Real consumer spending was reported today to have increased a slight 0.1% in August, as goods spending declined -0.2%, while services spending rose 0.2%. This occurred alongside a 0.1% increase in real disposable personal income, so personal saving on the month was about unchanged.

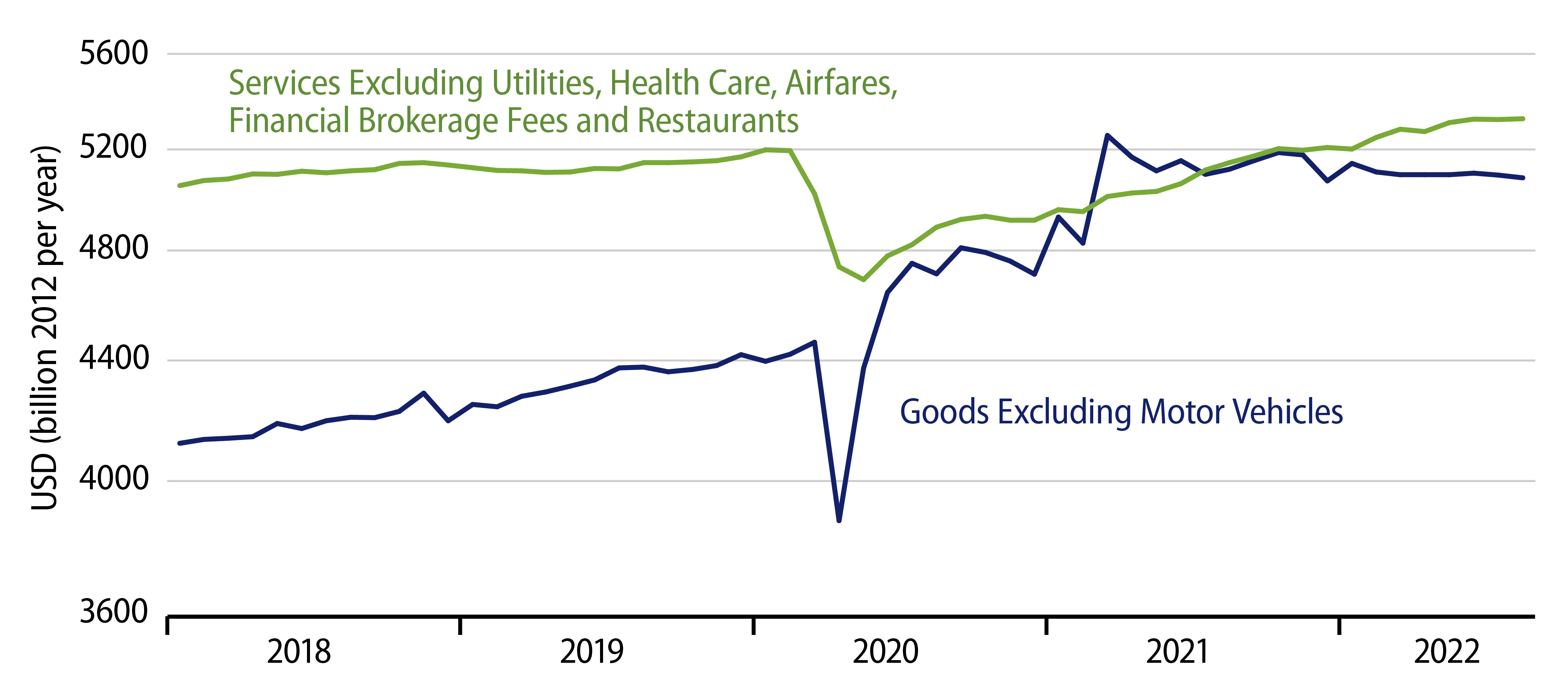

For goods spending, the declines continued a downtrend that has been in place for 21 months. Real goods spending is still slightly elevated relative to pre-Covid trends, but it has become progressively less so since March 2021, as consumers have gradually shifted spending from goods back to services that were essentially unavailable to them during and just after the Covid shutdown.

What’s new in the recent data is a slight deceleration in services spending. It is still rising, but at progressively slower rates than we saw in 2021 and early-2022. With the deceleration in services spending, growth in total consumption has slowed as well.

The slower total consumption growth coincides with the period over which personal incomes have failed to keep up with consumer inflation. In other words, real incomes have been dropping for the last 10 months or so, and consumers have had to dip into their savings to sustain any growth in real spending at all. And, yes, the slower growth in overall consumer spending has contributed to the slower economic growth of recent quarters. Real incomes have increased slightly in the last two months, as headline inflation has eased (though recently, gains in nominal incomes have moderated).

Today’s data featured benchmark revisions to the spending and income data going back to 2017. Those changes revised up income growth for 2019 and revised it down for 2020, 2021 and 2022. Spending growth was revised down for 2019, up substantially for 2020 and 2021, and down for 2022.

The revisions paint a somewhat different picture as to how consumer spending patterns stand after nearly three years of Covid sojourn. If you draw straight trend lines through 2018-2019 data in the chart shown here, you will see that “basic” goods spending still remains slightly elevated relative to those 2018-2019 (pre-Covid) trends, as stated earlier. However, basic services spending is now fully recovered back to pre-Covid trends. Pre-revision data had shown basic services spending still depressed relative to pre-Covid trends.

So, with the revisions, the recovery in basic services spending now looks complete. However, the lines in the chart exclude a number of volatile, Covid-affected sectors, including health care spending, and these remain depressed relative to pre-Covid trends.

In sum, consumer spending is presently still slightly elevated for most types of goods and is substantially depressed for service items health care and recreation (movies and sporting events). Otherwise, Covid effects are over, at least in terms of real consumer outlays.