Private-sector payroll jobs rose by only 74,000 in June, with a -16,000 revision to the May jobs total further softening the gain. Once again, most of the private-sector gains were in health care and social assistance, where a 59,000 job gain was reported. Other facets of the employment report showed a decline in workweeks and in total hours worked, a slight 0.2% increase in hourly wages and a slight decline in unemployment to 4.1%, the same level as was seen in February and most of 2024.

The private-sector job gain was much more modest in appearance than the reported 147,000 gain in total payroll jobs, thanks to the latter being bloated by a 63,000 gain in public school jobs. But public education didn’t boom last month. Rather, the school year ended later than usual this year, so the figure reflects school employees leaving for the summer break later than usual. Before seasonal adjustment, public school employment declined by -442,000, less than usual in June, so that after seasonal adjustment, there was a rise.

Those reported public school job gains will be reversed in the July data next month, once the summer break is fully reflected in the data. We focus on private-sector employment mostly because it is a better measure of how market forces are affecting employment. However, the seasonal vagaries in public school jobs are another rationale for our focus.

With private-sector job gains well below the average of recent years and with workweeks down and wage gains slight, the June employment report was mostly a disappointment. Favorable descriptions being reported in the financial press today reflect reporters flashing on the mirage in school jobs and also on the fact that even the 74,000 gain in private-sector jobs is much better than the -33,000 change that the ADP report projected yesterday. It is fair to say that the ADP report has generally been a very poor predictor of official job changes, and that was again the case this time. Despite these distractions, we’ll repeat our take that today’s news was on the softish side.

President Trump and Federal Reserve (Fed) Chair Powell have been sparring lately over the Fed’s refusal to cut interest rates in recent months. Mr. Powell has cited his concerns that tariff increases will spark inflation. Fair enough, but it could be pointed out that the Fed blithely cut rates and sustained them at near-zero levels over 2021-2022 despite the previous administration’s stimulative fiscal programs and despite Covid-impaired supply chains. Mr. Trump’s bluster is not conducive to dispassionate Fed policy decisions, but today’s softish employment report could be a first nudge to the Fed’s contemplation of further rate cuts in the coming months.

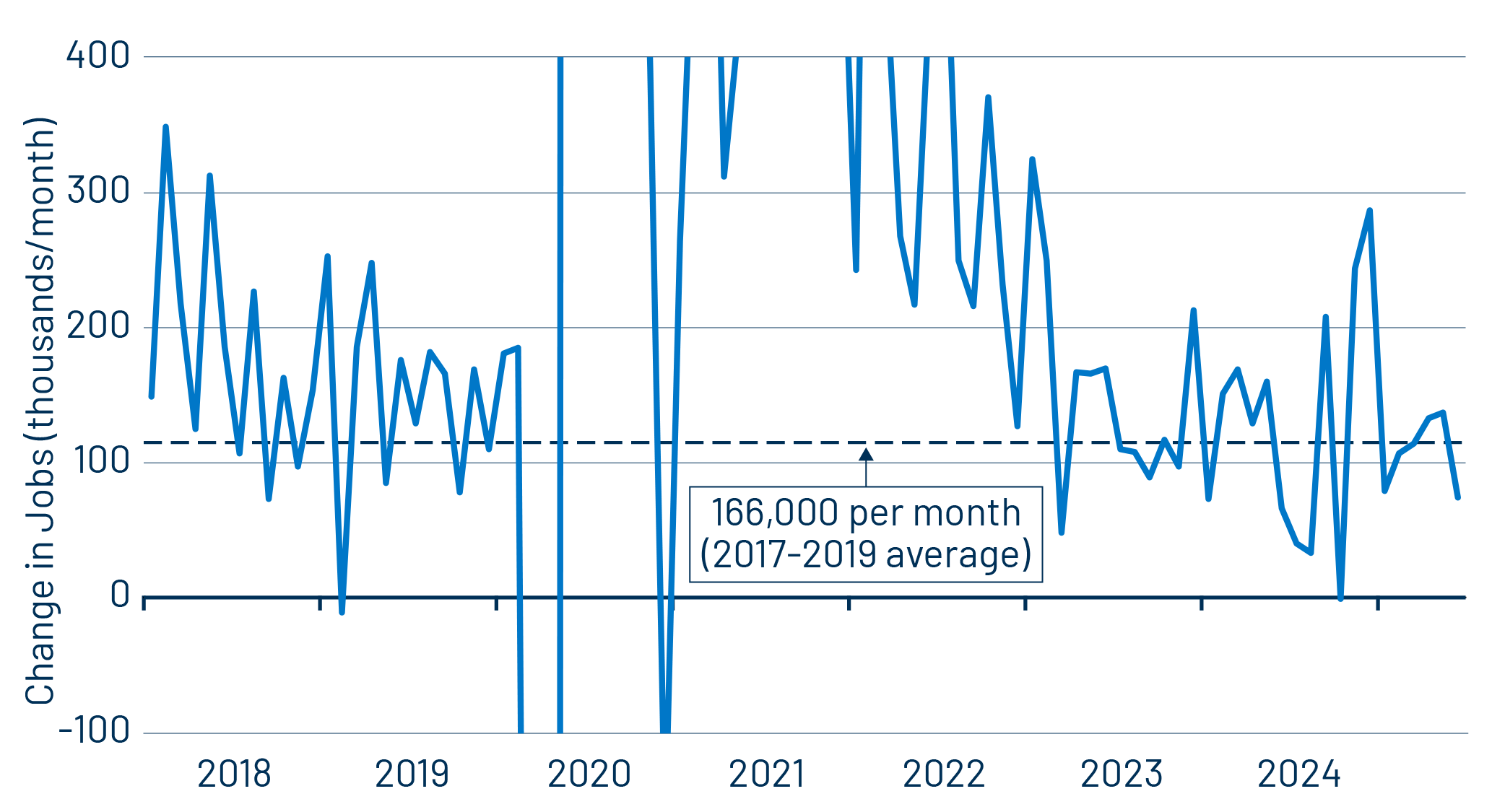

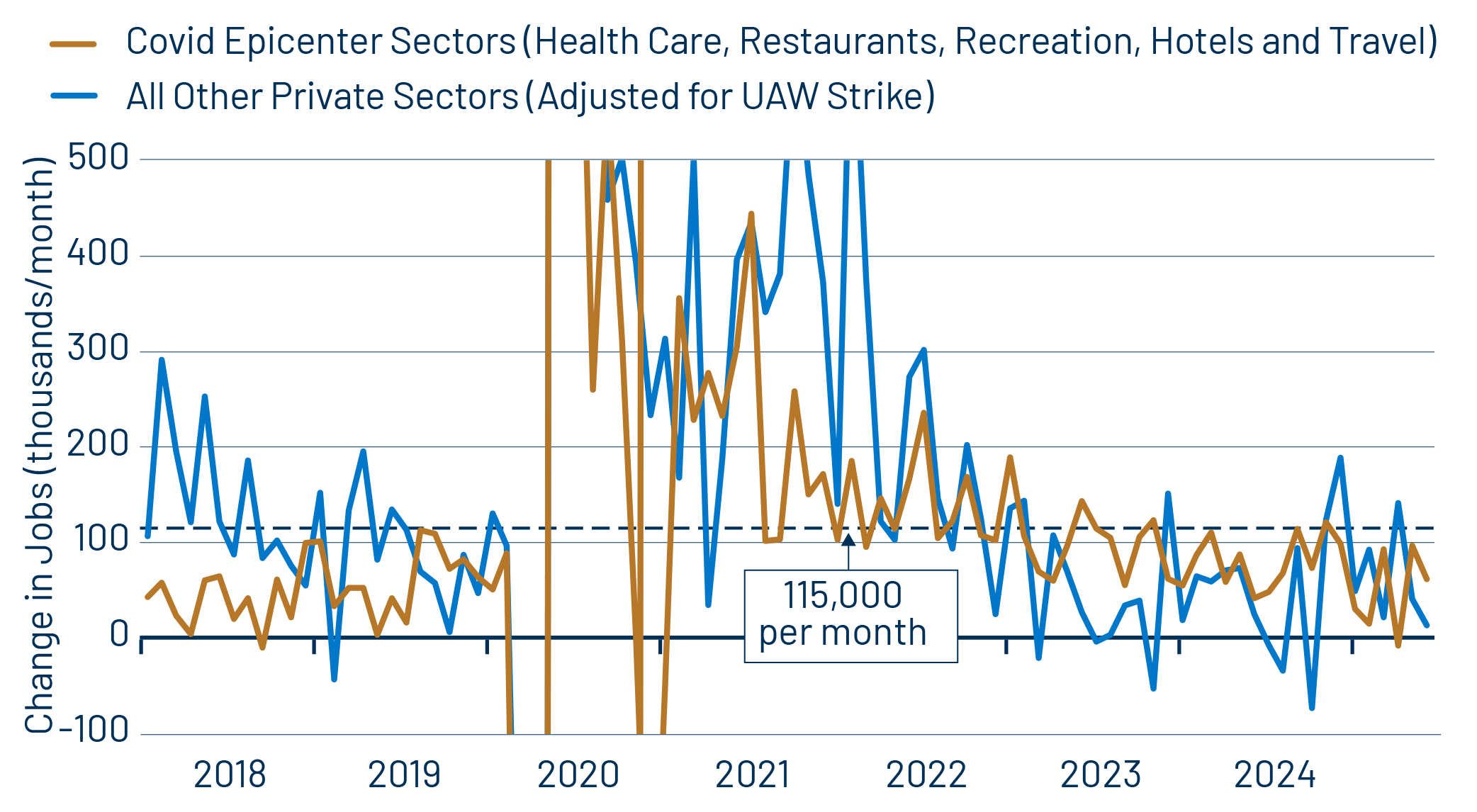

For the last four years, we have dissected the job data according to the effects of the Covid shutdown on various industries. We’re far enough past the shutdown that such dissection is no longer relevant. Exhibit 1 shows overall private-sector job growth, while Exhibit 2 illustrates the dichotomy we have presented in the past. We’ll shift to the Exhibit 1 take in the future.

As a final note on the Covid effects, we’ll note that restaurants and hotels both remain below pre-Covid jobs levels, let alone pre-Covid growth trends. Other “Covid epicenter” sectors have fully recovered to pre-pandemic growth trends, and the health care sector has shown faster growth in the last five years than it did prior to Covid.