during 1Q20, the rate of decline in real services consumption was multiples of that in GDP.

The media is talking about a collapse in demand last quarter. Demand did not collapse so much as it was repressed. It has become trite to say that the current decline is unlike anything we have seen before, but that is nevertheless true, and references to past recessions must therefore be made with a lot of uncertainty and even more humility.

It is questionable how effective fiscal and monetary stimulus measures will be—or how necessary they are—when demand has not declined so much as it has been suppressed. With all aforementioned humility up front, we are inclined to think the post-shutdown rebound can be quick and largely complete, precisely because the decline has been so artificially imposed. Still, for that to happen, the supply side of the economy has to be intact and able to rebound when and as the shutdown is lifted. Government efforts have attempted to address this transition, but the longer the shutdown lasts, the bigger potential problems could be.

Meanwhile, as shocking as the 1Q declines in consumer services were, remember that they reflect only about half a month of shutdown. So, even if the economy were to open broadly by May 15, that would make the 2Q shutdown-related declines in services consumption three times as large as those of 1Q. Furthermore, we will likely see piling on of 2Q declines in the sectors that were still adding to growth in 1Q, such as consumer spending on groceries (think hoarding), housing and foreign trade.

So, get ready for a much bigger GDP decline in 2Q, to be announced in late July. Then again, nothing in today’s news was surprising, given what we already knew of the shutdown-related carnage. In line with that, the equities markets are actually bouncing today in the face of the GDP news. As bad as 2Q GDP is going to be, that also will likely be baked into market pricing by the time it occurs. (Perhaps it already is.)