New-home sales rose 13.8% in June, with a positive revision to May’s level. Today’s data brought new-home sales to levels not seen since July 2007, which was before the global financial crisis (GFC), when an overbuilt housing market was pulling the economy toward oblivion. Sales rose strongly in every region of the country, but the gains were most impressive in the Northeast and South, with both regions fully recovering to pre-COVID highs.

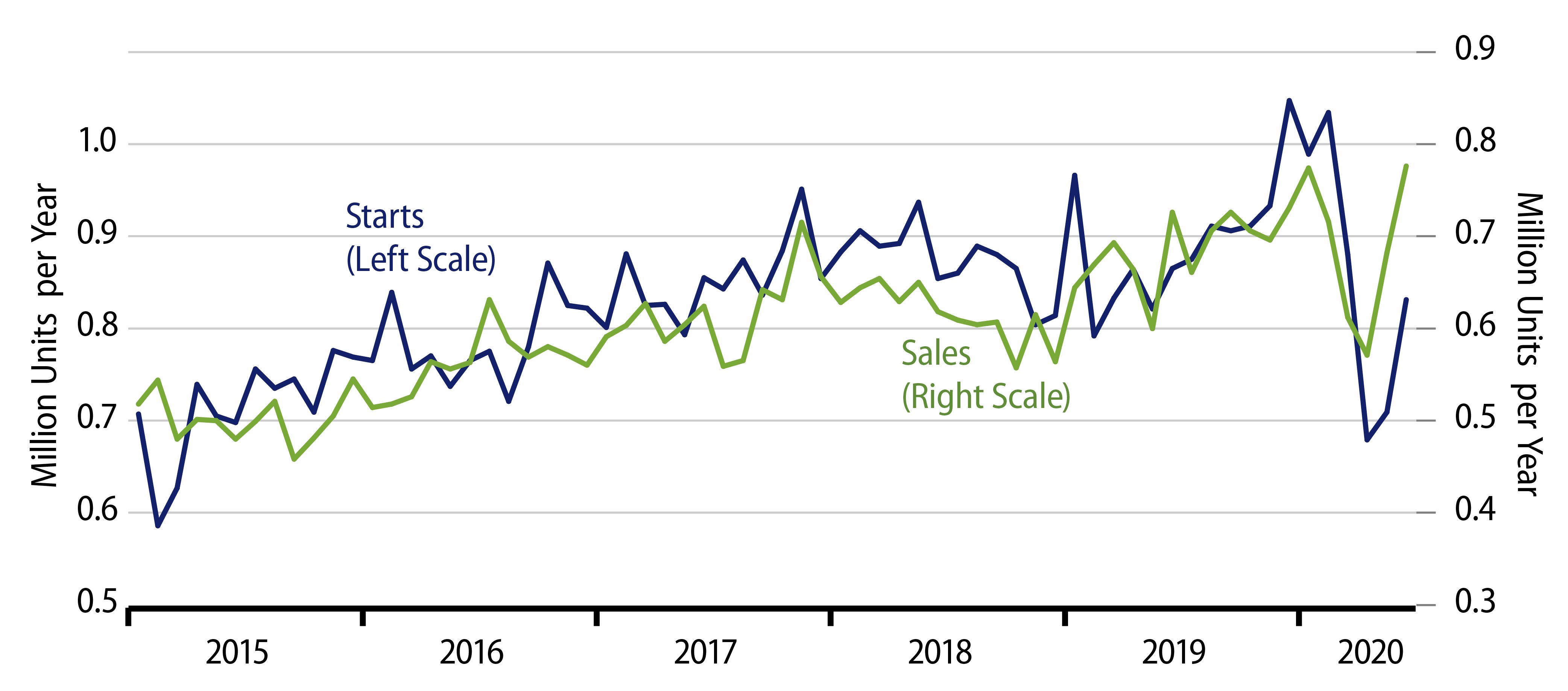

Today’s news came on the heels of a June housing starts announcement last week that showed single-family housing starts rising nicely in June, but still leaving them far below pre-COVID sustained levels. The lagging—for now—response of starts is not surprising.

Builders could not ramp down production of new homes during the shutdown as quickly as demand declined. That is, while starts on new homes did decline precipitously in March and April, construction continued then on homes started earlier, so that builders’ inventories of unsold homes did creep up when the shutdown was constraining demand. However, again, builders moved quickly to slow starts, and concessionary pricing helped them prevent a much larger decline in sales than might otherwise have occurred.

As a result, the build-up of unsold homes was dramatically smaller than was seen in previous recessions. Now, with demand having recovered over the last two months, inventories have been pulled back down to easily sustainable levels. Even more impressively, the June sales levels were achieved despite the apparent removal of price concessions.

With inventories low, with prices allowing builders decent margins and with sales rates high, there is every reason to expect that housing starts will continue to recover to and through early-2020 levels over the next few months. Here, too, construction spending on new homes will lag a bit—just as they did on the way down—as homes started in June and after will see peak outlays in later months. Still, homebuilding should be a noticeable boost to the economy’s recovery even in 3Q and a more substantial one in 4Q.

Finally, the new-home sales data provide an interesting perspective on the nature of the COVID crisis. In at least some circles, there is a contention that it was fear of the virus—not the government shutdowns per se—that was the major cause of economic collapse in March and April. Despite the rise in COVID case counts seen in June, new-home sales surged then. Financing and need issues will always be factors underlying home-buying decisions. However, it is hard to see COVID fears being an issue barring further shutdown initiatives.