In recent weeks, emerging markets have had to cope with the dual shocks of coronavirus/COVID-19 containment measures and the breakdown of OPEC+ negotiations. We’ve already seen EM central banks move to reduce benchmark interest rates and boost liquidity, and most EM countries are planning large relief programs to ease the shock on their local economies. As EM countries typically do not have the balance sheet capacity to boost spending on their own, we expect EM sovereigns to aggressively lock in funding for these relief programs via external, local and multilateral sources. As a result, we believe that a key theme for EM in 2020 will be a material increase in external (USD-denominated) sovereign bond issuance.

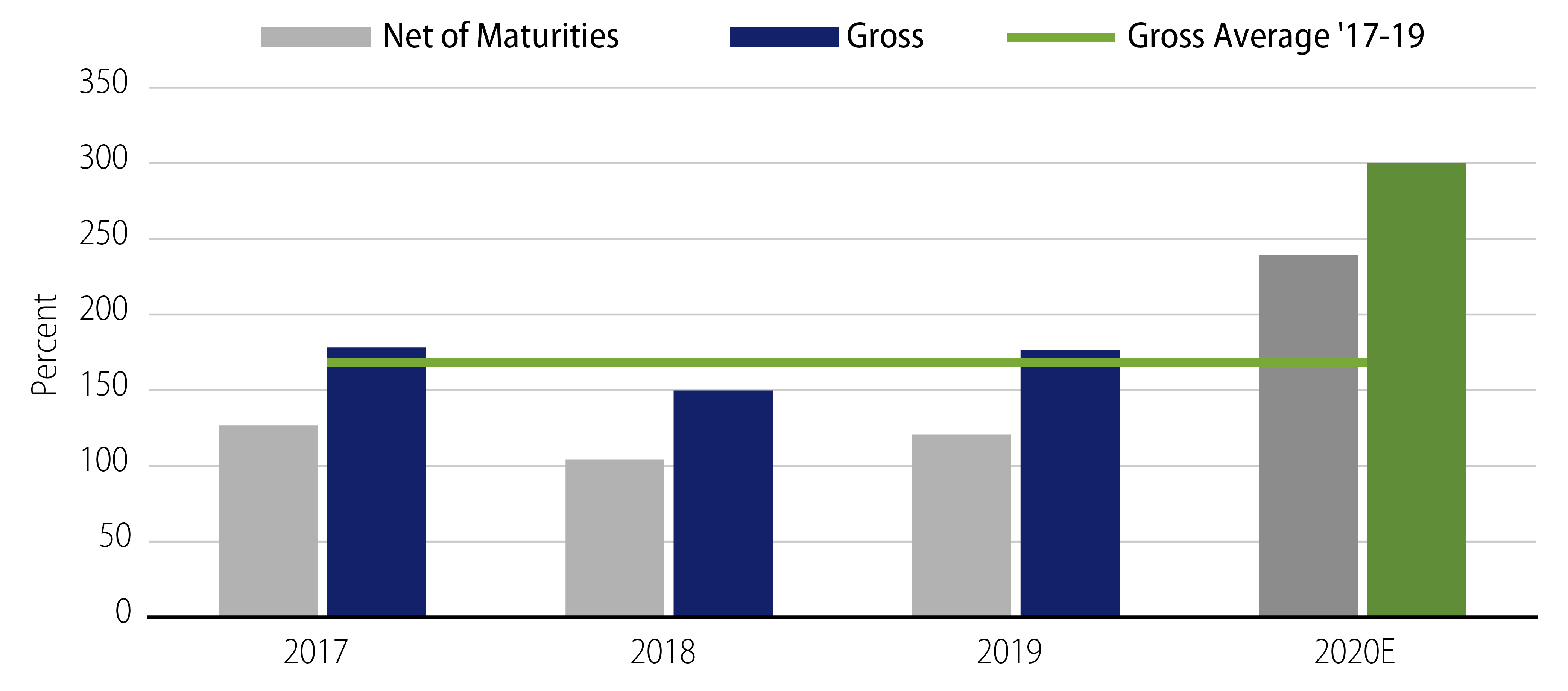

At the beginning of 2020, we expected gross EM hard currency sovereign issuance to be approximately $150 billion, much of which would go to refinance existing borrowings. As the magnitude of the growth shock from coronavirus and energy has unfolded, we now believe this year’s new supply will be as much as $300 billion. This could make issuance nearly twice the annual amount of recent years (Exhibit 1), which will be both an important technical in our market as well as an opportunity for Western Asset clients.

Handicapping Coronavirus Spending

We are already seeing a wide variety of planned fiscal relief programs in EM countries to combat fallout from the virus. The size of virus relief packages will obviously vary depending on countries’ willingness and ability to fund new spending. For example, Peruvian authorities are planning relief measures that will cost nearly 12% of GDP. Admittedly, Peru has plenty of fiscal space within the A3/BBB+ credit bucket to embark on this one-time fiscal expenditure. On the other hand, Israel has taken a more conservative approach and plans to spend about $22 billion (5% of GDP) to combat the viral outbreak, about a quarter of which was raised in March via new USD-denominated bonds.

For the purpose of this exercise, we assume that EM countries implement additional outlays amounting to 5% of GDP. Clearly not all of the additional EM fiscal spending will be financed through the USD-denominated sovereign market, as we would expect domestic and multilateral sources to complement bond issuance. But assuming that one-fifth of total needs are financed externally, this would amount to additional external sovereign issuance of $150 billion.

Fiscal Slippage From the OPEC+ Fallout

Further exacerbating coronavirus-impacted fiscal dynamics is the oil shock. For oil-dependent nations in particular, revenues will likely undershoot beginning-of-year estimates significantly. While the size of fiscal misses will be dependent on the path of front-month crude prices and the pace of a potential global recovery, particularly at risk are Gulf Cooperation Council (GCC) countries, which will be heavily impacted by lower energy prices. At the onset of the year, the market expected roughly $30 billion of GCC external debt issuance during 2020. However, we now anticipate issuance of as high as $80 billion, with Qatar and Abu Dhabi printing $17 billion just this past week!

Identifying a Value Opportunity

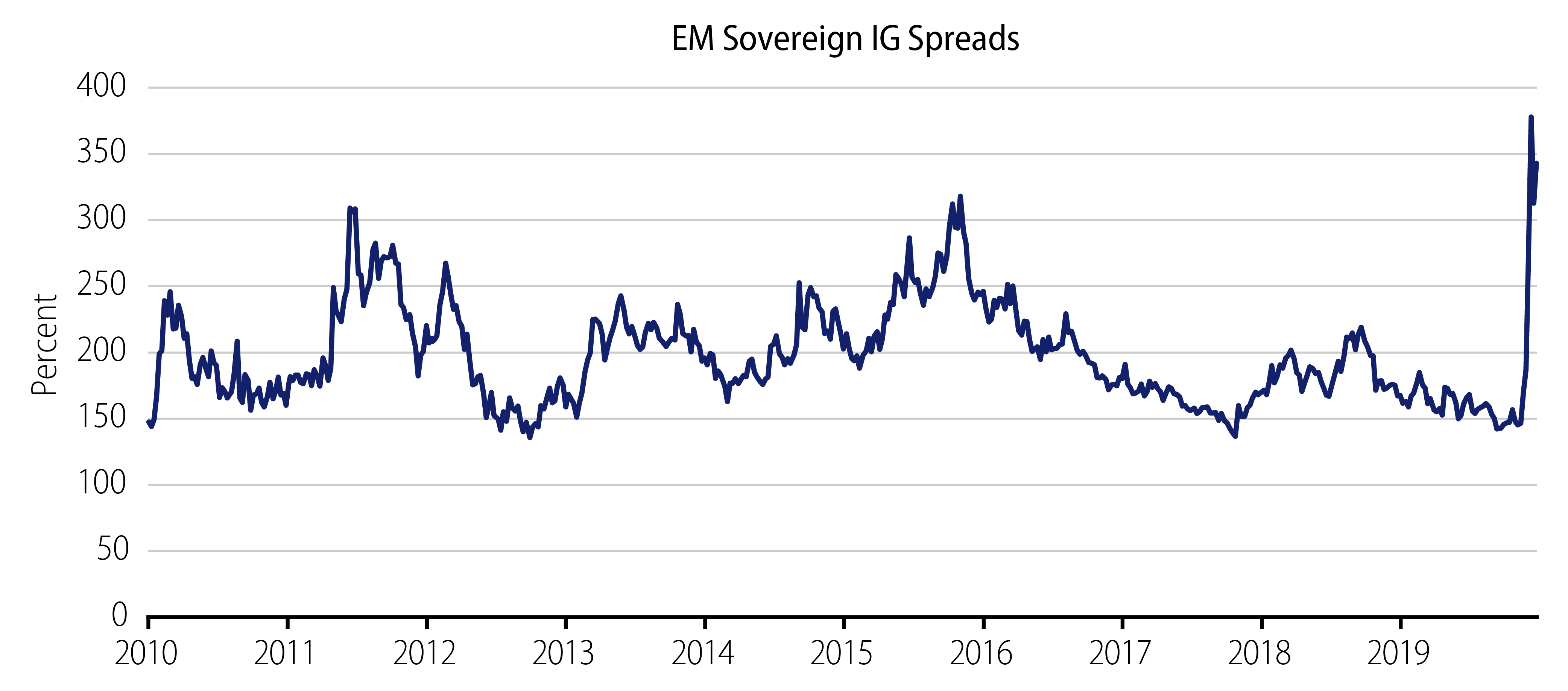

Much like recent trends in the US investment-grade market, we are expecting EM sovereign issuance to come with a significant concession for the foreseeable future, as exemplified by recent sovereign issues from Panama, Israel and Qatar. This opportunity is illustrated in Exhibit 2, which shows the historically high levels of credit spreads available in EM sovereign bonds, even exceeding stressed levels observed during the taper tantrum and the 2015 oil shock. Within the lower quality EM universe, we see significant divergence between issuers, with stressed credits such as Ecuador and Lebanon recently announcing restructurings, but BBB and BB rated credits watching for their opportunity to come to market as the post-virus recovery progresses.

While we acknowledge that EM economies have unique exposure to both COVID-19 and the oil price crash, we still find value in the higher quality part of the market—a strategy that lines up with our CIO Ken Leech’s recent discussion of value in the US investment-grade market. As with previous credit crises, we anticipate that the first deals back to the market will be the best, and Western Asset is poised to take advantage of this opportunity.