Macros, Markets and Munis

Municipals posted positive returns last week as Treasury yields ultimately moved 9 to 11 basis points higher across the curve, while munis continued to retrace year-to-date (YTD) underperformance as demand improved. Fixed-income markets sold off early in the week on favorable growth prospects following the announcement of a 90-day pause on existing tariffs with China. Meanwhile, economic data continued to soften, with CPI, retail sales and University of Michigan sentiment data all coming in below expectations. Against this backdrop, muni mutual funds recorded inflows amid elevated supply conditions, reflecting renewed investor interest. This week we highlight potential municipal market implications arising from the recent House Ways and Means Committee’s tax bill.

Strong Fund Flows and Elevated Supply Continue

Fund Flows (up $769 million): During the week ending May 14, weekly reporting municipal mutual funds recorded $769 million of net inflows, according to Lipper. Long-term funds recorded $337 million of inflows, intermediate funds recorded $161 million of inflows and high-yield funds recorded $140 million of inflows. Last week’s inflows led YTD inflows higher to $5 billion.

Supply (YTD supply of $198 billion; up 28% YoY): The muni market recorded $14 billion of new-issue supply last week, up 38% from the prior week. YTD, the muni market has recorded $198 billion of new issuance, up 28% year-over-year (YoY). Tax-exempt and taxable issuance are up 25% and 28%, respectively, though tax-exempt issuance has comprised the vast majority (93%) of YTD supply. This week’s calendar is expected to increase to $15 billion. The largest deals include $731 million Kansas State Department of Transportation and $659 million Black Belt Energy (gas prepay) transactions.

This Week in Munis: House Bill Tax Takeaways

After extensive negotiations, last week the House Ways and Means Committee released the one “Big, Beautiful Bill” that includes tax measures which, if enacted, could have direct and indirect implications on the municipal market. Most notably, the draft bill does not include changes to the tax exemption of municipal bond interest. As highlighted in our prior blogs, earlier this year the Committee included the elimination of tax-exempt interest as part of a menu of measures that could be proposed within a broader reconciliation package to close budget gaps.

The proposal would extend individual income tax brackets of the 2017 Tax Cuts and Jobs Act, notably keeping the top marginal rate at 37% rather than reverting to the previous rate of 39.6%. Leading up to the bill’s release, there were discussions within the administration about a higher “millionaires’ tax,” but it was ultimately not included in the draft. The Tax Foundation estimates that the package would prevent tax rates from rising for 62% of taxpayers.

The bill also proposes increasing the state and local tax (SALT) deduction cap to $30,000 from $10,000, with income limits of $400,000 and $200,000 for joint and single filers, respectively. While a higher state and local tax deduction could reduce tax burdens that drive investors to munis, we believe that the income limits largely blunt the impact of the state and local tax deduction proposed in its current format.

Beyond these changes that largely influence the value of the municipal tax exemption, the draft bill also includes tax provisions that could impact municipal credit. Notably, it seeks to institute an endowment tax on higher education institutions based on endowment-per-student thresholds. Private universities with $2 million or more per student in endowment funds would pay 21% on net investment income, while schools with lower endowment levels would pay closer to the current rate of 1.4%.

Considering the slim Republican majority in Congress, Western Asset does not anticipate the bill will pass in its current form. The bill does little to appease deficit hawks with the estimated federal tax revenue reduction of $4 trillion over 10 years. Meanwhile, Republicans in higher-tax states remain committed to expanding the SALT deduction beyond the current proposal. However, as it stands, the bill should bring relief to muni investors concerned about losing the tax exemption on municipal interest. With the House aiming to vote on the legislation by the end of the month, we believe it will be difficult to add significant new measures at this stage.

Municipal Credit Curves and Relative Value

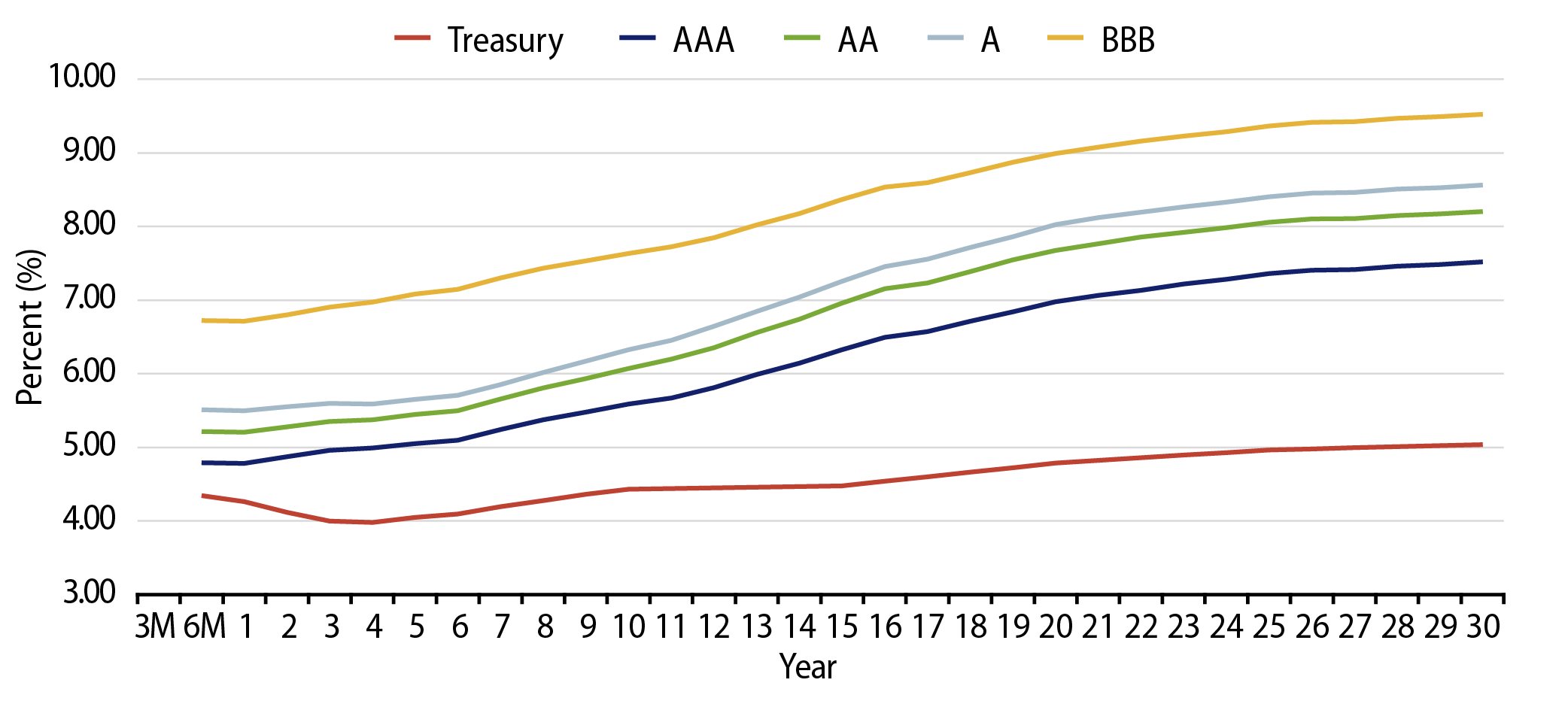

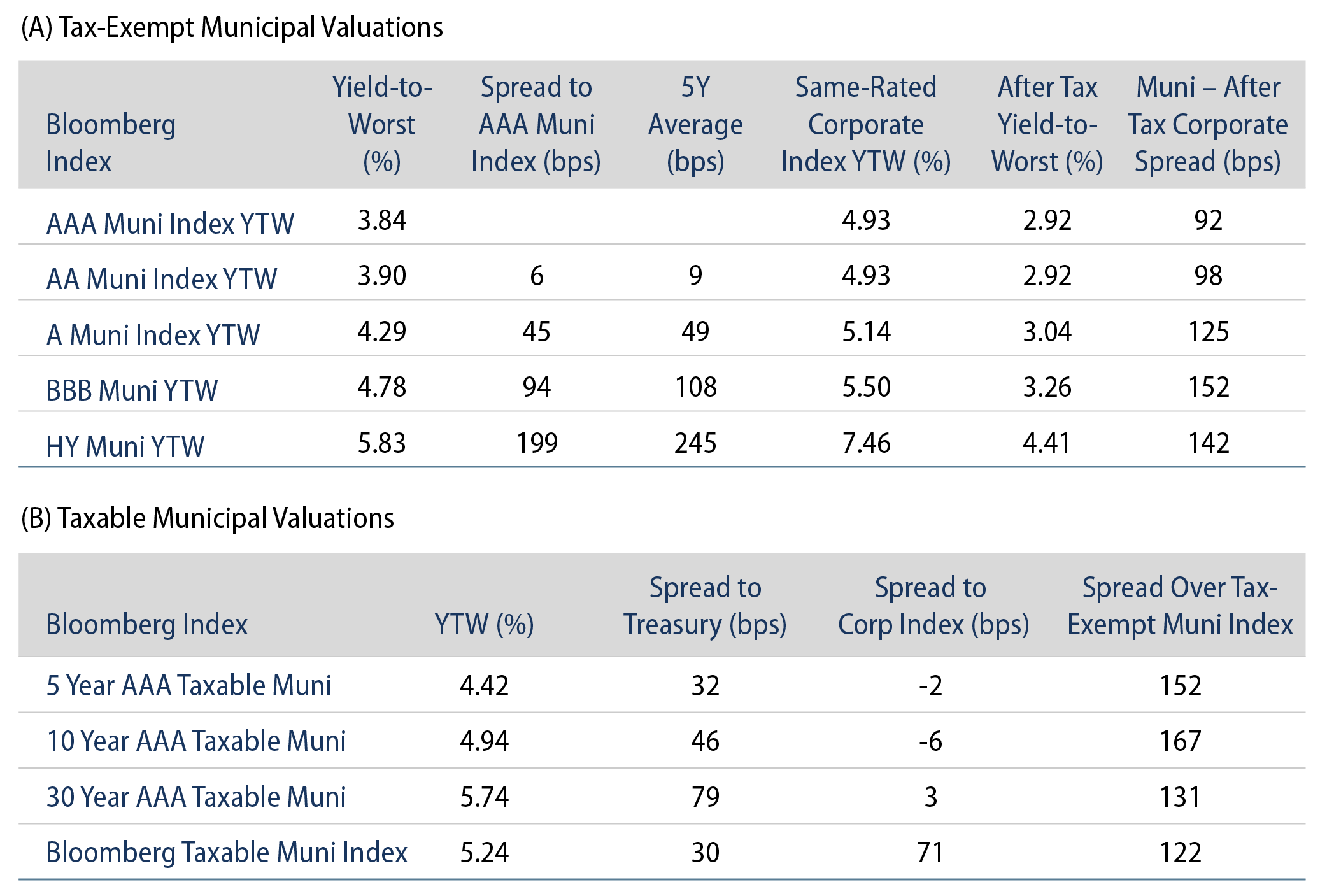

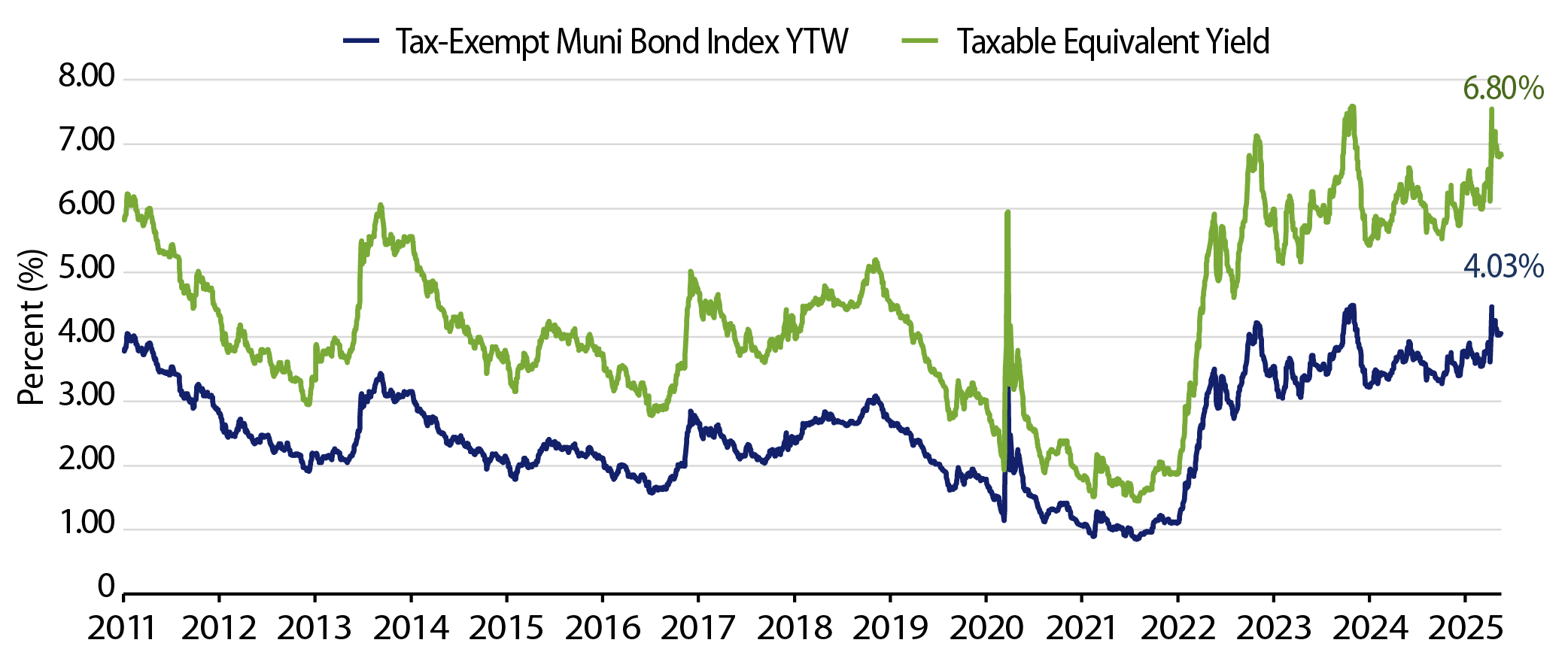

Theme #1: Municipal taxable-equivalent yields and income opportunities remain near decade-high levels.

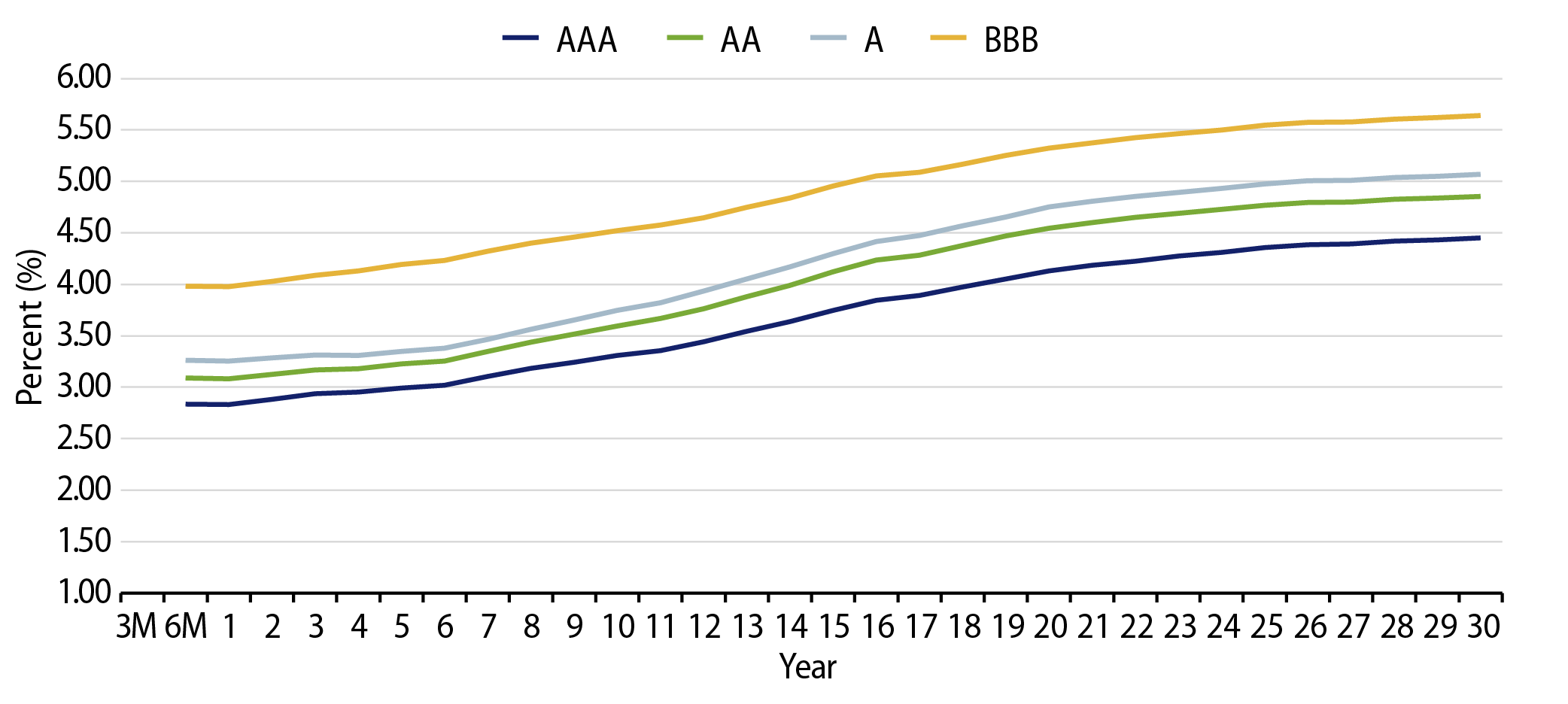

Theme #2: The muni curve has steepened, offering better value in intermediate and longer maturities.

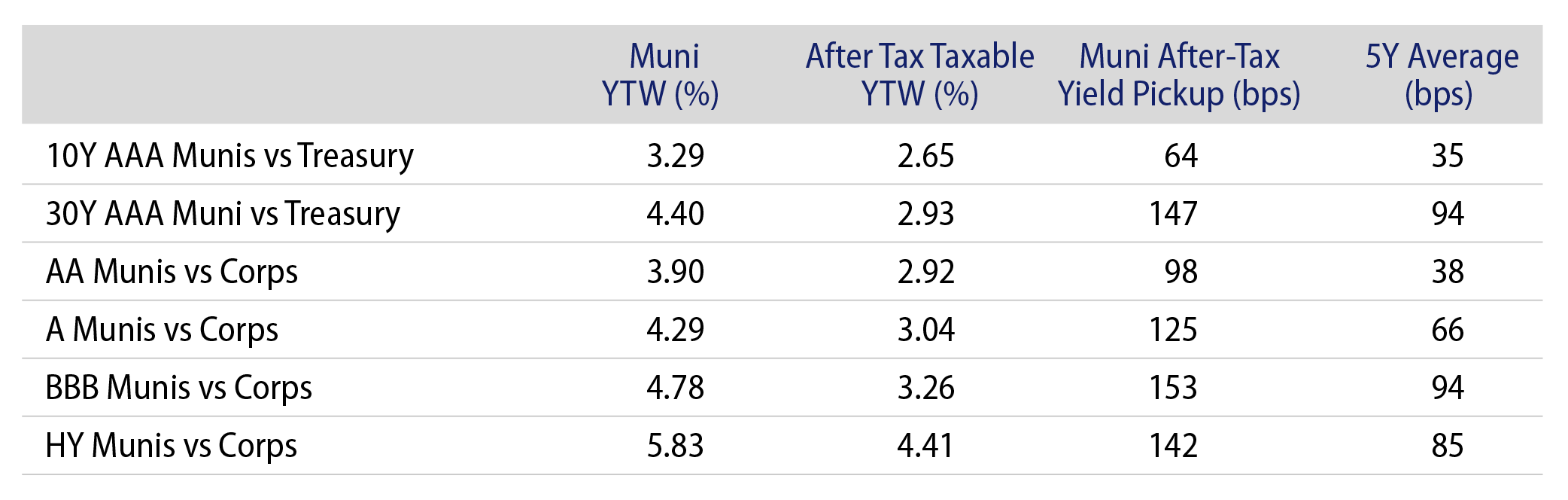

Theme #3: Munis offer attractive after-tax yield compared to taxable alternatives.