Spread sectors have delivered strong performance this year, but valuations are tight. Across five- and 10-year ranges, spreads are near historical lows. As we enter 2026, the focus shifts to identifying compelling opportunities, monitoring underappreciated risks and positioning Multi-Asset Credit (MAC) strategies to navigate a market still supported by strong fundamentals yet increasingly shaped by late-cycle dynamics.

Where We See Opportunities in Credit

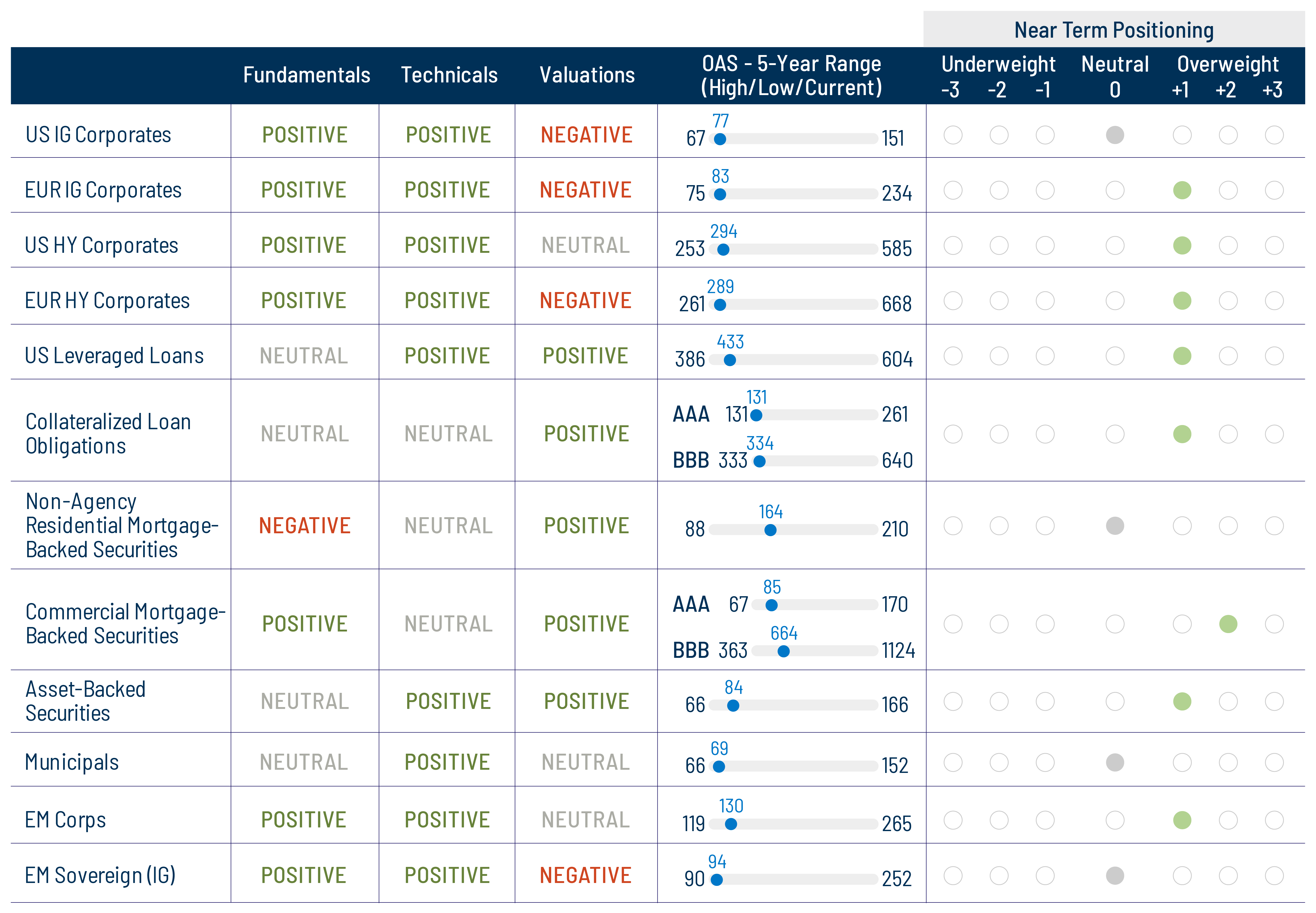

Structured Credit: We continue to favor structured credit, with a preference for commercial mortgage-backed securities (CMBS) over residential MBS (RMBS) given relative value and clearer visibility into fundamentals. Demand for on-the-run CMBS remains robust, and 2026 may have the potential to surpass post-2008 records for non-agency CMBS issuance. While liquidity has improved across the commercial real estate (CRE) capital stack, CMBS remains the primary refinancing channel for maturing loans. Fundamentals are stable to improving across most property types, though we remain cautious on hospitality assets targeting mid- and lower-income consumers. Beta to broader credit has risen, but spreads remain wide further down the capital structure. Our focus is on high-quality carry with lower correlation to growth or rate volatility, including multifamily (CRE CLO and single-asset/single-borrower (SASB)), self-storage, high-quality office, data centers and strong retail. Seasoned, shorter-tenor credits may also offer attractive total-return potential with embedded downside protection.

High-Yield (HY) Corporate Credit: The HY space continues to present compelling relative value versus equities and other higher-volatility alternatives. Currently, spreads adequately compensate for expected defaults, roughly 4% on an issuer-count basis and 2% on a par-weighted basis. Leverage and coverage metrics remain resilient, and management teams are behaving conservatively as growth moderates. Institutional and retail demand is robust, and increased M&A activity is supporting incremental spread compression. About 70% of primary market issuance this year has been tied to refinancing, pushing maturity walls further out. Our cyclical bias remains, with overweights in airlines, copper producers, and E&P and midstream energy credits, where yield premiums remain attractive.

Investment-Grade (IG) Credit: Even at tight spreads, US IG credit can provide high-quality income, liquidity and relatively stable risk-adjusted returns for MAC portfolios. Opportunities remain across the global banking system, where steeper yield curves have supported profitability. An overweight in banks offers a defensive way to play offense, given attractive asset quality, high capital levels and a robust regulatory backdrop. Corporate fundamentals across IG issuers have been broadly resilient. Technicals in 2026, however, may face pressure from increased net supply driven by AI-related capex—lifting tech and media to roughly a third of issuance—and a growing M&A pipeline, which often raises leverage and modestly widens spreads for acquisitive borrowers. Foreign demand has held up despite elevated hedging costs, but potential supply-driven concessions could create attractive entry points for our IG credit team. Large technology, AI infrastructure, data and energy transition companies may issue at scale, offering opportunities to participate in marquee IG names with potential spread tightening.

Leveraged Loans: The loans space delivered steady, carry-driven returns in 2025, though floating-rate structures lagged fixed-rate credit amid rising expectations for Federal Reserve (Fed) rate cuts. A 2026 environment defined by marginal policy easing, stronger M&A-driven issuance and stable fundamentals should support outperformance relative to tighter fixed-rate alternatives. We favor BB/B loans, with a tilt toward single-Bs, for attractive risk-adjusted carry. Loans currently offer mid-7% yields with minimal duration risk, and any market volatility is likely to present buying opportunities.

Collateralized Loan Obligations (CLOs): CLOs have delivered strong year-to-date performance on a risk-adjusted basis. AAA tranches are up over 5%, with BBB and BB tranches up 7% to 8%. Combined with a moderately hawkish Fed tone, this supports CLOs in 2026. While supply remains heavy, increased loan issuance should balance CLO formation and collateral availability. We favor AAA and BBB tranches, particularly shorter tenors, and remain constructive on BBs with 9% to 10% yields. Select equity in seasoned deals with refinancing optionality also appears attractive.

Emerging Markets (EM): The macro backdrop for EM continues to support a structural alpha story. Inflation is trending lower and fundamentals remain broadly intact. While growth is mixed, low debt-to-GDP levels provide room for modest fiscal expansion. A gradually weakening US dollar as the Fed makes cuts while other G10 central banks pause should add an additional tailwind to EM. The asset class currently offers high real yields in areas such as Latin America and South Africa, selective opportunities in frontier markets and attractive Sharpe ratios across Asia. The asset class also offers incremental spread pickup versus like-rated IG and HY credit, meaningful diversification within a broad MAC mandate and supportive technicals from steady inflows.

Key Risks We’re Watching

Private Credit Spillover: While refinancing needs for loans and HY credit have been pushed out, private credit faces a nearer and more concentrated maturity wall. Individual stresses are frequent, and although many are idiosyncratic, deterioration in private credit could spill over into broader markets. We view this as a low-probability risk but are monitoring forward-looking indicators including coverage trends, underwriting quality, capital flows and deal-level fundamentals.

Macro Factors: Monetary and fiscal policy are currently procyclical. The Fed is easing into an economy with ongoing momentum, while fiscal policy remains aimed at supporting above-trend demand, keeping recession risk relatively low. The labor market remains the key swing factor. Unemployment has edged higher and most labor indicators lag, so persistent deterioration could lift recession probabilities from today’s low starting point. Bottom-up signals from corporate management teams remain reassuring but warrant monitoring. Meanwhile, inflation is still above the Fed’s 2% target but far less burdensome for consumers than in prior years. Oil prices remain a potential swing variable, and geopolitical flare-ups could amplify volatility. Tariffs have not yet materially impacted aggregate inflation, but previously absorbed costs or inventory buffers may begin to pass through to consumers in the new year.

Additional Market Risks: Several cross-asset risks deserve ongoing monitoring:

- Geopolitical uncertainty that could influence energy markets or global trade,

- China-related spillovers, including property market deterioration, commodity demand shifts and broader EM growth effects,

- Election and policy-related volatility heading into 2026, particularly around fiscal policy, regulation and trade,

- Refinancing risk if the Fed slows or pauses its rate-cutting cycle,

- Liquidity risk tied to thinner dealer balance sheets and ETF-driven flows,

- Credit-rating migration risk, particularly among IG credit issuers increasing capital expenditures related to AI, data center buildouts and energy transition projects and

- Overbuild risk in AI-related capex among large IG credit issuers, which could lead to higher leverage than markets currently expect.

None of these risks are in our base case, but they remain important considerations as MAC strategies seek to capture carry, stay responsibly invested and maintain flexibility for sector rotation opportunities.