New-home sales rose 20.5% in August from upwardly revised July sales estimates, according to data released today by the Census Bureau. This news comes just a week after an announced -7.0% decline in single-family housing starts. Talk about a mixed message!

Recent reports on the housing market have been mostly downbeat, reflecting high mortgage interest rates, soft sales levels in the existing-home market, and a declining trend in new-home sales through July. The housing starts data were clearly in line with this narrative, but obviously, the new-home sales data are headed in another direction entirely.

We are inclined to be skeptical of the veracity—or, at least, the sustainability—of the August new-home sales data. While mortgage rates have dipped recently, the size of the announced August sales gain is way out of line with preceding history and seems to be way more pronounced than said declines in mortgage rates would suggest.

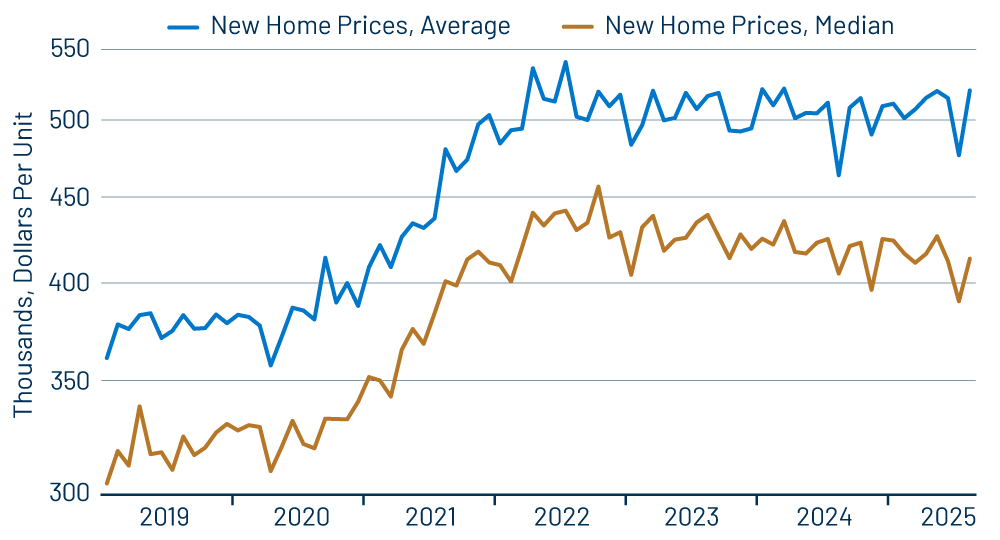

One might also think that perhaps “fire sales” by homebuilders provided an August sales boost. However, as you can see in Exhibit 2, new-home sales prices rose in August, offsetting most of July’s declines. Median sales prices were down slightly on a net basis, while average sales prices were little changed from previous levels. Neither median nor average prices were low enough to explain the sales bounce.

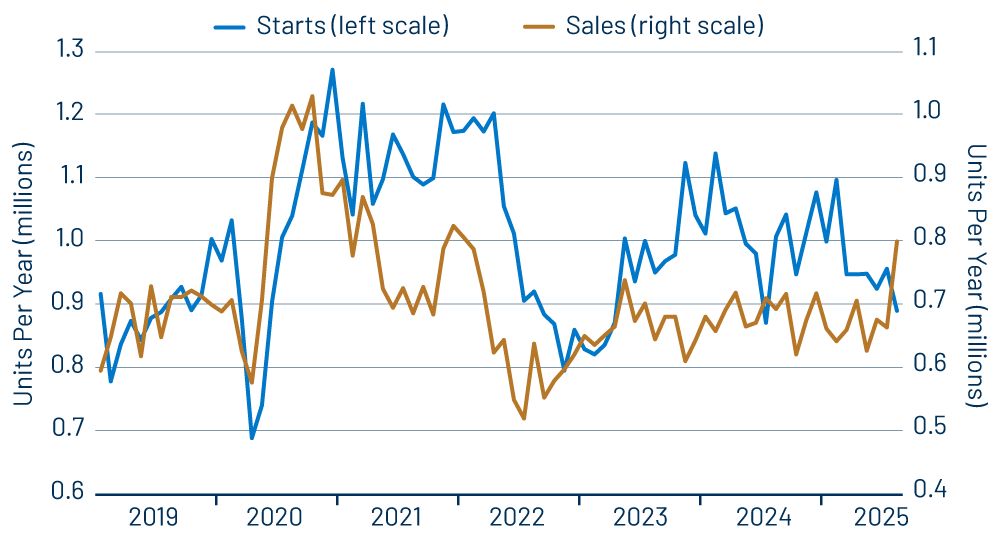

As you can likely perceive, our guess is that these sales levels will be either reversed or revised away when September sales are announced a month from now. However, they are the standing data as of now. Let’s handicap outcomes for the new-home market depending on how the data come out next month. As you can see from Exhibit 1, new-home sales bounced enough that they are “above” August housing starts (allowing for the effects of owner builds, which don’t show up in new-home sales); that is, they are high enough to allow builders to pare down new-home inventories from the extremely high levels reached in July.

First, if new-home sales can sustain similar levels in September to what they are now showing for August, homebuilders will be in much better shape than we thought one month ago. Such levels would allow a gradual normalization in new-home inventories without builders having to cut back sharply on production (i.e., housing starts).

Second, if the September new-home sales release shows a pullback in sales then—but no meaningful downward revision to August sales estimate—then builders’ problems will remain, but at a slightly less intensive level than seemed to be the case a month ago.

Third, if the August sales gains are revised away, and September sales are low as well, then builders are in the same pickle we thought them to be in before today’s data release.

Bottom line: today’s data throw out hope for a soft landing for the new-home industry this year. Coming data will tell us how substantial that hope is.