Municipals Posted Negative Returns

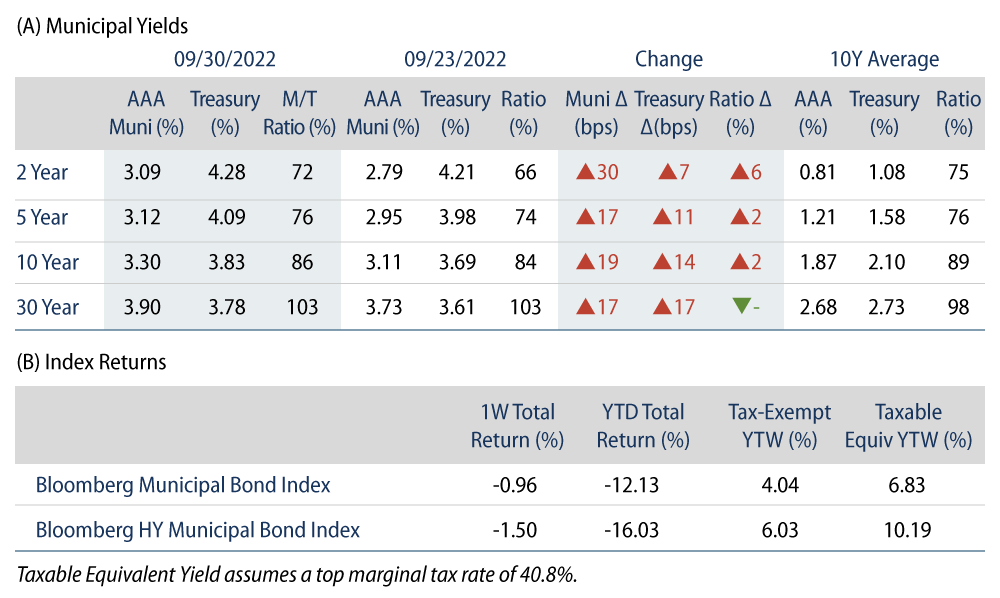

Municipals posted negative returns last week and underperformed Treasuries across maturities. High-grade municipal yields moved 17-30 bps across the curve. Meanwhile, technicals weakened on heavy fund outflows and higher supply conditions. The Bloomberg Municipal Index returned -0.96% while the HY Muni Index returned -1.50%. This week we highlight the value offered at the short end of the municipal curve.

Technicals Weaken on Elevated Fund Outflows and Higher Supply Conditions

Fund Flows: During the week ending September 28, weekly reporting municipal mutual funds recorded $3.6 billion of net outflows, according to Lipper. Long-term funds recorded $2.4 billion of outflows, high-yield funds recorded $1.0 billion of outflows and intermediate funds recorded $586 million of outflows. The week’s outflows extend year-to-date (YTD) outflows to $92 billion.

Supply: The muni market recorded $7.5 billion of new-issue volume, up about 3x from the prior week. Total YTD issuance of $294 billion is 12% lower than last year’s levels, with tax-exempt issuance trending 3% lower year-over-year (YoY) and taxable issuance trending 45% lower YoY. This week’s new-issue calendar is expected to decline to $4 billion. Larger deals include $1.4 billion New York City General Obligation and $500 million California Earthquake Authority transactions.

This Week in Munis: Short Munis Shine

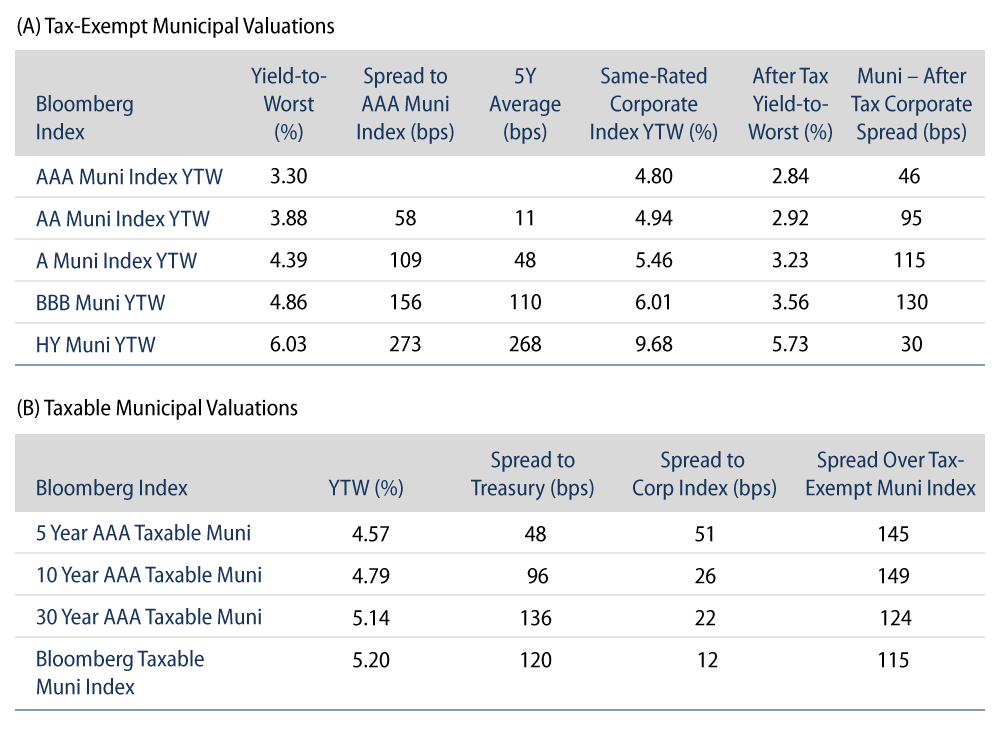

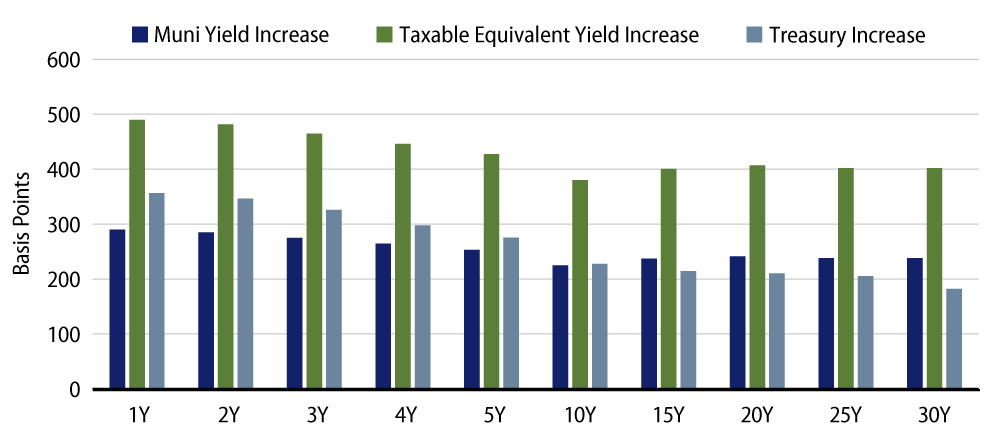

Fixed-income returns YTD have been challenged by the re-emergence of inflation and the Federal Reserve’s rate-hiking cycle, leaving many investors to re-evaluate downside risks associated with an overall portfolio allocation. Short-duration munis have been one area of the market where risk-adjusted value has emerged amid the volatility. Short-term yields moved to their highest levels in over a decade, taxable-equivalent yields increased at a higher pace than taxable fixed-income and downside risks remain limited by both lower duration and that the Fed’s rate hikes are better reflected in short maturities.

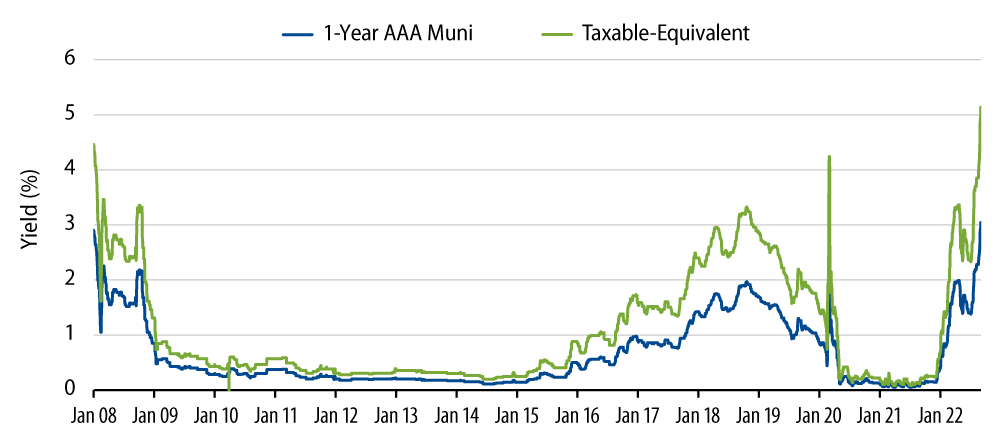

Short-term municipal bond yields moved to their highest levels since 2007. Following the Fed increasing short-term rates at all six Federal Open Market Committee (FOMC) meetings this year, the 1-year AAA municipal bond yield, which fell as low as 0.05% in 2021, increased 290 bps YTD to 3.0% last week. Notably, the impact of Fed rate increases has been particularly pronounced at the short end of the municipal curve, as intermediate to long maturities increased just 220-240 bps despite their longer duration. As such, short-duration munis now offer more attractive yields per unit of duration risk.

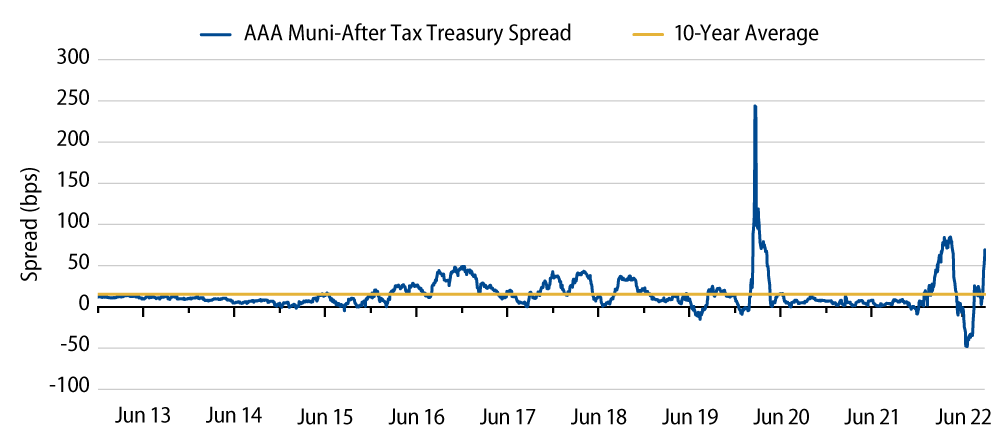

The increasing value of tax-exempt income at higher nominal rates contributes to a favorable after-tax relative value proposition. At the end of 2021, an individual in the top marginal tax bracket would record a higher after-tax yield in a 1-year Treasury than in a 1-year AAA municipal security. Despite the 1-year tax-exempt yield increasing at a lower nominal rate than the 1-year Treasury (+356 bps) YTD, the increased value of the tax exemption at higher nominal rates has translated to a better after-tax yield pickup for the AAA muni versus the comparable Treasury counterpart. Last week the spread between the 1-year Muni yield-to-worst (YTW) (3.04%) and the 1-year after-tax Treasury YTW (2.35%) reached 69 bps, well above the historical average of 15 bps.

While 2022 has been a challenging year for fixed-income investors, a silver lining to the market volatility has been that savers and income seekers can now enjoy relatively high income levels at the short end of the curve. After years of short-term municipals bonds offering yields of 30 bps or less, the tightening program by the Fed has now created trading opportunities in the 1- to 5-year area of the municipal market, including credit spread opportunities that an active manager can exploit. Western Asset believes investors looking for a defensive area of the fixed-income market should consider adding exposure to short-duration munis considering the relatively high absolute yield levels, relative after-tax yield levels versus taxable asset classes, along with the structural downside protection offered by relatively lower duration and Fed rate hike activity better priced within the short end of the curve.