Performance Overview

Municipals posted negative returns and underperformed taxable fixed-income in April.

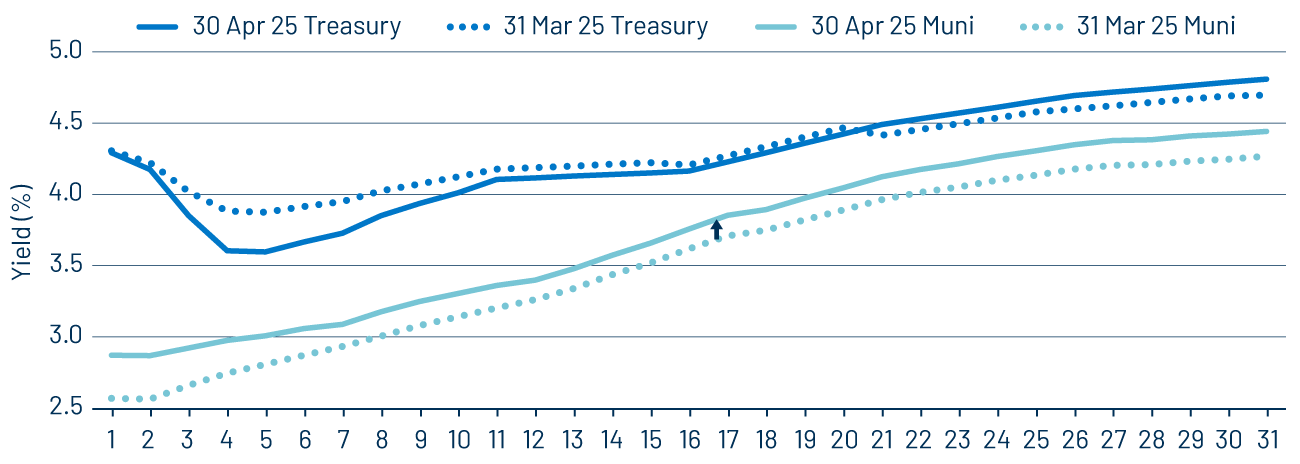

Market volatility accelerated in April as President Trump’s tariff announcements drove uncertainty around the path of growth and inflation. Meanwhile, economic data generally came in weaker than expected and inflation maintained a downward trajectory. All told, equities moved sharply lower early in the month before rebounding toward month-end on hopes of tariff concessions. Similarly, Treasury yields initially moved lower before retracing that decline in the latter half of the month. Municipals sold off amid the volatility, significantly underperforming due to fraught liquidity conditions associated with elevated supply and seasonally weak demand technicals, which were further compounded by broader market volatility.

Supply and Demand Technicals

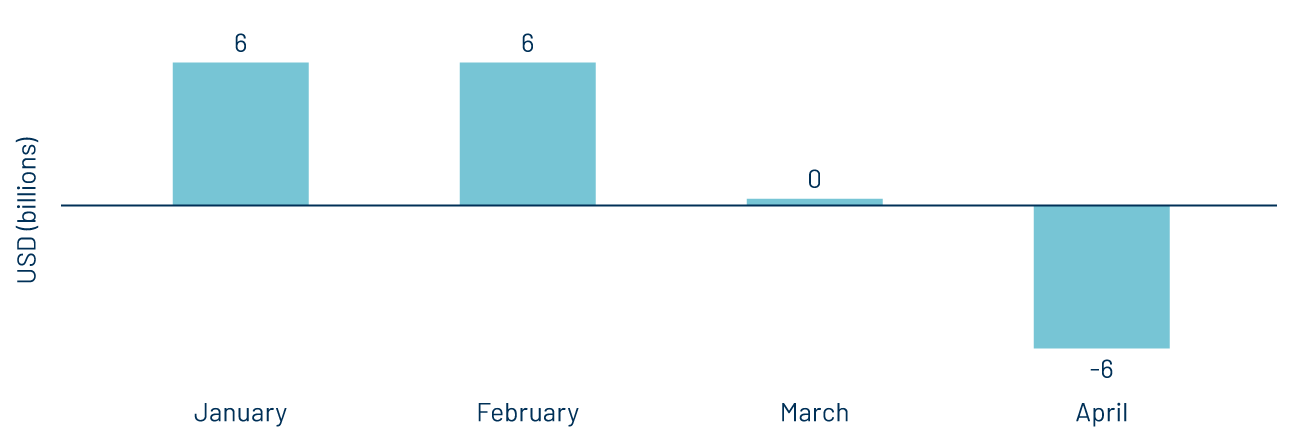

Muni fund flows turned sharply lower in April.

Municipal supply remained elevated. Total April issuance of $51 billion marked the highest level of issuance in six months and was 14% higher than April 2024 levels. Year-to-date (YTD) issuance of $170 billion is tracking above the prior record year’s levels by 17%. Issuance for taxable and tax-exempt municipals is higher year-over-year, though tax-exempt offerings continue to comprise the vast majority of total issuance. Municipal demand moved sharply lower in April, driven by seasonal tax-related selling and compounded by broader market volatility. This contributed to a flight to quality—specifically, increased exposure to cash equivalents and a shift away from fixed-income within model allocations. The Investment Company Institute (ICI) reported that municipal mutual funds recorded $6 billion of net outflows, leading YTD inflows lower to $6 billion.

Fundamentals/Outlook

Despite federal funding reductions impacting federal government employment, state and local government employment continues to grow.

Municipal credit fundamentals have continued to demonstrate resilience amid concerns about the scope of federal funding. The April nonfarm payroll report indicated that, while federal employment has declined by 23,000 jobs YTD, state and local employment has increased by 75,000 jobs. From year-end 2022 through the first quarter of 2025, state and local payrolls have also exceeded the pace of national employment growth. As federal funding concerns filter down to the state and local levels and several large issuers record budget gaps, Western Asset anticipates that the growth of municipal payrolls could slow going forward.

Valuations

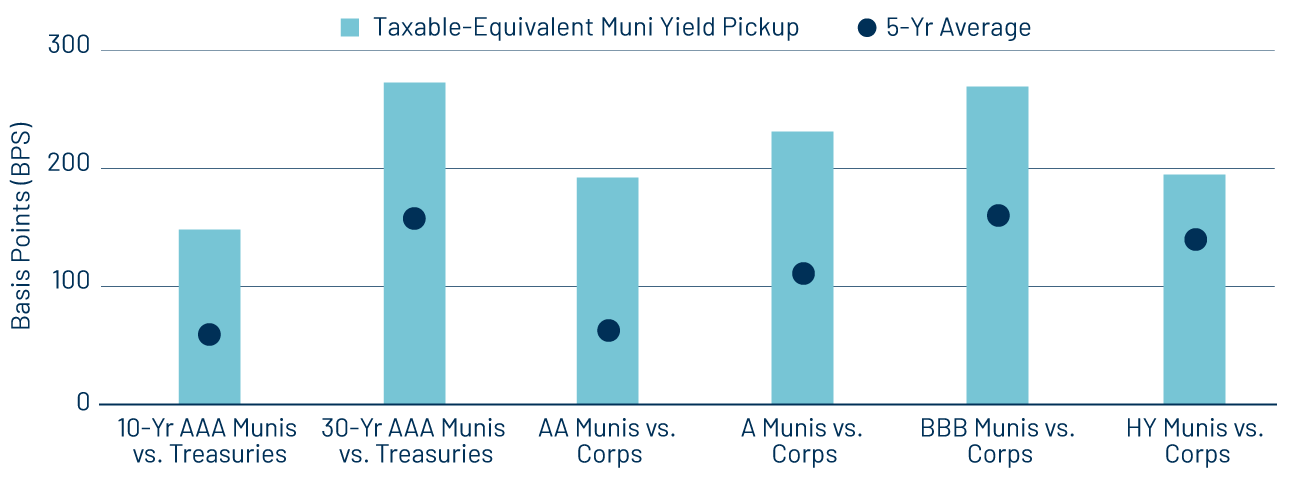

Municipals offer above-average after-tax yield pickup versus taxable counterparts.

Significant municipal underperformance, despite lower Treasury yields and strong credit fundamentals, highlights the strong influence that weaker supply and demand technicals can have on the municipal market. These conditions have improved income opportunities and the relative value of the asset class. The Bloomberg Municipal Bond Index average yield-to-worst ended the month at 4.06%, up over 25 basis points from the start of the year and equivalent to 6.86% on a taxable equivalent basis. Considering the positive performance recorded in taxable fixed-income sectors in April, the after-tax yield pickup has improved and underscores the enduring relative value opportunity of the muni asset class.