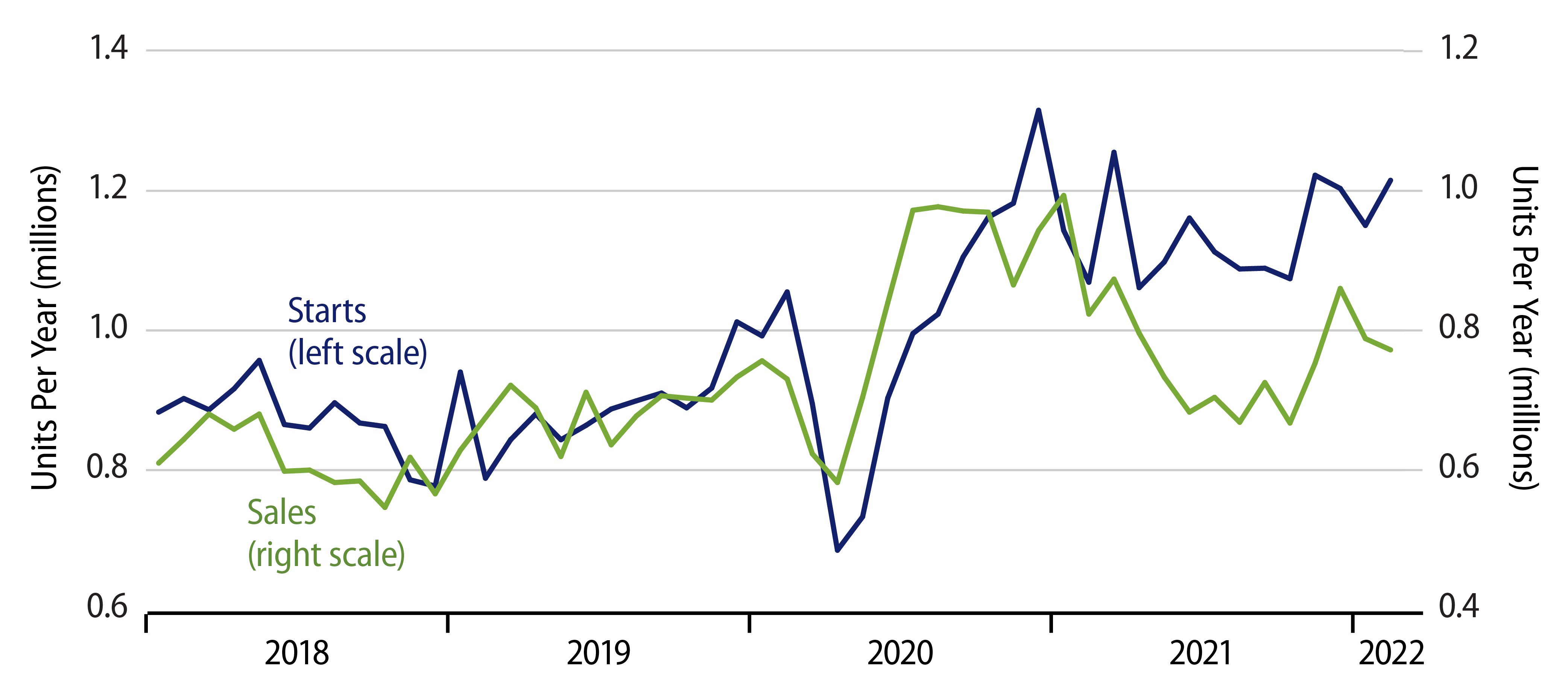

The U.S. Census Bureau announced this morning that sales of new homes declined 2.0% in February alongside a -1.6% revision to the January estimate (although the December estimate was revised up). The reported declines there are in modest contrast to the data on single-family housing starts, which showed a 5.7% increase in February on top of an upward revision to the January estimate. These somewhat disparate strands are plotted in the accompanying chart.

For the last year plus, our take has been that homebuilding would trend steadily lower. While the economy was recovering nicely from the 2020 shutdown-induced recession, we thought homebuilding had overshot its rebound in 2020. We didn’t see what in the demographics had changed due to Covid in a way that could be favorable to household formation trends. Stimulus checks are of little or no value for either qualifying for a mortgage or making ongoing mortgage payments. In addition, job prospects and employment levels had if anything deteriorated in the wake of Covid, so that Gen Xers and Millennials who had continued to live with their parents or in groups during the 2009-2019 post-GFC expansion would continue to do so post Covid. So, following a brief, overdone, post-shutdown bounce, we thought homebuilding would retreat in 2021 and 2022 back to pre-Covid norms.

This is the story that played out over most of 2021, as both housing starts and new-home sales declined steadily and fairly sharply. However, both series then saw some further bounce in November 2021 and after. For new-home sales, at least, activity has since begun to subside again. However, starts have remained elevated over the last four months.

Said start elevation is most noticeable in the South, where over half of US homebuilding takes place and which has benefited most from the ex-urbanization following the 2020 Covid shutdown. Starts also remain somewhat elevated in the West as well (which accounts for about 25% of US homebuilding). Meanwhile, with today’s new-home sales data, sales have retreated all the way back to pre-Covid levels in all regions except the South. And even in the South, single-family starts are almost 200,000 units per year above pre-Covid levels, while new-home sales are “only” 60,000 units per year above pre-Covid levels.

In other words, starts remain enough above sales levels to keep inventories of unsold new homes rising pretty much everywhere. Inventories have held at six months’ worth of sales even since last summer, compared to long-term norms of about four months’ sales.

Our best guess is that starts will begin to retreat again in coming months, to bring them back in line with sales and to prevent an inventory glut in the new-home market. Still, we have to acknowledge that the starts data have been at odds with this assessment for the last four months.