Municipals Posted Negative Returns During the Week

US municipals posted negative returns as high-grade yields moved higher with Treasuries. High-grade municipal yields moved 1-8 bps higher across the curve. Municipals generally moved in line with Treasuries, but underperformed in the short end of the curve. Weekly reporting municipal mutual funds continued their positive flow streak. The Bloomberg Municipal Index returned -0.24%, while the HY Muni Index returned -0.10%. This week we highlight implications of California Governor Gavin Newsom’s 2023 fiscal-year budget proposal.

Municipal Technicals Remained Supportive

Fund Flows: During the week ending January 12, weekly reporting municipal mutual funds recorded $231 million of net inflows, according to Lipper. Long-term funds recorded $118 million of inflows, high-yield funds recorded $364 million of outflows and intermediate funds recorded $276 million of inflows. Weekly reporting municipal mutual funds have now recorded inflows 86 of the last 87 weeks, extending the record inflow cycle to $164 billion.

Supply: The muni market recorded approximately $10 billion of new-issue volume during the week. Total year-to-date (YTD) issuance of $12.5 billion is over 2x higher than last year’s levels, with tax-exempt issuance trending 3.6x higher year-over-year (YoY) and taxable issuance trending 2x higher YoY. This week’s new-issue calendar is expected to decline to $7 billion, which remains below recent averages but still sizeable considering the holiday-shortened week. Largest transactions include $950 million New York Transitional Finance Authority and $600 million Maine Street Natural Gas transactions.

This Week in Munis—California Budget

Last week California Governor Newsom introduced a $286 billion budget proposal for fiscal-year 2023. Headline spending initiatives include universal health care, which would cost an additional $2.7 billion annually. The budget also calls for $2.4 billion in additional infrastructure spending and a 12% increase in education spending. Other major initiatives include nearly $4 billion dedicated to the development of zero-emission automobiles, $3 billion for climate change to fight wildfires and address drought conditions, and $2 billion to house and care for the homeless. Finally, Californians will likely get tax rebates again, as they did last year, which could help Newsom politically during an election year.

Newsom seeks to fund these spending increases through the state’s historic $46 billion 2022 fiscal-year surplus, but additional tax increases on large businesses and wealthy individuals are also expected. The Assembly proposed an imposition of a 2.3% gross-receipts tax on large businesses and an increase in the top individual marginal income tax rate to 18.05%, which could be put to voters in November.

High reliance on personal income and capital gains taxes has supported California’s credit profile through the pandemic recovery, and with high reserves and extra pension deposits we believe California has the flexibility to increase spending while maintaining strong fiscal footing. However, increasing tax rates could be problematic for the state’s longer-term demographic trends. California’s population growth rate has been slowing for two decades, and the number of those leaving the state has been increasing more recently. From 2010 to 2020, 1.3 million more people left California for other states than arrived in California from other states. Net international immigration had partially offset negative total net migration trends early in the decade, but this trend has been slowing as immigration has declined since 2017.

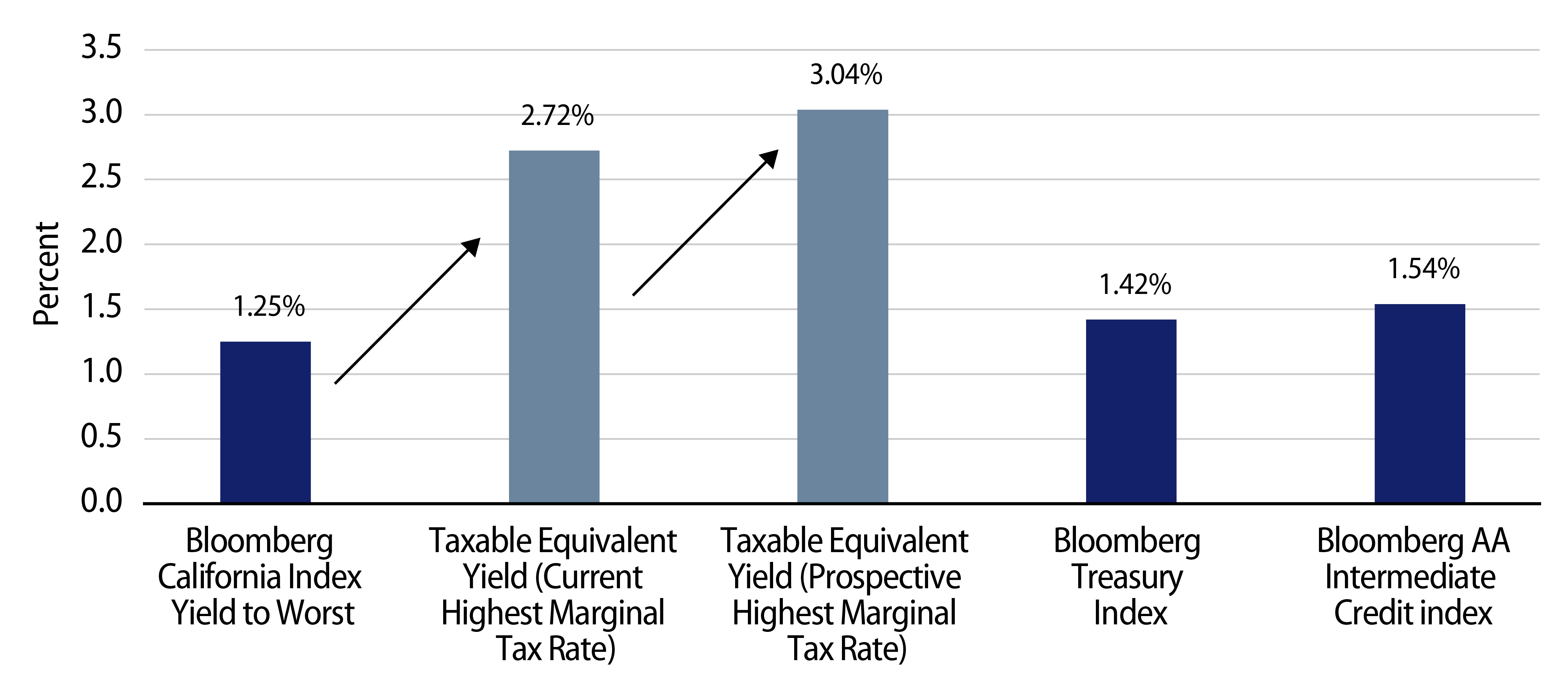

While Western Asset believes most of the recent favorable fundamental trends are priced into current valuations of the state’s credit, increasing top marginal tax rates could increase the appeal for California munis more broadly. At the current highest marginal tax rates, Californians can be subject to a total effective tax rate of up to 54.1%. Considering the tax reform proposal, the top effective rate would increase to 58.85%. Under this new tax regime, the taxable equivalent value of the Bloomberg California Municipal Index yield of 1.25% would increase 12% (+32 bps) to 3.04%. As this is well above other high-quality fixed-income sector yields, we would expect higher taxes in California to increase the already robust demand observed for California municipal debt.