Single-family housing starts were unchanged in September, off an August level that saw very slight upward revisions. Meanwhile, a decline in multi-family starts resulted in a 1.6% decline in headline starts.

The single-family starts numbers came in right between market expectations and our own. Suffice it to say that the actual data confirmed neither Wall Street expectations of a rebound in homebuilding nor our expectations of a pronounced further decline in homebuilding in order to prevent excessive build-up of new-home inventories. Homebuilding does still look to be on a downtrend, but single-family home construction continues to run far above the rate of new-home sales, thus resulting in further accumulation of unsold new homes.

Through August, new-home inventories were equivalent to six months’ worth of sales. Unless September new-home sales show increases of 10% or more, that inventory-to-sales ratio will rise further.

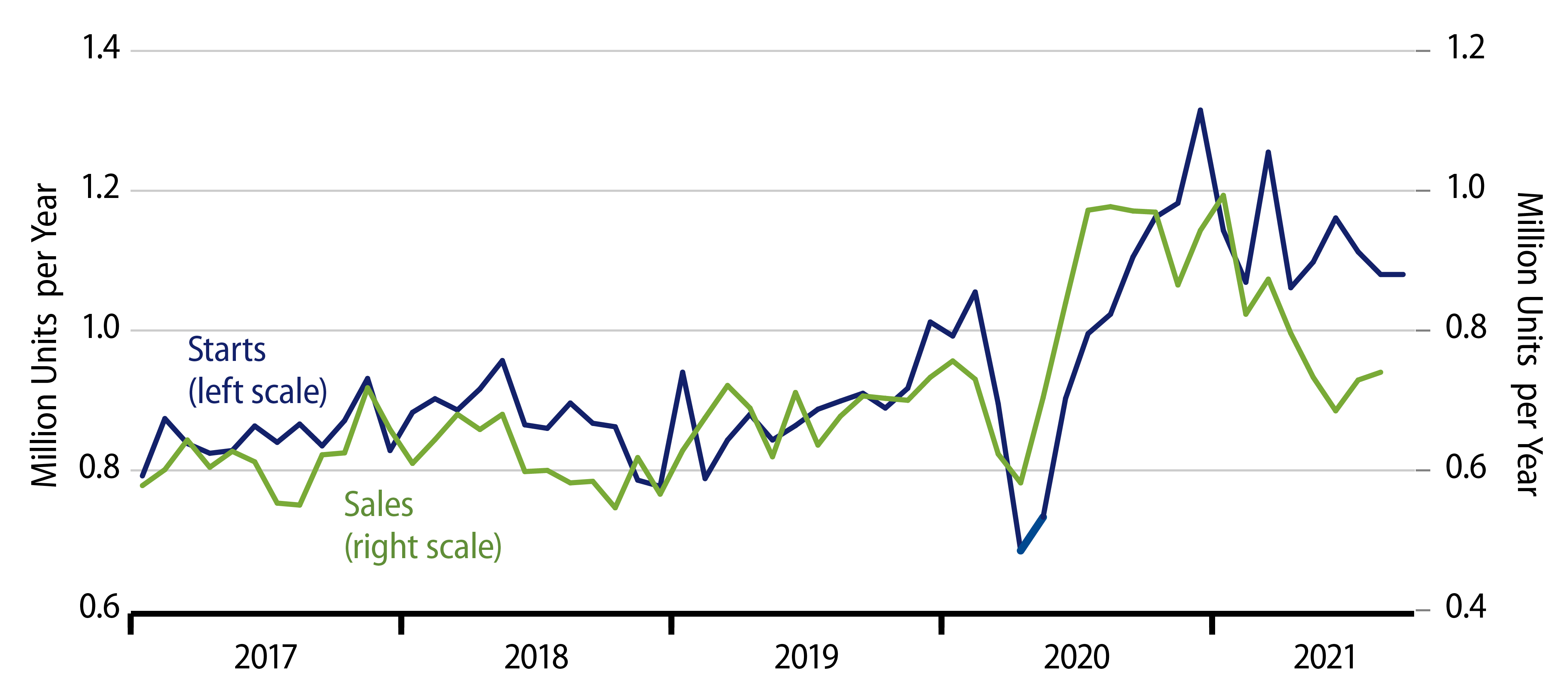

As we have explained before, the scales in this chart are adjusted to deal with owner-builds, which are counted within starts, but don’t register in new-home sales. Utilizing such an adjustment, new-home inventories can be expected to rise any time the blue line lies above the green line in the chart. This has been the case for the last year, and new-home inventories have risen throughout that period.

The gap between the lines has grown especially large over the last six months, as new-home sales have fallen even faster than starts. Again, we expected starts to begin to catch up (catch down?) with sales in the closing months of 2021, but September data fail to show such a development (as yet).

Once again, none of this is meant to imply that housing or homebuilding is weak. New-home sales remain at healthy levels. However, they have cooled noticeably from the heady pace of late-2020, and homebuilders have yet to respond fully or effectively to that pullback. The longer they wait, the greater the risk of a housing glut, as outlandish as that statement might seem given recent home price increases.