Headline retail sales rose 0.7% in November, with the October sales estimate revised up by 0.1%. We, along with others, routinely focus on a ''control'' sales measure which excludes sales at store types commonly frequented by businesses as well as consumers and that are more volatile: car dealers, service stations, building material stores and restaurants. That control measure rose a more modest 0.2%, also with a +0.1% revision to the October estimate.

As you may have guessed, the headline sales gains were paced by a post-hurricane 2.8% jump in vehicle sales, which accounted for most (71%) of the headline sales gain. For that matter, the increase in control sales was more than fully accounted for by a strong increase in online sales, which rose 1.8%. In other words, sales declined slightly at most brick-and-mortar store types outside of vehicle dealers.

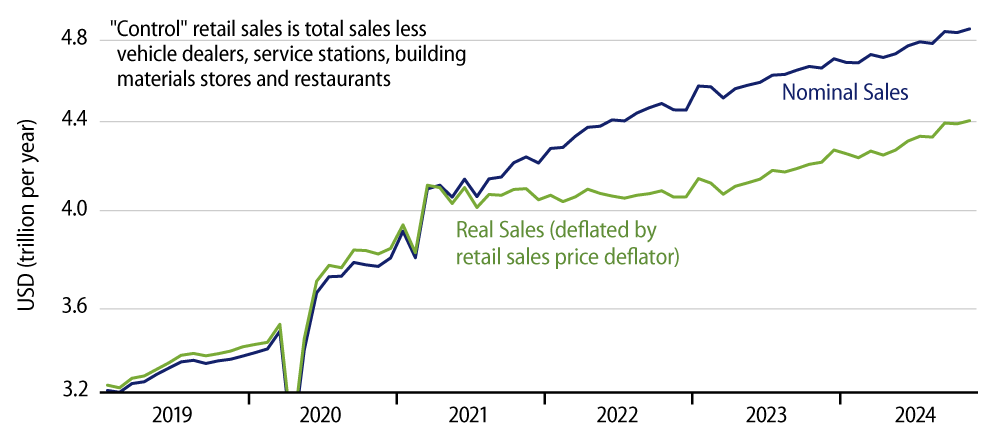

However, this has been the pattern for quite a while. Consumers may not be spending more at the mall, but they are spending more in total. As you can see in Exhibit 1, there is no real sign of any weakening in the overall retail sales trends. As we have mentioned frequently in these posts, the late-summer and early-fall hurricanes that buffeted the Southeast have caused very volatile monthly readings in the various economic indicators, and they likely served to boost retail prices some. However, even with these effects, the real (i.e., price-adjusted) trend for retail sales appears to be progressing just fine recently. This is in contrast to the jobs data, where growth has slowed a bit on net recently.

The sluggish pace of sales at brick-and-mortar retailers will spur further consolidation and downsizing there. However, for the overall economy, it is total sales—brick-and-mortar and online—that drives GDP, and, again, the total sales aggregates look just fine. We have been looking for slower growth in consumer spending and in the economy in general, thinking that the lagged effects of two years of Federal Reserve tightening would eventually set in. However, this has yet to be the case. Instead, consumers continue to roll along.