Macros, Markets and Munis

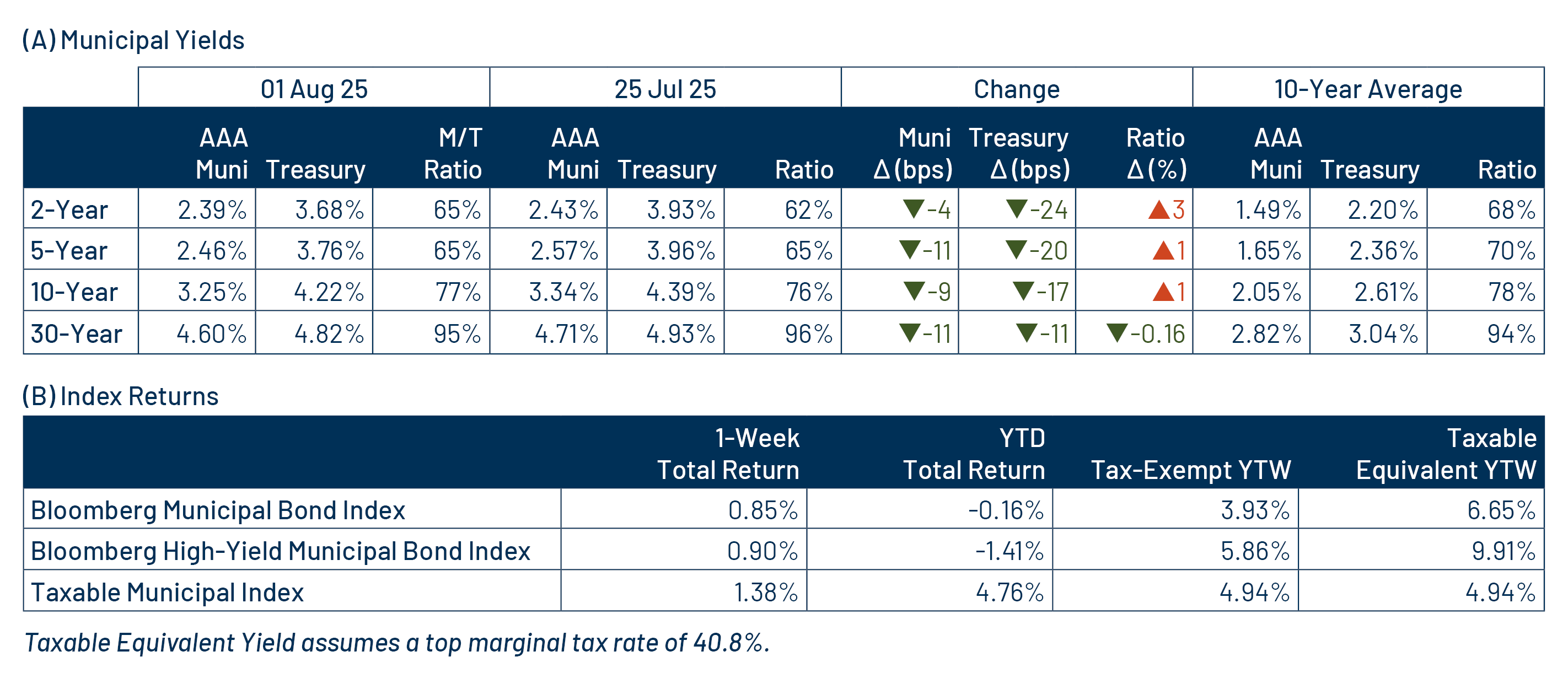

Municipals posted positive returns last week but generally underperformed Treasuries, which moved lower across the curve following the jobs data release. High-grade municipal yields trailed Treasuries lower but generally underperformed amid elevated supply conditions. Fixed-income markets navigated a packed economic calendar, as GDP and core Personal Consumption Expenditures (PCE) data came in stronger than expected last Wednesday ahead of the Federal Open Market Committee’s decision not to cut interest rates. Market sentiment shifted Friday as the nonfarm payrolls report indicated July’s payrolls fell below expectations, and notably included a sharp 258,000 downward revision for the prior three months. Meanwhile, muni technicals strengthened as funds recorded inflows. This week we touch on the significant muni curve steepening that took place this year.

Technicals Improve as Fund Flows Accelerate

Fund Flows (up $973 million): During the week ending July 30, weekly reporting municipal mutual funds recorded $937 million of net inflows, according to Lipper. Intermediate funds recorded $573, short and short/intermediate funds recorded $212 million, long-term funds recorded $202 million and high-yield funds recorded $44 million of net inflows. Last week’s inflows led year-to-date (YTD) inflows higher to $16 billion.

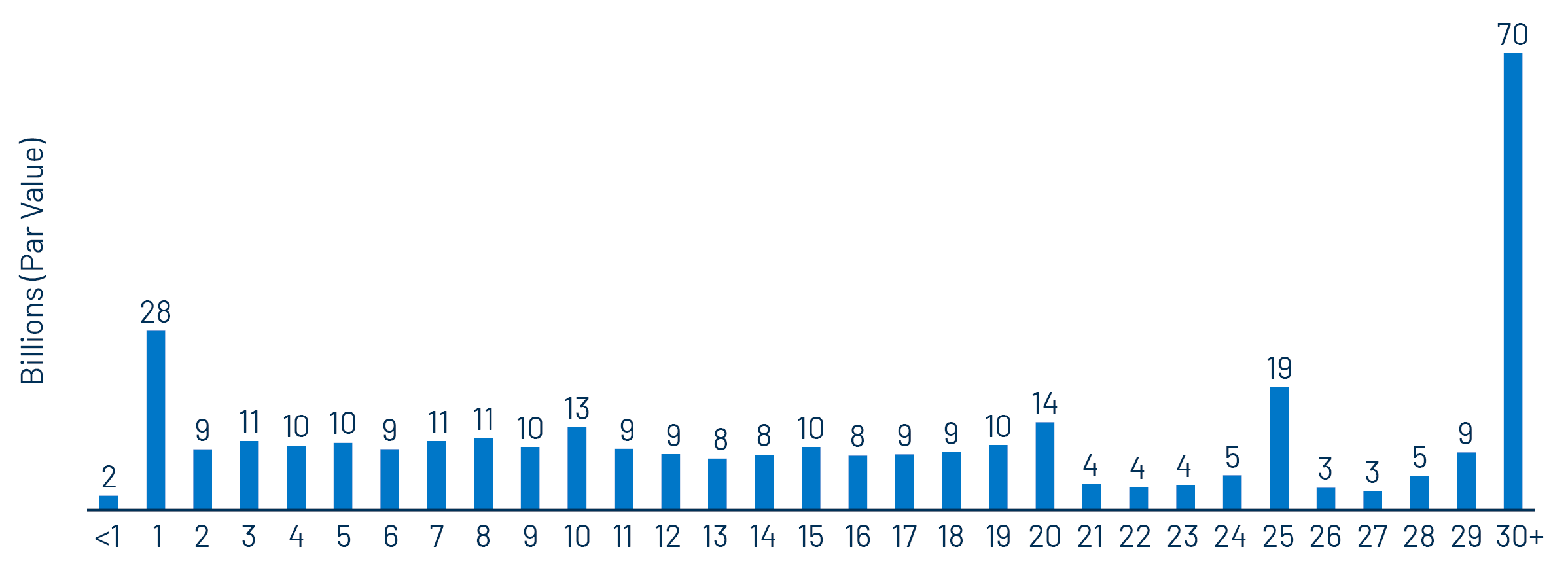

Supply (YTD supply of $341 billion; up 25% YoY): The muni market recorded $14 billion of new-issue supply last week, down 6% from the prior week. YTD new-issue supply of $341 billion is 25% higher than the prior year, with tax-exempt issuance up 26% year-over-year (YoY) and taxable issuance up 6%, respectively. This week’s calendar is expected to remain elevated at $17 billion. The largest deals include $985 million Brightline Trains (FL) and $1.8 billion New York City General Obligation transactions.

This Week in Munis: Yield Curve Steepening

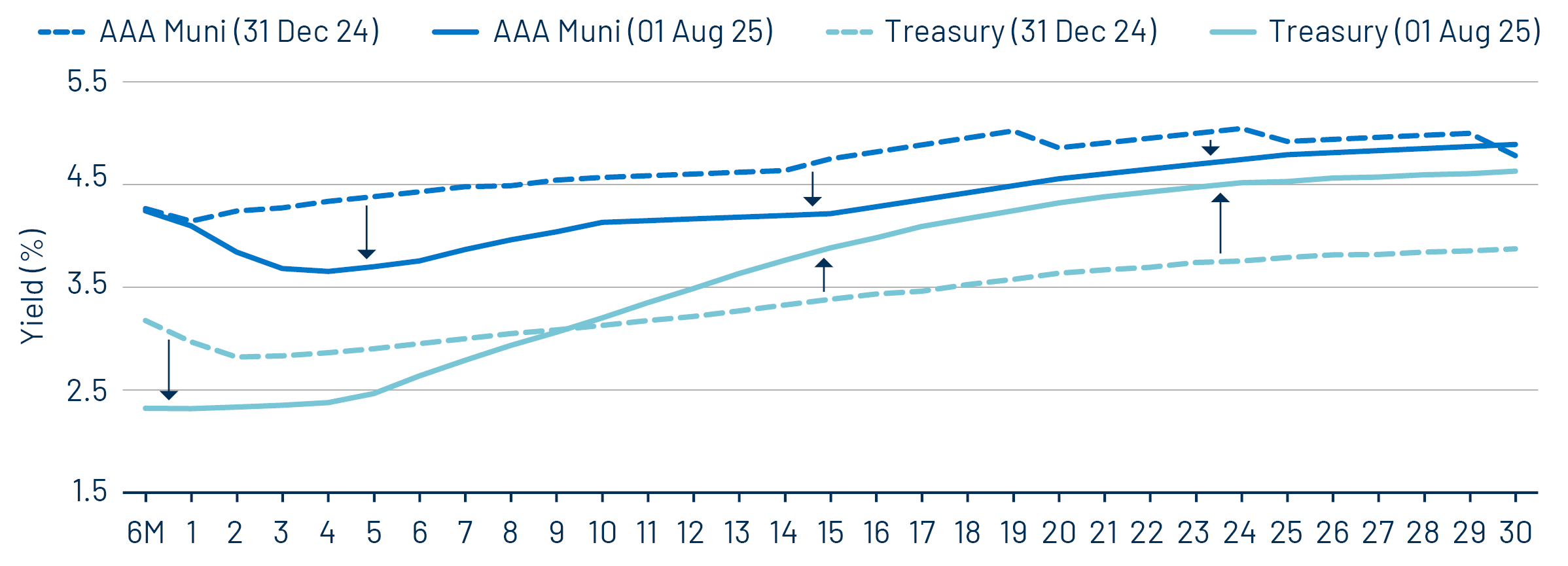

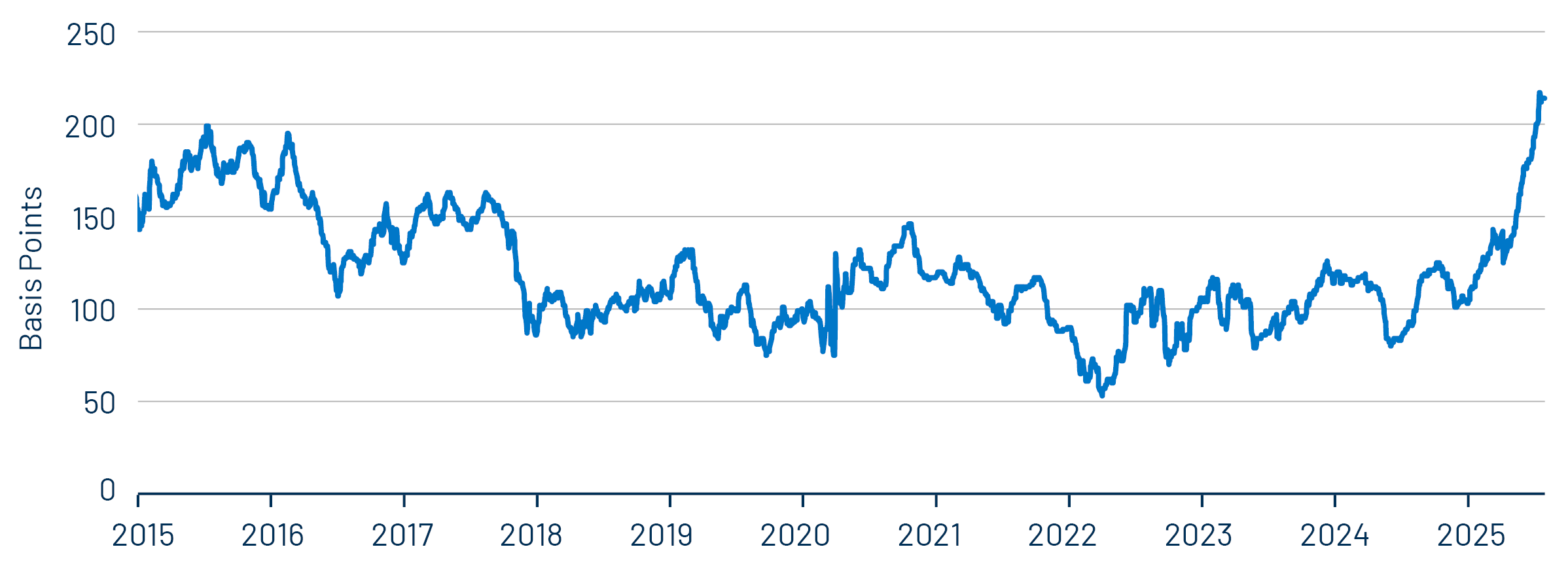

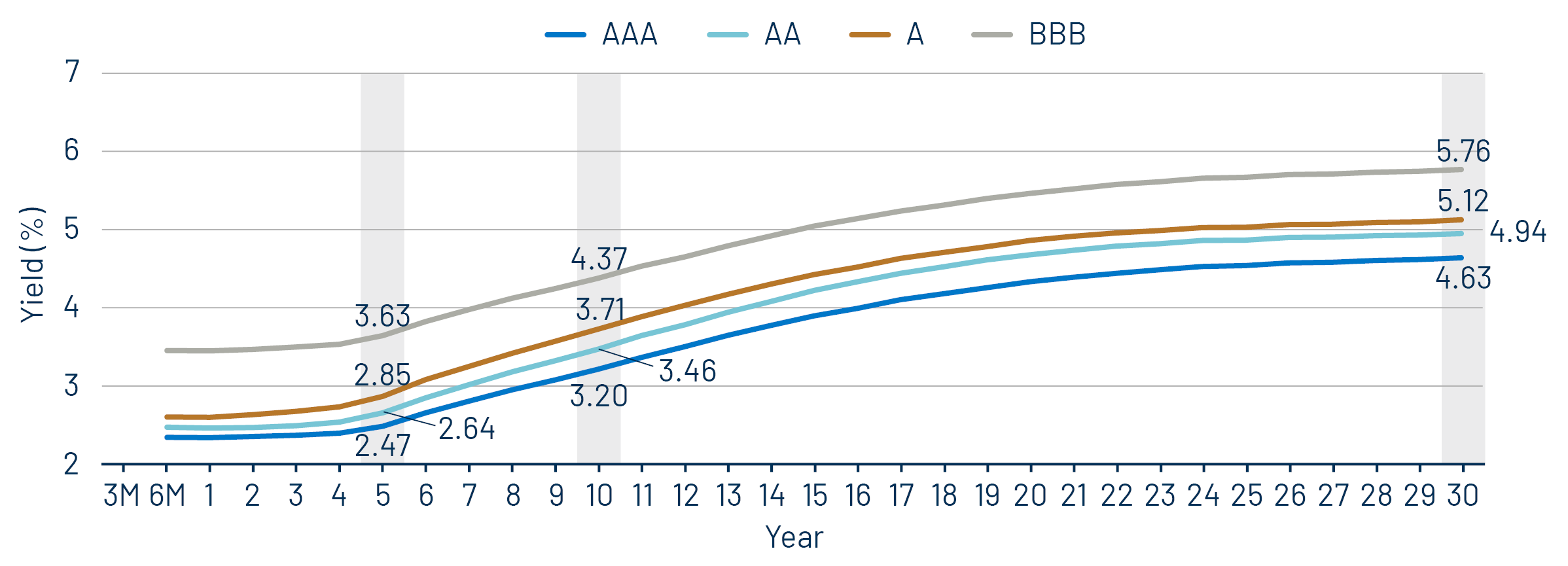

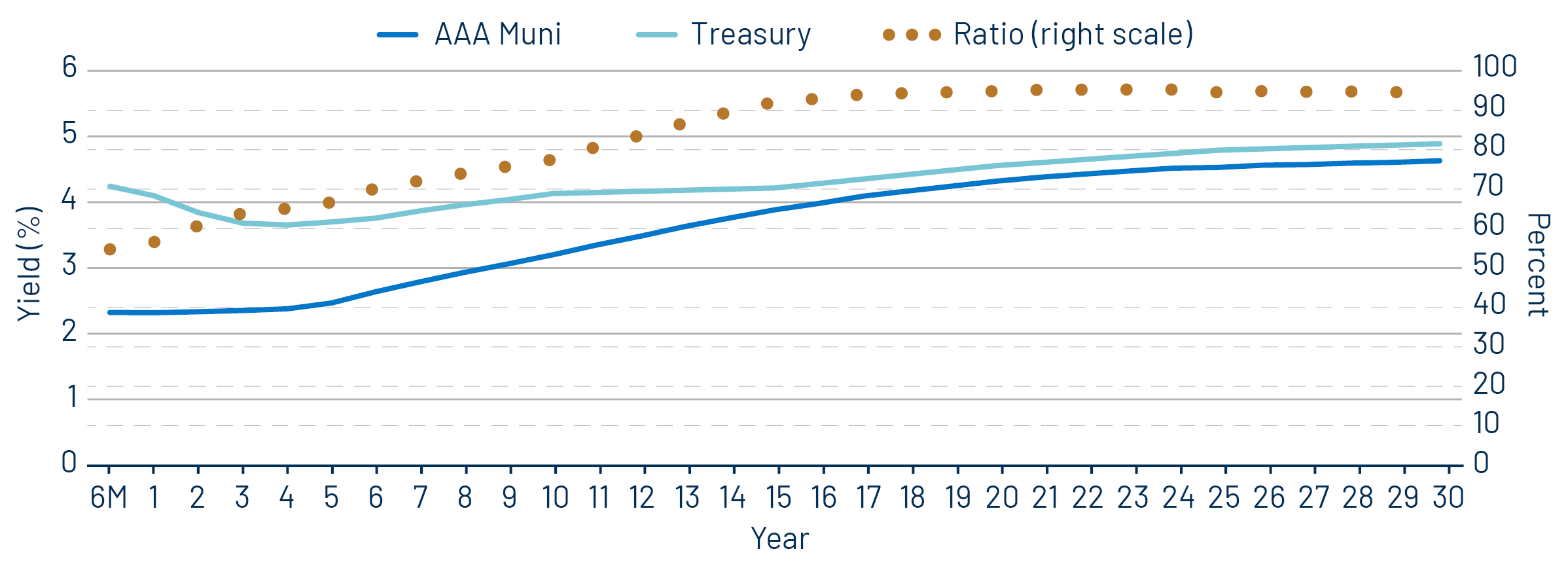

A significant development in the muni market this year has been the sharp steepening of the high-grade municipal yield curve. Despite Treasury yields moving lower across most maturities this year, the muni yield curve only moved lower inside of 10 years, while shifting materially higher (up to 76 bps) in longer maturities. From a historical perspective, the yield differential between the 30- and the 5-year AAA municipal bond, the 5s/30s spread, increased from 103 bps at year end to a decade-high level of 217 bps in July.

Western Asset attributes the muni yield curve steepening to the shifting supply and demand technicals that have been pronounced within the muni market this year. Demand for muni mutual funds, a primary consumer of longer-duration municipal securities, has been relatively lackluster with Morningstar data indicating $2 billion of net outflows from the long category over the first half of 2025. Meanwhile, positive muni demand has largely been contained within shorter and intermediate maturities, driven by mutual funds ($6 billion of short category inflows in 1H25), as well as separately managed accounts (SMAs) that typically invest within 1- to 15-year maturities. While demand has been frontloaded YTD, the record muni new-issue supply observed this year has been backloaded, further pressuring longer duration valuations this year.

The significant yield curve steepening has provided opportunities for long-term investors that can benefit from higher tax-exempt income and potentially attractive total returns associated with rolldown opportunities. These municipal curve dynamics represent just one of the many levers an active manager can navigate to deliver after-tax relative value within the municipal market. As such, Western Asset seeks to deliver active solutions across fund and SMA strategies that can capitalize on these attractive relative valuations in longer maturities.

Municipal Credit Curves and Relative Value

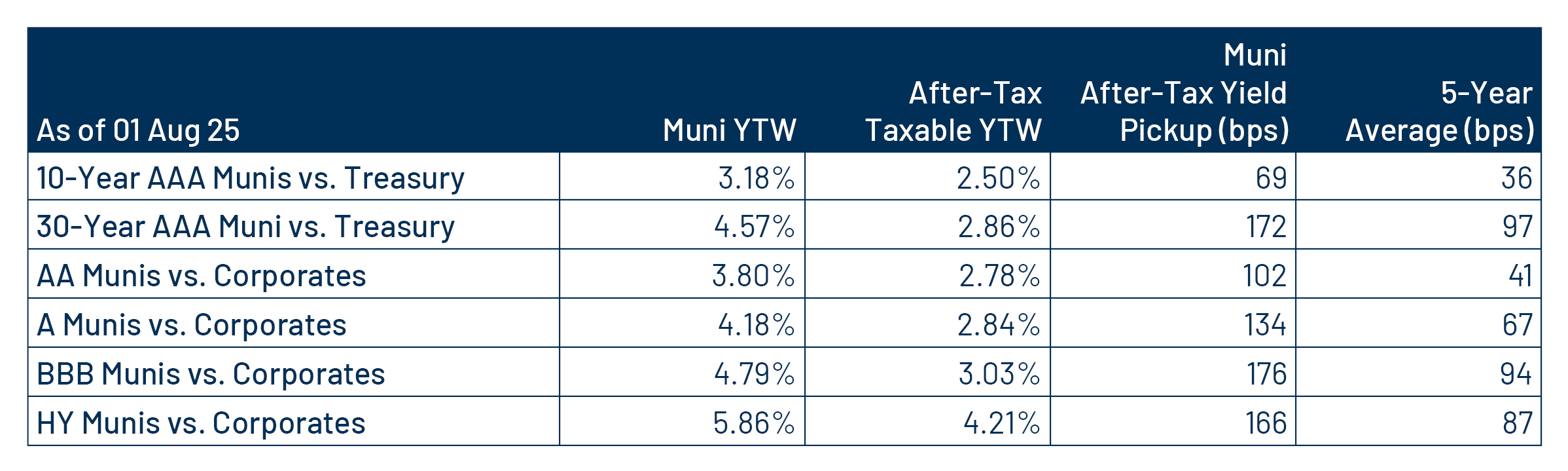

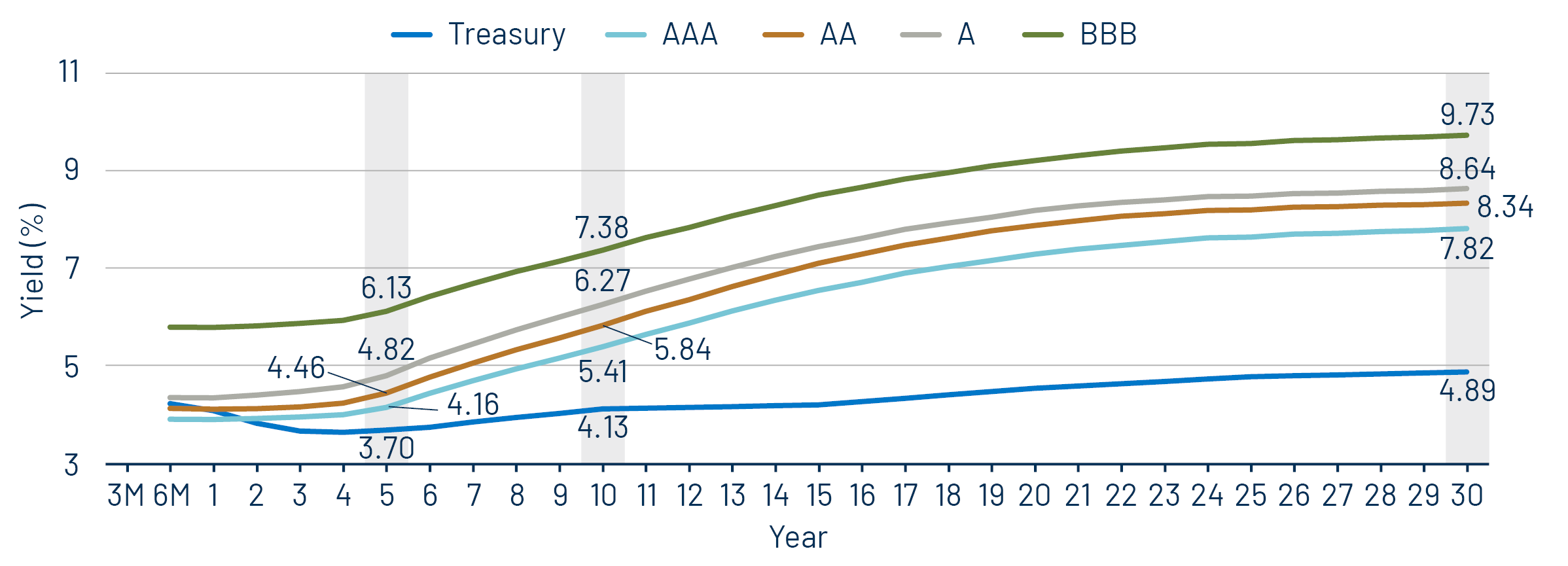

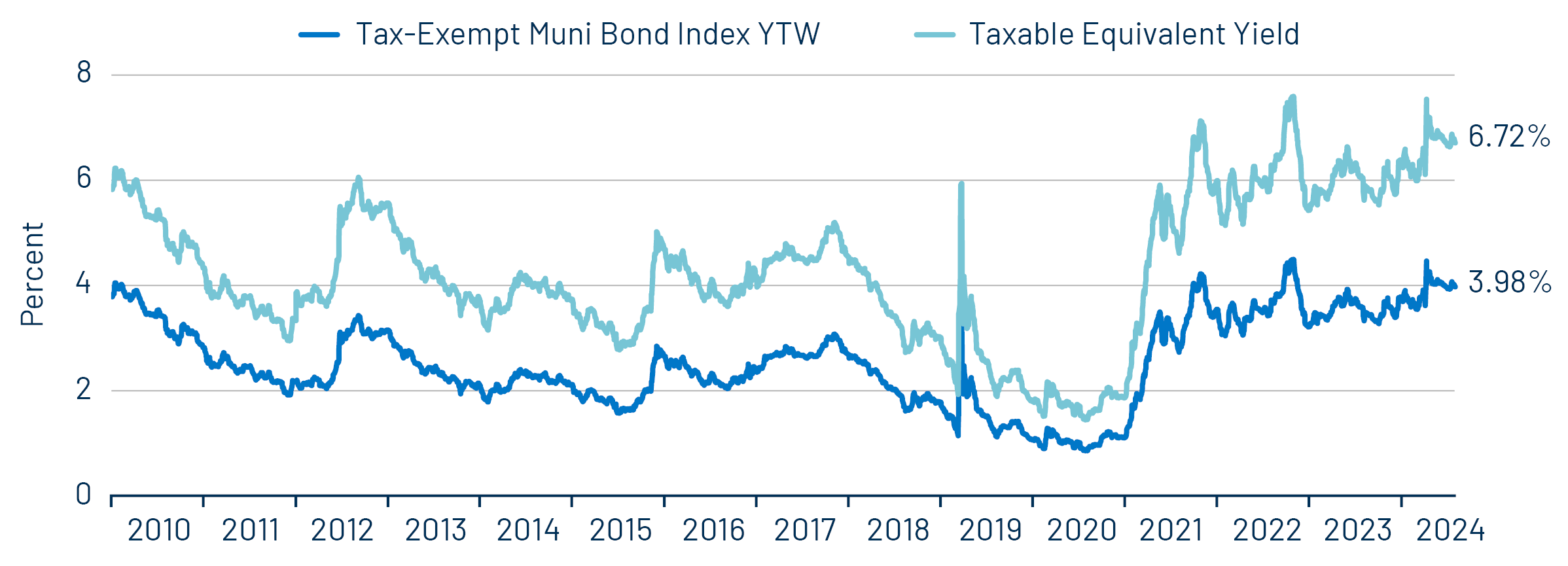

Theme #1: Municipal taxable-equivalent yields and income opportunities remain near decade-high levels.

Theme #2: The AAA muni curve has steepened, offering better value in intermediate and longer maturities.

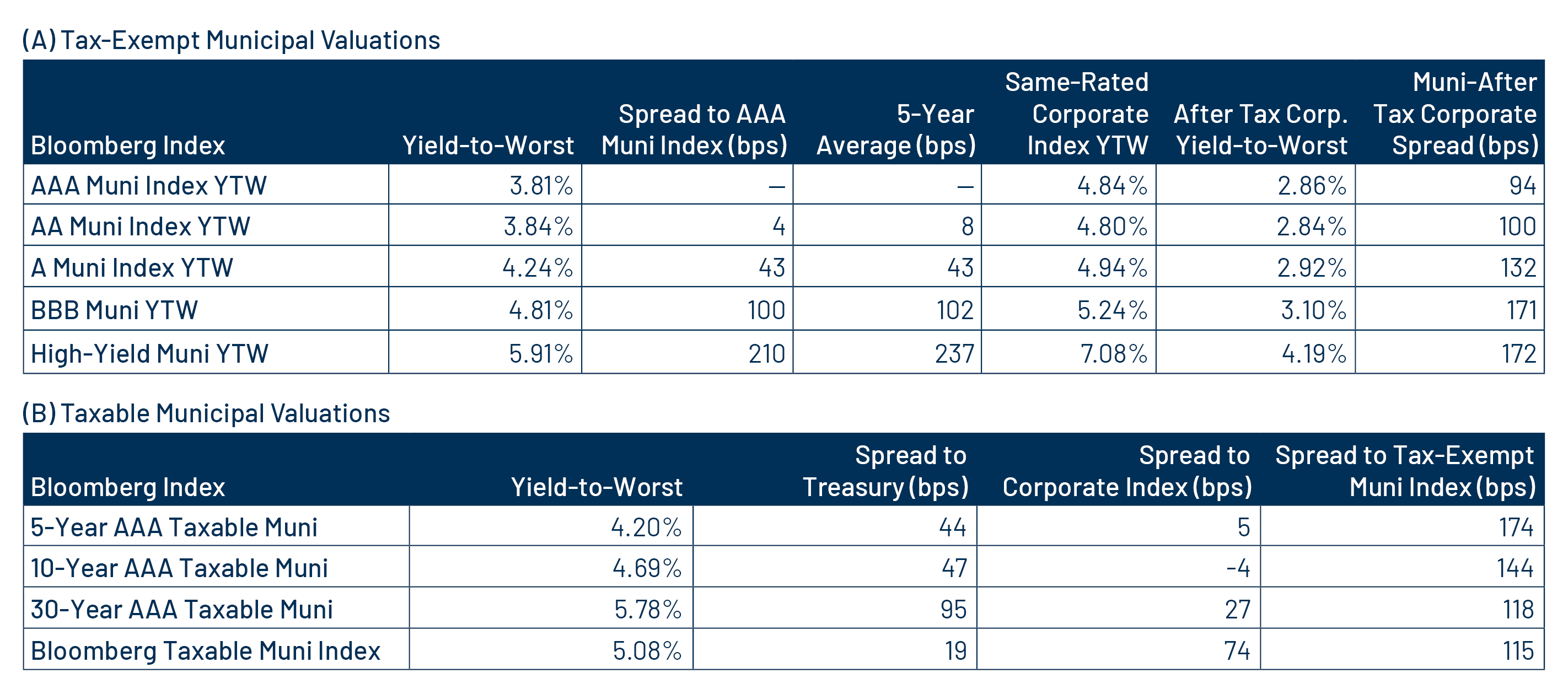

Theme #3: Munis offer attractive after-tax yield compared to taxable alternatives.