AAA Municipal yields were generally unchanged during the week. Muni technicals softened as intermediate- and long-term fund categories recorded outflows. The Bloomberg Barclays Municipal Index returned 0.02%, while the HY Muni Index returned 0.07%. This week we explore the opportunity emerging in the healthcare sector.

Technicals Continue to Weaken as Fund Flows Slow

Fund Flows: During the week ending September 23, municipal mutual funds reported a 20th consecutive week of inflows at $499 million, or -18.5% week-over-week (WoW), according to Lipper. Long-term funds recorded $33 million of outflows and intermediate funds recorded $15 million of outflows, while high-yield funds recorded $57 million of inflows. Municipal mutual fund net inflows YTD total $20.3 billion.

Supply: The muni market recorded $14.8 billion of new-issue volume last week, up 35% from the prior week. Issuance of $337 billion YTD is 28% above last year’s pace, primarily driven by taxable municipal issuance which comprises over 30% of YTD issuance, while tax-exempt issuance is relatively unchanged year-over-year. We anticipate approximately $10 billion in new issuance this week (-33% WoW). The largest deals include $518 million North Texas Tollway Authority and $434 million State of Louisiana taxable transactions.

This Week in Munis: Healing Healthcare

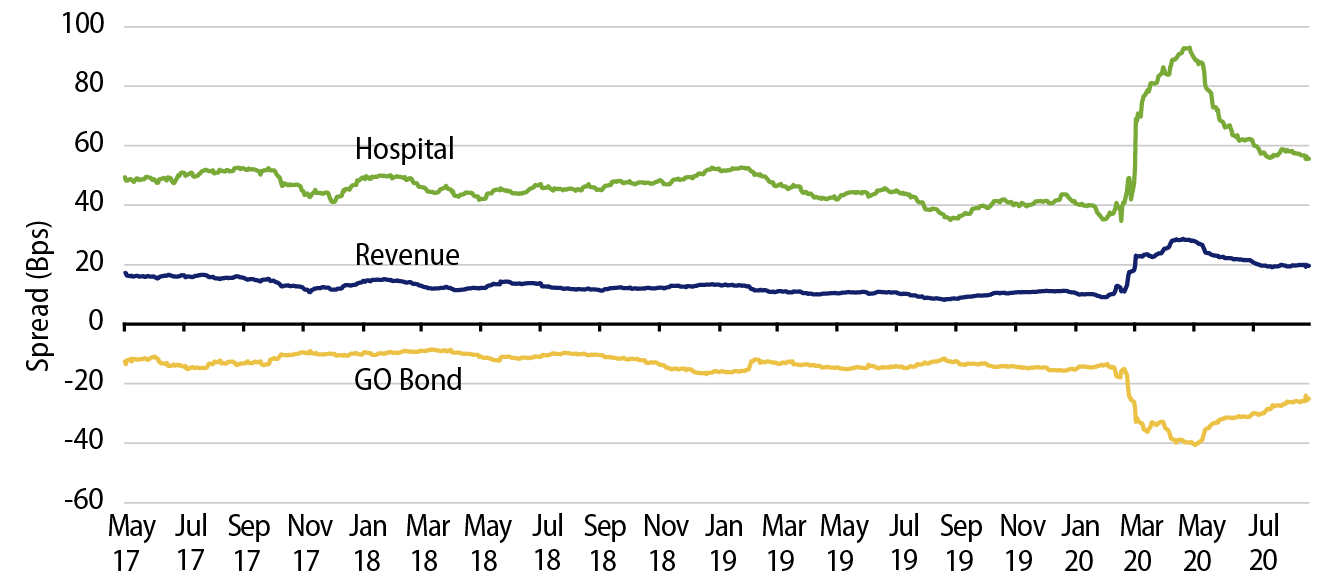

Since the Great Recession, the pace of hospital consolidation has been rapid as the susceptibilities of smaller, less-endowed hospitals were exposed by rising costs and limited revenues. Industry consolidation was also promoted under the Affordable Care Act, which encouraged the improvement of population health through care coordination. Hospitals were incentivized to build out a continuum of integrated care, and they did so by partnering with other hospitals, expanding ambulatory networks, aligning with physician groups and at times offering their own insurance products. The credit profiles of healthcare systems strengthened as a result, thanks to the realization of economies of scale, diminished competition and enhanced bargaining power.

Strengthened balance sheets and an improved credit position supported large healthcare systems when COVID-19 hit. The vulnerabilities of smaller standalone hospitals, however, were further magnified. The industry’s margins were undoubtedly affected as providers were forced to suspend most non-emergency procedures, but larger healthcare systems were simply in a much better position to absorb the shock of an industry-wide disruption given their ability to source and allocate resources, implement cost mitigation strategies and utilize telemedicine capabilities.

Patient utilization has since rebounded with many hospitals reporting volumes that are at or near pre-pandemic levels. Importantly, most patient procedures that were suspended in the early months of the pandemic were not lost but merely postponed, and a backlog of these delayed procedures is expected to boost operating performance in the back end of this year and into next year. We expect the pace of industry consolidation to continue and perhaps accelerate as smaller hospitals, especially those serving rural markets, may now view the independent route through a different lens. The same may be true for private physician practices, who have been disproportionately impacted as well.

While we have observed some fundamental challenges within the sector due to Covid, we believe bond prices are better compensating investors for the risks. Given recent industry consolidation, we believe many providers will maintain the scale and resources to weather the pandemic-driven conditions. From a valuation perspective, we continue to find value at the issuer level within the healthcare sector, which offers incremental yield opportunities versus other segments of the municipal market.