Macros, Markets and Munis

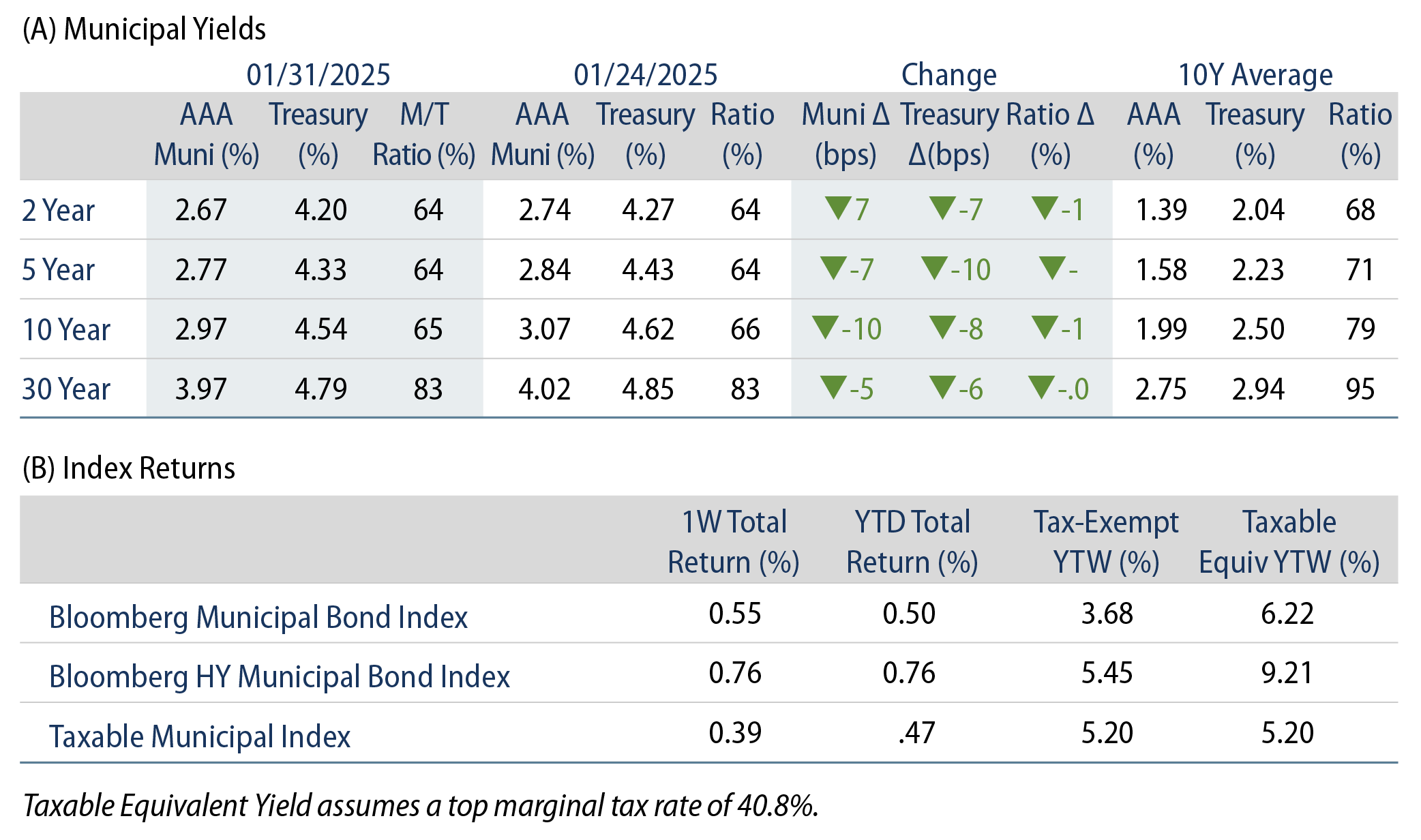

Muni yields moved lower with Treasuries last week and generally outperformed their taxable counterparts amid positive demand conditions. Fixed-income yields moved lower amid a risk-off sentiment in equity markets spurred by DeepSeek AI developments. The Federal Reserve (Fed) left the fed funds rate unchanged, but Fed Chair Powell reiterated that policy remains restrictive which may warrant the need for additional rate reductions. Fourth quarter GDP came in below expectations at 2.3% year-over-year (YoY), continuing a downward trend. Meanwhile, municipal funds recorded inflows amid elevated supply conditions. This week we highlight tax policy rhetoric, which has accelerated following potential proposals put forth by the House Ways and Means Committee.

Technicals Strengthen as Fund Flows Turn Positive

Fund Flows (up $742 million): During the week ending January 29, weekly reporting municipal mutual funds recorded $742 million of net inflows according to Lipper. Long-term funds recorded $520 million of inflows, intermediate funds recorded $123 million of inflows and high-yield funds recorded $335 million of inflows. Last week’s inflows led year-to-date (YTD) inflows higher to $3.4 billion.

Supply (YTD supply of $41 billion, up 19% YoY): The muni market recorded $12 billion of new-issue supply last week, up 24% from the prior week. The muni market has recorded $41 billion of new issuance YTD, and January supply set a record level for a typically quieter month. This week’s calendar is expected to decline to $8 billion. The largest deals include $776 million Dallas Independent School District and $545 million Lower Colorado River Authority transactions.

This Week in Munis: Tax Policy Rhetoric

The municipal market entered 2025 with anticipation of tax policy changes, particularly considering the year-end expiration of the individual income tax provisions within the Tax Cuts and Jobs Act (TCJA). On January 17, the House Ways and Means Committee introduced a menu of potential budgetary measures, including the elimination of tax-exempt interest as a potential revenue raising measure within a broader reconciliation package. According to the proposal, eliminating tax-exempt income could generate $250 billion over 10 years for the federal government.

There have been historical suggestions to repeal the municipal tax exemption, which never materialized. While repealing the tax exemption might seem popular on the surface given the benefits to higher earners, state and local governments rely on the relatively low cost of financing provided by these bonds to fund US infrastructure projects. Proponents of maintaining the exemption argue that repealing it would disincentivize infrastructure investments, lead to higher borrowing costs (with some 10-year estimates exceeding $800 billion), and contribute to higher state and local individual tax rates to cover additional costs. The $25 billion annual federal government savings is also relatively small compared to the overall federal deficit, which exceeds $700 billion. Additionally, there would be complications associated with the potential taxing of existing tax-exempt debt that was sold as tax-free to generate the federal savings.

Western Asset believes that the elimination of the municipal tax exemption is highly unlikely. We anticipate bipartisan opposition to repealing the tax-exempt benefit, as many members of Congress have experience at the state and local levels and understand the benefits of the tax exemption. Western Asset expects the market to focus more on the tax rates associated with the TCJA, as President Trump aims to extend the current tax rates before they are set to increase at the end of the year. The House Ways and Means Committee also proposed other measures, such as eliminating the exclusion of interest on private activity bonds, which may gain more traction than an outright elimination of the tax exemption. The muni market has not reacted significantly to the House Ways and Means Committee’s proposals and has performed in line with taxable fixed-income assets since the proposal was released.

Municipal Credit Curves and Relative Value

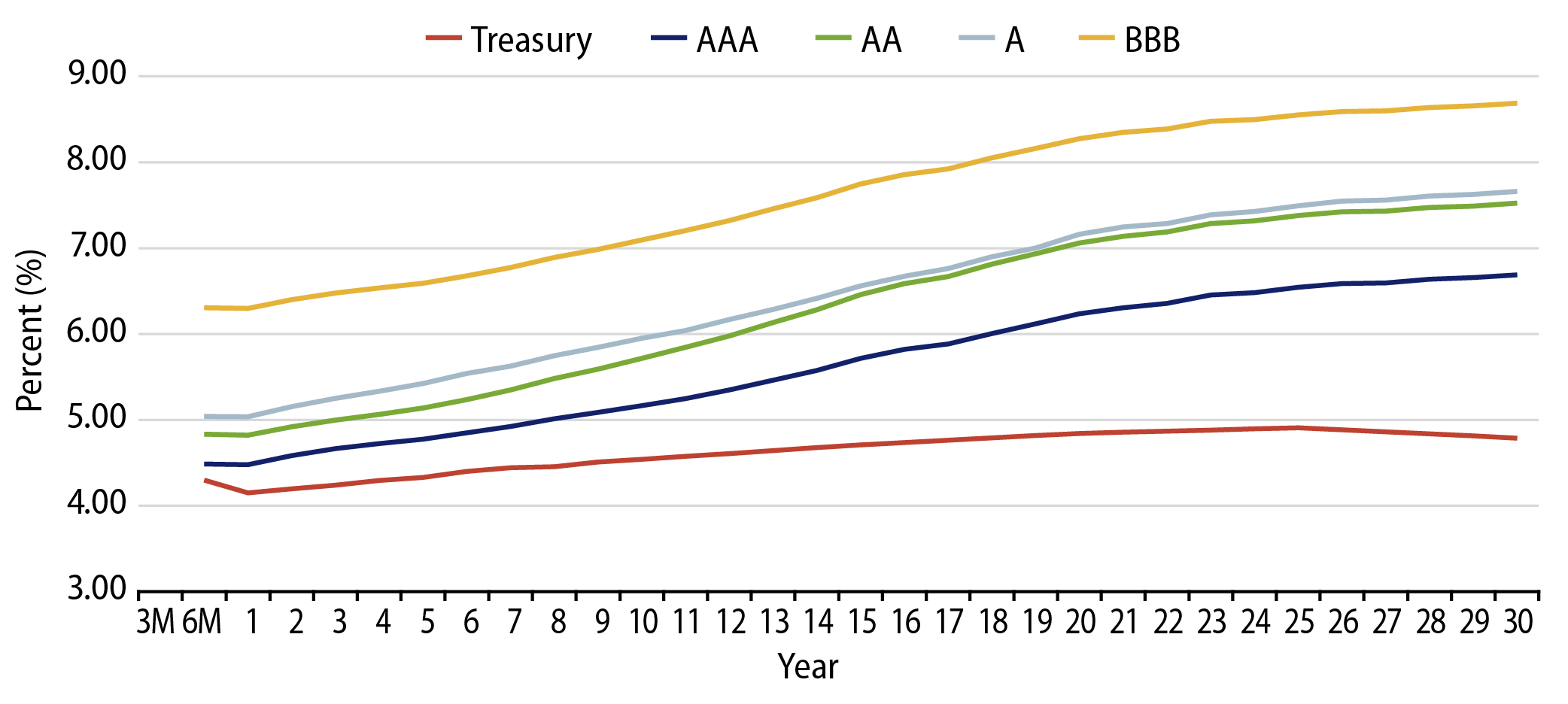

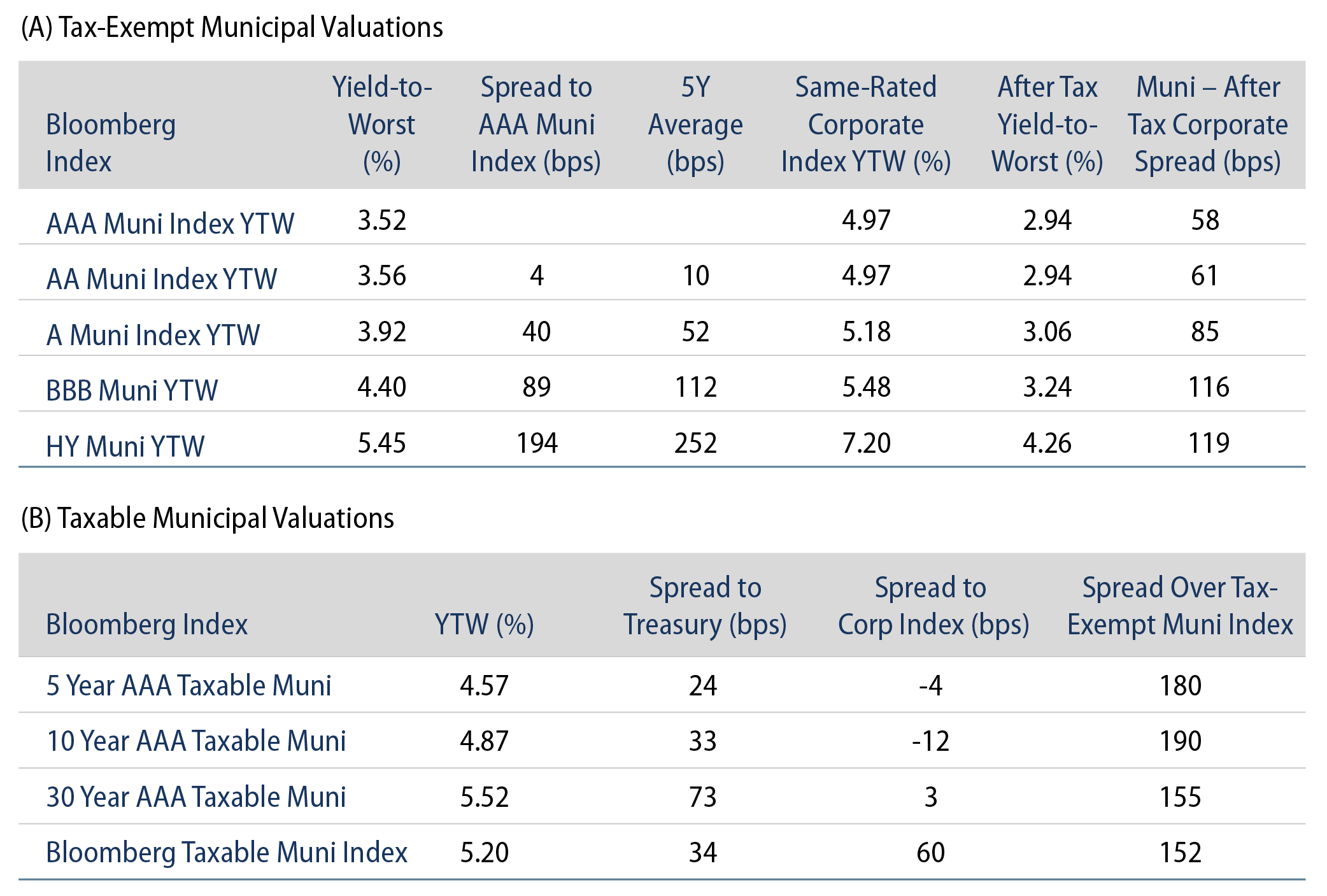

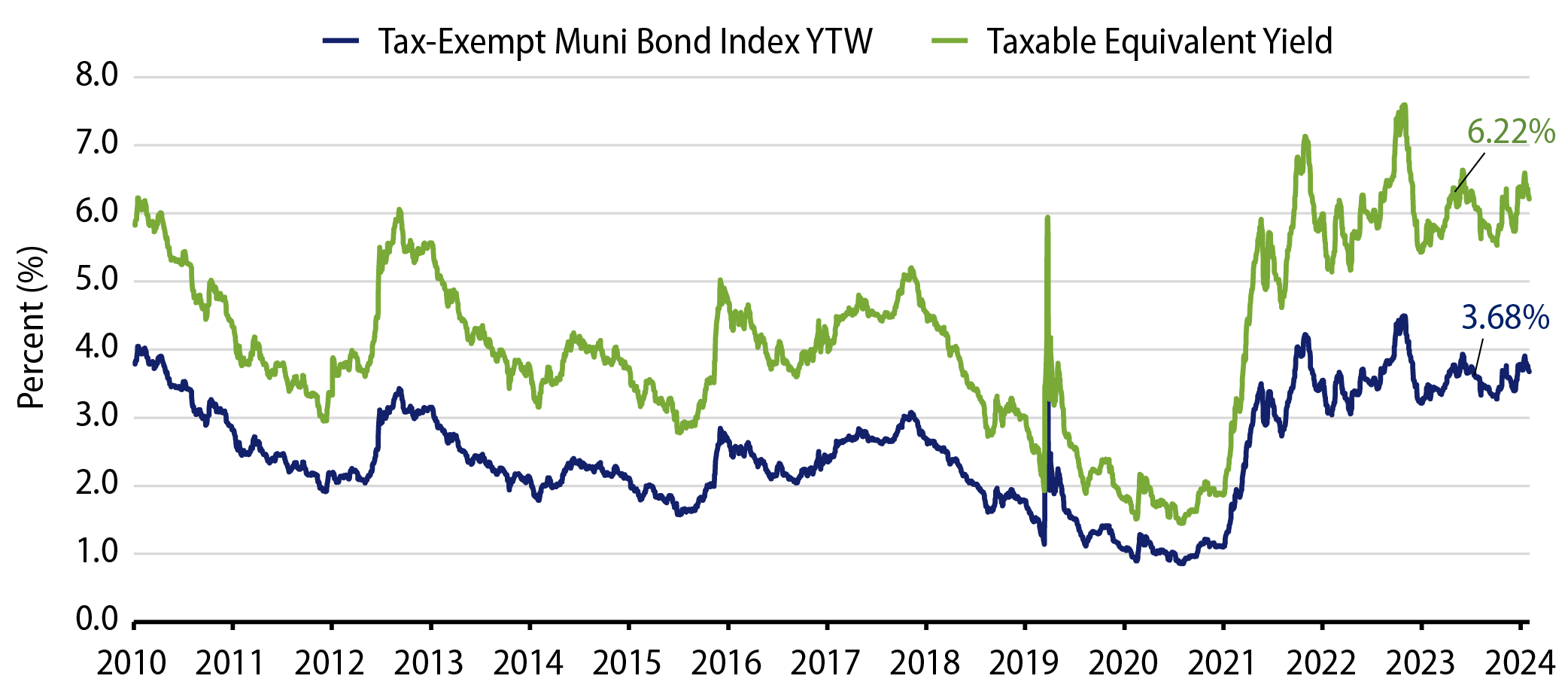

Theme #1: Municipal taxable-equivalent yields and income opportunities remain above decade averages.

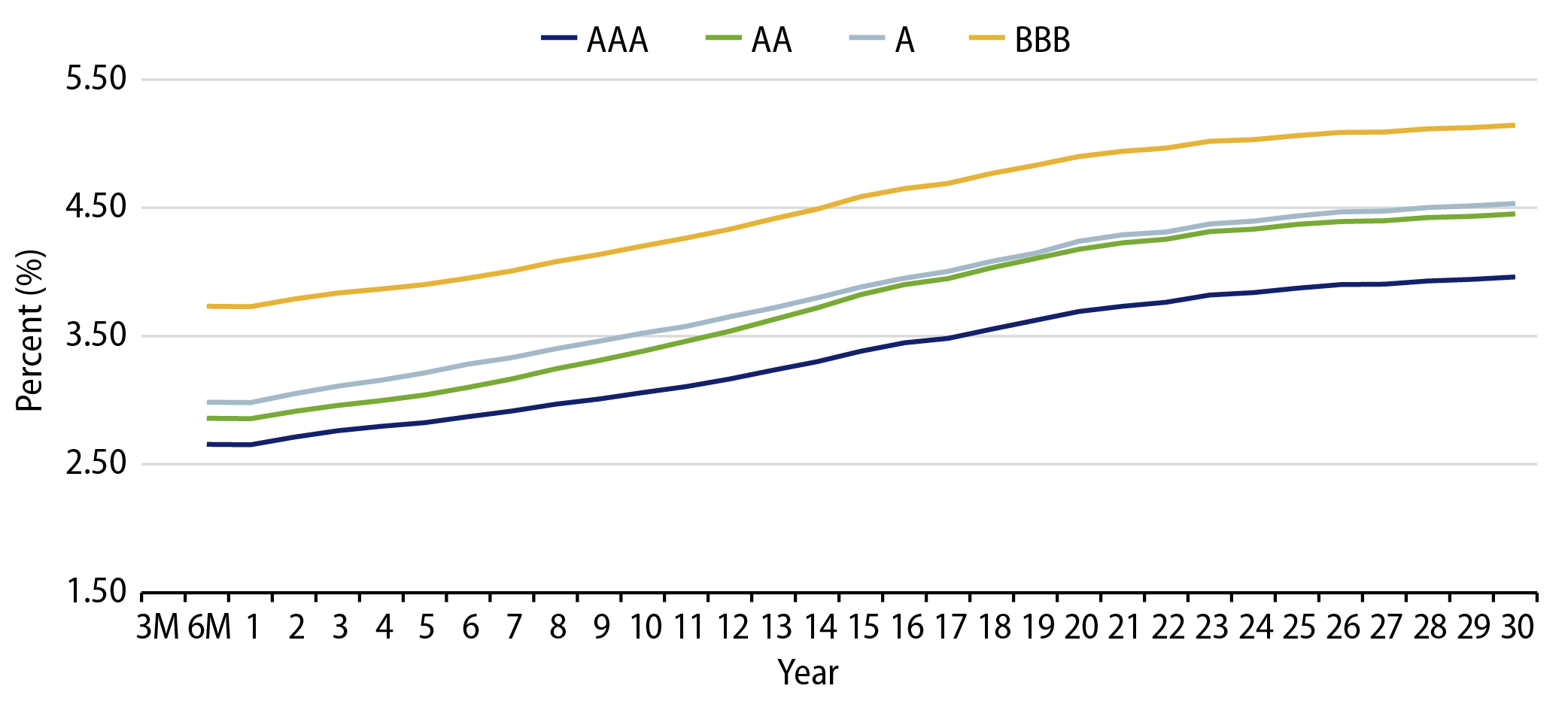

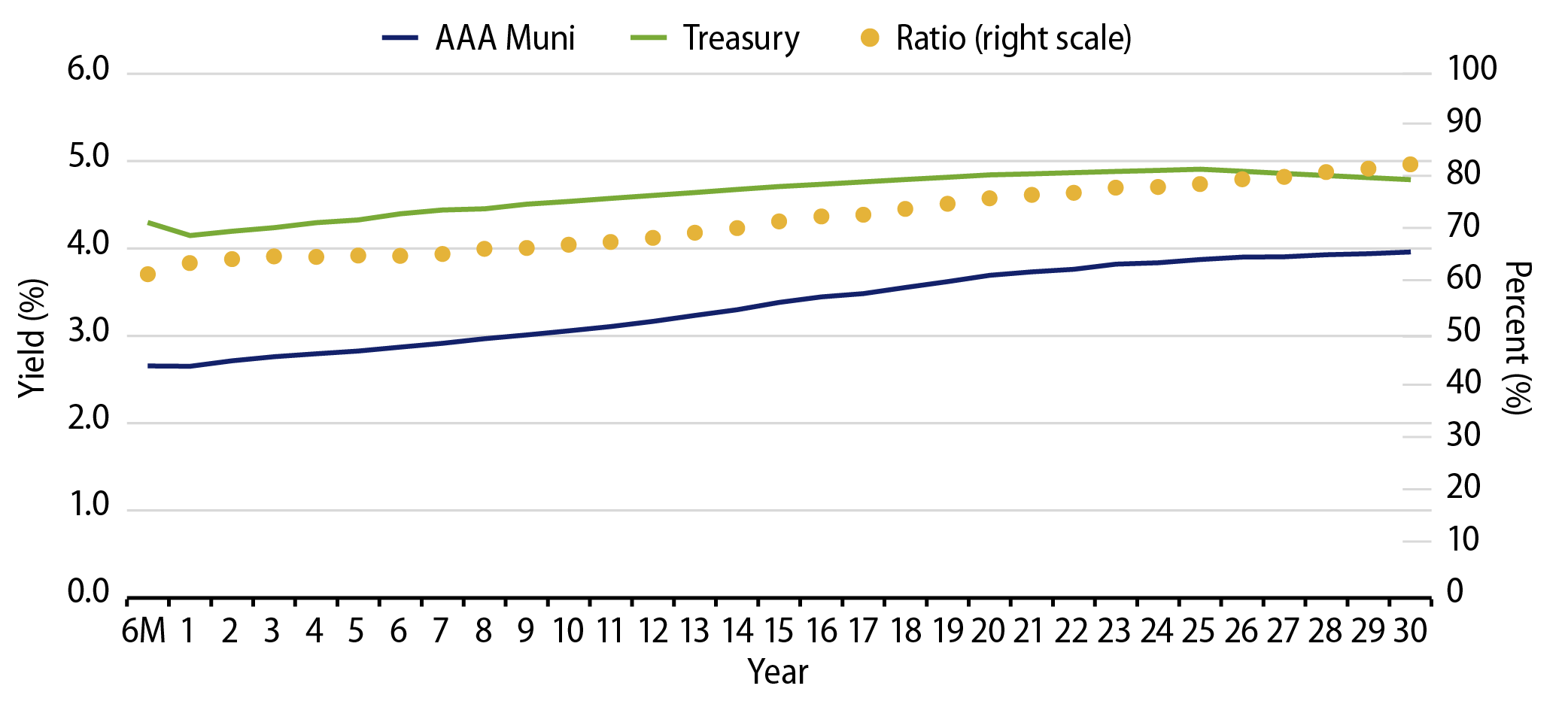

Theme #2: The muni curve has steepened, offering better roll-down value further out the curve.

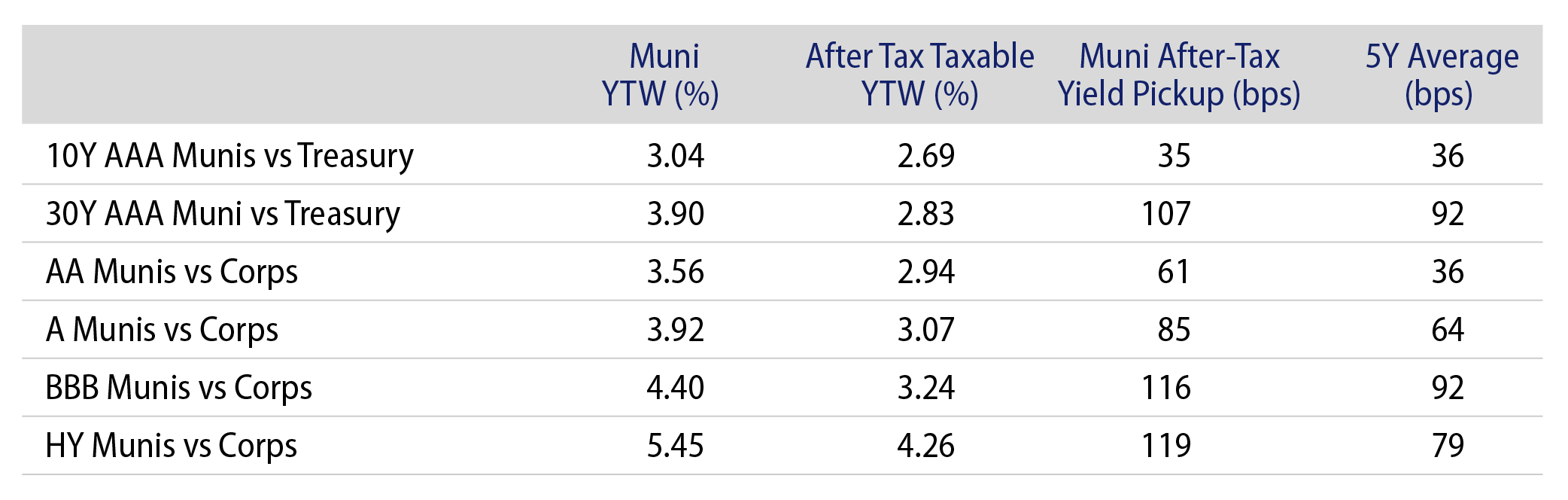

Theme #3: Munis offer attractive after-tax yield pickup versus longer-dated Treasuries and investment-grade corporate credit.