Munis Posted Positive Returns Last Week

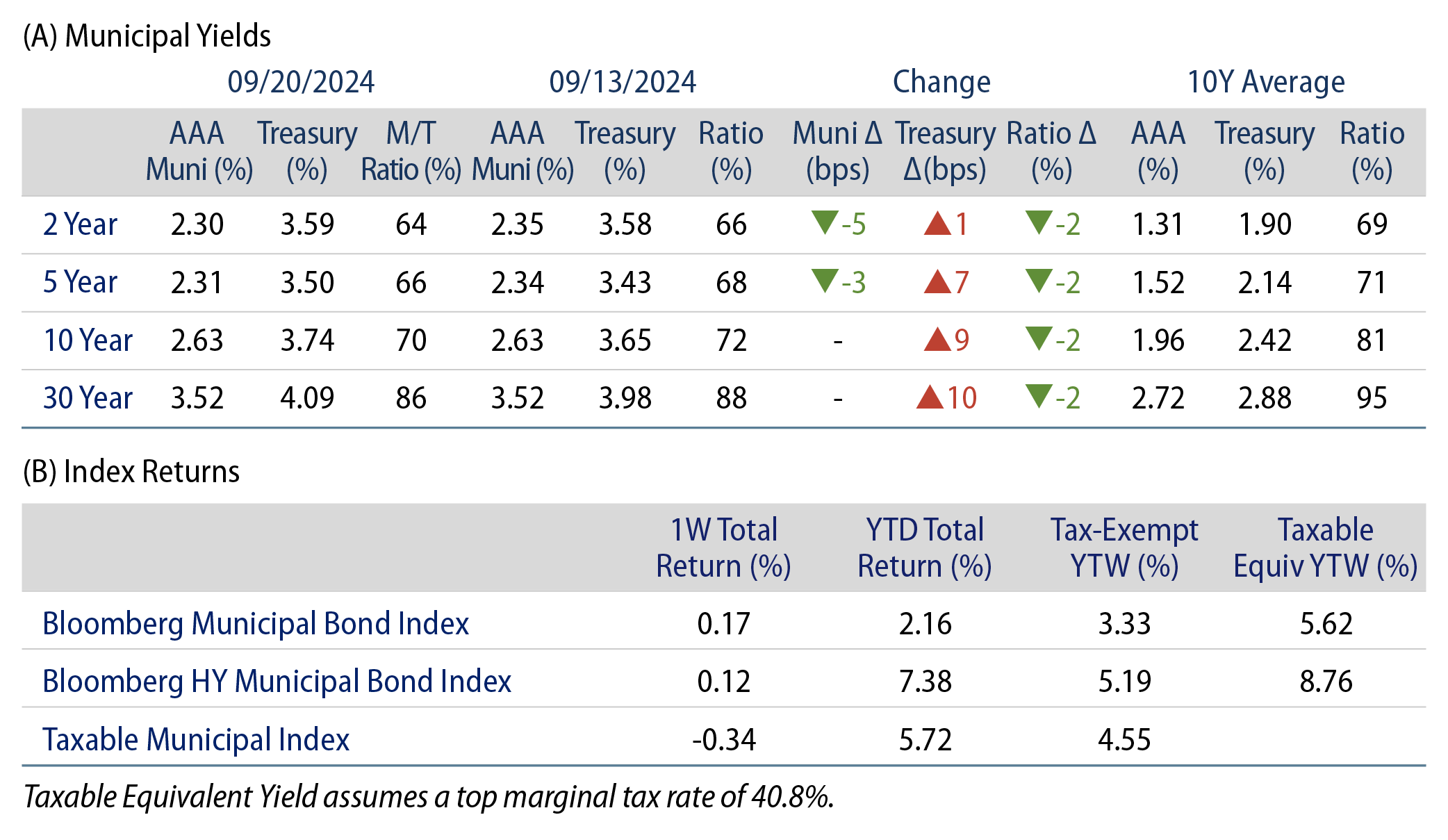

Municipals posted positive returns last week as muni yields outperformed Treasuries, which moved higher following the Federal Reserve’s (Fed) 50-bp rate cut. Meanwhile, high-grade muni yields moved just 3-5 bps lower in short maturities, and supply and demand trends remained elevated. The Bloomberg Municipal Index returned 0.17% during the week, the High Yield Muni Index returned 0.12% and the Taxable Muni Index returned -0.34%. Following the Fed’s rate cut last week, we highlight the municipal market reaction to prior rate-cutting cycles.

Muni Inflows Continued for a 12th Consecutive Week

Fund Flows (up $ 716 million): During the week ending September 18, weekly reporting municipal mutual funds recorded $716 million of net inflows, according to Lipper. Long-term funds recorded $628 million of inflows, intermediate funds recorded $107 million of inflows and high-yield funds recorded $389 million of inflows. This week’s inflows mark the 12th consecutive week of inflows and lead estimated year-to-date (YTD) net inflows higher to $25 billion.

Supply (YTD supply of $360 billion, up 42% YoY): The muni market recorded $9 billion of new-issue volume last week, down 38% from the prior week. YTD issuance of $360 billion is 42% higher than last year’s level, with tax-exempt issuance 47% higher and taxable issuance 12% higher year-over year (YoY). This week’s calendar is expected to jump to $15 billion. The largest deals include $1.3 billion Texas Water Development Board and $1.1 billion Los Angeles Unified School District transactions.

This Week in Munis: Impact of Fed Cuts

Last week, the Fed delivered a 50-bp reduction to the fed funds rate, lowering the top end of the rate range from 5.50% to 5.00%. The rate reduction was well telegraphed considering slowing inflation and labor market trends, and represents the start of a potential new rate-cutting cycle.

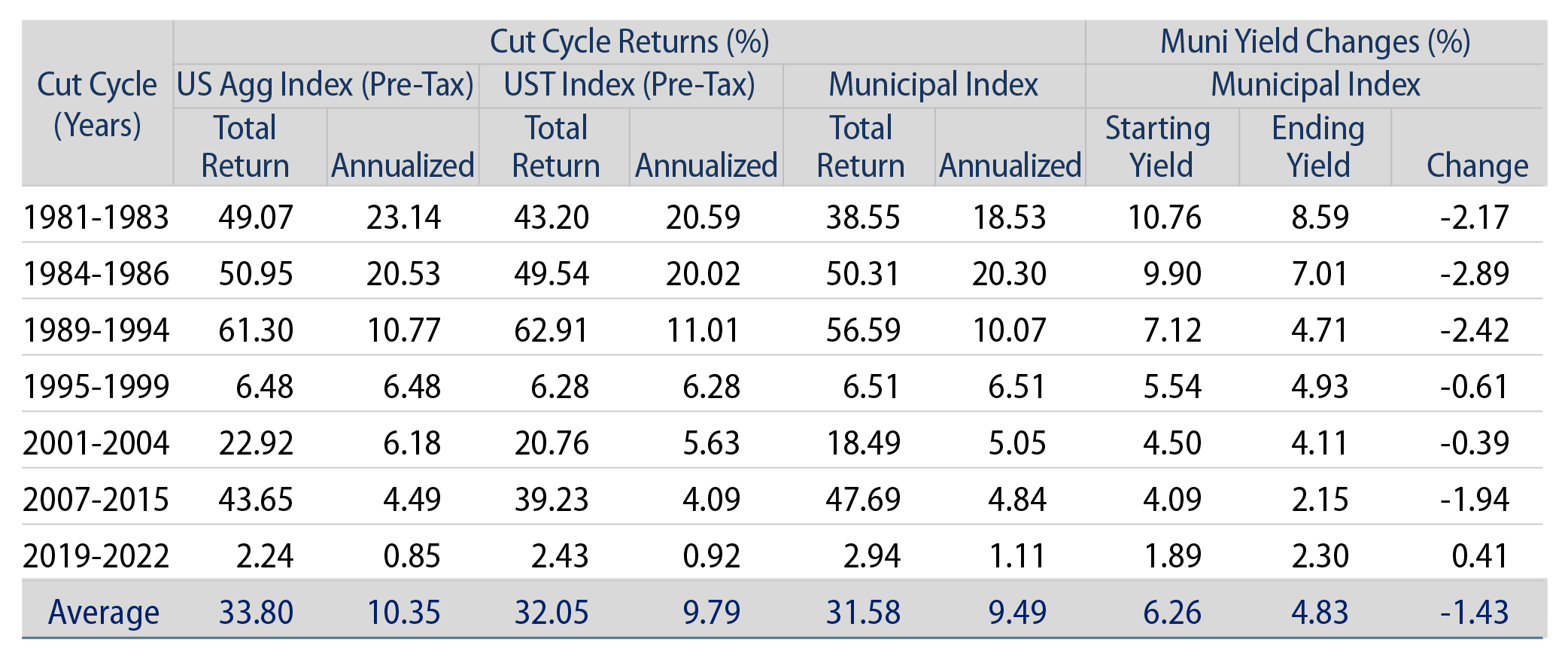

Rate-cutting cycles have historically contributed to fixed-income and municipal performance, which is not surprising due to the inverse relationship between interest rates and fixed-income price returns. During the prior seven significant rate-cutting cycles observed since 1981, the Bloomberg U.S. Aggregate Bond Index returned an average of 33.8% (or 10.4% annualized). The Bloomberg Municipal Bond Index generally mirrored these strong returns, posting an average of 31.6% during these cycles (9.5% annualized), and outperformed the Bloomberg U.S. Aggregate Bond and U.S. Treasury indices in three of the last four cycles. Considering that these index returns do not reflect income tax liabilities, municipals have outperformed these indices on an after-tax basis for most taxpayers.

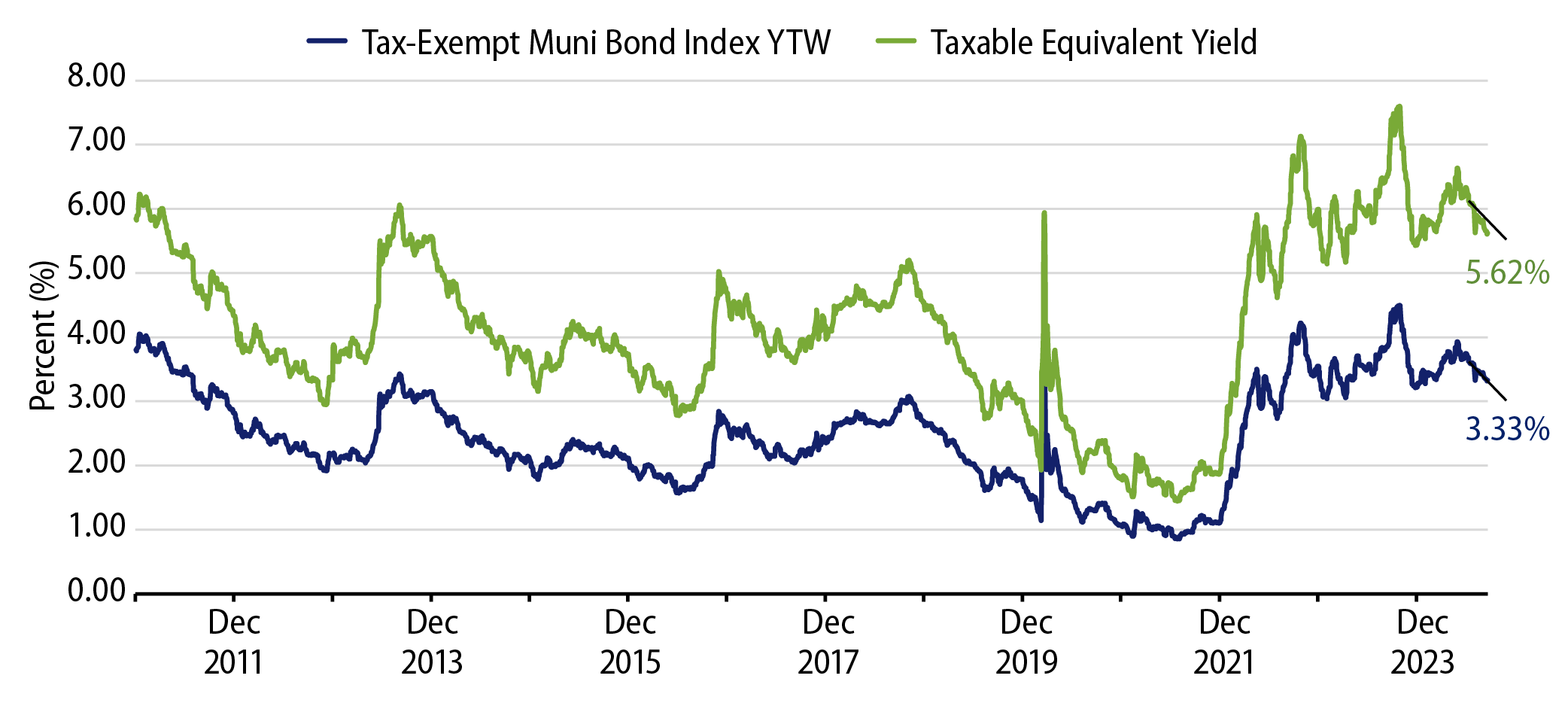

Rate-cutting cycles have also generally contributed to lower tax-exempt income opportunities by the end of the cycle. The average yield to worst of the Muni Bond Index declined in six of the last seven rate cut cycles by an average of 1.4%, underscoring the value income seekers can achieve by entering the asset class ahead of the rate cut cycle.

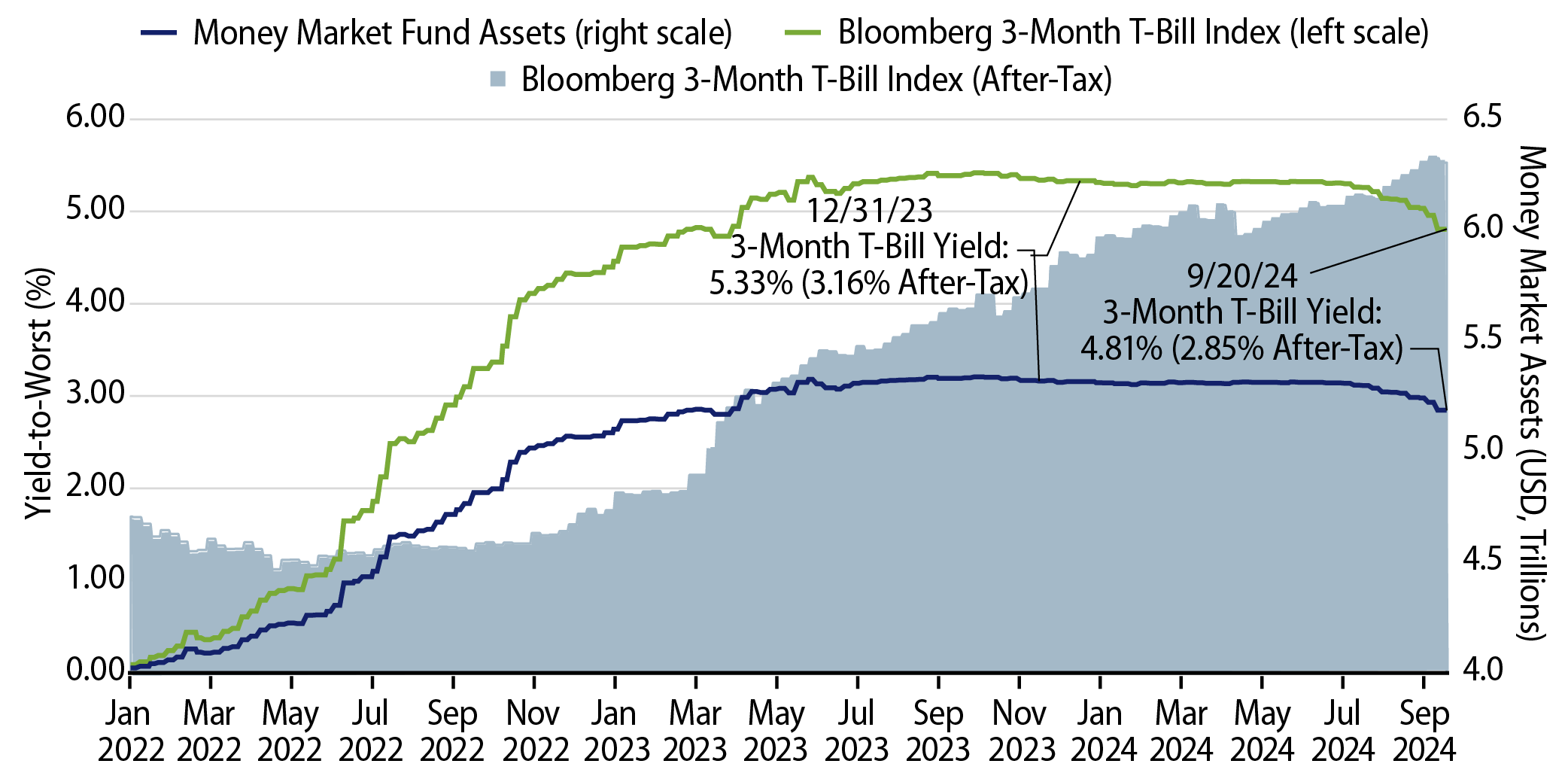

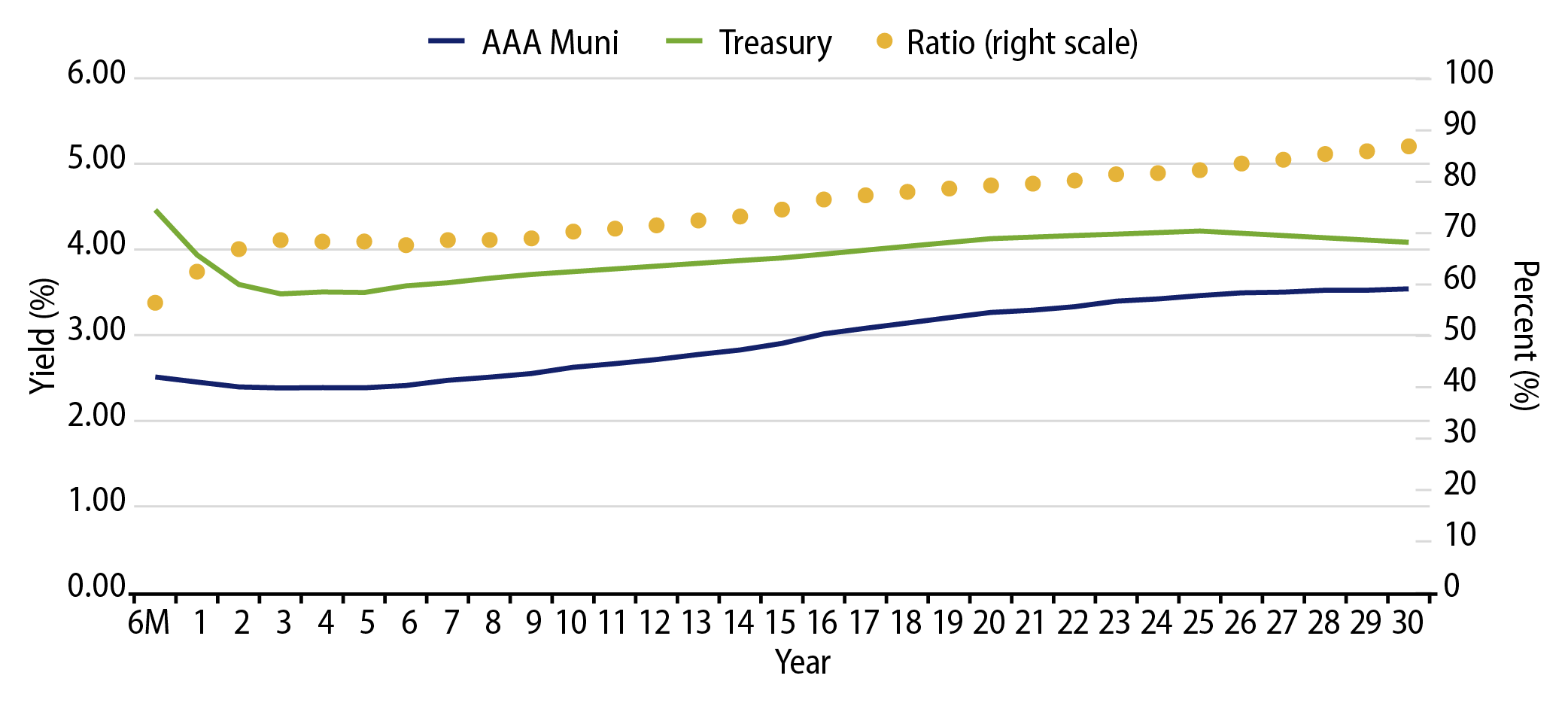

Western Asset believes that the longer-duration structure of the municipal asset class offers investors attractive tax-exempt income opportunities today, along with the potential for additional price appreciation in a potential lower rate environment ahead. In the near term, we expect the Fed cut could have a pronounced impact on the front end of the curve and cash-like investment products (such as money market funds and CDs), which could add an improved demand tailwind to the municipal asset class should the over $6 trillion from these products flow to attractive after-tax yield opportunities offered by munis.

Municipal Credit Curves and Relative Value

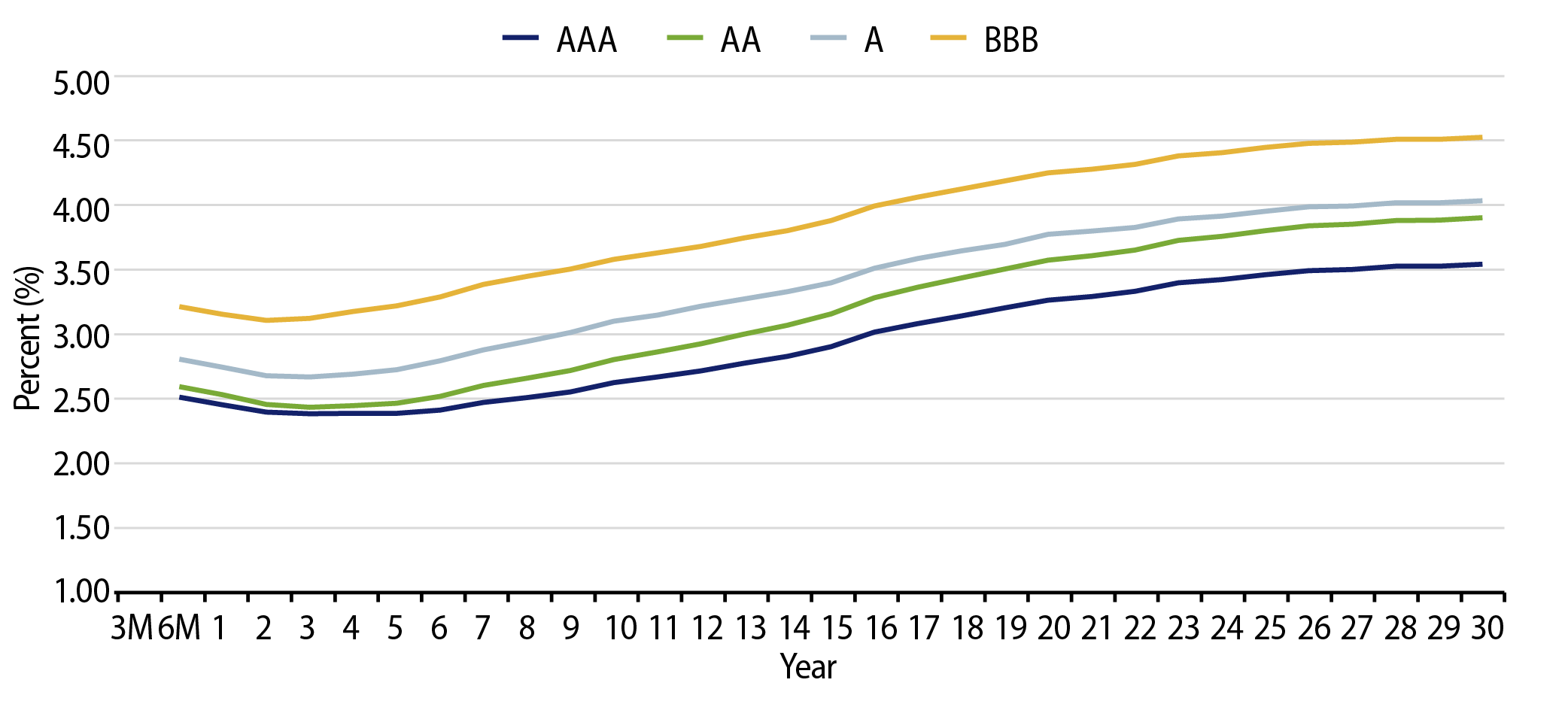

Theme #1: Municipal taxable-equivalent yields and income opportunities are above decade averages.

Theme #2: The muni yield curve has disinverted, offering better rolldown opportunity in intermediate maturities.

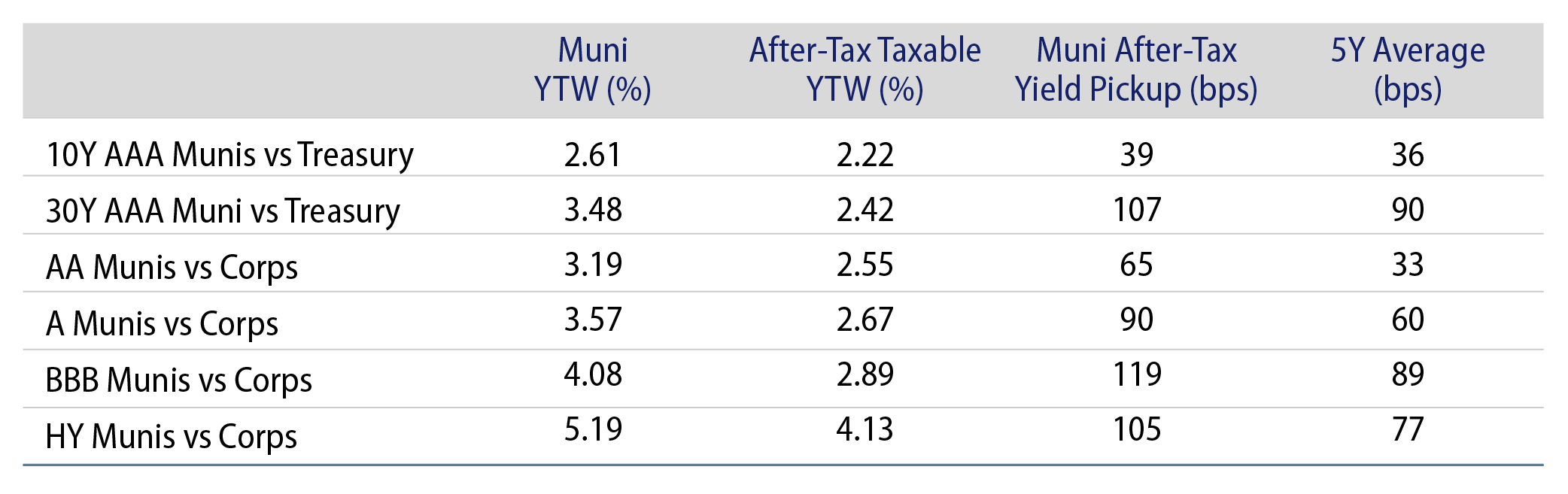

Theme #3: Munis offer attractive after-tax yield pickup versus longer-dated Treasuries and investment-grade corporate credit.