Private-sector payroll jobs rose by 223,000 in December, with the November payroll estimate essentially unchanged (revised down 1,000 jobs). The financial press headlines we have seen today regard this as a job “surge.” The reality is much more sober. As we have remarked in the last few months’ posts, the hurricanes that hit the Southeastern US between August and October substantially disrupted job growth, and the “pickup” we have seen recently is mostly a return to work of folks kept home by the hurricanes in preceding months.

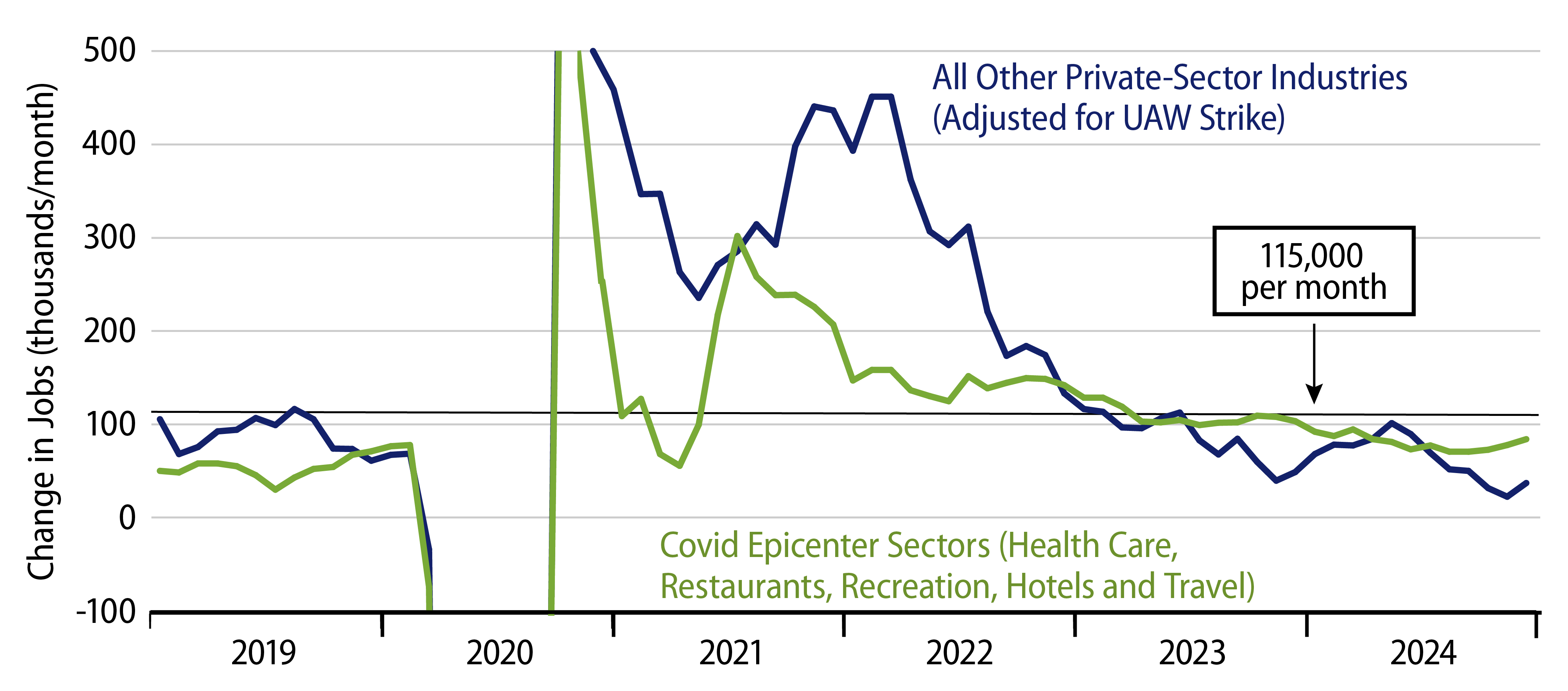

The accompanying charts provide context on this. Exhibit 1 shows a 6-month growth rate in jobs, six months being sufficiently long to average out both the lost jobs during the hurricane and the rebound since. As you can see there, net of hurricane disruptions, job growth has been decelerating substantially in recent months across most of the economy; that is, outside the five sectors hit hardest by the Covid disruptions.

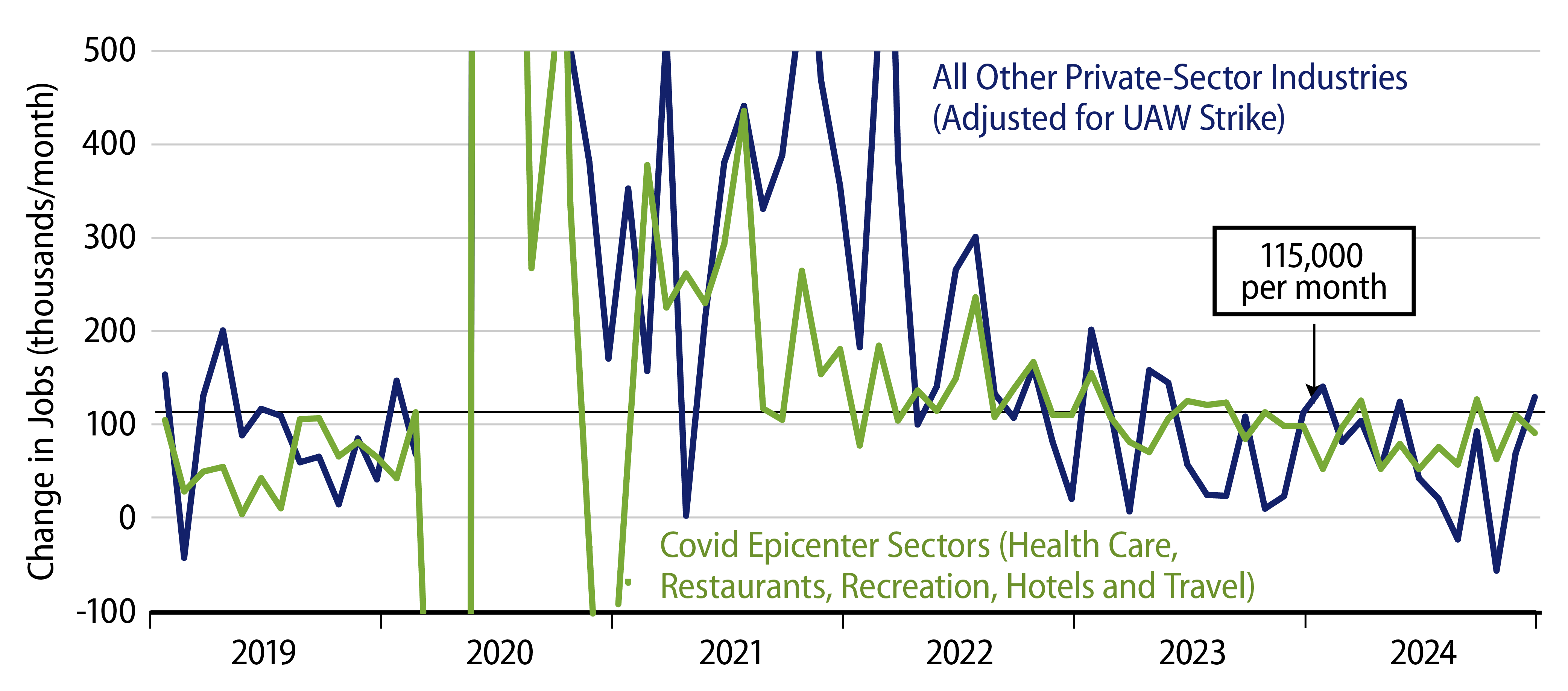

Exhibit 2 shows the 1-month changes, again splitting out between Covid-disrupted sectors and the rest of the private-sector economy. As you can see there, yes, the November-December gains were relatively large, but, again, these came off the heels of five months of generally weak gains, thanks again to the hurricanes.

Within the “Covid” sectors, job gains continued primarily in the health care industry, although hotel/motel employment has also proceeded better in the last two months.

Outside of the “Covid” sectors, construction job gains have been slowing in line with flat/declining construction activity. Manufacturing jobs declined again. There was something of a bounce in retail and professional services jobs after these had struggled in preceding months.

Average workweeks were flat. Total hours worked rose 0.20%. Average hourly earnings for all workers rose 0.28%, while those for nonsupervisory workers rose 0.20%, both of which are mild decelerations from previous months.

Finally, all these data are subject to large benchmark revisions due a month from now. We have already learned that 2023 job growth will be substantially marked down. It will be interesting to see whether those downward revisions apply to 2024 jobs data as well.

No, today’s jobs data were not weak, but they certainly were not a surge. The better gains reported for November and December should be taken in the context of much weaker, hurricane-affected data in preceding months in order to get an accurate assessment of what is going on.