Municipals Yields Higher on Fed Comments

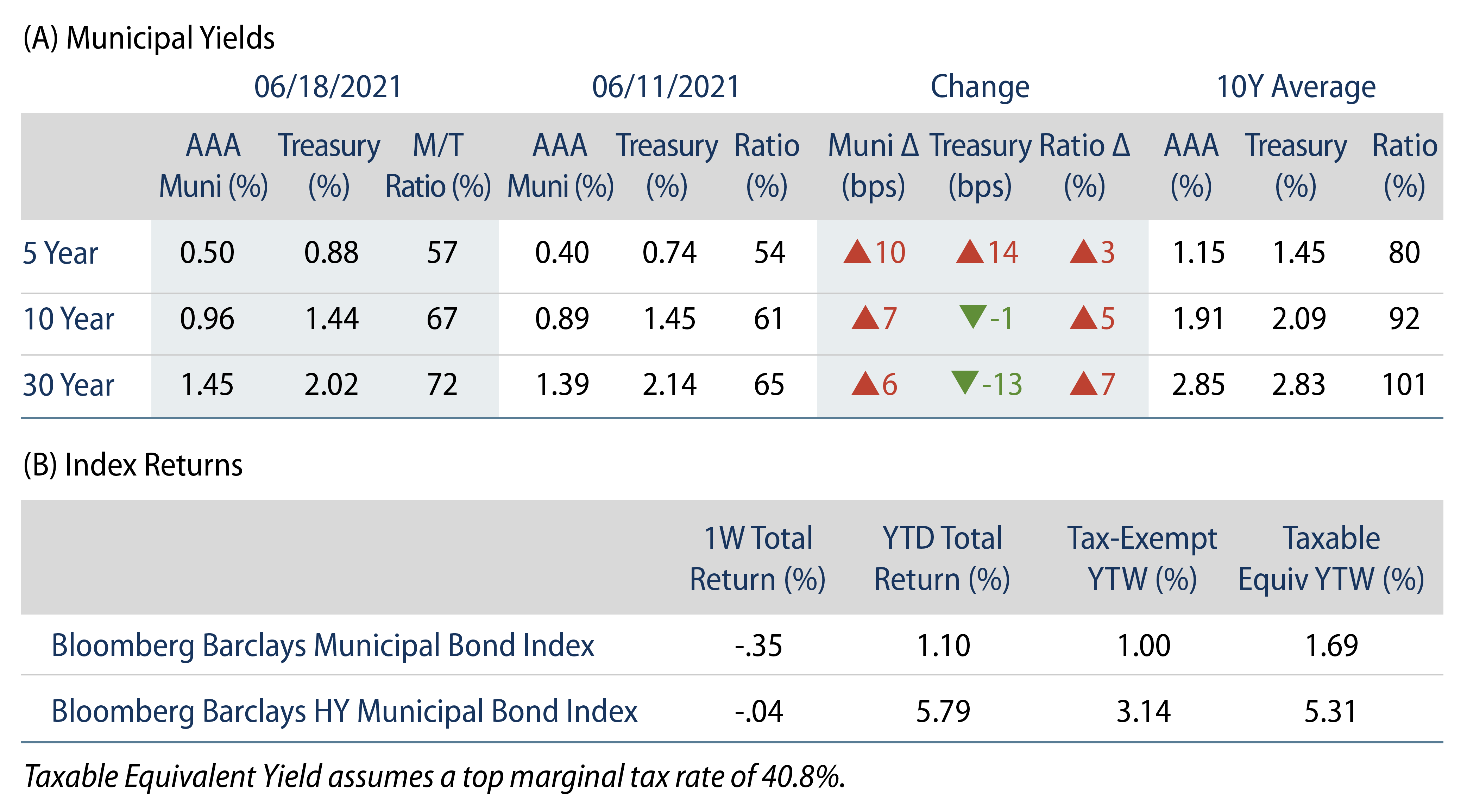

US municipals significantly underperformed Treasuries, taking ratios off historically rich lows. AAA municipal yields moved 6 to 10 bps higher across the curve. High grade municipal yields moved higher across the curve amid more hawkish than expected comments following the Federal Open Market Committee (FOMC) meeting. The Bloomberg Barclays Municipal Index returned -0.35%, while the HY Muni Index returned -0.04%. This week, we evaluate the favorable market technicals which are expected to remain supported in the summer months.

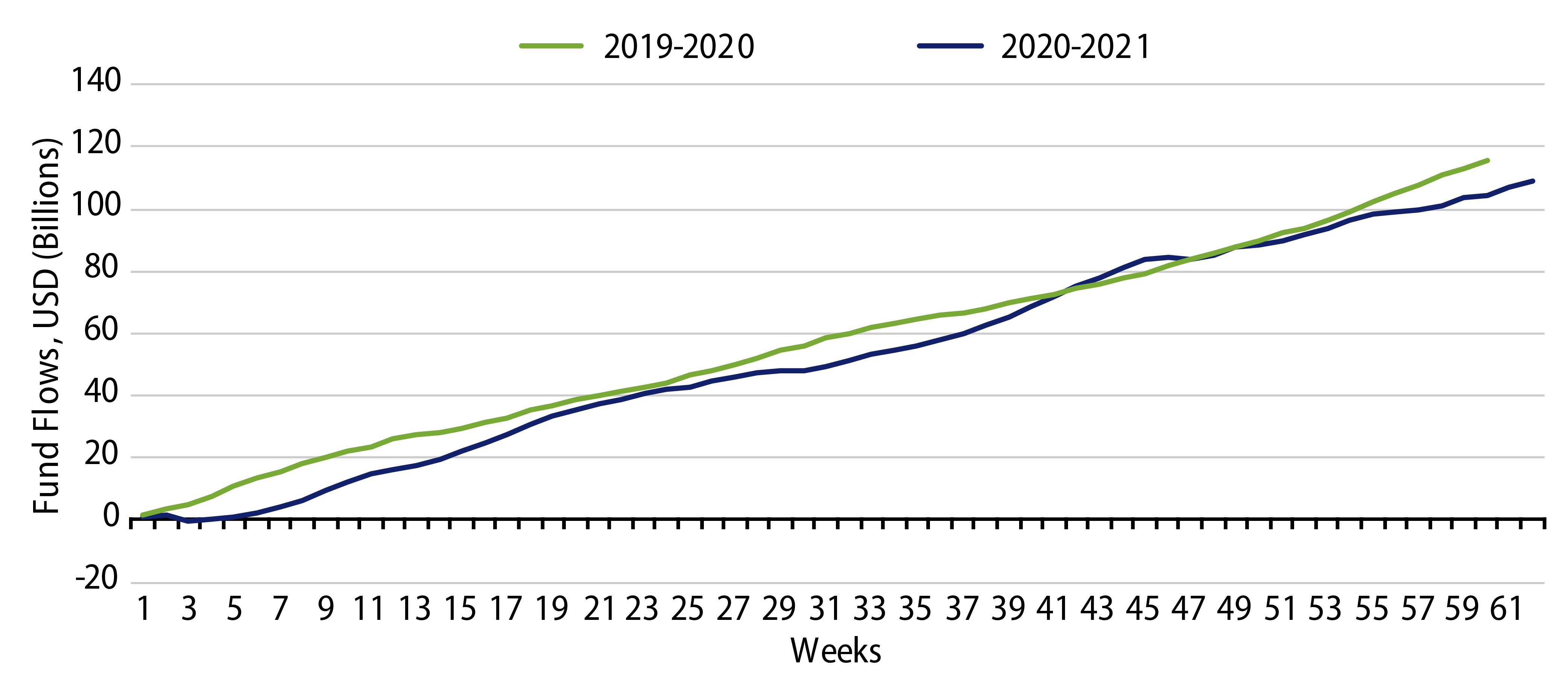

Municipal Mutual Fund Flows Maintain Record Pace

Fund Flows: During the week ending June 16, municipal mutual funds recorded $1.9 billion of net inflows. Long-term funds recorded $1.5 billion of inflows, high-yield funds recorded $695 million of inflows and intermediate funds recorded $199 million of inflows. Municipal mutual funds have now recorded inflows 56 of the last 57 weeks totaling $117 billion, with net inflows year-to-date (YTD) maintaining a record pace of $56 billion.

Supply: The muni market recorded $14.3 billion of new-issue volume during the week. Total issuance YTD of $207 billion is 20% higher than last year’s levels, with tax-exempt issuance trending 21% higher year-over-year and taxable issuance 16% higher. This week’s new issue calendar is expected to decline moderately to $11.5 billion of new issuance. The largest deals include $1.9 billion City of Los Angeles Tax and Revenue Anticipation Notes and $658 million State of Tennessee General Obligation transactions.

This Week in Munis: Favorable Muni Technicals in Focus

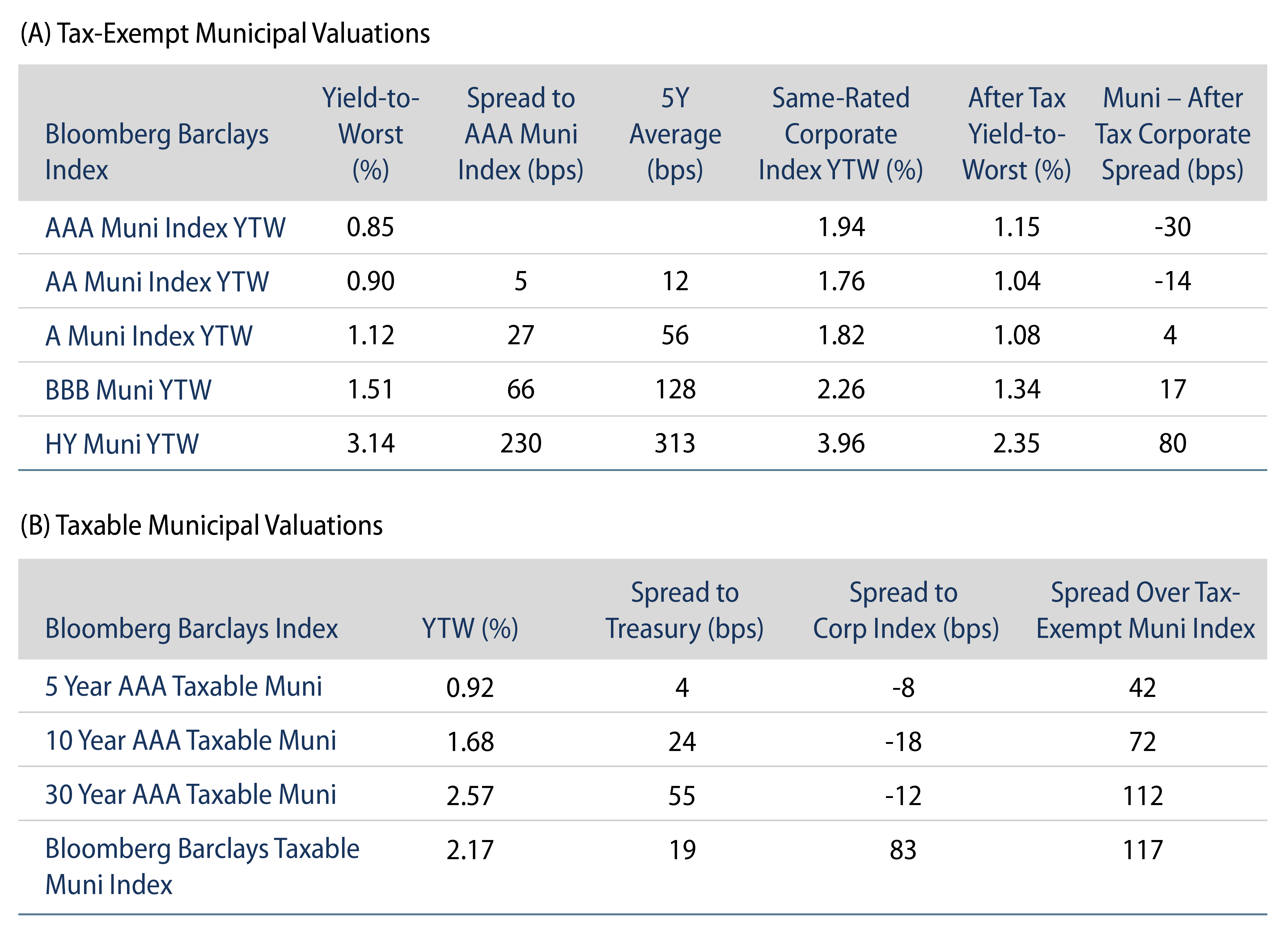

Favorable municipal supply and demand technicals have had a pronounced impact on market valuations YTD as the municipal market has largely outperformed other fixed-income asset classes. The Bloomberg Barclay’s municipal bond index has returned 1.1% YTD, compared to the US Aggregate YTD total return of -1.6% and the US Treasury Index return of -2.5%. While these other fixed-income asset classes grappled with the impact of a higher rate environment, unrelenting demand for tax-exempt income against a backdrop of muted new-issue supply has supported municipal outperformance.

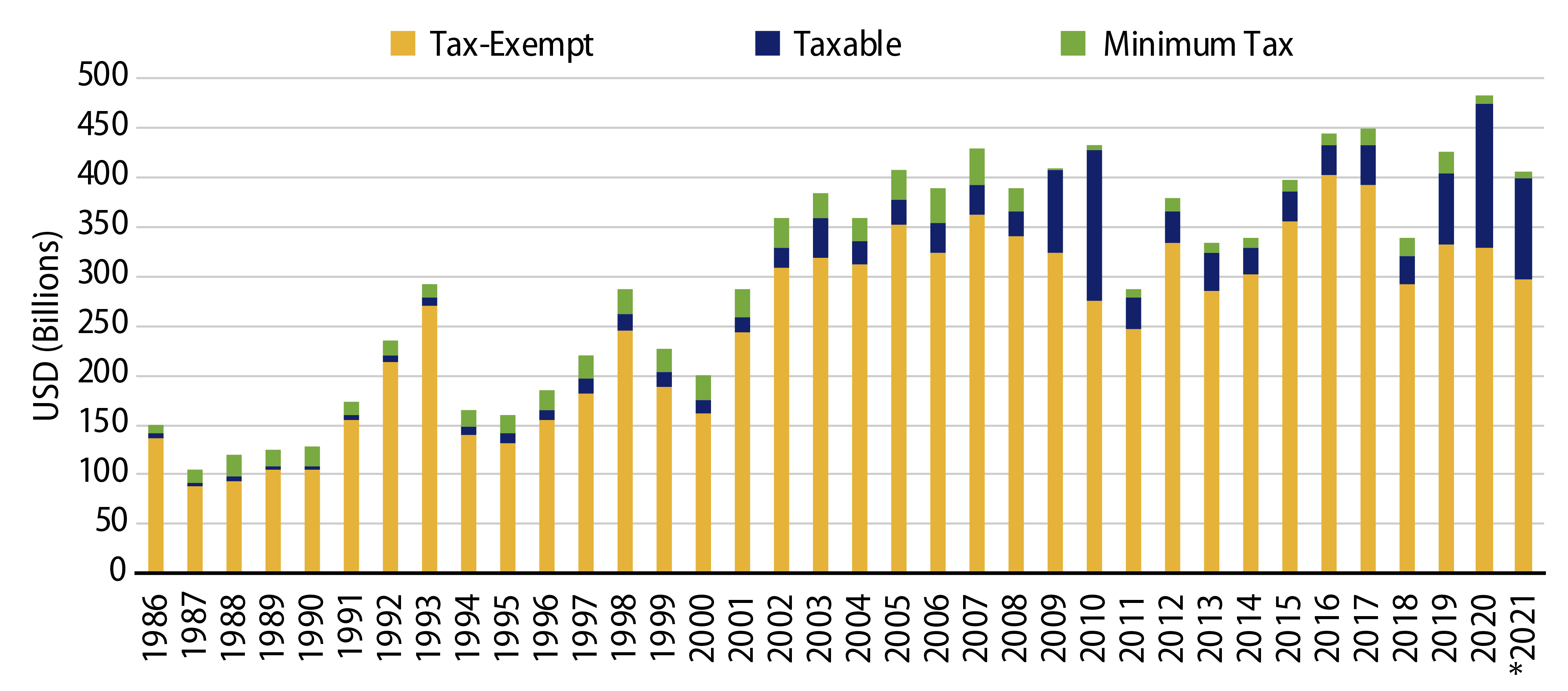

Supply Tailwinds

Declining New Tax-Exempt Issuance: While other fixed-income markets have grown materially over the past decade, the supply of tax-exempt municipal debt has been declining. Annual tax-exempt issuance has declined 19% from its high water mark of $415 billion in 2016 to $338 billion in 2020, and is on pace to fall an additional 12% in 2021 ($298 billion). The 2017 Tax Cuts and Jobs Act repealed the ability for municipalities to refund outstanding issuance with tax-exempt debt, and issuers have since found economy in replacing outstanding tax-exempt debt with taxable issuance.

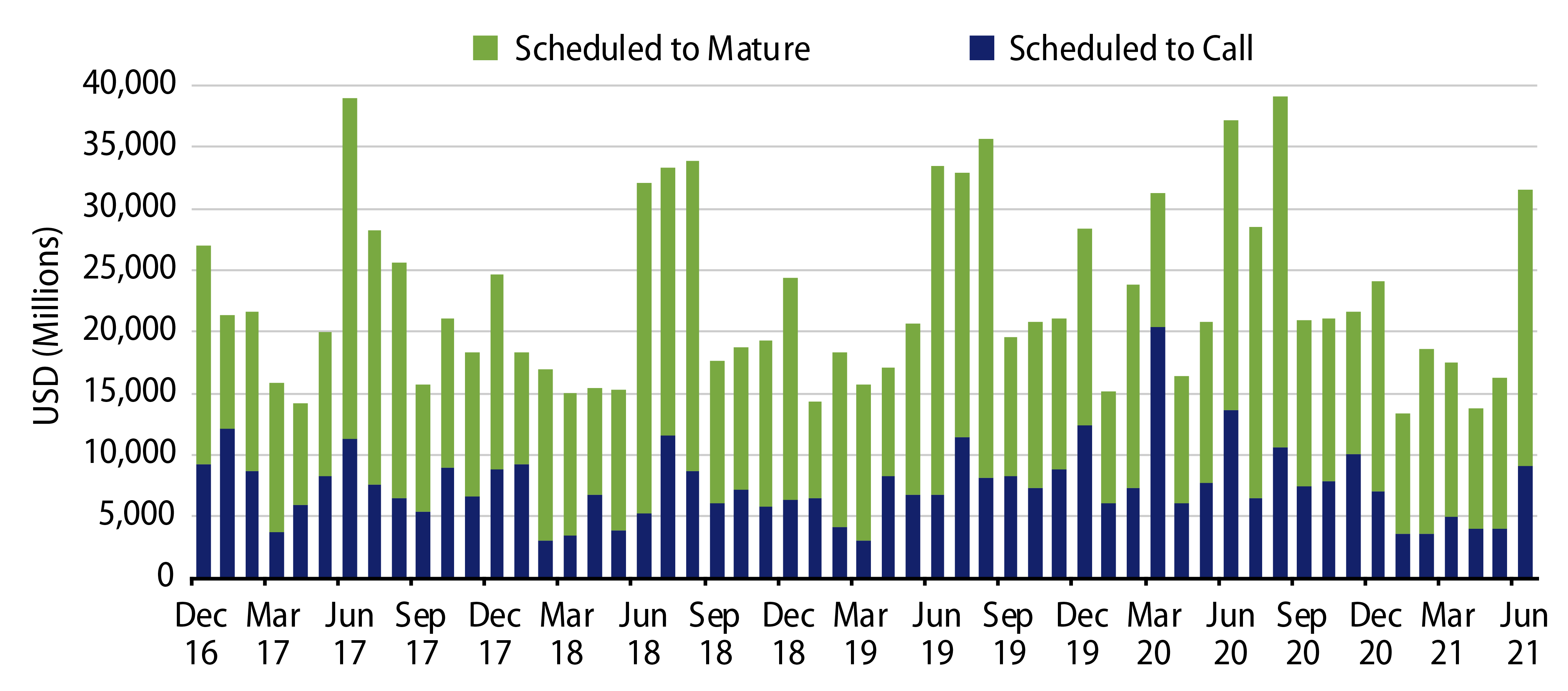

Increasing Redemptions During Summer: Over the last five years during June, July and August, total market redemptions in the form of callable debt or maturities averaged $99 billion. June scheduled redemptions currently stand at $32 billion, keeping pace with recent trends, which will weigh on net new issuance.

Favorable Demand Trends

Near-Record Municipal Bond Demand: According to Lipper, municipal mutual funds recorded net inflows 56 of the past 57 weeks, approaching the record inflow cycle level observed prior to the pandemic downturn. Demand has been driven by a persistent appetite for tax-exempt income as high net worth individuals are facing prospects of higher federal and state tax rates. In addition to the increasing demand from individuals, higher corporate tax rates could drive bank and insurance demand—which remains $72 billion (-6%) below December 2017 levels—back to the asset class.

Seasonal Coupon Reinvestment: In addition to the favorable demand prospects, summer months tend to drive relatively elevated coupon payments, which typically drive seasonal reinvestment into the asset class. We estimate $49 billion of coupon payments to be delivered in June to September.

Looking forward, it is difficult to envision what will reverse these strong technical trends. Despite relatively rich valuations on a historical basis, we believe shifting demographics will support continued appetite for income. In addition, the benefit of the municipal tax-exemption should continue to support relative valuations versus other asset classes, particularly as municipal credit fundamentals strengthen as local economies reopen. While infrastructure policy dynamics have the potential to create supply headwinds, we anticipate an infrastructure solution would have only a marginal impact on new-issue supply and could be offset by additional demand generated by higher tax rates to fund any initiatives. As such, we remain overweight municipal credits that offer relative yield opportunities and would continue to benefit from a recovery.