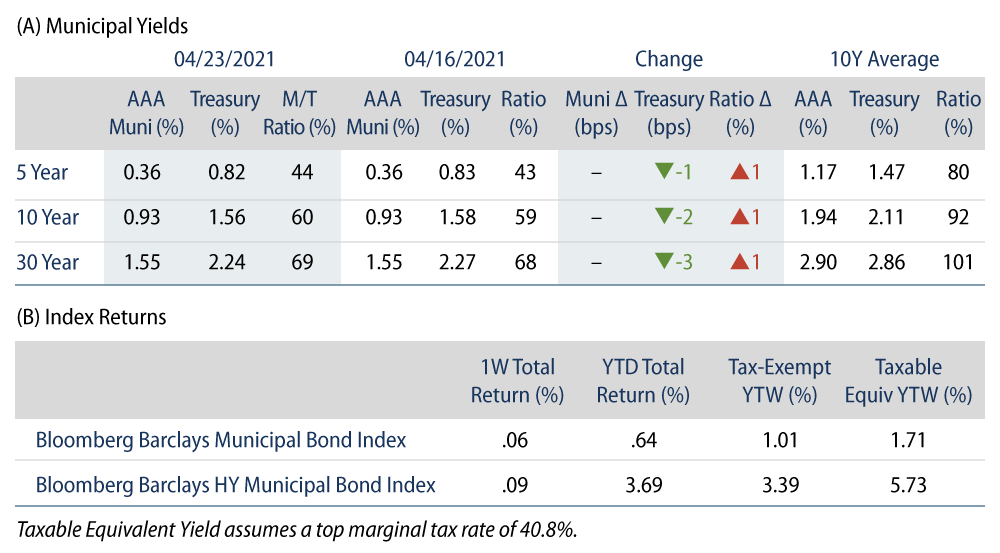

Municipals Posted Positive Returns as AAA Yields Were Unchanged During the Week

US municipals posted positive returns this week as AAA muni yields were unchanged. Muni/Treasury ratios ticked 1% higher across the curve as Treasuries moved lower. Fund flows remained positive as new-issue supply moved higher. The Bloomberg Barclays Municipal Index returned 0.06%, while the HY Muni Index returned 0.09%. This week we evaluate the increasing sustainable-labeled issuance in the muni market as well as evolving environmental, social and governance (ESG) related sensitivities that resulted in the withdrawal of a large correctional facilities transaction.

Persistent Muni Fund Flows Were Met with Higher Supply Levels

Fund Flows: During the week ending April 21, municipal mutual funds recorded $1.9 billion of net inflows, according to Lipper. Long-term funds recorded $1.5 billion of inflows, high-yield funds recorded $642 million of inflows and intermediate funds recorded $200 million of inflows. Net inflows year to date (YTD) reached $39.9 billion.

Supply: The muni market recorded $12.7 billion of new-issue volume during the week, up 76% from the prior week. Total issuance YTD of $137 billion is up 27% from last year’s levels, with tax-exempt issuance 24% higher and taxable issuance 37% higher. This week’s new-issue calendar is expected to drop to $5.3 billion (-58% week-over-week). The largest deals include $1.5 billion New Jersey Transportation Trust Fund and $354 million Massachusetts Clean Water Trust transactions.

This Week in Munis: ESG in Focus During Climate Week

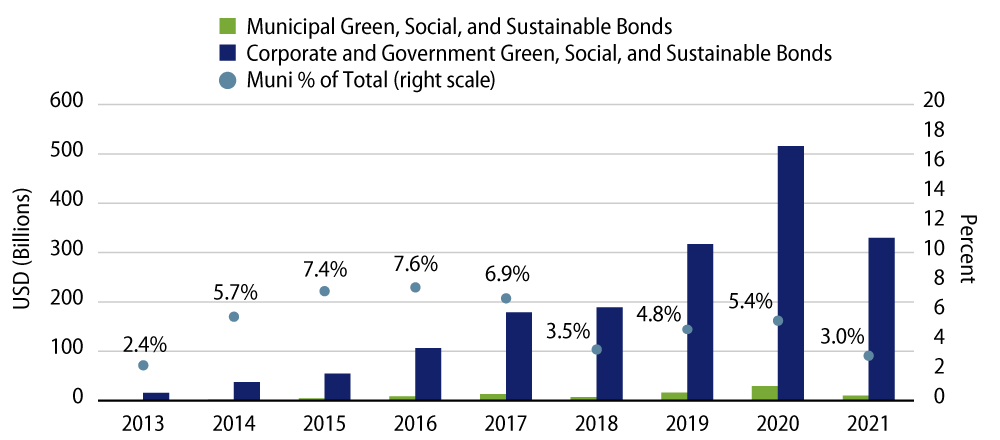

For climate week, we highlight the development of green, social and sustainable bond issuance which represents a growing trend for municipal issuers. Green, social and sustainable labels are designations for bonds linked to the guidelines established by the International Capital Market Association (ICMA) to promote environmental and social advancement. Green bonds focus on environmental initiatives, social bonds focus on social objectives and sustainability bonds include issuances that incorporate both environmental and social advancement objectives.

Despite the fact that muni bonds largely achieve their tax-exemption from funding a public good, municipal issuance labeled as green, social or sustainable has comprised a small proportion of total muni issuance and has lagged corporate and governmental issuance. In 2020, municipal green, social or sustainable-linked issuance totaled $30 billion, which while representing a record level comprised just 4% of total muni issuance and 5.7% of global corporate and governmental sustainable issuance.

We attribute the limited uptick in issuance of municipal bonds labeled sustainable to a variety of factors. Some issuers already believe investors perceive their issuance as sustainable and do not see a pricing benefit from procuring an official label. Others are concerned that additional disclosures of environmental or social issues can open the door for regulatory challenges.

While green and social bond labels have not materially impacted pricing to date, new market forces around ESG are emerging and influencing demand for certain issues. This month, market participants raised concern around a transaction for a state correctional facility, because it included a private prison contractor to build and maintain the facility. The transaction received subdued initial market reception and the subsequent resignation by the lead underwriter, stemming from the negative perception of funding private entities that profit from mass incarceration. Such evolving risk and impact issues along with the changing liquidity dynamic for certain transactions exemplify new considerations investors face as disclosures improve and the market becomes increasingly sensitive to ESG investing.

At Western Asset, we promote green, social or sustainable labeling as appropriate because we believe it will help incentivize additional disclosures from issuers. However, we recognize that these sustainable labels are voluntary and standards around third party certification are far from established. With additional information and understanding, we believe the market will come closer to coalescing around a certain set of standards, but in the mean time we believe it is important to incorporate an independent process in assessing ESG risks and impact opportunities to deliver on sustainably driven performance objectives.