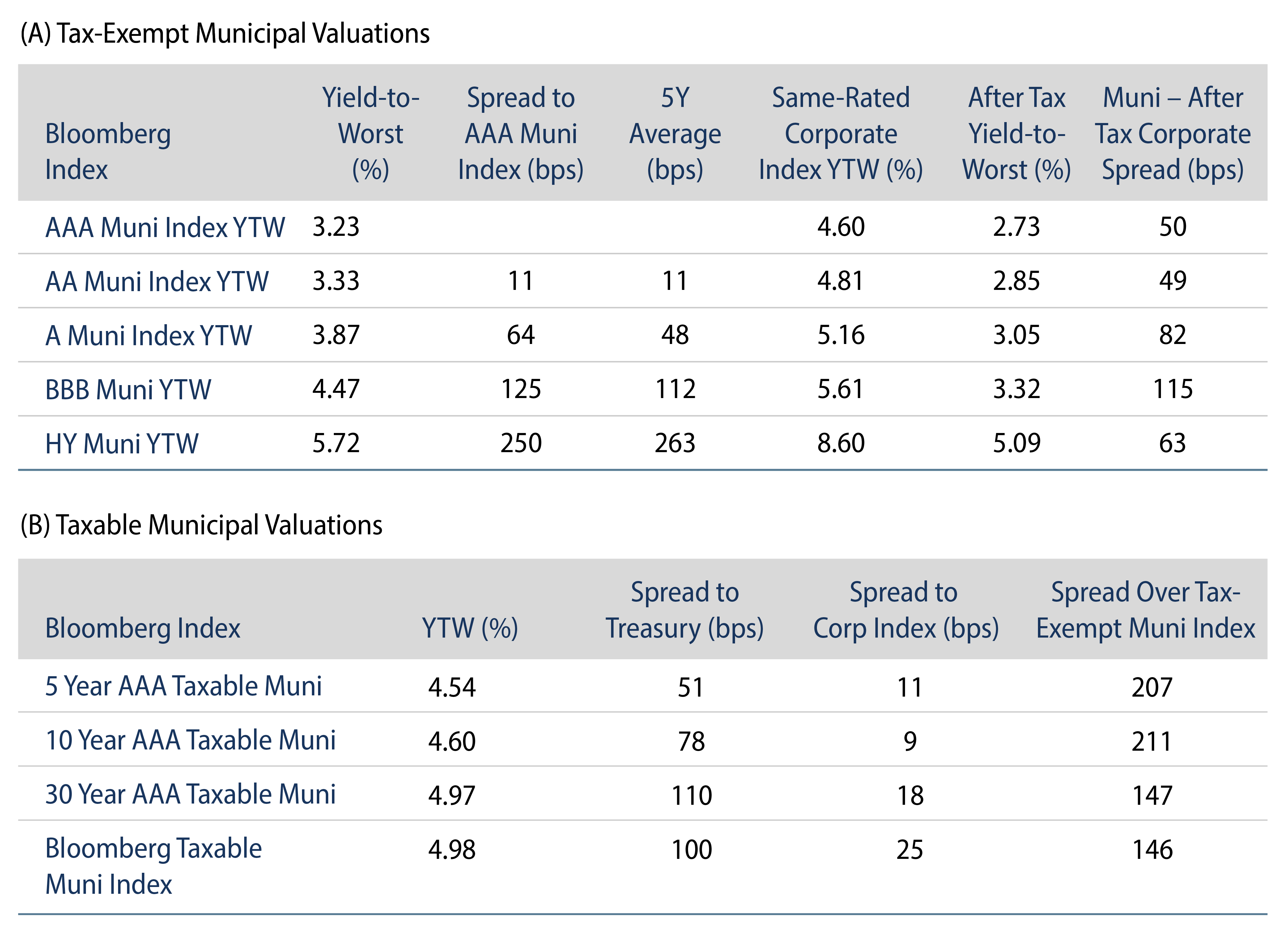

Municipal Yields Moved Higher Last Week

Municipal yields moved higher last week and underperformed Treasuries as technicals weakened and high-grade muni yields moved 22-34 bps higher across the curve. Meanwhile, muni mutual fund flows turned negative. The Bloomberg Municipal Index returned -1.43% during the week, the HY Muni Index returned -2.44% and the Taxable Muni Index returned -0.40%. This week we highlight the recently released Puerto Rico Electric Power Authority (PREPA) plan of adjustment, and potential implications for holders of the final Puerto Rico government entity to restructure outstanding debt.

Technicals Soften as Muni Funds Record Outflows and Supply Moves Higher

Fund Flows: During the week ending February 15, weekly reporting municipal mutual funds recorded a modest $68 million of net outflows, according to Lipper. Long-term funds recorded $159 million of inflows, high-yield funds recorded $80 million of outflows and intermediate funds recorded $133 million of inflows. This week’s flows reduce year-to-date (YTD) inflows to $558 million.

Supply: The muni market recorded $7.7 billion of new-issue volume last week, up 55% from the prior week. YTD issuance of $38 billion is down 13% year-over year (YoY), with tax-exempt issuance down 8% YoY and taxable issuance down 49% YoY. This week’s calendar is expected to decline to $3 billion. Large transactions include $678 million New York City general obligation bond and $428 million Tarrant County Hospital District transactions.

This Week in Munis: Oversight Board Amends PREPA Restructuring Plan

Earlier this month the Federal Oversight and Management Board (FOMB) of Puerto Rico filed an amended Plan of Adjustment to reduce outstanding debt of PREPA, the last major Puerto Rico government entity to restructure as part of the Commonwealth’s bankruptcy process. The plan proposes to reduce over $8 billion of outstanding PREPA bonds to $5.7 billion via a new issuance that would be amortized over 35 years, according to the FOMB’s amended disclosure statement.

Just prior to Hurricane Maria in 2017, PREPA filed for bankruptcy protection under Title III of the Puerto Rico Oversight, Management and Economic Stability Act (PROMESA). An initial restructuring agreement was reached in 2019; however, the FOMB walked away from the agreement in early 2022 due to controversy around the underlying rate hikes implied to achieve bondholder recoveries and a general lack of support from the Puerto Rico legislature.

Under the amended plan, bondholder recoveries would range from as little as 0.21% to potentially full recovery depending on the outcome of key litigation and whether or not a holder agrees to settle. The litigation seeks to limit legacy bondholders’ secured lien on current and future revenues, as well as cap recourse to just the $16 million in Trustee-held funds at the time of the Title III filing. A win for bondholders on one or both of these counts could materially improve recoveries and incentivize bondholders not to settle. The litigated issues are fundamental to the strength of dedicated revenue bond security more broadly. The current proposal is also controversial in the fact that it offers different levels of recoveries for shareholders within the same security class that choose to settle (or not).

While the eventual restructuring of Puerto Rico’s final lien should be welcomed by the Commonwealth and municipal market participants, wide ranging recoveries on this final lien highlight how limited municipal bankruptcy precedent can contribute to wide investor outcomes that should still be managed with deep institutional and credit resources.